Market Definition

Threat Intelligence is the process of collecting, analyzing, and interpreting information about potential or existing threats that target an organization’s digital infrastructure. It helps organizations identify vulnerabilities, assess risks, and make informed decisions to prevent or respond to cyberattacks. The market includes solutions and services that deliver actionable intelligence tailored to various security needs.

It covers cloud-based and on-premises deployment models, offering flexibility based on infrastructure and compliance requirements. The market also includes strategic, tactical, and operational intelligence types, each supporting different layers of decision-making and defense planning. It serves both large enterprises and small and medium enterprises, addressing diverse threat landscapes and resource capabilities.

Threat Intelligence Market Overview

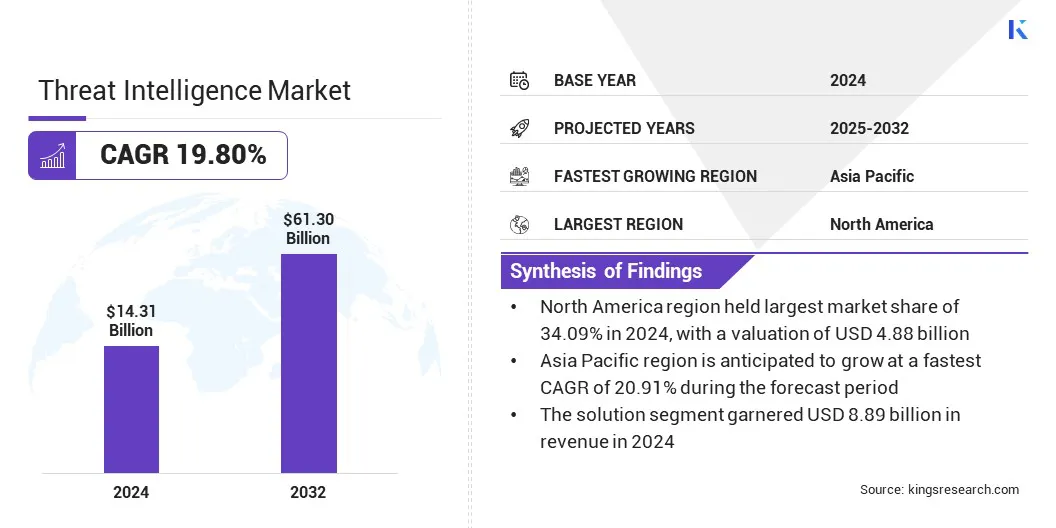

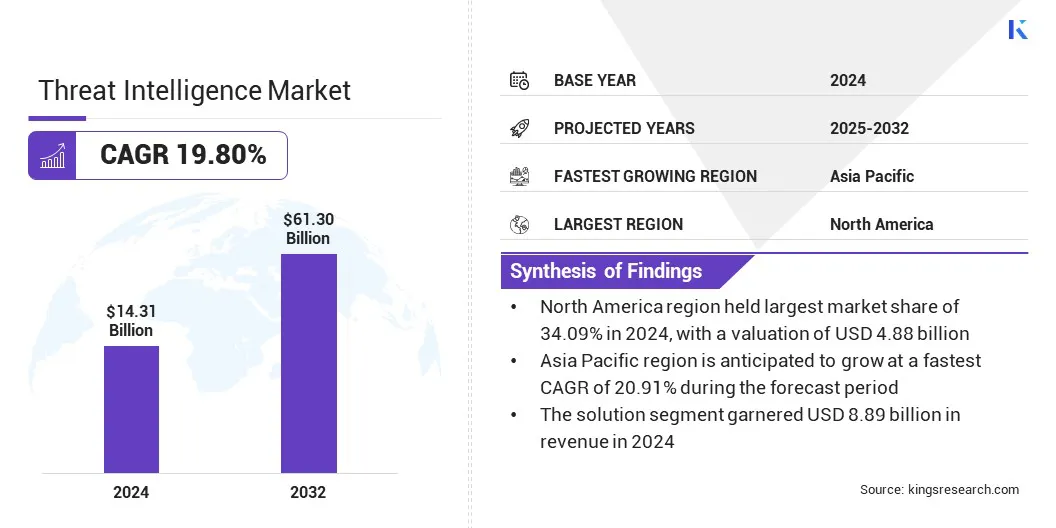

The global threat intelligence market size was valued at USD 14.31 billion in 2024 and is projected to grow from USD 17.05 billion in 2025 to USD 61.30 billion by 2032, exhibiting a CAGR of 19.80% during the forecast period. This growth is attributed to the growing demand for end-to-end security solutions that enable organizations to detect, analyze, and respond to threats across their digital infrastructure.

