Market Definition

Automotive cybersecurity protects vehicles, their electronic systems, communication networks, software, and data from unauthorized access, cyberattacks, or malicious manipulation. It focuses on securing connected and automated vehicles against threats that compromise safety, privacy, or operational integrity.

It includes safeguarding in-vehicle control units, over-the-air updates, telematics, infotainment systems, and vehicle-to-everything (V2X) communication from vulnerabilities that attackers exploit. The market encompasses security solutions, services, and technologies that protect passenger cars, commercial vehicles, and autonomous vehicles.

Automotive Cybersecurity Market Overview

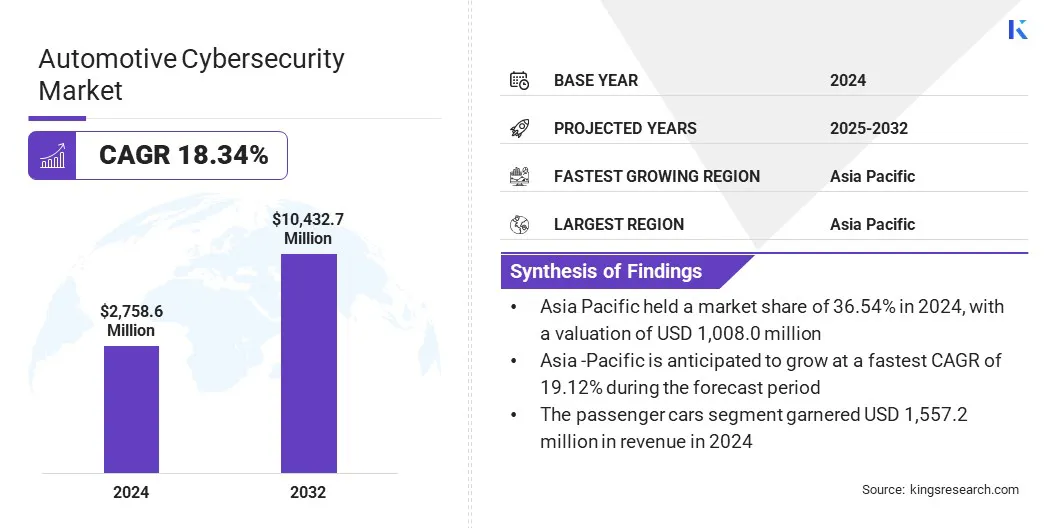

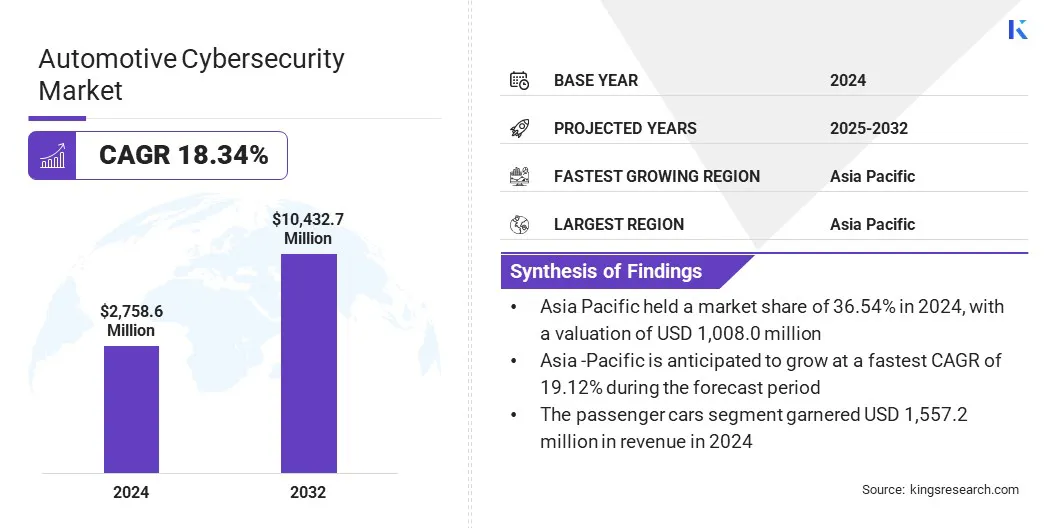

The global automotive cybersecurity market size was valued at USD 2,758.6 million in 2024 and is projected to grow from USD 3,210.3 million in 2025 to USD 10,432.7 million by 2032, exhibiting a CAGR of 18.34% over the forecast period.

