Aviation Test Equipment Market Overview

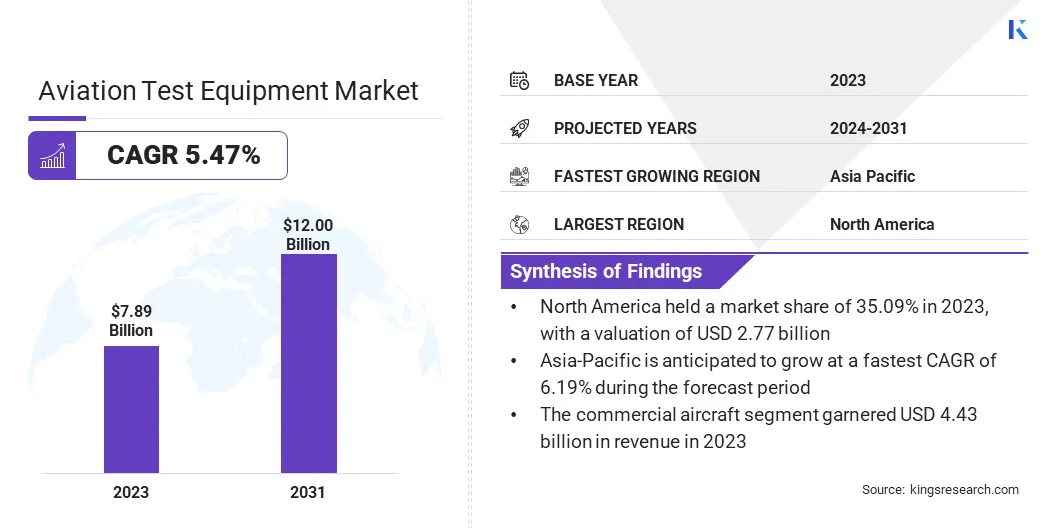

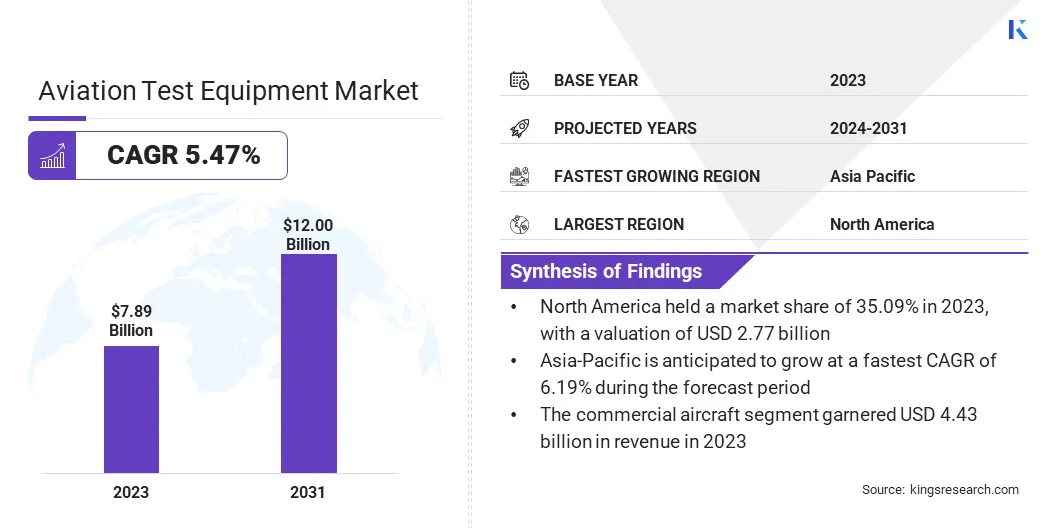

The global aviation test equipment market size was valued at USD 7.89 billion in 2023 and is projected to grow from USD 8.27 billion in 2024 to USD 12.00 billion by 2031, exhibiting a CAGR of 5.47% during the forecast period.

The market is driven by the increasing demand for advanced testing solutions to ensure the safety, reliability, and efficiency of modern aircraft systems. The rising focus on predictive maintenance, along with the growing adoption of next-generation avionics and connected technologies in both commercial and military aviation, is further fueling this expansion.

Key Market Highlights

- The aviation test equipment industry size was recorded at USD 7.89 billion in 2023.

