Market Definition

Aviation lubricant is a specialized type of oil or grease designed to reduce friction, wear, and heat in aircraft engines, hydraulic systems, and other mechanical components. These lubricants withstand extreme temperatures, high pressures, and varying atmospheric conditions while ensuring smooth and efficient operation.

They also provide corrosion resistance, oxidation stability, and thermal durability, enhancing the longevity and reliability of critical aircraft systems. Aviation lubricants come in different types, including mineral-based, synthetic, and semi-synthetic formulations, tailored to meet the rigorous demands of commercial, military, and general aviation applications.

Aviation Lubricant Market Overview

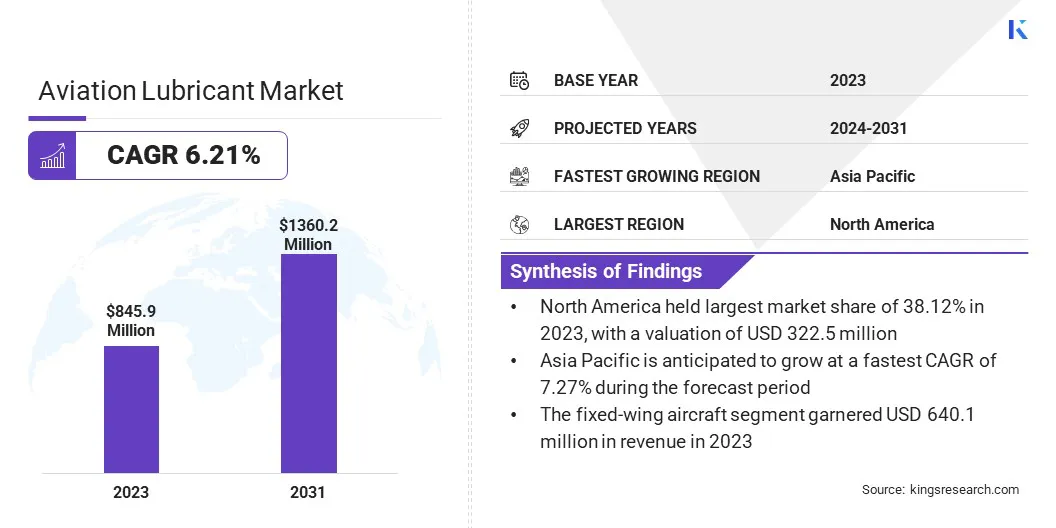

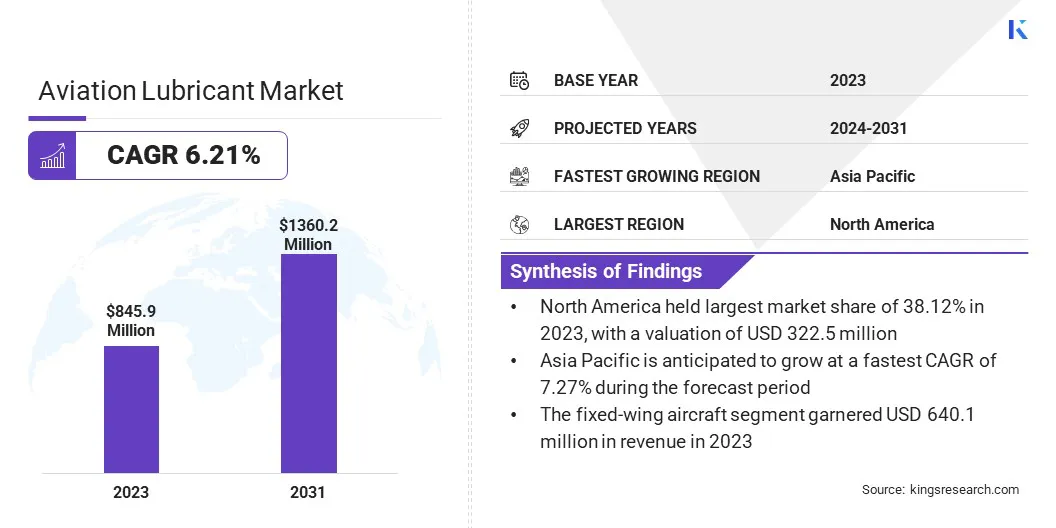

The global aviation lubricant market size was valued at USD 845.9 million in 2023 and is projected to grow from USD 891.9 million in 2024 to USD 1,360.2 million by 2031, exhibiting a CAGR of 6.21% during the forecast period.

