Market Definition

The market focuses on the development, manufacturing, and application of advanced materials designed to reduce vehicle weight while maintaining structural integrity and performance.

It includes materials such as aluminum alloys, carbon fiber composites, high-strength steel, and magnesium, which undergo specialized processes like extrusion, stamping, and resin transfer molding to enhance durability and crash resistance.

These materials are integrated into various vehicle components, including the chassis, powertrain, and body panels, to improve fuel efficiency, extend EV battery range, and enhance overall performance. Their application spans internal combustion engine (ICE) vehicles, electric vehicles (EVs), and hybrid models across passenger and commercial segments.

Automotive Lightweight Materials Market Overview

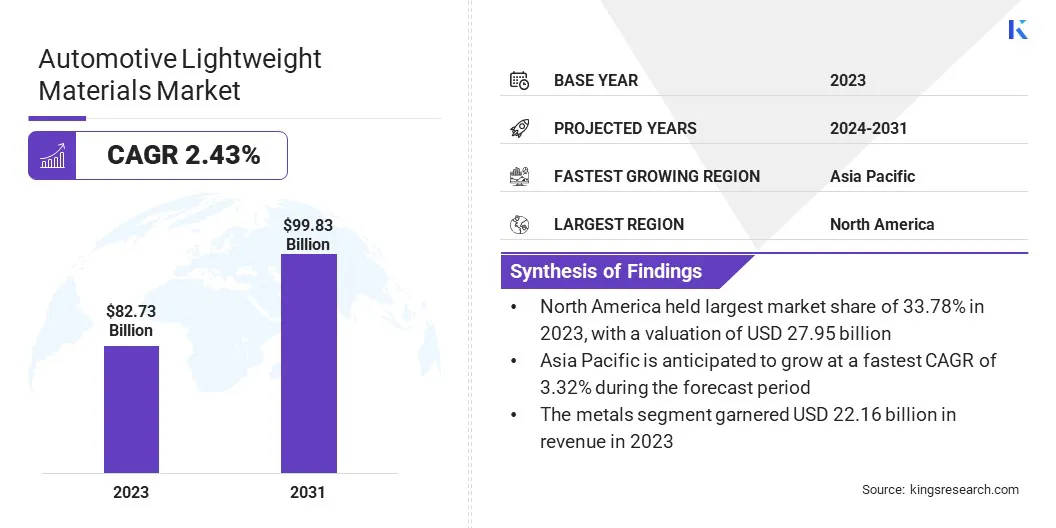

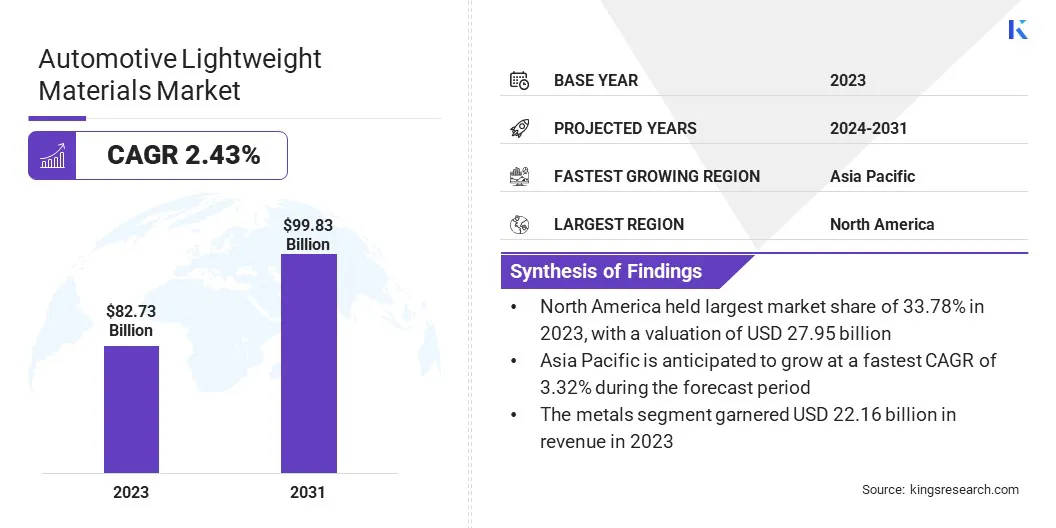

According to Kings Research, the global automotive lightweight materials market size was valued at USD 82.73 billion in 2023 and is projected to grow from USD 84.38 billion in 2024 to USD 99.83 billion by 2031, exhibiting a CAGR of 2.43% during the forecast period.

