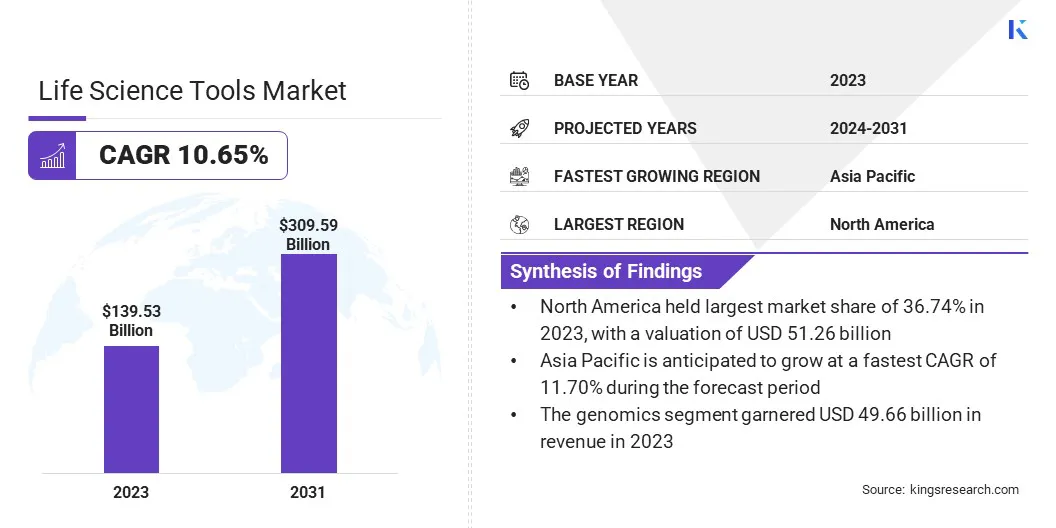

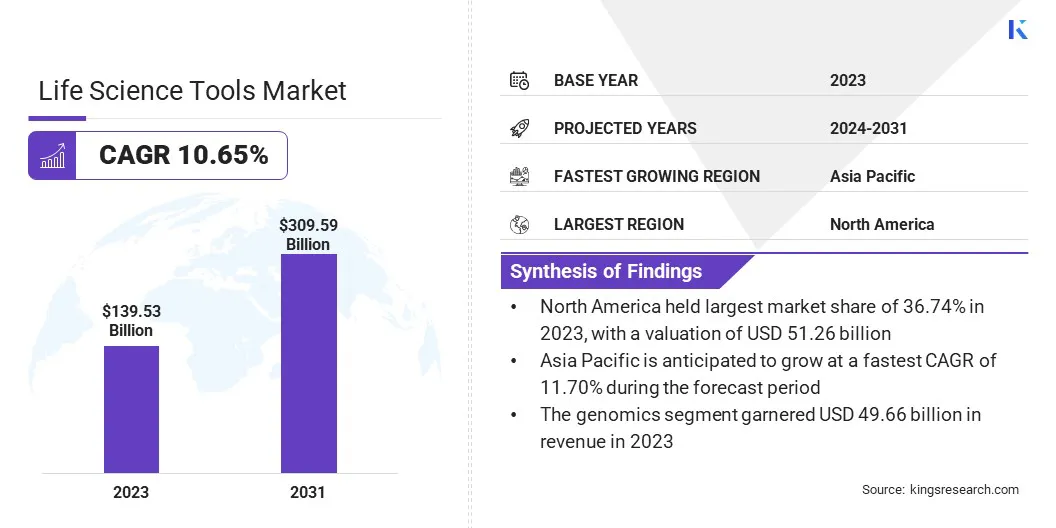

The global life science tools market size was valued at USD 139.53 billion in 2023 and is projected to grow from USD 152.45 billion in 2024 to USD 309.59 billion by 2031, exhibiting a CAGR of 10.65% during the forecast period.