The market is a vital segment of the aerospace industry, driven by the increasing demand for commercial and military aircraft, rising air passenger traffic, and advancements in aircraft engine technology.

The market encompasses a range of products, including turbine oils, hydraulic fluids, and greases, designed to enhance engine efficiency, reduce wear and tear, and ensure optimal performance under extreme conditions.

Key factors influencing the market include stringent regulatory standards, the shift toward more fuel-efficient and environmentally friendly lubricants, and the expansion of the global aviation sector.

Major companies operating in the global aviation lubricant Industry are Exxon Mobil Corporation, Shell, TotalEnergies, BP p.l.c., The Chemours Company, Phillips 66 Company, NYCO, PJSC LUKOIL, Nye Lubricants, Inc., LANXESS, ROCOL, Whitmore Manufacturing LLC., FUCHS SE, Castrol Limited, and Eastman Chemical Company.

Additionally, the growing demand for maintenance, repair, and overhaul services is fueling market expansion, particularly in emerging economies with expanding air travel networks. This growth is further fostered by the increasing adoption of next-generation aircraft with advanced engine designs, which require high-performance lubricants to meet enhanced operational efficiency and durability standards.

Key Highlights:

- The global aviation lubricant market size was valued at USD 845.9 million in 2023.

- The market is projected to grow at a CAGR of 6.21% from 2024 to 2031.

- North America held a market share of 38.12% in 2023, with a valuation of USD 322.5 million.

- The engine oils segment garnered USD 381.4 million in revenue in 2023.

- The fixed-wing aircraft segment is expected to reach USD 993.2 million by 2031.

- The mineral-based lubricants segment is expected to reach USD 823.4 million by 2031.

- The engine components segment is expected to reach USD 541.1 million by 2031.

- The OEMs (Original Equipment Manufacturers) segment is expected to reach USD 926.6 million by 2031.

- The commercial aviation segment is expected to reach USD 884.4 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 7.27% over the forecast period.

Market Driver

"Fleet Expansion and Regulatory Standards"

The aviation lubricant market is witnessing robust growth, primarily driven by the expansion of global air travel and the increasing number of aircraft in operation. As air passenger traffic rises, particularly in emerging markets such as India, China, and Southeast Asia, airlines are expanding their fleets with modern, fuel-efficient aircraft.

These aircraft require high-performance lubricants to enhance engine efficiency, minimize wear and tear, and extend maintenance intervals, reducing operational costs.

- In September 2024, Airports Council International (ACI) World released its 2024 Annual World Airport Traffic Report, projecting a 10% increase in global passenger traffic to 9.5 billion passengers. The report, based on data from over 2,700 airports across 180+ countries, highlights the resilience and recovery of the aviation industry, with passenger traffic surpassing pre-pandemic levels.

Additionally, stringent aviation regulations and maintenance requirements imposed by regulatory bodies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) are reinforcing the demand for high-quality, certified aviation lubricants.

These regulations ensure that lubricants meet strict safety, reliability, and environmental standards, compelling airlines and maintenance, repair, and overhaul (MRO) providers to adopt premium lubricants that comply with industry guidelines.

Market Challenge

"High Cost and Stringent Regulatory Framework"

A major challenge impeding the growth of the aviation lubricant market is the high cost of advanced synthetic and bio-based lubricants, which can be significantly more expensive than traditional mineral-based alternatives.

Airlines and maintenance providers, particularly in cost-sensitive markets, may be hesitant to switch despite the long-term benefits. This challenge can be addressed through increased research and development efforts to enhance production efficiency and scalability, thereby reducing costs and making sustainable lubricants more affordable.

Another key challenge hampering the expansion of the market is the frequent updates and evolving standards set by aviation authorities such as the FAA and EASA. These regulatory bodies continuously revise their guidelines to enhance safety, environmental sustainability, and engine performance, posing challenges for lubricant manufacturers to remain compliant.

The stringent approval process involves extensive testing, documentation, and compliance verification, which can significantly delay product certification and market entry. Additionally, each new aircraft model or engine technology often comes with unique lubrication requirements, further complicating the certification process.

