Market Definition

Biocomposites are formed by combining natural fibers (e.g., flax, hemp, wood) with a biopolymer matrix derived from renewable resources (e.g., starch, PLA). These materials offer an environmentally friendly alternative to traditional composites, decreasing reliance on fossil fuels and reducing environmental impact.

Key characteristics include high biodegradability strength with respect to weight ratio, low density, and thermal and acoustic insulation properties. Biocomposites have wide-ranging applications in industries such as automotive, construction, packaging, and aerospace. Customization is possible by modifying fiber content, orientation, and matrix composition.

Driven by ongoing research, biocomposites are increasingly recognized as versatile, sustainable solutions that address environmental challenges and promote a greener future.

Biocomposites Market Overview

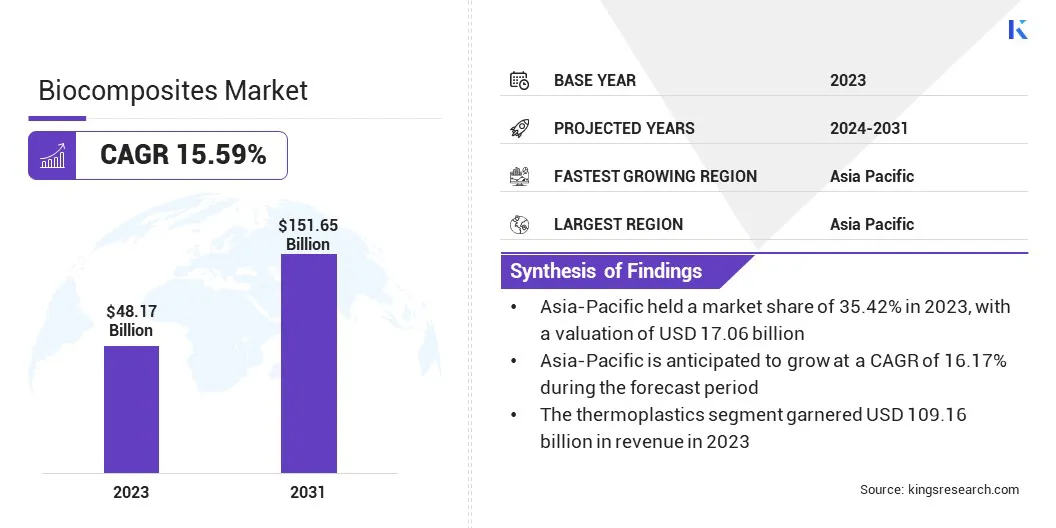

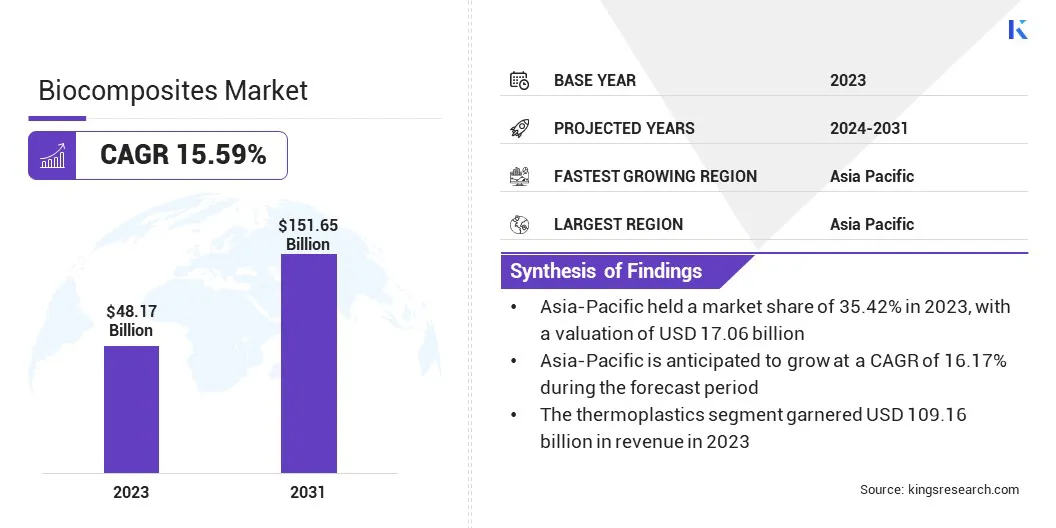

The global biocomposites market size valued at USD 48.17 billion in 2023 and is projected to grow from USD 55.00 billion in 2024 to USD 151.65 billion by 2031, exhibiting a CAGR of 15.59% during the forecast period. The growing demand for bio-based polymers is anticipated to significantly boost the market.