The rapid growth of biotechnology research worldwide is fueling the demand for life science tools. As biomanufacturing, synthetic biology, and genetic engineering gain focus, advanced tools are essential for enabling breakthroughs in these fields.

In the scope of work, the report includes products and services offered by companies such as Agilent Technologies, Inc., Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd., DH Life Sciences, LLC, Illumina, Inc., Merck KGaA, Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., Qiagen N.V., Bruker Corporation, and others.

Additionally, the rapid advancements in next-generation sequencing (NGS) technology are contributing to the growth of the life science tools market. The growing adoption of NGS in laboratories, fueled by its ability to provide deeper insights into genetic mutations, diseases, and therapeutic responses, is propelling demand for more sophisticated sequencing tools.

As NGS technologies evolve, their widespread use in various research and clinical applications is expected to boost market expansion.

- In October 2024, Illumina, Inc. introduced the MiSeq i100 Series of sequencing systems, offering unmatched benchtop speed and simplicity to advance next-generation sequencing (NGS) in laboratories. This solution offers an affordable, user-friendly, all-inclusive system, allowing customers to gain valuable insights, evenwith limited NGS expertise.

Life science tools encompass instruments, technologies, reagents, and software used studying and analyzing biological systems. These tools are essential for conducting research and development in areas such as genomics, proteomics, cell biology, molecular biology, and biochemistry.

They enable scientists to analyze biological data, identify disease pathways, develop new treatments, and advance biological understanding. Examples include sequencing platforms, microscopy equipment, mass spectrometers, PCR machines, and laboratory reagents. These tools are integral to academic research, pharmaceutical development, biotechnology, and clinical diagnostics.

Analyst’s Review

Companies and research institutions are leveraging advanced strategies to support the growth of the life science tools market, with a major focus on technological innovation. The integration of automation, artificial intelligence (AI), and machine learning into laboratory tools is a key priority, enhancing workflow efficiency and data analysis precision.

- In December 2024, scientists at MIT unveiled Boltz-1, an open-source AI model set to revolutionize biomedical research and drug development. Boltz-1 is the first fully open-source model to match the performance of AlphaFold3, Google's cutting-edge model for predicting the 3D structures of proteins and other biological molecules.

High-throughput tools with real-time monitoring capabilities are being developed to cater to the growing demands of research and clinical applications. Organizations are prioritizing cost-effective and user-friendly solutions to enhance accessibility for smaller institutions. These strategic advancements are expanding the market footprint in both developed and emerging regions, leading to sustained growth.

Additionally, the increasing establishment of academic and research institutions globally is further bolstering the growth of the market. These institutions advance basic and applied sciences, generating significant demand for sophisticated tools and technologies.

- In December 2024, researchers at the University of California, San Diego, introduced the Spatial Modeling Algorithms for Reactions and Transport (SMART) software. This tool accurately simulates cell-signaling networks, enabling cells to respond to environmental signals. SMART has the potential to accelerate research across life science fields, including systems biology, pharmacology, and biomedical engineering.

Additionally, the expansion of life sciences curricula and the introduction of specialized training programs are highlighting the need for laboratory equipment and software, presenting long-term opportunities for market growth.

Life Science Tools Market Growth Factors

The increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders is propelling the growth of the life science tools market. There is a growing demand for advanced tools that facilitate early disease detection, accurate diagnostics, and effective therapeutic development.

- A September 2023 report from the World Health Organization highlights that cardiovascular diseases are the leading cause of death worldwide, responsible for 17.9 million fatalities each year. They are followed by cancers at 9.3 million deaths, chronic respiratory diseases at 4.1 million, and diabetes, including related kidney disease, contributing to 2 million deaths annually.

Research institutions and pharmaceutical companies are actively leveraging life science tools to develop precision treatments based on individual patient profiles. The increased focus on addressing chronic conditions is propelling investments in technologies critical to modern life science research and applications.

