Market Definition

The market involves the manufacturing and supply of carbon fiber materials for aerospace applications. It includes raw carbon fiber, intermediate products such as resin-impregnated fibers and fabric reinforcements, and composite components used in aircraft structures.

Market growth is fueled by the rising demand for lightweight materials that enhance fuel efficiency, improve performance, and regulatory compliance across commercial, military, and general aviation sectors.

Aviation Carbon Fiber Market Overview

The global aviation carbon fiber market size was valued at USD 2,310.0 million in 2023 and is projected to grow from USD 2,529.3 million in 2024 to USD 5,236.1 million by 2031, exhibiting a CAGR of 10.95% during the forecast period.

Market growth is driven by the increasing demand for lightweight, high-performance materials in the aerospace industry. Carbon fiber composites offer superior strength-to-weight ratios, making them ideal for reducing aircraft weight and improving fuel efficiency, crucial factors in advancing environmentally sustainable aviation.

The growing emphasis on reducing carbon emissions and operational costs has accelerated the adoption of carbon fiber in both commercial and military aviation sectors.

Major companies operating in the aviation carbon fiber industry are Hexcel Corporation, TORAY INDUSTRIES, INC., SGL Carbon, Mitsubishi Chemical Group Corporation, Teijin Carbon Europe GmbH, Syensqo, Formosa M Co., Ltd., DowAksa, Zoltek Corporation, Hyosung USA, BASF SE, PORCHER INDUSTRIES, Bally Ribbon Mills, Nippon Graphite Fiber Co., Ltd., and Carbon Light Private Limited.

Additionally, advancements in manufacturing technologies, including automated fiber placement and resin infusion techniques, have improved production efficiency and material performance.

The increasing production of next-generation aircraft, such as fuel-efficient commercial jets and advanced military planes, is further boosting the demand for carbon fiber materials.

These factors, combined with the aerospace industry's focus on innovation and regulatory pressures for fuel efficiency and performance, are propelling the expansion of the market globally.

- In January 2025, Hartzell Propeller introduced its Carbon Voyager propellers following STC approval for the Cessna Skywagon fleet. Constructed from aerospace-grade carbon fiber composite, these propellers are 20.8 pounds lighter than their metal counterparts, improving takeoff and climb performance by 3–4%. Specifically designed for backcountry operations, they offer enhanced durability, erosion resistance, and protection against foreign object damage.

Key Highlights

- The aviation carbon fiber industry size was valued at USD 2,310.0 million in 2023.

- The market is projected to grow at a CAGR of 10.95% from 2024 to 2031.

