Automotive Engineering Services Market Size

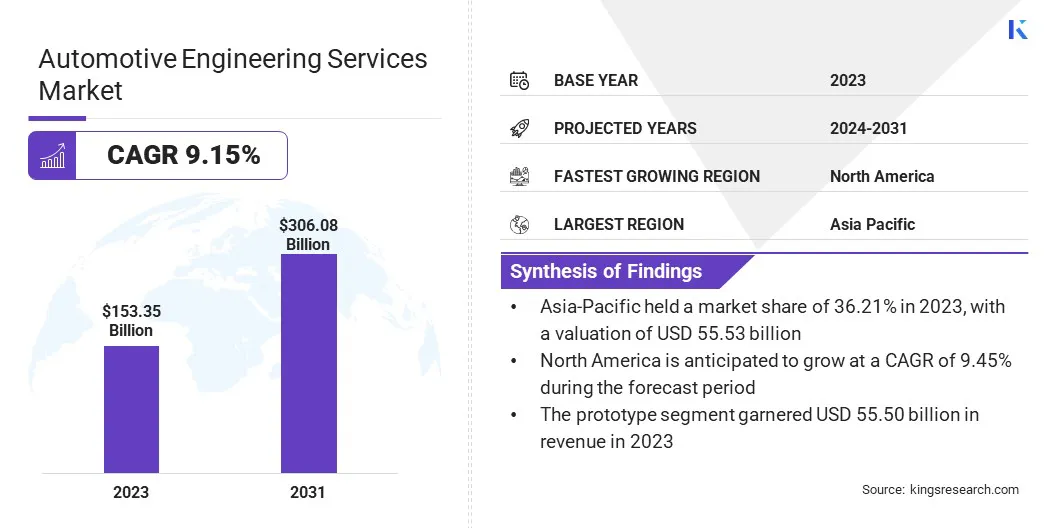

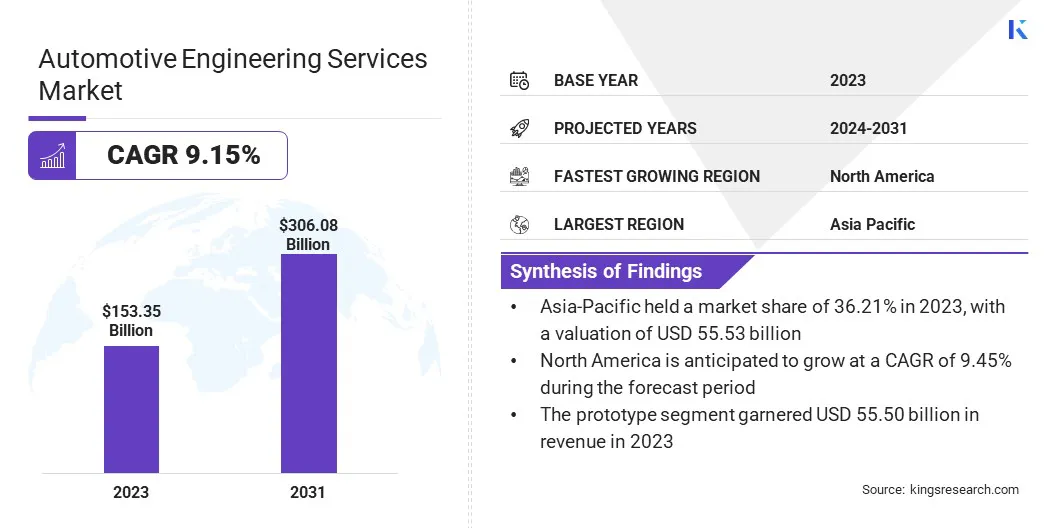

The global Automotive Engineering Services Market size was valued at USD 153.35 billion in 2023 and is projected to grow from USD 165.86 billion in 2024 to USD 306.08 billion by 2031, exhibiting a CAGR of 9.15% during the forecast period.

The market is witnessing substantial growth, largely due to the surge in demand for vehicle electrification, increasing emphasis on vehicle safety, and the shift toward improved fuel efficiency.

Technological advancements in automotive software and electronics, along with the integration of AI and IoT in vehicle systems, are further driving growth. Additionally, regulatory requirements for emissions and safety standards are propelling market expansion.