Market growth is driven by the rising adoption of connected cars to enable secure communication, data exchange, and vehicle network integration. The growing use of advanced driver-assistance systems (ADAS) and autonomous driving technologies is further driving demand for stronger cybersecurity measures across vehicles and automotive networks.

Key Highlights:

- The automotive cybersecurity industry size was recorded at USD 2,758.6 million in 2024.

- The market is projected to grow at a CAGR of 18.34% from 2024 to 2032.

- Asia Pacific held a share of 36.54% in 2024, valued at USD 1,008.0 million.

- The network security segment garnered USD 900.7 million in revenue in 2024.

- The intrusion detection and prevention systems segment is expected to reach USD 4,112.2 million by 2032.

- The electric vehicles segment is anticipated to witness the fastest CAGR of 21.31% over the forecast period.

- The ADAS & safety systems segment held a share of 32.12% in 2024.

- North America is anticipated to grow at a CAGR of 18.65% over the forecast period.

Major companies operating in the automotive cybersecurity market are PlaxidityX Ltd, Karamba Security, Upstream Security Ltd, Harman International Industries, Inc., GuardKnox Cyber Technologies Ltd., ETAS GmbH, Elektrobit Automotive GmbH, NXP Semiconductors N.V., Infineon Technologies AG, Thales S.A., BlackBerry Limited, Vector Informatik GmbH, Tata Elxsi Ltd, Trustonic, Cybellum Ltd.

The increasing emphasis on workforce training and skill development in the automotive sector is driving the adoption of advanced cybersecurity solutions. Market players are conducting specialized training programs to enhance skills, improve threat preparedness, and accelerate the deployment of cybersecurity measures across software-defined vehicles.

- In June 2025, ETAS India entered into a Memorandum of Understanding (MoU) with the Automotive Research Association of India (ARAI) to strengthen cybersecurity readiness in the Indian automotive sector. The collaboration focuses on conducting specialized training programs, practical workshops, and certification courses to equip OEMs, Tier 1 suppliers, and startups.

Market Driver

Growth in Electric Vehicle (EV) Adoption

A key factor propelling the growth of the automotive cybersecurity market is the rapid adoption of electric vehicles (EVs). EVs increasingly rely on connected systems, software-defined architectures, and telematics, which expose vehicles to potential cyber threats.

Manufacturers and suppliers are implementing advanced cybersecurity measures to secure battery management systems, over-the-air (OTA) updates, and vehicle-to-everything (V2X) communication. These factors are driving the demand for advanced cybersecurity solutions to protect against unauthorized access and secure critical data.

- The International Energy Agency (IEA) reported that global electric vehicle sales reached 17 million in 2024, a 25% increase over 2023.

Market Challenge

High Cost of Advanced Cybersecurity Solutions

A key challenge impeding the growth of the automotive cybersecurity market is the high cost of advanced cybersecurity solutions. Implementing comprehensive security measures, including intrusion detection systems and encryption technologies, requires substantial investment in hardware, software, and skilled personnel.

Ongoing maintenance, updates, and compliance with evolving standards further increase the costs and slow the adoption of these solutions across the automotive sector.

To address this challenge, market players are developing scalable and modular security platforms that allow OEMs and suppliers to purchase only the features they need, reducing upfront expenses. Additionally, market players are focusing on cloud-based security services and automated testing tools to lower maintenance costs and make advanced cybersecurity cost-effective.