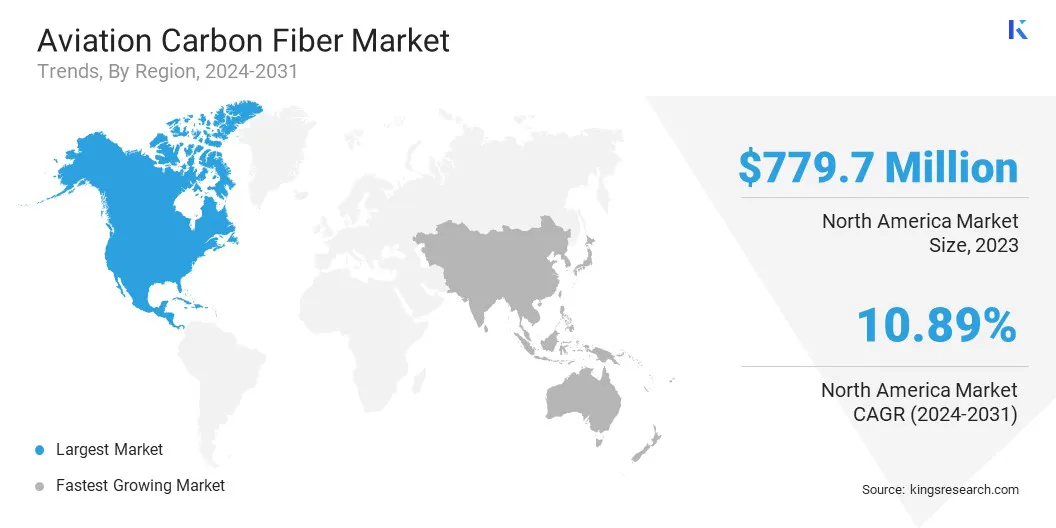

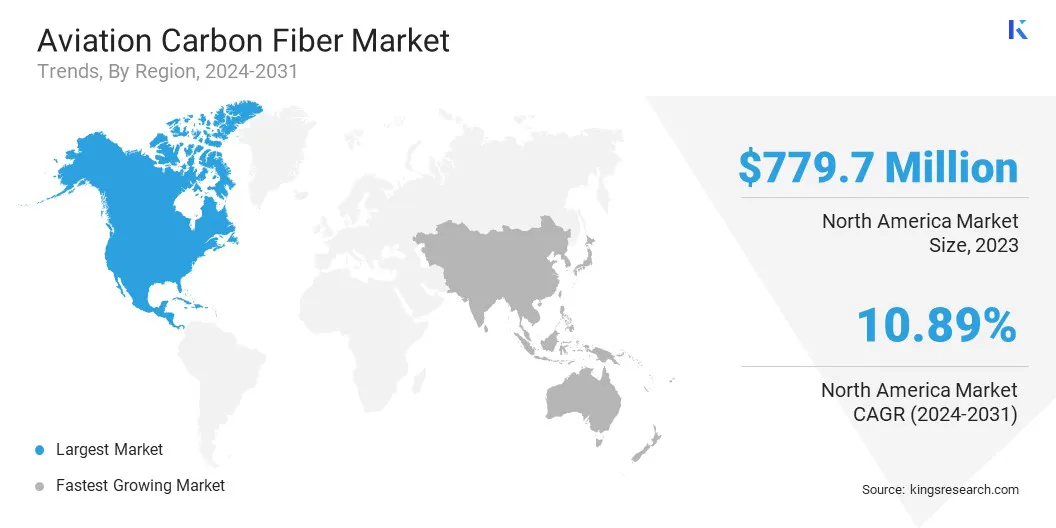

- North America held a share of 33.75% in 2023, valued at USD 779.7 million.

- The PAN-based segment garnered USD 1,335.5 million in revenue in 2023.

- The continuous segment is expected to reach USD 2,165.1 million by 2031.

- The commercial segment is projected to generate a revenue of USD 2,220.1 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 11.85% over the forecast period.

Market Driver

"Rising Demand for Lightweight Aircraft and the Growth of Next-Generation Aircraft Production"

The aviation carbon fiber market is experiencing robust growth, propelled by the rising emphasis on reducing aircraft weight to improve fuel efficiency and lower operating costs.

Carbon fiber composites offer an exceptional strength-to-weight ratio, allowing aircraft manufacturers to replace traditional metal structures with lightweight composite materials.

This shift significantly enhances fuel economy, reduces emissions, and improves aircraft performance. Airlines are increasingly focused on these benefits to reduce fuel costs and meet stringent environmental regulations, making carbon fiber an essential material in modern aircraft design.

- In January 2025, Hexcel Corporation showcased its latest aerospace composite innovations at Aero India 2025. The company highlighted its HexTow carbon fiber, HexPly prepregs, and HiTape reinforcements, designed for high-rate manufacturing and automation in next-generation aircraft, UAVs, and air mobility applications. Hexcel emphasized its out-of-autoclave technologies and liquid compression molding solutions, focused on enhancing efficiency, reducing costs, and supporting sustainability in aerospace manufacturing.

Furthermore, the increasing production of next-generation aircraft, including commercial airliners, military jets, UAVs (Unmanned Aerial Vehicles), and electric aircraft, is bolstering market expansion.

As aviation technology advances, aircraft manufacturers seek high-performance materials that meet modern demands for aerodynamics, durability, and fuel efficiency.

Carbon fiber composites provide superior fatigue and corrosion resistance, along with design flexibility, making them ideal for both structural and functional components. Additionally, the rise of electric and hybrid aircraft further fuels the demand for lightweight composites to improve battery efficiency and extend flight range.

Market Challenge

High Production Costs and Complex Manufacturing Processes

The expansion of the aviation carbon fiber market is hindered by the high production costs and complex manufacturing processes required for carbon fiber composites.

Unlike traditional aerospace materials such as aluminum, carbon fiber undergoes intricate fabrication techniques, including automated fiber placement (AFP), autoclave curing, and resin infusion, all of which require expensive equipment, skilled labor, and extended processing times.

Additionally, carbon fiber components require strict quality control and precision engineering to meet aerospace safety and performance standards, which increases costs.

Another challenge is the difficult repairability and recyclability of carbon fiber structures, as damaged components typically require full replacements instead of simple fixes, leading to higher maintenance and operational expenses for airlines and aircraft manufacturers.