Derived from renewable resources such as plants, sugars, and starches, bio-based polymers are becoming increasingly popular due to their lower environmental impact compared to traditional petroleum-based polymers. They not only reduce reliance on limited fossil resources but also help minimize greenhouse gas (GHG) emissions throughout their lifecycle.

The rising need for sustainable packaging solutions offers a promising opportunity for the biocomposites industry. These materials, made by combining natural fibers with biopolymer matrices, are well-suited for packaging applications due to their high strength, lightweight nature, and ability to decompose naturally.

Growing consumer awareness of the environmental impact of materials is shaping purchasing preferences, prompting companies to invest in biocomposite-based solutions.

Major companies operating in the global biocomposites market are UPM, UFP Industries, Inc., Stora Enso, Trex Company, Inc., FlexForm Technologies, Tecnaro GmbH, Bcomp, Nanjing Jufeng Advanced Materials Co., Ltd., BioComposites Group (BCG), Fiberon, Lingrove Inc., Procotex, RTP Company, Rock West Composites, Inc., and Meshlin Composites Zrt.

Innovations in production technologies are also enhancing the feasibility and cost-effectiveness of biocomposites, making them an increasingly attractive option for various industries. The market is expanding into various sectors, such as automotive, construction, and consumer goods, with uses ranging from electric vehicle (EV) components to packaging solutions.

The demand for biocomposites in EV components is particularly significant, fueled by the automotive industry's move toward sustainability. Moreover, the packaging industry is a significant growth area due to the need for eco-friendly packaging solutions.

Furthermore, government policies aimed at reducing carbon emissions and promoting biodegradable alternatives by utilizing renewable materials is propelling the market.

Key Highlights:

- The biocomposites industry value was recorded at USD 48.17 billion in 2023.

- The market is projected to grow at a CAGR of 15.59% from 2024 to 2031.

- North America held a market share of 24.31% in 2023, with a valuation of USD 11.71 billion.

- The natural fiber composites segment garnered USD 29.51 billion in revenue in 2023.

- The thermoplastics segment is expected to reach USD 109.16 billion by 2031.

- The extrusion segment is dominating the market with 35.33% market share.

- The automotive segment is growing rapidly with a CAGR of 16.34% over the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 16.17 during the forecast period.

Market Driver

"Government Regulatory Support on Use of Environmentally-Friendly Products"

Developed nations, such as Germany, the U.S., and Japan, are prioritizing the increased use of environmentally-friendly products over petroleum-based alternatives.

This includes promoting bio-based materials, encouraging the recyclability of vehicle components, and holding automotive manufacturers accountable for end-of-life vehicle disposal. Specifically, the Japanese government aims to replace 25% of plastic consumption with renewable products by 2031.

Government regulatory support for environmentally-friendly products serves as a significant driver for the market. Authorities worldwide are implementing stringent regulations and policies to curb pollution, reduce carbon emissions, and promote sustainability.

Initiatives like banning single-use plastics, offering subsidies or tax benefits for green materials, and mandating the use of renewable or biodegradable components in manufacturing have accelerated the adoption of biocomposites.

- In October 2024, India's Ministry of Environment, Forest and Climate Change introduced the Ecomark Rules, 2024, replacing the 1991 scheme. This initiative aims to encourage the production and consumption of eco-friendly products by providing Ecomark certification to items meeting specific environmental criteria. The scheme is implemented by the Central Pollution Control Board (CPCB) in partnership with the Bureau of Indian Standards (BIS).

- In November 2024, the UK announced plans to double funding for residents switching to heat pumps, an eco-friendly heating option, and to ease planning rules for their installation. This move aligns with the UK's commitment to reduce GHG emissions by 81% by 2035 compared to 1990 levels.

Market Challenge

"Concerns Pertaining to Cost Competitiveness"

High production costs are a significant barrier to the growth of the biocomposites market. The production of biocomposites involves natural fibers and biopolymers, which are often more costly than traditional materials.

