Bioactive Wound Care Market Size

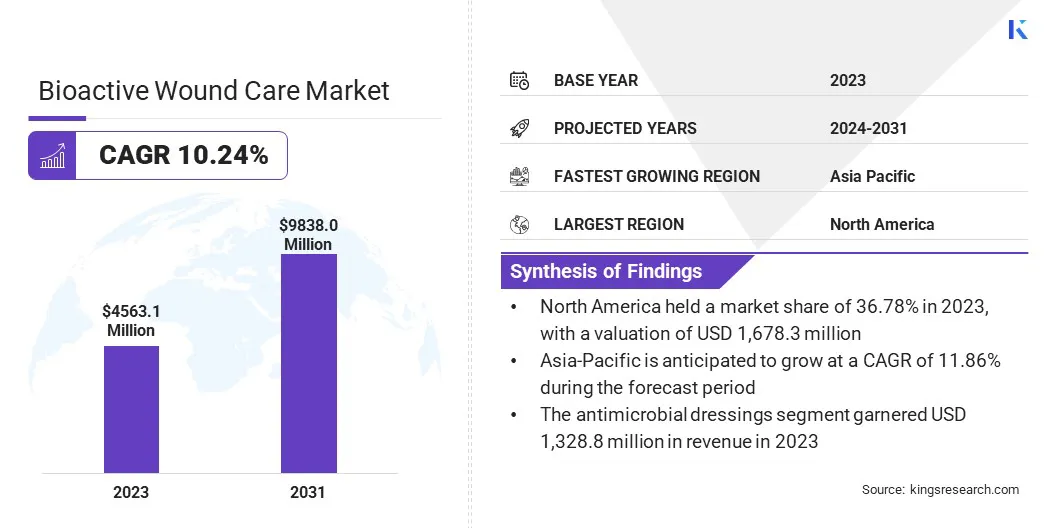

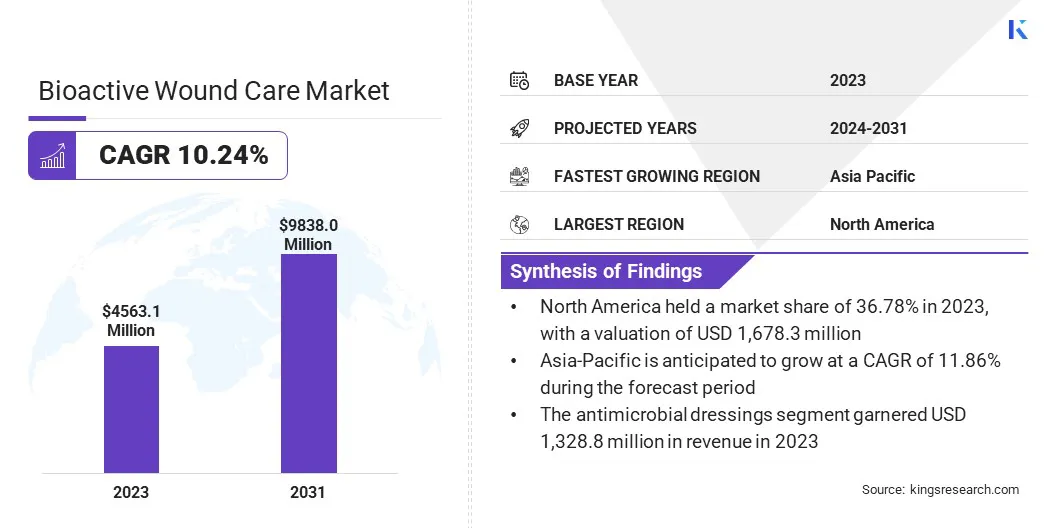

The global Bioactive Wound Care Market size was valued at USD 4,563.1 million in 2023 and is projected to grow from USD 4,971.9 million in 2024 to USD 9,838.0 million by 2031, exhibiting a CAGR of 10.24% during the forecast period. The growth of the market is driven by an increasing prevalence of chronic wounds, which is attributed to aging populations and rising diabetes rates.

Technological advancements in bioengineered tissues and stem cell therapies enhance healing. Awareness campaigns and product launches are propelling market growth. Regulatory approvals and strategic partnerships are further boosting market expansion.

In the scope of work, the report includes solutions offered by companies such as 3M, B. Braun SE, Convatec Group PLC, Essity Health & Medical., Covalon Technologies Ltd, DermaRite Industries LLC, Hollister Incorporated, Integra LifeSciences Holdings Corporation, Johnson & Johnson, Medtronic PLC, and others.