The market is driven by stringent emission regulations and increasing fuel efficiency standards, prompting automakers to adopt advanced materials such as aluminum, carbon fiber, and high-strength steel.

Additionally, the rising demand for Electric Vehicles (EVs) is accelerating the adoption of lightweight components to enhance battery efficiency and extend driving range, further contributing to market expansion.

Key Market Highlights:

- The automotive lightweight materials industry size was valued at USD 82.73 billion in 2023.

- The market is projected to grow at a CAGR of 2.43% from 2024 to 2031.

- North America held a market share of 33.78% in 2023, with a valuation of USD 27.95 billion.

- The metal segment garnered USD 22.16 billion in revenue in 2023.

- The passenger cars segment is expected to reach USD 38.31billion by 2031.

- The powertrain segment is poised for a robust CAGR of 3.13% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 3.32% during the forecast period.

Major companies operating in the automotive lightweight materials industry are ArcelorMittal, thyssenkrupp AG, Novelis Inc., Alcoa Corporation, Owens Corning, TORAY INDUSTRIES, INC., BASF, Covestro AG, Magna International Inc., 3M, Arconic, DuPont, Nippon Steel Corporation, Sumitomo Chemical Co., Ltd., and LyondellBasell Industries Holdings B.V.

Governments globally are enforcing strict emission standards, compelling automakers to adopt lightweight materials that improve fuel efficiency and reduce carbon emissions. Regulations such as the Corporate Average Fuel Economy (CAFE) standards in the U.S. and Euro 6 standards in Europe have intensified the focus on vehicle weight reduction.

Lightweight materials, including high-strength steel, aluminum, and composites, play a crucial role in meeting these stringent requirements. The rising pressure to comply with emission norms has encouraged manufacturers to develop innovative lightweight solutions, contributing to the expansion of the market.

- In March 2024, the Environment Protection Agency (EPA) finalized the Multi-Pollutant Emissions Standards for Model Years 2027 and Later Light-Duty and Medium-Duty Vehicles, establishing stricter regulations to further minimize harmful air pollutant emissions from these vehicles, beginning with the 2027 model year.

Consumer Preference for Fuel Efficiency

Consumers are increasingly prioritizing fuel efficiency when purchasing vehicles, prompting automakers to integrate lightweight materials that enhance fuel economy. Reducing vehicle weight decreases fuel consumption, making lightweight materials essential for achieving improved mileage.

Automakers are leveraging advanced composites, aluminum, and high-strength steel to develop vehicles that meet consumer expectations for efficiency without compromising durability or safety.

The shift in consumer preferences, driven by fluctuating fuel prices and environmental concerns, is pushing the automotive industry to adopt innovative lightweight solutions, further supporting the expansion of the automotive lightweight materials market.

- A report from the U.S. Department of Energy underscores the substantial impact of lightweight materials on vehicle efficiency. Reducing a vehicle's weight by 10% can improve fuel economy by 6%–8%. Replacing cast iron and conventional steel components with lightweight alternatives could decrease the weight of a vehicle's body and chassis by up to 50%, resulting in lower fuel consumption. Integrating lightweight materials and high-efficiency engines across just one-quarter of the U.S. vehicle fleet can save more than 5 billion gallons of fuel annually by 2030.

High Production Costs and Material Availability

The high production costs associated with advanced lightweight materials, such as carbon fiber composites and high-strength aluminum alloys, pose a significant challenge to market growth. These materials require specialized manufacturing processes, increasing overall production expenses. Additionally, fluctuations in raw material availability impact supply chain stability.

Companies are investing in research and development to enhance cost-effective manufacturing techniques, including recycling and hybrid material solutions.

Strategic partnerships with suppliers and automakers are also being formed to secure a stable supply chain and optimize production efficiencies, ensuring the wider adoption of lightweight materials in the automotive industry.

Growing Adoption of Additive Manufacturing

The increasing use of additive manufacturing is revolutionizing the production of lightweight automotive components. 3D printing enables manufacturers to produce complex structures with minimal material waste, reducing production costs and enhancing efficiency.