A shift toward pre-configured threat intelligence platforms enables faster deployment, streamlined integration, and improved operational efficiency by reducing customization requirements and supporting standardized security workflows.

Key Highlights

- The threat intelligence industry size was valued at USD 14.31 billion in 2024.

- The market is projected to grow at a CAGR of 19.80% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 4.88 billion.

- The solution segment garnered USD 8.89 billion in revenue in 2024.

- The cloud-based segment is expected to reach USD 32.13 billion by 2032.

- The strategic segment is expected to reach USD 25.58 billion by 2032.

- The large enterprises segment is expected to reach USD 34.90 billion by 2032.

- The BFSI segment garnered USD 3.46 billion in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 20.91% over the forecast period.

Major companies operating in the threat intelligence industry are Cyble, FireEye, Inc., Anomali Inc., Cyware, Palo Alto Networks, Flashpoint, Musarubra US LLC, Recorded Future, Splunk LLC, CrowdStrike, Zoho Corporation Pvt. Ltd., ZeroFox, ThreatConnect, AO Kaspersky Lab, and IBM.

Market expansion is propelled by the rising adoption of high-fidelity threat intelligence solutions that deliver a high true positive rate (TPR). Organizations are prioritizing accuracy in threat detection to reduce false alerts and focus resources on verified risks. These solutions enhance operational efficiency by enabling faster response to real threats and minimizing the time spent on non-actionable data.

Enterprises are integrating high-fidelity intelligence into their security operations to improve decision-making, reduce alert fatigue, and strengthen overall threat management.

- In March 2024, eSentire, Inc. launched its first standalone cybersecurity product, eSentire Threat Intelligence, offering high-fidelity threat intelligence with 99% true positive rate. The AI-based platform provides mid-market and enterprise organizations with access curated Indicators of Compromise (IoCs) derived from validated security investigations across eSentire’s global customer base.

Market Driver

Growing Demand for End-To-End Security Solutions

The growth of the threat intelligence market is driven by the rising demand for end-to-end security solutions across enterprise networks. Organizations are adopting integrated platforms that combine threat detection, risk analysis, and automated response to streamline security operations. This approach addresses the need for consistent protection across cloud, on-premises, and hybrid environments.

Businesses are replacing isolated security tools with unified solutions to improve visibility, reduce response time, and maintain compliance. This demand for comprehensive coverage continues to boost the adoption of threat intelligence solutions.

- In September 2024, CrowdStrike introduced enhancements to its Falcon cybersecurity platform, aimed at unifying IT and security operations. The updates streamline the threat lifecycle, from risk assessment and detection to remediation and response, through a single-agent, cloud-native platform.

Market Challenge

Limited Integration with Existing Security Infrastructure

The progress of the threat intelligence market is hindered by the limited integration with existing security infrastructure. Many organizations operate fragmented systems, making it difficult to implement threat intelligence platforms without disrupting current operations. This lack of compatibility delays deployment and weakens threat response capabilities.

To address this challenge, companies are introducing modular, API-driven platforms designed to integrate seamlessly with both legacy and modern security tools. Enterprises are adopting centralized security architectures to improve system alignment and support more efficient threat intelligence implementation.

Market Trend

Rising Shift Toward Pre-Configured Threat Intelligence Platforms

The threat intelligence market is experiencing a notable shift toward pre-configured threat intelligence platforms. Organizations are adopting these solutions to accelerate deployment and simplify integration across security operations.

These platforms offer standardized threat data, built-in analytics, and automated workflows that support faster threat detection and response. This trend reflects the growing focus on scalable intelligence platforms that reduce implementation time and support real-time risk management across complex IT environments.

- In January 2025, Cyware collaborated with Team Cymru to launch a pre-configured threat intelligence platform. The partnership integrated Team Cymru’s threat feeds into Cyware’s Threat Intelligence Platform to deliver real-time visibility into botnets, malware, and command and control infrastructure.

Threat Intelligence Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solution, Services

|

|

By Deployment

|

Cloud-based, On-premises

|

|

By Type

|

Strategic, Tactical, Operational

|

|

By Organization

|

Large Enterprises, Small & Medium Enterprises

|

|

By End Use

|

BFSI, Government, Healthcare, IT & Telecommunications, Manufacturing, Retail, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Solution, and Services): The solution segment earned USD 8.89 billion in 2024, mainly due to the rising demand for real-time threat detection and automated response capabilities.