Market Trend

Increasing Integration of Artificial Intelligence

A key trend influencing the automotive cybersecurity market is the increasing integration of artificial intelligence (AI) into vehicle security solutions. Market players are incorporating AI-driven capabilities such as real-time anomaly detection, predictive threat modeling, and automated response across electronic control units (ECUs).

These advancements help identify and mitigate cyber threats proactively and enhance the resilience of connected and software-defined vehicles. This shift is driving the adoption of intelligent, AI-enabled cybersecurity platforms across the automotive sector.

- In January 2025, VicOne expanded its collaboration with NXP Semiconductors to enhance automotive cybersecurity through AI-powered edge processing. The partnership integrates VicOne’s intrusion detection and prevention system with NXP’s connectivity domain controller to detect and prevent cyber threats across multiple vehicle ECUs. It protects drivers, vehicle data, and manufacturers’ operations while supporting innovative AI-based services such as smart cockpits.

Automotive Cybersecurity Market Report Snapshot

|

Segmentation

|

Details

|

|

By Security Type

|

Network Security, Application Security, Endpoint Security, Cloud Security, Others

|

|

By Solution

|

Intrusion Detection and Prevention Systems, Encryption and Cryptography, Identity and Access Management, Risk and Vulnerability Management, Others

|

|

By Vehicle Type

|

Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric Vehicles

|

|

By Application

|

Telematics, Infotainment Systems, Powertrain Systems, ADAS & Safety Systems, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Security Type (Network Security, Application Security, Endpoint Security, Cloud Security, and Others): The network security segment earned USD 900.7 million in 2024, driven by increasing connectivity and rising cyber threats targeting vehicle networks.

- By Solution (Intrusion Detection and Prevention Systems, Encryption and Cryptography, Identity and Access Management, Risk and Vulnerability Management, and Others): The intrusion detection and prevention systems segment held 36.54% of the market in 2024, due to growing demand for real-time threat monitoring and protection across vehicle ECUs.

- By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Electric Vehicles): The passenger cars segment is projected to reach USD 6,004.8 million by 2032, owing to high production volumes and increasing adoption of connected and software-defined vehicles.

- By Application (Telematics, Infotainment Systems, Powertrain Systems, ADAS & Safety Systems, Others): The ADAS & safety systems segment is anticipated to witness the fastest CAGR of 21.22% over the forecast period, driven by rising deployment of advanced driver assistance and autonomous features.

Automotive Cybersecurity Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific automotive cybersecurity market share stood at 36.54% in 2024 in the global market, with a valuation of USD 1,008.0 million. This dominance is due to the rapid expansion of the automotive industry across this region. Increasing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) in the region is driving demand for cybersecurity solutions to protect vehicle electronics, infotainment, and telematics systems.

Government initiatives and regulations, including local compliance requirements and ISO 21434 adoption, are compelling OEMs and suppliers to implement standardized security measures.

The rise of over-the-air (OTA) software updates in Asia Pacific further increases the need for continuous monitoring and secure deployment of vehicle systems and software. Additionally, regional players are focusing on partnerships with cybersecurity technology providers to integrate advanced threat detection and further support market expansion.

- In November 2024, VVDN Technologies signed an MoU with SecureThings.ai to collaborate on vehicle cybersecurity solutions. The partnership integrates SecureThings.ai’s advanced cybersecurity technologies into VVDN’s automotive offerings, including connected vehicles, infotainment, ADAS, and software-defined vehicle solutions. The collaboration ensures compliance with ISO 21434 and introduces initiatives such as intrusion detection and threat intelligence to enhance customer protection.

North America is set to grow at a CAGR of 18.65% over the forecast period. This growth is attributed to the rising adoption of software-defined vehicles, driving demand for cybersecurity solutions to protect vehicles from cyberattacks. Rising government regulations, such as the UN R155/156, are compelling OEMs to implement advanced security measures to ensure compliance and safety of vehicles.

