Market Definition

The market refers to the global industry and commercial activity surrounding the development, and production, of Light Detection and Ranging (LiDAR) systems specifically used in automobiles. LiDAR is a sensing technology that uses laser light pulses to measure distances.

It creates detailed 3D maps of the environment by calculating how long it takes for the light to bounce back from surrounding objects. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of market trends and regulatory frameworks.

Automotive LiDAR Market Overview

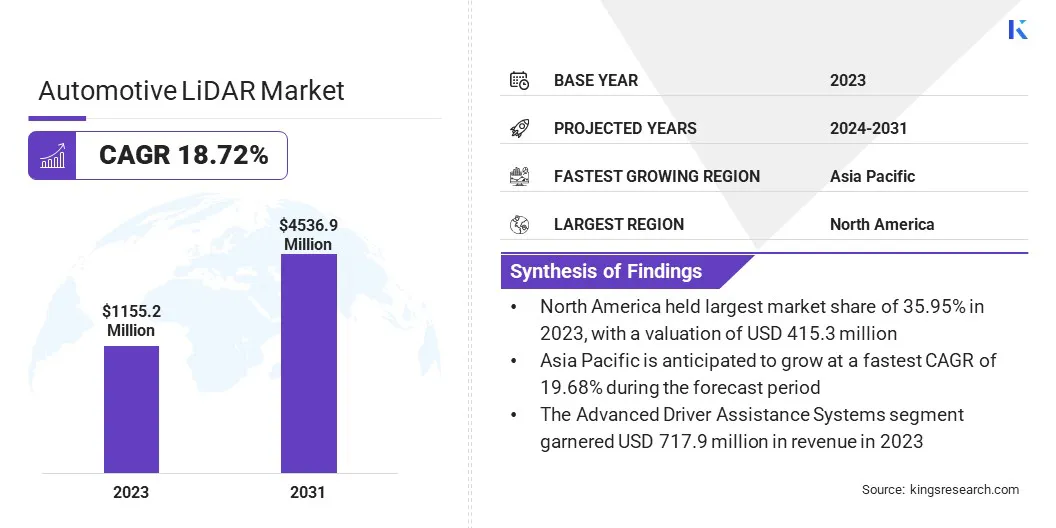

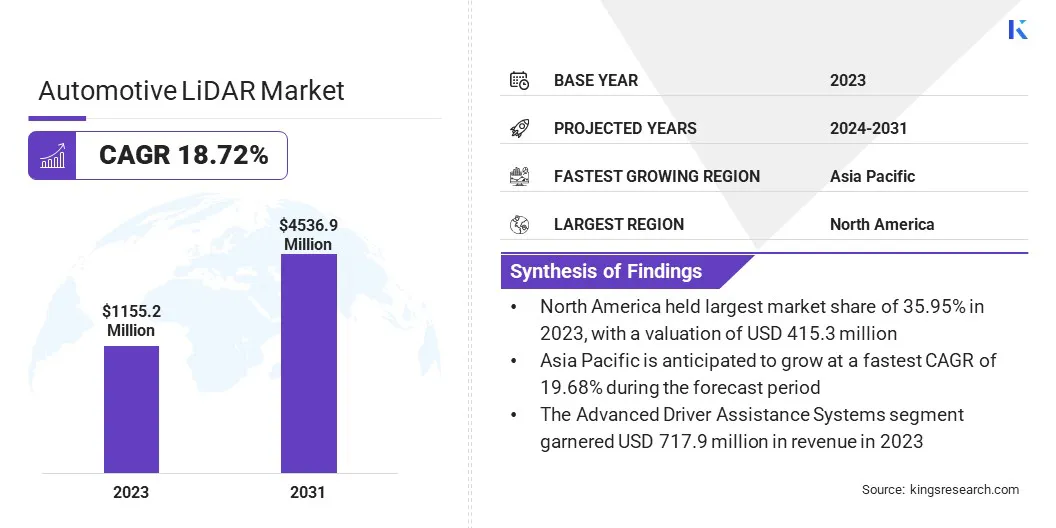

The global automotive LiDAR market size was valued at USD 1155.2 million in 2023, which is estimated to be USD 1364.7 million in 2024 and reach USD 4536.9 million by 2031, growing at a CAGR of 18.72% from 2024 to 2031.

The growing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles significantly drives the demand for high-quality LiDAR sensors, as these technologies rely on precise environmental mapping for enhanced safety and navigation.

Major companies operating in the automotive LiDAR industry are RoboSense, Hesai Group, Luminar Technologies, Inc., Seyond, Huawei Technologies Co., Ltd., Innoviz Technologies Ltd, VALEO, Ouster Inc., DENSO CORPORATION, Continental AG, Magna International Inc., Aptiv, Cepton, Inc., Aeva Inc., and LeddarTech Holdings Inc.