Moreover, the increasing emphasis on precision diagnostics is boosting the adoption of innovative life science tools, contributing to market growth. Technologies such as molecular diagnostics and liquid biopsy tools are being increasingly used in clinical settings for early disease detection and monitoring.

The demand for high-performance diagnostic solutions is prompting investments in tools that provide faster and more accurate results. These advancements are enhancing healthcare efficiency and supporting the rising need for personalized treatment approaches.

However, a significant factor restraining the growth of the life science tools market is the high cost of advanced equipment and technologies, limiting access for smaller research institutions and emerging markets. The substantial upfront investment, coupled with maintenance and operational costs, poses a financial barrier.

To address this challenge, companies are developing cost-effective, user-friendly solutions that lower the entry barrier. Additionally, they are offering flexible pricing models, including leasing and subscription-based services, to make advanced life science tools more accessible to a broader range of institutions, fueling market growth.

Increased global drug discovery and development activities is a notable trend influencing the life science tools market. Pharmaceutical and biotechnology companies are investing heavily in R&D to develop innovative therapeutic technologies addressing unmet medical needs.

- In December 2024, Professor Sangmin Lee from POSTECH's Department of Chemical Engineering, in collaboration with Professor David Baker, the 2024 Nobel Chemistry Laureate from the University of Washington, introduced a groundbreaking therapeutic platform. This platform leverages artificial intelligence (AI) to replicate the complex viral structures, offering significant potential for advancements in gene therapeutics and next-generation vaccine development.

Technological breakthroughs in genomics and proteomics are aiding the expansion of the life science tools market. Innovations such as next-generation sequencing (NGS) and advanced mass spectrometry systems are enabling researchers to analyze genetic and protein structures with unprecedented accuracy and speed.

- In October 2023, Illumina, Inc., a global leader in DNA sequencing and array-based technologies, introduced its Illumina Protein Prep proteomics solution, providing comprehensive sample-to-analysis protein discovery. The solution can identify and quantify over 6,000 human proteins and is compatible with the NovaSeq X and NovaSeq 6000 Systems, enabling multiomics analysis on a single platform, setting it apart from existing proteomics approaches.

The growing adoption of these technologies in academic research, clinical diagnostics, and pharmaceutical development is bolstering market expansion and advancing life sciences globally.

Furthermore, the growing focus on regenerative medicine, including stem cell research and tissue engineering, is creating demand for specialized life science tools. These fields require advanced instruments and reagents for cell culture, analysis, and genetic modification.

The need for precision tools to advance regenerative therapies and address complex medical conditions is fostering market expansion. Companies and research organizations are prioritizing regenerative medicine due to its potential to revolutionize healthcare.

Segmentation Analysis

The global market has been segmented based on product, technology, end-user, and geography.

By Product

Based on product, the market has been segmented into consumables, instruments, and services. The consumables segment led the life science tools market in 2023, reaching a valuation of USD 66.17 billion. Consumables, such as reagents, chemicals, and laboratory kits, are integral to experiments, diagnostics, and research, generating a consistent demand.

These products are indispensable for researchers and clinical laboratories, ensuring smooth execution and reliable results. The widespread adoption of personalized medicine, along with increased research in genomics and proteomics, further fuels demand. Their lower cost compared to advanced equipment and the frequent need for replenishment contribute to the dominance of the segment.

By Technology

Based on technology, the market has been classified into genomics, cell biology, proteomics, stem cell research, and immunology. The genomics segment secured the largest revenue share of 35.59% in 2023. The increasing demand for precise, scalable DNA sequencing and analysis solutions has accelerated the adoption of genomics technologies.

Advances in next-generation sequencing (NGS) have improved efficiency, cost-effectiveness, and accessibility, fueling growth in diagnostics, agriculture, and biotechnology,. Ongoing innovations in CRISPR, gene editing, and bioinformatics are further advancing genomic research, reinforcing its market dominance.

By End-User

Based on end-user, the market has been divided into academic and research institutions, biotechnology and pharmaceutical companies, hospitals and diagnostic laboratories, contract research organizations (CROs), and government and regulatory agencies.

