Market Definition

The market encompasses electronic systems that manage and convert electrical power in vehicles. It includes components such as inverters, converters, and controllers essential for electric powertrains and advanced driver-assistance systems.

The market covers products used in electric vehicles (EVs), hybrid electric vehicles (HEVs), and internal combustion engine vehicles with electronic subsystems. The market also covers services such as system integration, testing, and maintenance for OEMs and aftermarket applications.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry in the forecast period.

Automotive Power Electronics Market Overview

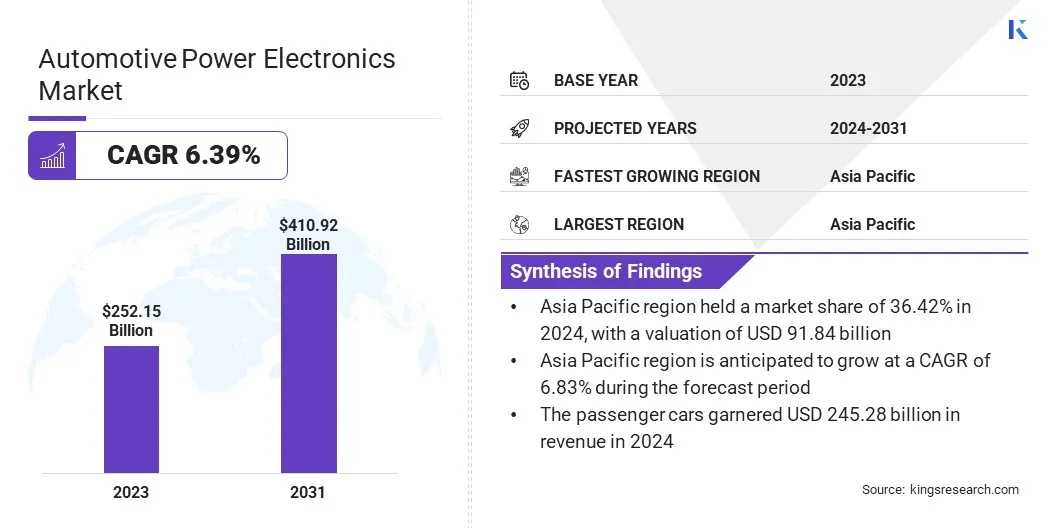

The global automotive power electronics market size was valued at USD 252.15 billion in 2024 and is projected to grow from USD 266.36 billion in 2025 to USD 410.92 billion by 2032, exhibiting a CAGR of 6.39% during the forecast period.

The rapid expansion of EV charging infrastructure is advancing in power conversion technologies and accelerating EV adoption, Thereby driving the growth in the market.

Major companies operating in the automotive power electronics industry are Jabil Inc., Danfoss, August Electronics Inc., Robert Bosch GmbH, Continental AG, Infineon Technologies AG, STMicroelectronics, Semiconductor Components Industries, LLC,3CEMS Group., Omron Corporation, HGM Automotive Electronics, Delta Electronics, Inc., Lear Corp., NVIDIA Corporation, and AISIN CORPORATION.

The increasing adoption of advanced driverassistance systems (ADAS) is boosting the demand for automotive power electronics. ADAS relies on complex electronic components for realtime data processing, sensor integration, and control systems to improve vehicle safety.

This rise in ADAS implementation is driving advancements in power electronics, contributing to growth in the automotive industry and supporting the expansion of the market.

- In March 2025, Honda Cars India Ltd. (HCIL) achieved a significant sales milestone, with 50,000 Advanced Driver Assistance System (ADAS)-enabled Honda vehicles now operating on Indian roads. This achievement underscores HCIL’s growing commitment to automotive safety and innovation, reflecting the increasing consumer demand for intelligent mobility solutions in line with global advancements in driver assistance technologies.

Key Highlights:

- The automotive power electronics market size was recorded at USD 252.15 billion in 2024.

- The market is projected to grow at a CAGR of 6.39% from 2025 to 2032.

- Asia Pacific held a market share of 36.42% in 2024, with a valuation of USD 91.84 billion.

- The ECU/DCU technology segment garnered USD 172.71 billion in revenue in 2024.

- The powertrain segment is expected to reach USD 142.84 billion by 2032.

- The passenger cars technology segment garnered USD 245.28 billion in revenue in 2024.

- The ICE segment is expected to reach USD 284.44 billion by 2032.

- North America is anticipated to grow at a CAGR of 6.50% during the forecast period.