To overcome these challenges, aerospace companies are focusing on advanced manufacturing innovations such as out-of-autoclave (OOA) processing, rapid curing resins, and automated production techniques to enhance efficiency and reduce material waste.

Additionally, the adoption of thermoplastic composites is rising due to their enhanced repairability, shorter production cycles, and improved recyclability compared to traditional thermoset carbon fiber.

Market Trend

"Sustainability and Material Innovation"

The aviation carbon fiber market is evolving with a strong focus on sustainability and material innovation. Key trend include advancements in recyclable and sustainable carbon fiber solutions, fueled by manufacturers's investment in eco-friendly alternatives to reduce the environmental impact of aerospace manufacturing.

These innovations, such as bio-based resins, closed-loop recycling systems, and reclaimed carbon fiber technology, aim to minimize waste, lower carbon emissions, and comply with stringent aviation sustainability regulations. As the aerospace industry transitions to net-zero emissions, demand for sustainable carbon fiber solutions is growing.

Another major trend is the increased adoption of thermoplastic carbon fiber composites, which offer high impact resistance, reduced curing time, and enhanced recyclability over traditional thermoset composites.

These materials also enable automated manufacturing techniques, such as out-of-autoclave processing, allowing for faster production cycles and cost-effective large-scale manufacturing.

Their lightweight, durable properties make them ideal for next-generation aircraft, including commercial jets, electric vertical take-off and landing aircraft, and unmanned aerial vehicles. As a result, thermoplastic carbon fiber composites are set to revolutionize aircraft structures, improving efficiency and sustainability in aviation.

- In April 2024, SOGECLAIR EQUIPMENT and SPIRAL RTC announced a partnership to enhance the circularity of carbon fiber-based thermoplastic composites. The collaboration aims to recycle production waste and promote eco-design, supporting the aerospace industry's decarbonization efforts.

Aviation Carbon Fiber Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

PAN-based, Pitch-based

|

|

By Type

|

Continuous, Long, Short

|

|

By Application

|

Commercial, Military, Rotorcraft

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (PAN-based and Pitch-based): The PAN-based segment earned USD 1,335.5 million in 2023 due to its widespread use in high-performance applications, offering superior strength and durability for aerospace components.

- By Type (Continuous, Long, and Short): The continuous segment held a share of 41.79% in 2023, fueled by its ability to provide stronger, more durable composite materials for critical aerospace structures.

- By Application (Commercial, Military, and Rotorcraft): The commercial segment is projected to reach USD 2,220.1 million by 2031, attributed to the growing demand for fuel-efficient, lightweight materials in modern commercial aircraft.

Aviation Carbon Fiber Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America aviation carbon fiber market accounted for a substantial share of 33.75% in 2023, valued at USD 779.7 million. This dominance is primarily attributed to its well-established aerospace industry, which demands lightweight, high-strength materials to improve fuel efficiency and performance in both commercial and military aircraft.

This growth is further supported by extensive investments in R&D and innovation, as well as government-driven initiatives focused on advancing aerospace technologies. Stringent environmental regulations further increase demand for fuel-efficient aircraft.

Additionally, the presence of major aviation hubs and leading aircraft manufacturers boosts the adoption of advanced composite materials, solidifying region's leading market position.

- In November 2024, SK Capital acquired Parker Hannifin's North America Composites & Fuel Containment Division, subsequently renaming it Axillon Aerospace. The company specializes in engineered carbon fiber composite components and fuel containment solutions for the defense and commercial aerospace sectors.

Asia Pacific aviation carbon fiber industry is expected to register the fastest CAGR of 11.85% over the forecast period. This growth is largely fueled by the rapid industrialization and urbanization in countries such as China, India, and Japan, leading to a significant increase in air travel demand.

In particular, the expanding middle-class population in these countries is highlighting the need for commercial aircraft, thereby spurring demand for lightweight, fuel-efficient materials such as carbon fiber.

This growth is further aided by the region's expanding defense sector, with increased government spending on military aircraft and next-generation aviation technologies.

Furthermore, growing investments in advanced manufacturing capabilities and new production facilities further strengthen its position. Additionally, partnerships and collaborations within the region are enhancing the supply chain for carbon fiber materials, contributing to market expansion.

Regulatory Frameworks

- In the United States, aviation carbon fiber materials are regulated by the Federal Aviation Administration (FAA), under the Federal Aviation Regulations (FAR), particularly Part 25, which defines airworthiness standards for transport-category airplanes. These materials must meet strict safety, durability, and performance standards.