The biotechnology and pharmaceutical companies segment is set to grow significant growth at a robust CAGR of 12.31% through the forecast period. These companies rely heavily on advanced life science tools for drug discovery, clinical trials, and biologics manufacturing.

The increasing demand for precision medicine and personalized treatments further is highlighting the need for advanced tools in genomic sequencing, protein analysis, and molecular diagnostics.

As biotechnology and pharmaceutical companies focus on innovation, they are turning to cutting-edge tools to enhance research accuracy and efficiency, thereby accelerating the development of novel therapies.

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America life science tools market accounted for a substantial share of around 36.74% in 2023, valued at USD 51.26 billion. North America remains a global leader in biotechnology and pharmaceutical research, fueling substantial demand for life science tools.

Increased investments in drug discovery, personalized medicine, and biologics are highlighting the need for advanced technologies such as genomic sequencing, high-throughput screening, and mass spectrometry.

- According to a 2024 report by the Pharmaceutical Research and Manufacturers of America, by April 2023, biopharmaceutical companies and their suppliers were operating 1,580 production facilities across 48 states and Puerto Rico. Nearly 20% of these facilities are dedicated to manufacturing active pharmaceutical ingredients (APIs), the key components that drive a medicine's intended health effects.

Companies in the region are increasingly prioritizing innovative therapeutics, fueling the growth of the North America market thorugh a demand for sophisticated tools to support extensive R&D activities.

Additionally, the U.S. and Canada are prominent for their significant government funding in healthcare and scientific research. Initiatives such as the National Institutes of Health (NIH) in the U.S. and the Canadian Institutes of Health Research (CIHR) provide substantial financial support for life sciences research, creating a favorable environment for adopting advanced life science tools.

This consistent funding is boosting demand across academic institutions, research organizations, and healthcare providers.

Asia Pacific life science tools market is expected to witness significant growth, regostering a robust CAGR of 11.70% over the forecast period. Asia-Pacific has emerged as a key hub for clinical trials due to its large patient populations, diverse genetic backgrounds, and lower costs.

Collaborations between global pharmaceutical companies and regional biotech firms are contributing to the rising demand for life science tools. The region's increasing participation in clinical studies, particularly in genomics, oncology, and infectious diseases, is highlighting the need for advanced diagnostic and analytical tools, thus bolstering regional market growth.

Furthermore, Asia-Pacific's increasing focus on agricultural biotechnology, driven by the need for enhanced food security and sustainable farming practices, is creating a demand for life science tools. Countries such as China and India are investing in crop genomics, pest-resistant crops, and soil health monitoring technologies, which require specialized life science tools for research and development.

Competitive Landscape

The global life science tools market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Life Science Tools Market

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Hoffmann-La Roche Ltd.

- DH Life Sciences, LLC

- Illumina, Inc.

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Qiagen N.V.

- Bruker Corporation

Key Industry Developments

- December 2024 (Acquisition): Merck entered into a definitive agreement to acquire HUB Organoids Holding B.V. (HUB), a Netherlands-based leader in organoids. This acquisition enhances Merck's portfolio, reinforcing its commitment to advancing its strategic focus on next-generation biology.

- October 2024 (Launch): Illumina, Inc. introduced its MiSeq i100 Series of sequencing systems, designed to provide unmatched benchtop speed and simplicity. This solution enable laboratories to acheive valuable insights through an affordable, user-friendly system, even for those with limited NGS experience.

The global life science tools market has been segmented as:

By Product

- Consumables

- Instruments

- Services

By Technology

- Genomics

- Cell Biology

- Proteomics

- Stem Cell Research

- Immunology

By End-User

- Academic and Research Institutions

- Biotechnology and Pharmaceutical Companies

- Hospitals and Diagnostic Laboratories

- Contract Research Organizations (CROs)

- Government and Regulatory Agencies

By Region

- North America

- Europe

- France

- UK.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America