- By Deployment (Cloud-based, and On-premises): The cloud-based segment held a share of 53.82% in 2024, fueled by the increased adoption of scalable and remote security solutions across enterprises.

- By Type (Strategic, Tactical, and Operational): The strategic segment is projected to reach USD 25.58 billion by 2032, largely attributed to the growing need for long-term threat assessments and high-level cybersecurity planning.

- By Organization (Large Enterprises, and Small & Medium Enterprises): The large enterprises segment is projected to reach USD 34.90 billion by 2032, owing to rising investments in advanced threat intelligence platforms to protect complex networks.

- By End Use (BFSI, Government, Healthcare, IT & Telecommunications, Manufacturing, Retail, and Others): The BFSI segment held a share of 24.20% in 2024, on account of increasing cyberattacks targeting financial data and critical infrastructure.

Threat Intelligence Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America threat intelligence market share stood at 34.09% in 2024, valued at USD 4.88 billion. This dominance is reinforced by strong collaboration between public agencies and private enterprises, which has led to the development of unified threat intelligence platforms that enable streamlined threat detection, data sharing, and coordinated response.

Enterprises in the region are adopting these platforms to enhance real-time visibility and improve security operations, reinforcing North America's market dominance.

- In May 2025, Cyware launched a suite of threat intelligence solutions tailored for State, Local, Tribal, and Territorial (SLTT) governments across the U.S. The launch focused on strengthening cyber defenses through unified threat intelligence, streamlined collaboration, and proactive threat response.

The Asia-Pacific threat intelligence industry is poised to grow at a significant CAGR of 20.91% over the forecast period. This growth is propelled by rising cybersecurity risks across the finance, healthcare, and manufacturing sectors.

Enterprises in the region are increasing investment in advanced threat intelligence platforms to improve threat visibility, accelerate incident response, and safeguard digital infrastructure. Expanding digital transformation initiatives and growing regulatory focus on cybersecurity compliance are further boosting the adoption of real-time threat detection solutions.

Regulatory Frameworks

- In the U.S., the Cybersecurity and Infrastructure Security Agency (CISA) regulates the market by setting national cybersecurity standards and overseeing federal and critical infrastructure security.

- In Europe, the European Union Agency for Cybersecurity (ENISA) supports the implementation of cybersecurity directives and guides member states in threat intelligence coordination and risk management.

- In India, the Indian Computer Emergency Response Team (CERT-In), under the Ministry of Electronics and Information Technology issues operational guidelines and oversees incident reporting and threat intelligence activities.

Competitive Landscape

Key players in the threat intelligence industry are focusing on strategic collaborations and targeted solution development to strengthen their competitive position. The banking and financial services sector remains a key focus due to its need for advanced threat intelligence to address complex regulatory and operational risks.

Vendors are partnering with financial institutions to deliver integrated platforms that enable real-time threat detection, automated response, and secure information exchange. These solutions align with industry-specific compliance requirements and help mitigate fraud, data breaches, and targeted cyberattacks.

Market participants are enhancing their offerings by embedding threat intelligence into broader security operations, enabling unified analysis and faster incident response across financial systems. These strategies support long-term positioning in high-risk environments and reinforce the relevance of threat intelligence in financial cybersecurity operations.

- In March 2025, the Institute for Development and Research in Banking Technology (IDRBT) and Quick Heal Technologies Limited launched IBCART 3.0 to strengthen cybersecurity in the banking sector. The platform offers advanced security controls, wider reach, and contextual threat intelligence tailored for regulated financial institutions.

Key Companies in Threat Intelligence Market:

- Cyble

- FireEye, Inc.

- Anomali Inc.

- Cyware

- Palo Alto Networks

- Flashpoint

- Musarubra US LLC

- Recorded Future

- Splunk LLC

- CrowdStrike

- Zoho Corporation Pvt. Ltd.

- ZeroFox

- ThreatConnect

- AO Kaspersky Lab

- IBM

Recent Developments (Product Launches)

- In February 2024, Recorded Future launched Recorded Future AI, an enterprise-grade generative AI platform designed to support intelligence and defense operations. Built on the company's Intelligence Graph, the platform enables organizations to define and analyze large threat surfaces across cyber and physical domains, providing real-time situational awareness and AI-driven assistance to address converging global threats.