The expansion of the bioactive wound care market is fueled by the growing incidences of chronic wound as a result of aging populations and the rising rates of diabetes and obesity globally.

- According to the 2022 report by the World Health Organization (WHO), the global population of people over the age of 60 is projected to grow from 1 billion in 2020 to 2.1 billion by 2050. Additionally, the WHO reports that annually, 20 to 50 million people experience non-fatal injuries due to road traffic crashes.

Technological advancements in areas such as bioengineered tissues, growth factors, and stem cell therapies are significantly enhancing healing outcomes and reducing the risk of complications. There is a noticeable shift toward advanced wound care solutions such as hydrocolloids, hydrogels, and alginate dressings, which offer better moisture management and promote faster healing.

These trends are fostering market growth as healthcare providers seek more effective treatments to manage complex wounds and improve patient outcomes, thereby positioning the bioactive wound care sector as a vital component of modern healthcare strategies.

Bioactive wound care refers to advanced medical treatments and products specifically designed to actively interact with the wound environment to promote healing. These products typically incorporate biological materials or components that enhance or support the body's natural healing processes.

Examples include bioengineered tissues, growth factors, stem cell therapies, and specialized dressings such as hydrocolloids and hydrogels. Bioactive wound care is designed to enhance wound closure, reduce the risk of infection, and improve overall healing outcomes, offering advantages over traditional wound care methods. This approach is particularly beneficial for managing chronic wounds and complex injuries where standard treatments may be inadequate.

Analyst’s Review

The bioactive wound care market is poised to witness substantial growth, mainly due to increasing chronic wound incidences and ongoing advancements in medical technologies. Key market players are implementing strategic initiatives to capitalize on these trends and propel market expansion.

- For instance, Wound Australia's allocation of USD 1.5 million in the 2022-23 Pre-Budget Submissions demonstrates a proactive approach to increase awareness regarding the prevention and treatment of chronic wound.

Their investment in national media and digital campaigns aims to educate both healthcare professionals and the general public, thereby potentially increasing the demand for advanced wound care solutions. These initiatives enhance market visibility and foster a supportive ecosystem that promotes innovation and the adoption of bioactive wound care products. The rising awareness and recent product launches are likely to aid market growth, prompting key players to expand their product portfolio.

Bioactive Wound Care Market Growth Factors

The increasing prevalence of chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers is propelling the growth of the bioactive wound care market. As the global population ages and the prevalence of diabetes and obesity rises, the incidence of these wounds is also increasing.

Traditional wound care methods often fall short in managing such complex conditions, leading to increased demand for advanced solutions. Bioactive wound care products, including bioengineered tissues and stem cell therapies, are accelerating the healing process and reducing infection risks. These advancements address the needs of an expanding patient demographic and improve overall patient outcomes, thus contributing to the growth of the market.

The high cost associated with advanced bioactive wound care products is hindering market growth by limiting their affordability and accessibility to both patients and healthcare providers. Insurance coverage and reimbursement challenges further restrict adoption, potentially causing delays or reductions the use of these effective treatments.

However, key players are actively engaging with healthcare providers and insurers to demonstrate the cost-effectiveness and long-term benefits of advanced wound care products. Additionally, investing in research and development is intended to optimize manufacturing processes and reduce production costs, making these treatments more competitive in the market.

Bioactive Wound Care Market Trends

Continuous innovations in bioactive wound care products are significantly propelling the expansion of the market. Developments such as bioengineered tissues, growth factors, and stem cell therapies are enhancing the body’s natural healing processes, improving patient outcomes, and reducing complications.

These advancements are highly sought after in the healthcare industry, as they offer effective solutions for complex wound management. Additionally, the introduction of technologically advanced products with superior healing properties is expected to bolster market growth.

- For instance, in October 2023, DuPont launched the DuPont Liveo MG 7-9960 Soft Skin Adhesive, specifically designed for advanced wound care and long-wear medical devices. Moreover, in August 2022, 3M advanced its 3M Veraflo Therapy, a negative pressure wound therapy system with instillation, providing faster, easier, and less painful dressing process.

These innovative products exemplify the ongoing progress in the field, providing enhanced healing solutions and contributing to the growth of the bioactive wound care market.

There is a notable trend toward adopting advanced wound care products over traditional methods in healthcare. Hydrocolloids, hydrogels, and alginate dressings are increasingly favored for their superior capabilities in wound management. Hydrocolloids form a gel that maintains a moist healing environment and provides protection against infection.