- The market is projected to grow at a CAGR of 5.47% from 2024 to 2031.

- North America held a market share of 35.09% in 2023, with a valuation of USD 2.77 billion.

- The electrical test equipment technology segment garnered USD 2.38 billion in revenue in 2023.

- The commercial aircraft segment is expected to reach USD 6.56 billion by 2031.

- The maintenance, repair, and overhaul service providers segment is projected to generate a revenue of USD 4.42 billion by 2031

- Asia Pacific is anticipated to grow at a CAGR of 6.19% during the forecast period.

Major companies operating in the aviation test equipment market are Teradyne, The Boeing Company, 3M, General Electric Co, Rolls Royce Holdings Plc, Honeywell International Inc, Rockwell Collins Inc., Lockheed Martin Corporation, Viavi Solutions Inc, ATEQ Aviation, Testek Solutions, Airbus Group, Moog Inc, SPHEREA Test & Services, and DAC International, Inc.

As new-generation aircraft undergo rigorous certification processes, the need for precise, reliable, and efficient testing solutions is expected to rise. This drives increased demand for advanced test equipment within the aviation sector, ensuring compliance with safety and performance standards.

- In July 2024, Boeing commenced certification flight testing of the 777-9 at Boeing Field in Seattle, under the oversight of the U.S. Federal Aviation Administration (FAA). These tests are aimed at certifying the aircraft and preparing it for global use.

Rising Investment

The rising investment is poised to drive significant growth in the aviation industry. Federal and government initiatives are fueling the development of advanced aircraft maintenance and testing facilities. Additionally the focus on onshoring maintenance and testing capabilities are driving the growth of market.

- In February 2025, Prairies Economic Development Canada, announced a federal investment of $180 million to the Calgary Airport Authority. The funding will support the construction and equipping of a 150,000 square foot aircraft engine maintenance and test facility at Calgary International Airport (YYC). The facility aims to enable the onshoring of engine maintenance and testing, supporting the transition to lower emission engines and sustainable aviation fuels..

High Capital Investment

High capital investment is a significant challenge in the aviation test equipment market, as developing and maintaining advanced testing facilities requires substantial financial resources. The costs associated with upgrading existing infrastructure or building new facilities can be prohibitive for smaller players or startups.

To address this challenge, companies can explore strategic partnerships with larger firms and government agencies for funding and shared resources. Government grants and subsidies for projects related to sustainability and defense, can mitigate these costs.

Digital transformation in aviation maintenance

A key trend in the market is the integration of Wi-Fi-enabled test equipment, data automation, and cross-platform compatibility to modernize airline operations and enhance productivity. This shift toward connected and intelligent testing tools reduces human error, accelerates diagnostics, and enables real-time data sharing between teams and systems.

Additionally, they offer enhanced predictive maintenance by streamlining data collection and analysis, thereby lowering operational costs and minimizing aircraft downtime.

- In September 2024, ATEQ Aviation and CCX Technologies announced a strategic partnership to advance avionics testing capabilities. The collaboration combines ATEQ’s T-RX Avionics Tester with CCX’s ADSE 650 Air Data Test Set, introducing a wireless solution that enables seamless data transmission over Wi-Fi. This eliminates the need for manual data entry and reduces the amount of equipment technicians must carry, streamlining maintenance procedures. As part of the agreement, both companies will act as resellers for each other’s products, broadening global access to their integrated testing solutions. The new joint technology debuted at National Business Aviation Association's Business Aviation Convention & Exhibition in Las Vegas and MRO Europe in Barcelona.

Aviation Test Equipment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Electrical Test Equipment, Hydraulic Test Equipment, Pneumatic Test Equipment, Power Test Equipment, Avionics Test Equipment

|

|

By Aircraft Type

|

Commercial Aircraft, Military Aircraft, Business Jets, Helicopters, Others

|

|

By End-User

|

Original Equipment Manufacturers (OEMs), Maintenance, Repair, and Overhaul (MRO) Service Providers, Airlines, Defense Organizations, Space Agencies

|

|

By Application

|

Production Testing, R&D Testing, Routine Maintenance, Performance Evaluation

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Electrical Test Equipment, Hydraulic Test Equipment, Pneumatic Test Equipment, Power Test Equipment, and Avionics Test Equipment): The electrical test equipment segment earned USD 2.38 billion in 2023 due to the increasing complexity of aircraft electrical systems and the need for precise diagnostics.