Automakers are leveraging this technology to develop lightweight parts with optimized strength-to-weight ratios, improving vehicle performance. The ability to customize designs and integrate multi-material components is further enhancing its appeal in the automotive industry.

The growing adoption of additive manufacturing is accelerating the development of advanced lightweight solutions, driving the automotive lightweight materials market.

- In February 2023, Ford inaugurated a new 3D printing center to support the production of its first all-electric vehicle manufactured in Europe. This advanced facility houses twelve state-of-the-art 3D printers capable of producing a diverse range of plastic and metal components. These parts vary in size from just a few centimeters in length and weighing as little as 30 grams to larger components—crafted by the center's largest 3D printer—measuring up to 2.4 meters long, 1.2 meters wide, and 1 meter high, with a weight of 15 kilograms.

Automotive Lightweight Materials Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Metal, Composites, Plastics, Elastomer, Others

|

|

By Vehicle

|

Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles

|

|

By Application

|

Body in White, Chassis and Suspension, Powertrain, Closures, Interiors, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Metal, Composites, Plastics, Elastomer, and Others): The metal segment earned USD 22.16 billion in 2023, due to its superior strength-to-weight ratio, cost-effectiveness, and widespread adoption of aluminum and high-strength steel in vehicle structures to enhance fuel efficiency and meet stringent emission regulations.

- By Vehicle (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles): The passenger cars segment held 38.43% share of the market in 2023, due to the increasing demand for fuel-efficient vehicles, stringent emission regulations, and the growing adoption of EVs, driving the integration of advanced lightweight materials to enhance performance and energy efficiency.

- By Application (Body in White, Chassis and Suspension, Powertrain, Closures, Interiors, and Others): The powertrain segment is poised for significant growth at a CAGR of 3.13% through the forecast period, attributed to the growing adoption of advanced lightweight alloys and composites that enhance fuel efficiency, optimize engine performance, and support electrification, aligning with stringent emission regulations and increasing demand for high-performance vehicles.

Automotive Lightweight Materials Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 33.78% share of the automotive lightweight materials market in 2023, with a valuation of USD 27.95 billion. The increasing adoption of EVs in North America is fueling the demand for lightweight materials that enhance battery efficiency and driving range.

EV manufacturers, including Tesla, Rivian, and Lucid Motors, are prioritizing lightweight designs to maximize vehicle efficiency. Government incentives, tax credits, and investments in EV infrastructure are further accelerating this transition.

As automakers strive to optimize energy consumption and extend the range of EVs, the demand for lightweight materials such as aluminum, carbon fiber-reinforced polymers, and advanced composites is rising, strengthening the market in North America.

- The Environmental Defense Fund's report, published in August 2024, estimates that by 2027, U.S. EV manufacturing facilities will be capable of producing approximately 5.8 billion new EVs annually. This production volume represents 36% of the total vehicles sold in the U.S. in 2023.

Additionally, the strong regional presence of industry leaders, including Ford, General Motors, and Tesla, coupled with continuous innovation in automotive materials, is driving the automotive lightweight materials market in North America. These companies are investing in research and development to integrate advanced composites, aluminum alloys, and carbon fiber into vehicle structures.

Automakers are also collaborating with material science firms to develop innovative lightweight solutions that enhance vehicle performance and safety.

The market in Asia Pacific is poised for significant growth at a CAGR of 3.32% over the forecast period. Asia Pacific is the largest automotive manufacturing hub, with key countries such as China, Japan, South Korea, and India driving production volumes.

The increasing demand for passenger and commercial vehicles, supported by rapid urbanization and rising disposable incomes, is fueling the adoption of lightweight materials. Automakers are integrating aluminum, high-strength steel, and composites to meet fuel efficiency standards and enhance vehicle performance.

The continuous expansion of domestic automotive production, along with global automakers establishing manufacturing facilities in the region, is accelerating the growth of the market in Asia Pacific.

Furthermore, strict emission norms across Asia-Pacific are prompting automakers to adopt lightweight materials to improve fuel efficiency and reduce carbon footprints.

Countries like China and India have introduced stringent Corporate Average Fuel Consumption (CAFC) and Bharat Stage (BS-VI) standards, pushing manufacturers to develop lightweight vehicle designs. Additionally, China’s New Energy Vehicle (NEV) regulations incentivize the use of advanced materials in electric and hybrid vehicles.