- In Europe, the European Union Aviation Safety Agency (EASA) regulates carbon fiber materials, setting standards for the certification, manufacturing, testing, and quality assurance of composites used in aviation.

- In China, the Civil Aviation Administration of China (CAAC) governs aviation carbon fiber materials through its Airworthiness Regulations, which include requirements for aircraft components and testing.The Civil Aviation Industry Standard of China (CAISC) ensures carbon fiber composites meet safety and performance standards.

- In Japan, aviation carbon fiber materials are governed by the Japan Civil Aviation Bureau (JCAB) under the Civil Aviation Law and Japan Aircraft Regulations. JCAB ensures compliance with international standards for aviation safety and enforces specifications for composite materials used in aircraft.

- In India, the Directorate General of Civil Aviation (DGCA) oversees aviation carbon fiber materials, enforcing safety regulations based on the Civil Aviation Requirements (CAR) and international standards, while adhering to ISO 9001 and AS9100 quality standards.

Competitive Landscape

The aviation carbon fiber industry is characterized by the increasing demand for advanced composite materials in aerospace applications. Key market players are focused on enhancing production capabilities, expanding product portfolios, and investing in research and development to offer innovative solutions that meet the evolving needs of the aviation sector.

Companies are also emphasizing the development of high-performance carbon fiber materials that deliver superior strength, durability, and weight reduction, which are critical for fuel efficiency and overall aircraft performance.

Manufacturers are focusing on improving manufacturing processes, such as automated fiber placement and resin infusion technologies, to reduce costs and increase efficiency. Additionally, there is a growing trend toward sustainable production practices, with some companies exploring eco-friendly alternatives to traditional carbon fiber production methods.

Furthermore, ongoing investments in the development of next-generation aircraft, including both commercial and military platforms, are reshaping the market's competitive dynamics.

As the aerospace industry prioritizes lightweight materials to enhance fuel efficiency and reduce emissions, industry participants are estimated to focus on offering highly specialized carbon fiber solutions tailored to specific applications and regional needs.

- In May 2024, Toray Group showcased its advanced carbon fiber and composite materials at SAMPE 2024, highlighting innovations for aerospace, defense, and industrial sectors. The exhibition featured lightweight, high-strength materials designed to improve fuel efficiency and structural performance, complemeted by technical sessions on fiber placement and polyimide prepreg development.

List of Key Companies in Aviation Carbon Fiber Market:

- Hexcel Corporation

- TORAY INDUSTRIES, INC.

- SGL Carbon

- Mitsubishi Chemical Group Corporation

- Teijin Carbon Europe GmbH

- Syensqo

- Formosa M Co., Ltd.

- DowAksa

- Zoltek Corporation

- Hyosung USA

- BASF SE

- PORCHER INDUSTRIES

- Bally Ribbon Mills

- Nippon Graphite Fiber Co., Ltd.

- Carbon Light Private Limited

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In March 2025, Toray Composite Materials America, Inc. signed a memorandum of understanding with Elevated Materials to repurpose carbon fiber prepreg waste from its Washington facility. The partnership aims to reduce waste, conserve resources, and promote sustainability by transforming scrap prepreg materials into press-cured carbon fiber sheets, plates, and blocks for various applications.

- In October 2024, Hexcel outlined its strategy for high-rate aerospace composites at the Carbon Fiber 2024 Conference. The company emphasized the need for cost-effective, sustainable composite solutions for next-generation single-aisle aircraft and Advanced Air Mobility (AAM) electric aircraft. Hexcel is optimizing production efficiency through its vertically integrated manufacturing of carbon fiber, prepreg resin systems, and honeycomb materials, while advancing compression molding and out-of-autoclave methods for high-rate manufacturing.

- In January 2025, Arkema showcased advancements in aerospace carbon fiber composites at JEC World 2025. The HAICoPAS aerospace demonstrator, developed in collaboration with Hexcel, featured HexTow AS7 and IM7 carbon fibers with Kepstan PEKK resin, enhancing recyclability and productivity for next-generation aerospace applications.

- In February 2025, Toray Industries, Inc. showcased next-generation composite technologies at JEC World 2025, including TORAYCA carbon fiber, advanced towpreg, and thermoplastic composites. The exhibition highlighted Toray’s commitment to sustainability and innovation in aviation materials, underscoring its leadership in lightweight, high-performance aerospace composites for aerospace applications.

- In February 2025, Exel Composites partnered with FLYING WHALES to supply 75 km of carbon fiber tubes for the LCA60T, the world’s largest VTOL airship, designed for sustainable cargo transport with reduced CO2 emissions.