In the scope of work, the report includes solutions offered by companies such as AKKA, Altair Engineering Inc., Alten Group, ARRK Engineering Gmbh, ASAP Holding Gmbh, AVL, Bertrandt AG, EDAG Group, ESG Elektroniksystem- und Logistik-GmbH, Horiba, LTD., and others.

The automotive engineering services market is experiencing significant growth, mainly fueled by advancements in technology, increasing regulatory pressures, and the rising demand for electric and autonomous vehicles.

- For instance, according to the International Energy Agency (IEA), electric car sales neared 14 million in 2023, with 95% of these sales taking place in China, Europe, and the United States.

This surge in electric vehicle adoption highlights the increasing demand for advanced automotive engineering services in these regions. Companies operating in this market are focusing on innovation and strategic partnerships to enhance their capabilities and meet evolving industry needs.

The shift toward sustainable and connected mobility solutions is prompting automotive manufacturers to invest in specialized engineering services. Additionally, the growing complexity of modern vehicles, encompassing advanced safety features and connectivity, is leading to increased demand for expert engineering support, thereby aiding market growth.

Automotive engineering services encompass a wide range of technical and consulting activities aimed at designing, developing, testing, and manufacturing vehicles and their components. These services include product engineering, process engineering, software development, and support for vehicle electronics and electrical systems.

They further cover areas such as safety testing, regulatory compliance, and the integration of advanced technologies such as autonomous driving, electric propulsion, and connected vehicle systems, ensuring that vehicles adhere to industry standards and meet consumer expectations.

Analyst’s Review

Government initiatives worldwide are promoting the adoption of electric vehicles (EVs) over conventional automobiles, thereby propelling market growth.

- For instance, the California ZEV program aims to have 1.5 million electric vehicles on the road by 2025.

Additionally, companies are offering sustainable, safe, secure, and connected solutions with expertise in software development and product engineering for autonomous, connected, electric, and shared (ACES) vehicles.

Key players in the automotive engineering services market are capitalizing on favorable government initiatives facilitated by a major focus on strategic partnerships and innovation. By collaborating with governments and other stakeholders, companies are aligning their product offerings with regulatory goals, such as the California ZEV program, to meet the increasing demand for electric vehicles.

Additionally, maintaining a strong emphasis on R&D, especially in areas such as software development and product engineering for autonomous, connected, electric, and shared (ACES) vehicles, could strengthen their market positioning and foster growth.

Automotive Engineering Services Market Growth Factors

The growing demand for specialized engineering services, mainly fueled by advancements in automotive technologies, is propelling market growth significantly. As manufacturers seek to develop electric vehicles, implement autonomous driving features, and enhance connectivity, they require expert support to address complex engineering challenges.

This reliance on specialized services fosters innovation and accelerates product development, leading to a faster time-to-market for new technologies. Additionally, the increased investment in R&D and collaboration with engineering firms enhances the quality and performance of vehicles while also attracting an increasing number of companies to enter the market.

A significant challenge hampering the progress of the automotive engineering services market is the high cost and complexity associated with developing advanced technologies, such as autonomous driving systems and electric vehicle components. This challenge is hindering market growth by limiting smaller companies' ability to compete and slowing the overall pace of innovation.

Key players are mitigating this issue by forming strategic partnerships, investing in research and development, and leveraging economies of scale to reduce costs. Additionally, they are adopting flexible engineering solutions to efficiently manage complexity and accelerate the development of new technologies, thereby ensuring sustained market growth.

Automotive Engineering Services Industry Trends

The development and adoption of autonomous vehicles, also known as self-driving or driverless cars, are stimulating the growth of the automotive engineering services market. These vehicles integrate sensors, actuators, machine learning systems, and complex algorithms to operate without human input.

Achieve this capability requires advanced services such as ADAS (Advanced Driver Assistance Systems), AI-based connectivity, and sophisticated electrical and body electronics. As manufacturers invest heavily in these cutting-edge technologies to meet consumer demand and regulatory standards, the need for specialized engineering services grows.

This supports market expansion as companies seek expertise in designing, developing, and integrating these advanced systems into autonomous vehicles.

Several automotive manufacturers are increasingly outsourcing engineering services to specialized firms to reduce costs and focus on core competencies. By leveraging the expertise of these firms, manufacturers are streamlining their operations, improving efficiency, and accelerating product development cycles.