The extraction, processing, and treatment of natural fibers necessitate specialized equipment and technology, which increases production costs. Moreover, biopolymers, particularly those sourced from renewable materials, are generally more expensive than conventional petroleum-based polymers. This price disparity may affect continuous adoption, especially in price-sensitive industries where cost considerations are significant in material selection.

Furthermore, the lack of large-scale production facilities and economies of scale contribute to the higher costs. Consequently, industries may be reluctant to adopt biocomposites due to their financial implications, despite the environmental advantages they offer.

Advancements in production technologies, greater investment, and government incentives are essential to lower costs and make biocomposites economically viable, encouraging their broader adoption.

Due to economies of scale and widespread applications, there is potential for price reductions. Producing these biocomposites in developing countries like India and China can help lower overall costs.

Market Trend

"Growth in Adoption of Biocomposites in Construction and Furniture Industries"

The construction and furniture industries are registering a surge in the adoption of biocomposites, driven by their eco-friendly properties and versatile applications. Government regulations promoting environmentally friendly materials, coupled with advancements in biocomposite manufacturing technologies, have further accelerated this trend.

The integration of biocomposites aligns with industry goals to reduce environmental footprints while delivering innovative and sustainable solutions. Biocomposites offer high strength-to-weight ratios, durability, and biodegradability, making them ideal for building materials such as decking, panels, and insulation.

As a result, the construction and furniture industries are expected to remain significant contributors to the growth of the biocomposites market in the coming years.

- In September 2023, Lingrove, a company specializing in plant-based composites, secured $10 million in funding to scale up the production of Ekoa, a carbon-negative alternative to conventional materials used in construction. This investment aims to enhance the availability and application of sustainable materials in the industry.

Biocomposites Market Report Snapshot

| Segmentation |

Details |

| By Fiber Type |

Natural Fiber Composites, Synthetic Fiber Composites |

| By Polymer Type |

Thermoplastics, Thermosets |

| By Manufacturing Process |

Extrusion, Injection Molding, Compression Molding, Pultrusion, Others |

| By Application |

Building & Construction, Automotive, Consumer Goods, Electrical & Electronics, Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Fiber Type (Natural Fiber Composites, Synthetic Fiber Composites): The natural fiber composites segment earned USD 29.51 billion in 2023, due to its abundance and cost effectiveness.

- By Polymer Type (Thermoplastics, Thermosets): The thermoplastics segment held the largest market share of 71.28% in 2023 and will continue to dominate the market in the forecast period.

- By Manufacturing Process (Extrusion, Injection Molding, Compression Molding, Pultrusion, Others): The extrusion segment is projected to reach USD 54.85 billion by 2031.

- By Application (Building & Construction, Automotive, Consumer Goods, Electrical & Electronics, Others): The automotive segment is rapidly growing with 16.34% CAGR, due to the increasing demand for lightweight, fuel-efficient, and sustainable materials, driven by environmental regulations and consumer preferences.

Biocomposites Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for 35.42% biocomposites market share, which was valued at USD 17.06 billion in 2023. The rapid expansion of the automobile industry in countries like China and India, fueled by the growing demand for lightweight components that improve fuel efficiency and lower emissions, is anticipated to drive the market.

India’s strong presence in light and commercial vehicle production, as well as its ranking as the second-largest producer of two-wheelers, will further accelerate the market growth.

- In June 2024, Airbus developed bio-derived fibers for helicopter panels, capturing atmospheric CO2 during production. Committed to decarbonization, Airbus explores biocomposite alternatives for structural components, creating opportunities in sustainable aerospace materials.

Government regulations promoting lowering GHG emissions, developing circular economy action plans, and eco-friendly materials such as natural polymer composites are further accelerating the market growth.

However, the market in North America is poised to grow at a CAGR of 16.07% through the projection period. The market in the region is driven by stringent government regulations on plastic usage.

North America, as the hub of the automotive industry and with the growing adoption of lightweight materials, is expected to retain its leadership in the market. Moreover, the growing demand for EVs, driven by environmental concerns, is fueling the demand for biocomposites.

- In March 2023, Toray Advanced Composites became the first advanced composites company to achieve NADCAP's AC7124/6 accreditation for Non-Metallic Materials Manufacturing. This milestone highlights Toray's leadership in thermoplastic adoption, aligning with the market's growth by advancing sustainable, energy-efficient materials that reduce carbon footprints in high-performance industries such as aerospace and automotive.