Hydrogels provide hydration and support autolytic debridement, thereby aiding in the removal of necrotic tissue. Alginate dressings, which are derived from seaweed, offer high absorbency and conformability for heavily exuding wounds. These products are engineered to improve moisture control, accelerate healing process, and reduce patient discomfort. This shift reflects a growing preference for treatments that optimize healing outcomes and enhance overall patient care.

Segmentation Analysis

The global market is segmented based on type, application, end-user, and geography.

By Type

Based on type, the market is categorized into antimicrobial dressings, hydrocolloid dressings, alginate dressings, collagen, skin substitutes, and others. The antimicrobial dressings segment led the bioactive wound care market in 2023, reaching a valuation of USD 1,328.8 million. These dressings are designed to prevent and manage infections by incorporating agents such as silver, iodine, or other antimicrobial substances. They offer enhanced protection against pathogens, thereby reducing the risk of complications and promoting faster healing.

As healthcare facilities prioritize infection control, the demand for antimicrobial dressings is rising. Their effectiveness in managing chronic wounds, surgical sites, and burns further amplifies their appeal. Moreover, ongoing innovations in antimicrobial technologies and materials are supporting the growth of the segment.

By Application

Based on application, the market is divided into surgical & traumatic wounds, diabetic foot ulcers, pressure ulcers, venous leg ulcer, burns, and others. The surgical & traumatic wounds segment captured the largest bioactive wound care market share of 30.12% in 2023. This segment includes products specifically designed for the management of acute wounds resulting from surgeries, accidents, or injuries.

Bioactive wound care solutions in surgical & traumatic wounds facilitate faster healing, reduce infection risks, and improve patient comfort compared to traditional wound care methods. As the number of surgical procedures and trauma cases rises globally, there is an increasing demand for advanced wound care products tailored to address these specific needs.

- According to the World Bank Report 2022, the European Union had a rate of 11,075 surgical procedures per 100,000 people.

Key innovations in materials, such as bioengineered tissues and advanced dressings, further enhance healing outcomes, thereby boosting their adoption in clinical settings. These factors are collectively propelling the expansion of the surgical and traumatic wounds segment.

By End-User

Based on end-user, the market is categorized into hospitals & wound care center, homecare settings, and, others. The hospitals & wound care center segment is expected to garner the highest revenue of USD 6,411.6 million in 2031. These facilities are primary users of advanced wound care products due to their major focus on providing specialized treatment for chronic and complex wounds.

Bioactive wound care solutions, including bioengineered tissues, growth factors, and specialized dressings, are utilized in hospitals and wound care centers to facilitate faster healing and reduce the risk of infection. As healthcare facilities strive to improve patient outcomes and reduce healthcare-associated costs, there is a growing adoption of these advanced products. Furthermore, the increasing prevalence of chronic conditions and surgical procedures requiring advanced wound care are fostering the expansion of the segment.