These evolving regulatory frameworks are compelling automakers to prioritize lightweight solutions, driving the expansion of the market in Asia Pacific.

Regulatory Frameworks

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) establishes Corporate Average Fuel Economy (CAFE) standards, regulating the average fuel economy of passenger cars and light trucks. These standards are designed to improve vehicle efficiency and reduce petroleum consumption. Additionally, the Environmental Protection Agency (EPA) sets greenhouse gas (GHG) emission standards for vehicles, complementing the CAFE standards. Both regulatory frameworks encourage the adoption of lightweight materials to enhance fuel efficiency and meet emission targets.

- The European Union has implemented stringent CO₂ emission standards for passenger cars and light commercial vehicles, requiring manufacturers to reduce fleet-wide emissions. These regulations promote the use of lightweight materials to improve fuel efficiency. Recently, the European Commission proposed extending the deadline for automakers to meet new CO₂ emission targets by three years, shifting from 2025 to a compliance period spanning 2025-2027, providing the industry with additional flexibility.

- China has implemented the "China VI" emission standards, which are comparable to the Euro VI standards, setting stringent limits on vehicle emissions. The government also promotes the development of New Energy Vehicles (NEVs), encouraging the use of lightweight materials to enhance battery efficiency and extend driving range.

- India has implemented the Bharat Stage VI (BS-VI) emission standards, aligning with Euro VI norms, to reduce vehicular emissions. The government also introduced Corporate Average Fuel Efficiency (CAFE) norms to improve fuel economy, encouraging the use of lightweight materials.

Competitive Landscape:

The automotive lightweight materials industry is characterized by several market players that are are actively engaging in strategic collaborations with automakers to enhance the adoption of lightweight materials in vehicle manufacturing.

These partnerships focus on developing advanced material solutions that improve fuel efficiency, reduce emissions, and enhance vehicle performance. By integrating innovative lightweight materials into automotive structures, companies are meeting stringent regulatory standards while addressing the growing demand for high-performance, energy-efficient vehicles.

- In November 2024, Li Auto formed a strategic partnership with Novelis’ Customer Solution Center in Shanghai, initiating a collaborative effort to integrate Novelis’ lightweight aluminum solutions into nine key components of Li Auto’s premium model. A notable advancement in the Li MEGA is the incorporation of Novelis Advanz 6HS-s650, a specialized alloy engineered for structural applications requiring exceptional in-service strength and crash performance. This advanced material enabled an 11% reduction in weight compared to the initial aluminum design, enhancing vehicle efficiency while maintaining structural integrity.

Such collaborations accelerate technological advancements and strengthens the supply chain, positioning manufacturers to cater to the evolving needs of the automotive industry. This strategic approach significantly contributes to the growth of the market.

Key Companies in Automotive Lightweight Materials Market:

- ArcelorMittal

- thyssenkrupp AG

- Novelis Inc.

- Alcoa Corporation

- Owens Corning

- TORAY INDUSTRIES, INC.

- BASF

- Covestro AG

- Magna International Inc.

- 3M

- Arconic

- DuPont

- Nippon Steel Corporation

- Sumitomo Chemical Co., Ltd.

- LyondellBasell Industries Holdings B.V.

Recent Developments (Joint Venture/Agreements/New Product Launch)

- In April 2024, Hyundai Motor Group entered into a strategic cooperation agreement with Toray Industries Inc., a leader in carbon fiber and composite material technology, to drive material innovation for next-generation mobility. This partnership focuses on enhancing the development of lightweight and high-strength materials, supporting the production of eco-friendly and high-performance vehicles while advancing sustainability in the automotive sector.

- In January 2025, Kobe Steel, Ltd. completed the registration of a joint venture company for automotive aluminum panel production in China. This follows an agreement signed on August 8, 2024, with China Baowu Steel Group to establish the joint venture. The initiative integrates continuous heat treatment and finishing lines for aluminum panels, aiming to expand the automotive aluminum panel business while supporting automakers in meeting CO₂ reduction targets in China.

- In August 2023, Marelli introduced a new lightweight polyurethane foam designed for foam-in-place (FIP) applications, particularly for main dashboard panels. This innovative material achieves a 40% weight reduction with new tooling and an 8% reduction with existing tooling. Additionally, it decreases foam thickness by 50%, enhancing design flexibility, while lowering raw material costs by 20% compared to conventional foam solutions.