To successfully navigate these challenges, companies must proactively track regulatory changes, allocate resources to specialized regulatory teams, and integrate compliance measures into their research and development processes.

Market Trend

"Notable Shift Toward Sustainable and High-Performance Aviation Lubricants"

The aviation lubricant industry is evolving rapidly, supported by technological advancements and the industry's commitment to sustainability. The market is witnessing a significant shift toward sustainable and bio-based lubricants, as airlines and aviation companies increasingly prioritize environmentally friendly solutions.

With global sustainability goals and stricter emission regulations, manufacturers are advancing bio-based and synthetic lubricants that reduce carbon footprints without compromising performance.

- For instance, in July 2023, Shell Aviation introduced a new lifecycle sustainability approach for its AeroShell aviation lubricants to address lifecycle carbon emissions. This initiative aligns with Shell’s target to become a net zero-emissions energy business by 2050.

Additionally, there is a growing demand for high-performance synthetic lubricants due to their superior thermal stability, oxidation resistance, and extended service life.

As next-generation aircraft and advanced engine technologies, such as the CFM LEAP and Pratt & Whitney GTF engines, become more prevalent, the need for lubricants that can withstand extreme temperatures and pressures is rising.

These high-performance lubricants enhance engine efficiency, reduce maintenance costs, and improve overall aircraft reliability, making them a preferred choice for modern aviation fleets.

Aviation Lubricant Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Engine Oils, Hydraulic Fluids, Greases, Special Additives

|

|

By Aircraft Type

|

Fixed-Wing Aircraft, Rotary-Wing Aircraft, Unmanned Aerial Vehicles (UAVs)

|

|

By Technology

|

Synthetic Lubricants, Mineral-Based Lubricants, Bio-Based Lubricants

|

|

By Application

|

Engine Components, Landing Gear, Airframe, Hydraulic Systems

|

|

By Distribution Channel

|

OEMs (Original Equipment Manufacturers), Aftermarket

|

|

By End Use

|

Commercial Aviation, Military Aviation, General Aviation

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Engine Oils, Hydraulic Fluids, Greases, and Special Additives): The engine oils segment earned USD 381.4 million in 2023, mainly due to the increasing demand for high-performance lubricants that enhance engine efficiency and longevity.

- By Aircraft Type (Fixed-Wing Aircraft, Rotary-Wing Aircraft, and Unmanned Aerial Vehicles (UAVs)): The fixed-wing aircraft segment held a share of 75.67% in 2023, primarily fueled by the rising commercial and military aircraft operations worldwide.

- By Technology (Synthetic Lubricants, Mineral-Based Lubricants, and Bio-Based Lubricants): The mineral-based lubricants segment is projected to reach USD 823.4 million by 2031, owing to their cost-effectiveness and widespread use in legacy aircraft systems.

- By Application (Engine Components, Landing Gear, Airframe, and Hydraulic Systems): The engine components segment is likely to reach USD 541.1 million by 2031, mainly propelled by the critical role of lubricants in reducing friction and wear in high-performance aircraft engines.

- By Distribution Channel (OEMs (Original Equipment Manufacturers) and Aftermarket,): The OEMs (Original Equipment Manufacturers) segment is anticipated to generate a revenue of USD 926.6 million by 2031, largely attributed to the continuous production of new-generation aircraft with advanced lubrication requirements.

- By End Use (Commercial Aviation, Military Aviation, and General Aviation): The commercial aviation segment is estimated to register a valuation of USD 884.4 million by 2031, supported by the expanding global airline fleet and increasing air travel demand.

Aviation Lubricant Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America aviation lubricant market accounted for a substantial share of 38.12% in 2023, valued at USD 322.5 million. This dominance is attributed to the strong presence of key aircraft manufacturers, well-developed aviation infrastructure, and a high concentration of military and commercial aircraft operations.

The region’s demand for high-performance lubricants is further fueled by stringent regulatory requirements, increasing investments in next-generation aircraft, and the expansion of maintenance, repair, and overhaul (MRO) services.

The U.S. is at the forefront of this growth, supported by a growing focus on sustainable aviation lubricants and advanced synthetic formulations to enhance aircraft efficiency and longevity.

Asia Pacific aviation lubricant Industry is expected to register the fastest CAGR of 7.27% over the forecast period. This growth is bolstered by the rapid expansion of air travel, fleet modernization, and rising defense expenditures.