Outsourcing allows companies to access advanced technological solutions and innovative methodologies without requiring significant in-house investment.

This strategic move lowers operational costs and enables manufacturers to concentrate on their primary business areas, such as marketing and customer service. The demand for specialized engineering services is rising, contributing to market growth as these firms expand their offerings to meet the diverse needs of the automotive industry.

Segmentation Analysis

The global market is segmented based on service type, application, vehicle type, location, and geography.

By Service Type

Based on service type, the automotive engineering services market is categorized into prototype, design & development, testing & validation, manufacturing engineering, and others. The prototype segment garnered the highest revenue of USD 55.50 billion in 2023. Prototyping focuses on creating functional models of vehicles and components, allowing manufacturers to test designs, validate concepts, and identify potential issues early in the development process.

By facilitating rapid prototyping, companies are streamlining the design cycle and reducing time-to-market for new vehicles and technologies. This approach enhances collaboration between engineering teams and fosters a culture of innovation.

The growing emphasis on prototyping is augmenting the expansion of the segment by enabling manufacturers to respond quickly to changing consumer demands and evolving industry trends.

By Application

Based on application, the market is categorized into motor controls, chassis, powertrain, safety systems, and others. The powertrain segment captured the largest automotive engineering services market share of 35.15% in 2023. The powertrain encompasses the design and development of essential vehicle components, including engines, transmissions, and electric drivetrains.

With the growing shift toward electrification and increasing regulatory pressure for fuel efficiency, the demand for innovative powertrain solutions is rising.

Companies are investing heavily in advanced technologies to enhance performance, reduce emissions, and improve overall vehicle efficiency. This focus on developing efficient and sustainable powertrains is aiding segmental growth, as manufacturers are increasingly seeking to meet consumer expectations and comply with stringent environmental regulations.

By Vehicle Type

Based on vehicle type, the market is categorized into passenger cars and commercial vehicles. The passenger cars segment is expected to garner the highest revenue of USD 173.18 billion by 2031, primarily due to the increasing popularity of stylish designs, compact sizes, and economic value.

As the most common mode of transportation in numerous advanced countries, passenger cars are benefiting from enhanced lifestyles and rising disposable incomes. The growing brand awareness and enhanced economic conditions are leading to a shift in customer preferences, resulting in higher sales volumes.

This surge in demand is contributing significantly to segmental growth, as manufacturers are investing heavily in innovative features and sustainable technologies to attract consumers, thereby solidifying the passenger car segment's position in the market.