Market Driver

Expansion of EV Charging Infrastructure

The global market is growing due to the rapid expansion of electric vehicle charging infrastructure, especially fast-charging stations. These stations reduce charging time, increase convenience and boost consumer confidence in EVs. As a result, EV adoption is accelerating.

This demand is driving advancements in power conversion technologies like inverters and onboard chargers. Additionally, manufacturers are developing efficient components using materials such as silicon carbide and gallium nitride to improve performance and support sustainable EV growth.

- In January 2025, the International Council on Clean Transportation reported that electric vehicle (EV) sales in India reached 1.9 million units in 2024, reflecting a 19% increase compared to 2023. Additionally, the country saw a record expansion with the installation of 25,202 public charging stations nationwide.

Market Challenge

Challenge of Enhancing Efficiency and Reliability

The Automotive Power Electronics market faces a critical challenge in managing thermal efficiency amid rising power densities and compact designs. As electric vehicles demand higher performance, excessive heat generation threatens component reliability and lifespan.

Manufacturers are addressing this by investing in advanced thermal management solutions, including wide-bandgap semiconductors such as silicon carbide (SiC) and gallium nitride (GaN), which offer superior efficiency and heat tolerance.

Additionally, firms are optimizing packaging technologies and integrating smart cooling systems to ensure sustained operational stability, thereby enhancing overall system performance and aligning with evolving EV architecture requirements.

Market Trend

Rising Adoption of Lite System-on-Chip (SoC) Technology

A key trend shaping the market is the growing integration of Lite system-on-chip (SoC) technology. This shift is driven by the need for compact, energy-efficient, and high-performance solutions to support electric vehicle (EV) architectures and advanced driver-assistance systems (ADAS).

This is prompting automotive manufacturers to adopt Lite SoCs for enhanced functionality, reduced system complexity, and improved cost-efficiency.

- In April 2024, Mobileye launched the EyeQ6 Lite a system-on-chip developed to support global Advanced Driver-Assistance Systems (ADAS) in mass-market vehicles. It delivers enhanced processing efficiency to enable key functions such as lane-keeping, adaptive cruise control, and traffic sign recognition.

Automotive Power Electronics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

ECU/DCU, Sensors, Power Electronics, Others (Harnesses, Controls, Switches, Displays)

|

|

By Application

|

Body, Chassis, Powertrain, Infotainment, ADAS/AD

|

|

By Vehicle Type

|

Passenger Cars, Commercial Vehicles

|

|

By Propulsion

|

ICE, Electric/Hybrid

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (ECU/DCU, Sensors, Power Electronics, Others (Harnesses, Controls, Switches, Displays)): The ECU/DCU segment earned USD 172.71 billion in 2024 due to its critical role in enabling advanced driver assistance systems (ADAS), electric vehicle (EV) power management, and overall vehicle electrification

- By Application (Body, Chassis, Powertrain, and Infotainment): The powertrain segment held 32.97% of the market in 2024, due to the growing demand for high-performance electric and hybrid powertrains that require advanced power electronics for efficient energy conversion, management, and optimization in modern vehicles.

- By Vehicle Type (Passenger Cars, Commercial Vehicles): The passenger cars segment is projected to reach USD 402.25 billion by 2032, owing to the substantial global production and sales of passenger vehicles, which drive the demand for advanced electronic components essential for modern automotive systems.

- By Propulsion (ICE, Electric/Hybrid): The ICE segment earned USD 178.36 billion in 2024 due to its extensive global presence, established infrastructure, and the ongoing integration of power electronics to enhance fuel efficiency, emissions control, and overall vehicle performance in traditional vehicles.