The market in the U.S. is poised for significant growth driven by the well-established automotive, building, and construction sectors. The biocomposites market in the country is expected to flourish, driven by the increasing demand for lightweight materials in the automotive sector and advancements in plastic composites, presenting opportunities for market players.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In China, the government enforces national environmental protection standards that promote sustainable resource usage, alongside laws like the Circular Economy Promotion Law, which encourages recycling and the use of eco-friendly materials such as biocomposites. The GB/T standards specifically guide the production and use of bio-based composites.

- In India, the National Green Tribunal (NGT) plays a crucial role in regulating environmental impacts, including those associated with biocomposites. The Plastic Waste Management Rules incentivize the use of biodegradable products, including biocomposites. Additionally, the Bureau of Indian Standards (BIS) has developed guidelines for biocomposites to ensure sustainability in manufacturing.

- In the U.S., the American Society for Testing and Materials (ASTM) developed standards for biocomposites used in multiple sectors, including construction and automotive. The Environmental Protection Agency (EPA) regulates the environmental impact of biocomposites, ensuring that these materials meet safety and sustainability criteria. Additionally, the USDA and EPA oversee bio-based products regulations that support eco-friendly sourcing and production.

- In Canada, the Canadian Environmental Protection Act (CEPA) ensures that biocomposite materials meet environmental safety standards, while the Bureau de Normalisation du Québec (BNQ) sets regulations for bioplastics and composites in the province. The Clean Technology Regulations in Canada also encourage the development of sustainable, green products, including biocomposites.

Competitive Landscape

Companies can strengthen their brand image and attract environmentally conscious consumers by adopting biocomposite packaging. As a result, the growing emphasis on sustainability is driving significant investments and research in biocomposites, positioning them as a vital player in the future of the packaging industry and contributing to the larger goal of environmental conservation.

Strategies may also focus on diversifying products, forming partnerships, and expanding geographically to improve durability, esthetics, and performance in emerging markets. However, challenges such as cost pressures, fluctuations in raw material supply, and the need for improved technical properties like water and UV resistance still persist.

- In March 2024, the Lenzing Group developed biodegradable geotextiles to protect glaciers and prevent microplastic pollution, earning them the Biodiversity and Water Award.

With rising consumer demand for eco-friendly materials, the market is poised for significant growth, favoring companies that balance cost-effectiveness with sustainability & innovation and capitalizing on the abundant availability of natural fibers and supportive government policies promoting sustainable materials. Additionally, collaborations and partnerships are pivotal in fostering innovation within the market.

- In November 2024, Evolved by Nature partnered with Authentic Thai Leather to introduce biodegradable finishing systems, reducing reliance on harmful chemicals.

List of Key Companies in Biocomposites Market:

- UPM

- UFP Industries, Inc.

- Stora Enso

- Trex Company, Inc.

- Fiberon

- FlexForm Technologies

- Tecnaro GmbH

- Meshlin Composites Zrt

- Nanjing Jufeng Advanced Materials Co., Ltd.

- Bcomp

- BioComposites Group (BCG)

- Lingrove Inc.

- Procotex

- RTP Company

- Rock West Composites, Inc.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In August 2024, Bcomp supplied bodywork made from natural fiber composites for the Team Würth Power 135 TRD Hilux, which participated in the 2024 Asia Cross Country Rally (AXCR) held in Thailand.

- In December 2023, Lingrove, an innovative company utilized patented technology to convert rapidly maturing plants into composite surfaces and panels for diverse applications such as construction and other sectors. The investment rounds were led by Lewis & Clark Agrifood and Diamond Edge Ventures, accompanied by significant investments from Bunge Ventures and SOSV. This influx of capital is projected to boost the research and production of ekoa natural fiber composite panels and surfaces, leading to esthetically appealing, high-performing, and eco-conscious interior designs.

- In September 2023, Rock West Composites (RWC) acquired the assets of Performance Plastics Inc. This strategic move enables RWC to broaden its market reach by entering supplementary markets that share similarities with its current business operations but differ in terms of materials and processes.

- In December 2023, UPM launched 3D-printed biocomposite pipes in the Helsinki Music Centre’s organ, a unique installation featuring 260 meters of printed pipes and wind lines that produce sound.