The growing use of over-the-air (OTA) software updates is increasing the need for continuous monitoring and secure deployment to prevent remote cyber threats to vehicle systems. Additionally, regional players are focusing on collaboration to strengthen proactive security measures and implement robust cybersecurity solutions for the automotive sectors across the region.

- In November 2024, NCC Group and Zscaler joined the Automotive Information Sharing and Analysis Center (Auto-ISAC) as strategic partners to advance cybersecurity in the automotive sector. The collaboration aims to enhance connected vehicle security, regulatory compliance, and supply chain protection.

Regulatory Frameworks

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) regulates automotive safety, including cybersecurity for connected and automated vehicles. It oversees OEM compliance and sets guidelines for vulnerability management and over-the-air (OTA) updates. It also enforces Federal Motor Vehicle Safety Standards (FMVSS) and encourages information sharing to strengthen vehicle cybersecurity.

- In the UK, the Department for Transport (DfT) oversees vehicle safety and cybersecurity standards. It ensures compliance with UN R155/156 regulations and evaluates risk assessment and OTA security. DfT also facilitates industry collaboration and conducts audits to maintain safe and secure operation of connected, autonomous, and software-defined vehicles across the U.K. automotive ecosystem.

- In China, the Ministry of Industry and Information Technology (MIIT) regulates vehicle electronics, connectivity, and cybersecurity. It oversees compliance with GB/T standards and monitors telematics and networked systems. MIIT also enforces incident reporting and guides secure vehicle communications to ensure safe operation of connected and autonomous vehicles.

- In India, the Automotive Research Association of India (ARAI) functions as the primary authority for automotive safety and cybersecurity compliance. It audits connected vehicle systems and enforces ISO 21434 adoption. ARAI also conducts vulnerability testing and provides training and certification programs to strengthen industry capabilities in securing software-defined and connected vehicles.

Competitive Landscape

Companies operating in the automotive cybersecurity industry are actively developing advanced security solutions to protect connected vehicles from cyber threats. They are collaborating with specialized technology partners to integrate expertise and deliver end-to-end protection across vehicle networks and over-the-air software updates.

Additionally, market players are investing in proactive threat detection, intrusion prevention, and continuous monitoring initiatives to enhance vehicle safety and cybersecurity resilience.

- In June 2025, FPT entered into a Memorandum of Understanding (MoU) with the Israel-based Cymotive Technologies to jointly develop and commercialize advanced automotive cybersecurity solutions. The partnership focuses on Software-Defined Vehicles (SDVs), combining Cymotive’s expertise with FPT’s global delivery capabilities to provide end-to-end protection.

Top Key Companies in Automotive Cybersecurity Market:

- PlaxidityX Ltd

- Karamba Security

- Upstream Security Ltd

- Harman International Industries, Inc

- GuardKnox Cyber Technologies Ltd.

- ETAS GmbH

- Elektrobit Automotive GmbH

- NXP Semiconductors N.V

- Infineon Technologies AG

- Thales S.A.

- BlackBerry Limited

- Vector Informatik GmbH

- Tata Elxsi Ltd

- Trustonic

- Cybellum Ltd.

Recent Developments

- In October 2024, Sasken Technologies partnered with Trustonic to enhance automotive cybersecurity solutions. The collaboration integrates Trustonic’s AL 5+ certified execution environment technology into Sasken’s offerings. It also addresses vulnerabilities from IoT devices and OTA updates and enables end-to-end security for software-defined vehicles and OEMs.

- In February 2024, AutoCrypt launched the AutoCrypt CSTP, a comprehensive automotive cybersecurity testing platform. The platform enables OEMs and inspection centers to perform integrated testing for UN R155/156 and GB/GB-T compliance. It offers penetration testing, engineering specification testing, and AI-based fuzz testing. It also supports multi-ECU testing and customizable test cases to simplify regulatory approval and improve efficiency.