Automotive Power Electronics Market Regional Analysis

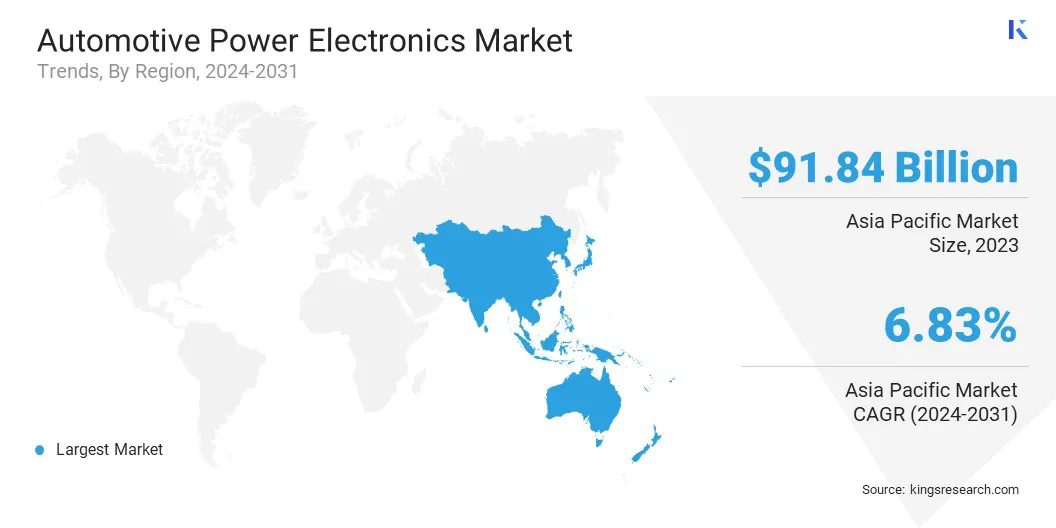

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific automotive power electronics market share stood at around 36.42% in 2024, with a valuation of USD 91.84 billion. This dominance is largely driven by the region’s rapid adoption of electric vehicles (EVs), with China leading in production and sales.

Government mandates, supportive policies, and rising consumer demand are accelerating EV deployment across the region. As a result, the need for advanced power electronics to ensure efficient energy conversion and system management is growing, contributing significantly to market expansion in the region.

- For instance, China recorded 8.1 million new electric car registrations in 2023, a 35% increase from 2022. While conventional vehicle sales declined by 8%, electric vehicle growth drove the overall market, underscoring their strong performance as the market matures..

North America is poised for significant growth at a robust CAGR of 6.50% over the forecast period. This growth is driven by rapid advancements in electric vehicle (EV) infrastructure and favorable government policies supporting EV adoption.

Increasing investments by key automotive OEMs in powertrain electrification, coupled with robust technological innovation, are accelerating market growth. Furthermore, the region’s strong presence of semiconductor manufacturers enhances supply chain efficiency, driving the demand for advanced power electronic components in next-generation vehicles.

Regulatory Frameworks

- In China, The China National Standards (GB Standards), governed by the Standardization Administration of China (SAC), regulate automotive electronics, including power electronics to ensure compliance with safety, environmental, and performance requirements.

- In the U.S., the Federal Communications Commission (FCC) regulates automotive electronics' electromagnetic compatibility (EMC), ensuring devices like inverters and charging systems don’t cause interference with communication systems. The FCC enforces standards to maintain efficient, interference-free vehicle operations.

Competitive Landscape

The automotive power electronics market is witnessing a surge in new product launches, as leading players focus on developing cutting-edge solutions to meet the growing demand for electric vehicles (EV) and hybrid technologies. These innovations, include advanced power inverters, battery management systems, and energy-efficient converters.

They are designed to enhance vehicle performance, reduce energy consumption, and support the transition to sustainable mobility. Such strategic launches position companies to capitalize on emerging market trends and technological advancements.

- In March 2025, Infineon Technologies AG launched the Power PROFET + 24/48V switch family, featuring two high-side switch variants with minimal power loss. It is ideal for modern automotive systems, including electric and hybrid vehicles, enhancing safety, sustainability, and comfort.

List of Key Companies in Automotive Power Electronics Market:

- Jabil Inc.

- Danfoss

- August Electronics Inc.

- Robert Bosch GmbH

- Continental AG

- Infineon Technologies AG

- STMicroelectronics

- Semiconductor Components Industries, LLC

- 3CEMS Group.

- Omron Corporation

- HGM Automotive Electronics

- Delta Electronics, Inc.

- Lear Corp.

- NVIDIA Corporation

- AISIN CORPORATION

Recent Developments (M&A/New Product Launch)

- In April 2025, Infineon introduced CoolSiC MOSFET 750V G2, designed for modern automotive power electronics. They offer 25% faster switching, reduced parasitic capacitance and gate charge, and improved body diode performance. Additionally, extended negative gate voltage tolerance and enhanced thermal performance support higher junction temperatures and improved reliability in power converters.

- In July 2024, Lear Corporation completed its acquisition of WIP Industrial Automation to enhance its advanced manufacturing capabilities. WIP specializes in developing and deploying robotics and AI-based computer vision crucial for improving precision, safety, and quality in production environments.