Bioactive Wound Care Market Regional Analysis

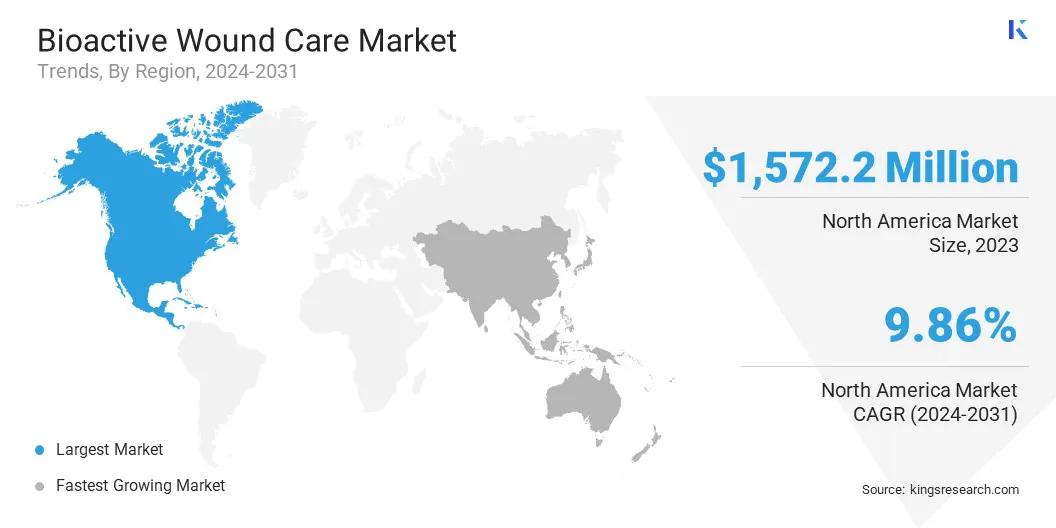

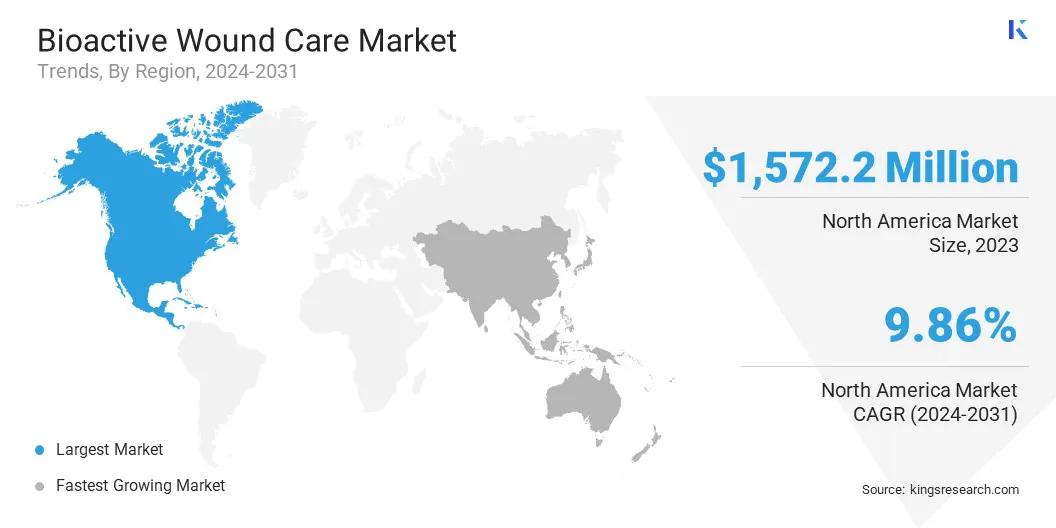

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America bioactive wound care market share stood around 36.78% in 2023 in the global market, with a valuation of USD 1,678.3 million. The rapidly growing aging population, coupled with a high prevalence of diabetes, has a significant positive impact on regional market dynamics.

The regional market benefits from a well-developed healthcare system that is highly receptive readily to novel innovations in wound care treatments. The prevalence of diabetes has notably increased, with projections indicating sustained growth in the near future.

- For instance, according to the International Diabetes Federation Diabetes Atlas Tenth edition, the number of people with diabetes in the United States was approximately 32.2 million in 2021 and is expected to rise to 36.3 million by 2045.

These trends underscore the increasing demand for advanced wound care solutions to manage diabetic complications, thereby supporting the expansion of the North America market.

Asia-Pacific is anticipated to witness the fastest growth at a CAGR of 11.86% over the forecast period. Given the growing and aging population, there is a rising demand for advanced wound care solutions to manage age-related chronic conditions effectively. The surging prevalence of chronic diseases, notably diabetes and cardiovascular ailments, further fuels this demand.

Healthcare systems in the region are actively adopting innovative technologies to enhance accessibility to bioactive wound care products. Moreover, the regulatory environments vary across countries, influencing market dynamics and strategies for market entry. Technological advancements in bioengineering and wound dressings are pivotal, catering to diverse healthcare needs and fostering opportunities for regional market expansion.

Competitive Landscape

The global bioactive wound care market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Bioactive Wound Care Market

- 3M

- Braun SE

- Convatec Group PLC

- Essity Health & Medical.

- Covalon Technologies Ltd

- DermaRite Industries LLC

- Hollister Incorporated

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson

- Medtronic PLC

Key Industry Development

- January 2023 (Product Launch): ConvaTec Group PLC introduced ConvaFoam in the U.S. This advanced bioactive wound care product is designed to enhance fluid absorption, improve adhesion, and incorporate a superabsorbent layer specifically for managing challenging wounds.

The global bioactive wound care market is segmented as:

By Type

- Antimicrobial Dressings

- Hydrocolloid Dressings

- Alginate Dressings

- Collagen

- Skin Substitutes

- Others

By Application

- Surgical & Traumatic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcer

- Burns

- Others

By End User

- Hospitals & Wound Care Centre

- Homecare Settings

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America