Automotive Engineering Services Market Regional Analysis

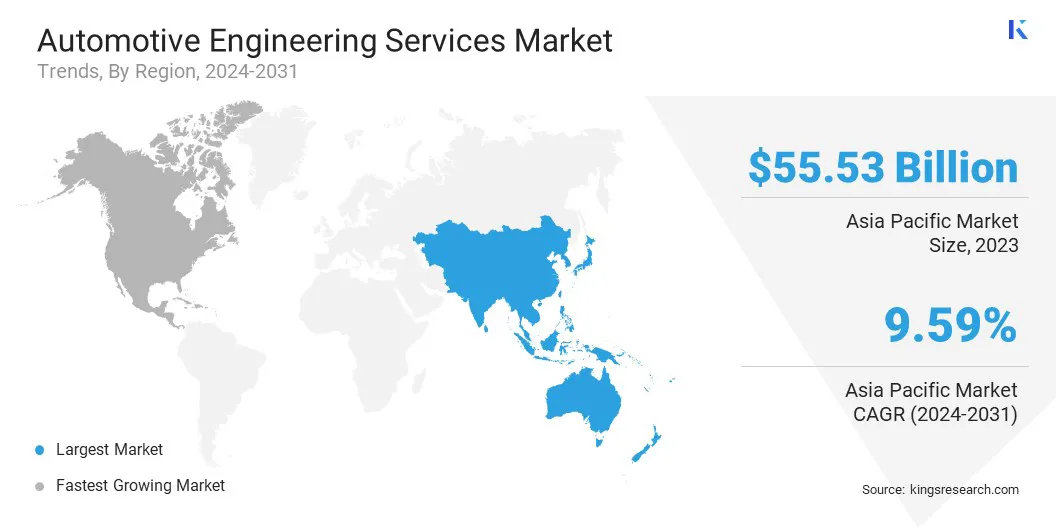

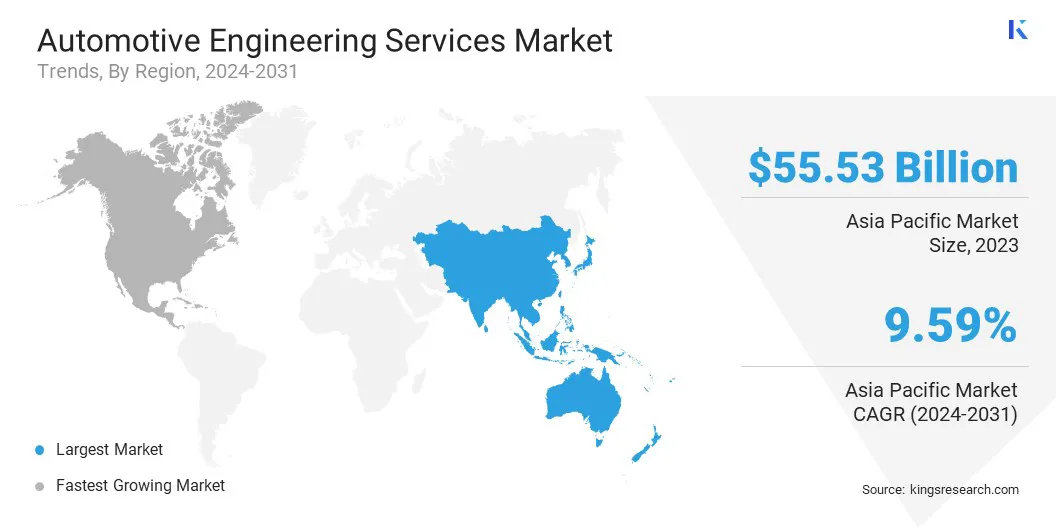

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific automotive engineering services market share stood around 36.21% in 2023 in the global market, with a valuation of USD 55.53 billion. This notable expansion is largely attributed to the presence of major automobile OEMs and the outsourcing of production operations to countries such as India, South Korea, and China due to low-cost labor availability.

This trend is prompting automotive engineering service providers to shift their operations to this region. India, in particular, offers a pool of low-cost, educated, and semi-skilled labor, making it an attractive market for international OEMs.

Several companies are focusing on forming partnerships to advance sustainable mobility solutions and develop the next generation of electric vehicles, autonomous driving technologies, and mobility services.

- For instance, in August 2022, L&T Technology Services secured a five-year infotainment deal with BMW Group to provide high-end engineering services, allowing real-time collaboration on various solutions.

These factors are expected to positively influence the growth of the Asia-Pacific market in the foreseeable future.

North America is anticipated to witness significant growth at a CAGR of 9.45% over the forecast period. The region is home to numerous leading automotive manufacturers and boasts a robust research and development infrastructure, creating a highly competitive environment.

With a growing focus on electric vehicles (EVs) and autonomous driving technologies, companies are increasingly investing in engineering services to meet rising consumer demand and regulatory requirements. Additionally, government initiatives and incentives aimed at promoting sustainable transportation are promoting investments in advanced automotive engineering solutions.

The presence of skilled labor and established supply chains further enhances the region's attractiveness, which ensure sustained market expansion as manufacturers seek to innovate and produce high-quality vehicles.

Competitive Landscape

The global automotive engineering services market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Automotive Engineering Services Market

Key Industry Development

- July 2023 (Acquisition): HCLTech announced the acquisition of ASAP Group, a Germany-based automotive engineering company, for EUR 251 million (approximately USD 273.25 million). By acquiring a 100% stake in ASAP Group, HCLTech aims to strengthen its market position in the mobility sectors, including autonomous driving, e-mobility, and connectivity.

The global automotive engineering services market is segmented as:

By Service Type

- Prototype

- Design & Development

- Testing & Validation

- Manufacturing Engineering

- Others

By Application

- Motor Controls

- Chassis

- Powertrain

- Safety Systems

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Location

- In-house Services

- Outsourced Services

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America