The market is rapidly evolving, driven by advancements in sensor technology and growing demand for autonomous and semi-autonomous vehicles. LiDAR systems provide high-resolution, 3D environmental mapping, enhancing vehicle safety and performance through ADAS.

Innovations such as on-chip LiDAR technology are poised to further accelerate market growth. With significant investments in research and development, the market is expected to expand, playing a key role in the future of mobility.

- In March 2024, Stellantis Ventures invested in SteerLight, a developer of innovative, cost-effective LiDAR technology for ADAS. SteerLight's on-chip LiDAR offers enhanced precision, resolution, and lower production costs, supporting the adoption of automated driving technologies and advancing Stellantis' Dare Forward 2030 strategy.

Key Highlights:

- The automotive LiDAR industry size was valued at USD 1155.2 million in 2023.

- The market is projected to grow at a CAGR of 18.72% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 415.3 million.

- The mechanical segment garnered USD 624.0 million in revenue in 2023.

- The passenger car segment is expected to reach USD 1893.0 million by 2031.

- The ICE segment held a market of 40.47% in 2023.

- The autonomous cars segment is anticipated to grow at a CAGR of 18.95% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 19.68% during the forecast period.

Market Driver

"Growing Demand for ADAS and Autonomous Vehicles"

The rising demand for ADAS vehicles and autonomous vehicles is driving the automotive LiDAR market. ADAS technologies, such as adaptive cruise control, lane-keeping assistance, and collision avoidance, require high-performance sensors like LiDAR to create accurate 3D maps of the vehicle’s surroundings.

The need for precise, reliable, and real-time environmental data intensifies as autonomous vehicles advance. LiDAR systems, with their ability to detect objects at long ranges with high accuracy, are crucial for enabling safe and efficient self-driving operations, thus propelling the market.

- In April 2023, Cepton announced the release of its Komodo ASIC, an advanced lidar point cloud processor designed to enhance lidar performance while reducing costs. This innovation significantly improves point cloud quality, enabling mass-market adoption of automotive LiDAR systems for ADAS and autonomous vehicles and supporting scalable, cost-effective solutions.

Market Challenge

"High Cost of LiDAR Systems"

The high cost of LiDAR systems remains a significant challenge for the automotive LiDAR market, particularly for mass-market vehicles and low-cost models. LiDAR sensors are still expensive to manufacture, due to their advanced technology and high-performance requirements.

This limits their widespread adoption. However, continued advancements in miniaturization, manufacturing efficiencies, and economies of scale are gradually lowering costs. Additionally, the development of more cost-effective solutions can help bring prices down, making LiDAR systems more accessible for mainstream vehicle production.

Market Trend

"Collaborations Between LiDAR Suppliers and OEMs"

Collaborations between LiDAR suppliers and original equipment manufacturers (OEMs) represent a key trend shaping the automotive LiDAR market. OEMs are increasingly seeking reliable, high-performance LiDAR solutions as the demand for autonomous and ADAS grows.

Partnering with Tier-1 suppliers enables them to integrate cutting-edge sensing technologies into their vehicles efficiently and at scale. These collaborations facilitate faster product development, ensure compliance with automotive-grade standards, and accelerate the commercialization of autonomous driving technologies across passenger, commercial, and delivery vehicle segments.

- In June 2023, Innoviz expanded its partnership with LOXO to deploy InnovizOne LiDAR in autonomous, zero-emission delivery vehicles. This collaboration supports safer, sustainable last-mile logistics, highlighting the growing role of high-performance automotive-grade LiDAR in enabling scalable, real-world autonomous transportation solutions across urban environments.

Automotive LiDAR Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Mechanical, Solid-state

|

|

By Vehicle

|

Passenger car, Light Commercial Vehicle, Heavy Commercial Vehicle

|

|

By Propulsion

|

ICE, Electric, Hybrid

|

|

By Application

|

Advanced Driver Assistance Systems, Autonomous Cars

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Mechanical, Solid-state): The mechanical segment earned USD 624.0 million in 2023, due to its lower cost, proven reliability, and widespread adoption in early-stage autonomous vehicle programs and driver-assistance system development.

- By Vehicle (Passenger car, Light Commercial Vehicle, Heavy Commercial Vehicle): The passenger car segment held 42.17% share of the market in 2023, due to the rising integration of LiDAR in ADAS and growing consumer demand for safer driving technologies.

- By Propulsion (ICE, Electric, Hybrid): The ICE segment is projected to reach USD 1816.9 million by 2031, owing to the continued dominance of traditional powertrains and integration of LiDAR for enhanced vehicle safety and automation.

- By Application (Advanced Driver Assistance Systems, Autonomous Cars): The autonomous cars segment is anticipated to register a CAGR of 18.95% during the forecast period, driven by rapid advancements in LiDAR technology and increased investments in self-driving vehicle development.