- By Aircraft Type (Commercial Aircraft, Military Aircraft, Business Jets, and Helicopters, Others): The commercial aircraft held 56.09% of the market in 2023, due to rising global air travel and the growing commercial fleet.

- By End-User (Original Equipment Manufacturers (OEMs), Maintenance, Repair, and Overhaul (MRO) Service Providers, Airlines, Defense Organizations, Space Agencies): The maintenance, repair, and overhaul (MRO) service providers are projected to reach USD 4.42 billion by 2031, owing to the increasing demand for aircraft maintenance and safety compliance.

- By Application (Production Testing, R&D Testing, Routine Maintenance, Performance Evaluation): The industry automation held 46.99% of the market in 2023, due to the growing integration of automated testing solutions in aerospace manufacturing and maintenance processes.

Aviation Test Equipment Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America aviation test equipment market share stood at around 35.09% in 2023 in the global market, with a valuation of USD 2.77 billion. This dominance is driven by the presence of well-establised aerospace manufacturers, high defense expenditure, and ongoing investments in next generation testing technology.

Additionally, effective regulatory environments, government-sponsored R&D projects, and a robust environment of MRO service further drive the market in North America.

In June 2023, the US military made a significant investment in aviation test equipment when Nellis Air Force Base awarded Curtiss-Wright Corporation a $24 million contract to provide Flight Test Instrumentation (FTI) equipment for the F-35 Technology Refresh 3 (TR-3) program.

Asia Pacific aviation test equipment industry is estimated to grow at a robust CAGR of 6.19% over the forecast period.The market is driven by the growth of defense budget and commercial aviation. China, India, and Japan are investing heavily in aircraft manufacturing and fleet modernization, driving the demand for advanced testing systems.

Regional players and international OEMs are establishing manufacturing and R&D facilities across Asia Pacific to meet the growing demand for avionics, hydraulic, and power system test equipment.

Regulatory Framework

- In the U.S., The Federal Aviation Administration (FAA) is the primary regulatory authority for civil aviation, including aviation test equipment. The FAA ensures the safety and performance of aircraft and associated equipment, including test equipment used for maintenance and certification.

- In the UK, The competency standard for aircraft instrumentation testing outlines the skills required to conduct testing on fixed-wing and rotary-wing aircraft in accordance with approved procedures. It includes the use of ARINC 429 and MIL-STD-1553 data buses, environmental data acquisition systems, and accident recorders.

Competitive Landscape

Key players are continually innovating to enhance their product offerings and strengthen their market positions. Additionally, market players are focusing on strategic initiatives such as partnerships, acquisitions, and technological upgrades to maintain their competitive edge and enhance market share.

- In December 2024, Honeywell announced a strategic agreement with Bombardier to deliver next-generation aviation technology, including advanced avionics, propulsion systems, and satellite communications for Bombardier aircraft. The collaboration centers on Honeywell's Anthem avionics, powerful HTF7K engines, and JetWave X satellite connectivity.

Key Companies in Aviation Test Equipment Market:

- Teradyne

- The Boeing Company

- 3M

- General Electric Co

- Rolls Royce Holdings Plc

- Honeywell International Inc

- Rockwell Collins Inc.

- Lockheed Martin Corporation

- Viavi Solutions Inc

- ATEQ Aviation

- Testek Solutions

- Airbus Group

- Moog Inc

- SPHEREA Test & Services

- DAC International, Inc.

Recent Developments (New Product Launch)

- In October 2024, Govrment of India inaugurated the Tata Aircraft Complex in Vadodara, first private facility to manufacture military aircraft. The complex will produce Airbus C295 tactical transport aircraft as part of a USD 2.5-billion deal with Airbus Defence and Space.

- In June 2024, GE Aerospace introduced a new inspection method for metal parts, developed in collaboration with Bruker, utilizing open beam X-ray fluorescence (XRF) spectroscopy. This technology will be implemented at GE’s new Services Technology Acceleration Center (STAC) to enhance the detection of microstructural variations in aerospace components.

, commonly used in art authentication,