The region is witnessing increased aircraft procurement, particularly in China and India, due to rowing commercial aviation and military investments. The surge in low-cost carriers (LCCs), airport infrastructure development, and government initiatives to strengthen domestic aerospace industries is further boosting the demand for aviation lubricants.

Additionally, growing partnerships between global lubricant manufacturers and regional airlines are expected to shape regional market.

- In January 2025, DHL Express signed an agreement with Cosmo Oil Marketing Co., Ltd. to purchase 7.2 million liters of Sustainable Aviation Fuel annually. Starting in April 2025, this initiative aims to support emission-reduced air freight in Japan, marking a first for the international express industry in Asia.

Regulatory Frameworks

- In the U.S., the Federal Aviation Administration (FAA) regulates aviation safety standards, including the approval and oversight of aviation lubricants used in aircraft operations. Additionally, tThe Environmental Protection Agency (EPA) enforced environmental regulations that impact the formulation and use of these lubricants.

- In Europe, the European Union Aviation Safety Agency (EASA) is responsible for ensuring aviation safety across member states, which includes setting standards for the use and approval of aviation lubricants. Additionally, the European Chemicals Agency (ECHA) oversees chemical safety regulations that affect lubricant formulations.

- In China, the Civil Aviation Administration of China (CAAC) regulates aviation lubricants by establishing standards and regulating their use in the civil aviation sector.

- In India, the Directorate General of Civil Aviation (DGCA) oversees civil aviation safety, encompassing the regulation and approval of aviation lubricants to ensurecompliance with safety and performance standards.

Competitive Landscape

The global aviation lubricant market is characterized by a large number of participants, including both established corporations and emerging players. Industry participants are focusing on product innovation, strategic partnerships, and expansion into emerging markets to strengthen their market position.

Market growth is propelled by the rising demand for high-performance, eco-friendly lubricants that enhance engine efficiency while meeting stringent regulatory standards.

Companies are heavily investing in research and development to introduce synthetic and bio-based lubricants with superior thermal stability, oxidation resistance, and extended service life.

The shift toward sustainable aviation fuels (SAF) and green technologies has further intensified competition, with manufacturers focusing on developing environmentally friendly lubricant formulations.

Moreover, strategic collaborations with aircraft manufacturers, maintenance, repair, and overhaul service providers, and airlines play a crucial role in gaining a competitive edge. The aftermarket segment is becoming increasingly important as airlines and defense organizations prioritize extending aircraft lifespan through efficient lubrication solutions.

- In January 2024, Shell Aviation signed a long-term agreement with Air Europa, designating Shell as the airline’s preferred supplier of aviation lubricants. Air Europa will benefit from AeroShell Ascender and AeroShell Turbine Oil, which enhance engine performance by reducing oil coke build-up and minimizing engine seal degradation.

List of Key Companies in Aviation Lubricant Market:

- Exxon Mobil Corporation

- Shell

- TotalEnergies

- BP p.l.c.

- The Chemours Company

- Phillips 66 Company

- NYCO

- PJSC LUKOIL

- Nye Lubricants, Inc.

- LANXESS

- ROCOL

- Whitmore Manufacturing LLC.

- FUCHS SE

- Castrol Limited

- Eastman Chemical Company

Recent Developments (M&A/Partnerships/Agreements)

- In July 2024, AMSOIL INC. acquired Aerospace Lubricants to strengthen its grease formulation and production capabilities, with Aerospace Lubricants continuing to operate as an independent subsidiary.

- In January 2024, Crane Company acquired Vian Enterprises, Inc. for approximately USD 103 million. The acquisition enhances Crane’s Aerospace & Electronics segment by expanding its portfolio of aerospace lubrication solutions and fluid management products for commercial and military aircraft.

- In June 2023, Avioparts and Volotea Airlines renewed their long-term Aviation Lubricants Supply Agreement for an additional three years in partnership with ExxonMobil Aviation Lubricants. The agreement includes forecasting, planning, advanced provisioning, and supply chain administration across Volotea’s 19 stations in Europe.

- In 2023, Akasa Air partnered with Team Aviation, ExxonMobil’s authorized distributor in India, to supply Mobil Jet Oil II and Mobil HyJet V lubricants for its Boeing 737 MAX fleet, ensuring efficient engine performance and reliability.