Automotive LiDAR Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America automotive LiDAR market share stood at around 35.95% in 2023, with a valuation of USD 415.3 million. North America is the dominant region in the market, driven by substantial investments in autonomous vehicle technology and ADAS.

The presence of major automotive manufacturers and tech companies, coupled with strong government support for innovation in mobility, contributes to the region's leadership. Additionally, North America's focus on enhancing vehicle safety standards boosts the demand for LiDAR sensors, positioning it as a key hub for the growth of the market.

- In December 2024, Innoviz Technologies confirmed its participation in the Consumer Electronics Show (CES) 2025, scheduled to take place in Las Vegas, Nevada. At the event, Innoviz will present its latest automotive-grade LiDAR technologies, highlighting real-time demonstrations and innovations that support the evolution of autonomous driving and smart mobility.

The automotive LiDAR industry in Asia Pacific is poised for significant growth at a robust CAGR of 19.68% over the forecast period. Asia Pacific is emerging as a rapidly-growing region in the market, due to the rapid adoption of autonomous vehicles and smart transportation technologies.

Countries like China, Japan, and South Korea are at the forefront of automotive innovation, with significant investments in Electric Vehicles (EVs) and autonomous driving solutions.

The region’s strong manufacturing capabilities, along with government initiatives to support the development of smart cities and green technologies, further fuel the demand for LiDAR sensors, driving the market.

Regulatory Frameworks

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) is committed to advancing safety through its regulation of automated vehicle technologies. Key initiatives include the Federal Automated Vehicles Policy (2016), Automated Driving Systems: A Vision for Safety, and the AV TEST initiative (2020), which supports transparency in testing. Additionally, the Standing General Order (2021) requires manufacturers of automated systems to report crashes, promoting safety innovation and public awareness in autonomous vehicle development.

- In the EU, Regulation 2019/2144 sets the framework for the integration of modern vehicle technologies aimed at enhancing road safety and reducing pollution. This regulation introduces specific requirements for automated and fully automated (driverless) vehicles, ensuring that the systems they employ meet strict safety standards before being deployed on the roads.

Competitive Landscape:

Companies in the automotive LiDAR industry are focusing on advancing sensor technologies, improving the performance and affordability of LiDAR systems, and enhancing integration with autonomous vehicle platforms.

Many are collaborating with automakers and technology firms to develop scalable solutions that enable safer and more efficient autonomous driving. Research and development efforts are concentrated on increasing detection range, precision, and reliability while reducing costs.

Additionally, firms are prioritizing regulatory compliance and enhancing their product offerings with software and perception solutions for better data analysis and real-time decision-making.

- In October 2024, Hesai Technology, a leading global provider of lidar technology, entered into a strategic cooperation framework with SAIC Volkswagen. This partnership is set to establish a new ecosystem within the automotive industry, leveraging Hesai’s cutting-edge lidar products and technologies. The collaboration focuses on enhancing the development and integration of autonomous driving systems, ensuring the safety and reliability of next-generation vehicles.

List of Key Companies in Automotive LiDAR Market:

- RoboSense

- Hesai Group

- Luminar Technologies, Inc.

- Seyond

- Huawei Technologies Co., Ltd.

- Innoviz Technologies Ltd

- VALEO

- Ouster Inc.

- DENSO CORPORATION

- Continental AG

- Magna International Inc.

- Aptiv

- Cepton, Inc.

- Aeva Inc.

- LeddarTech Holdings Inc.

Recent Developments (M&A/Partnerships/Product Launches)

- In October 2024, RoboSense and GAC AION announced a strategic partnership to enhance autonomous driving safety and drive technological innovation. RoboSense, a leader in automotive-grade LiDAR, has secured multiple design wins for GAC AION’s vehicle models, expanding its presence in the high-end intelligent driving market with a substantial market share.

- In September 2024, Hesai Technology unveiled its groundbreaking OT128 LiDAR at the IAA Transportation event in Hannover, Germany, Europe’s largest commercial vehicle trade fair. The OT128 boasts exceptional long-range detection, automotive-grade reliability, and impressive production efficiency, positioning it as a key enabler for the rapid deployment of autonomous vehicles and industrial automation systems.

- In July 2024, Cepton, a leader in high-performance LiDAR solutions, announced that it had signed a definitive agreement for its acquisition by Koito Manufacturing Co., Ltd. (Koito), a prominent automotive lighting supplier. The acquisition, expected to close in the first quarter of 2025, will enable Cepton to operate as a privately-held subsidiary of Koito in the U.S., driving enhanced scalability and financial stability to accelerate the commercialization of its lidar technology across automotive, smart infrastructure, and industrial sectors.