Market Definition

A battery management system (BMS) is an integrated electronic solution that monitors, controls, and protects rechargeable batteries to ensure safety, performance, and longevitiy. The market encompasses a wide range of hardware and software solutions designed for diverse battery chemistries, including lithium-ion and lead-acid.

It includes both standalone and embedded systems used in electric vehicles, stationary energy storage, industrial machinery, and portable devices. Key functionalities include voltage and temperature regulation, state-of-charge estimation, fault detection, and cell balancing for efficient and reliable battery operation.

Battery Management System Market Overview

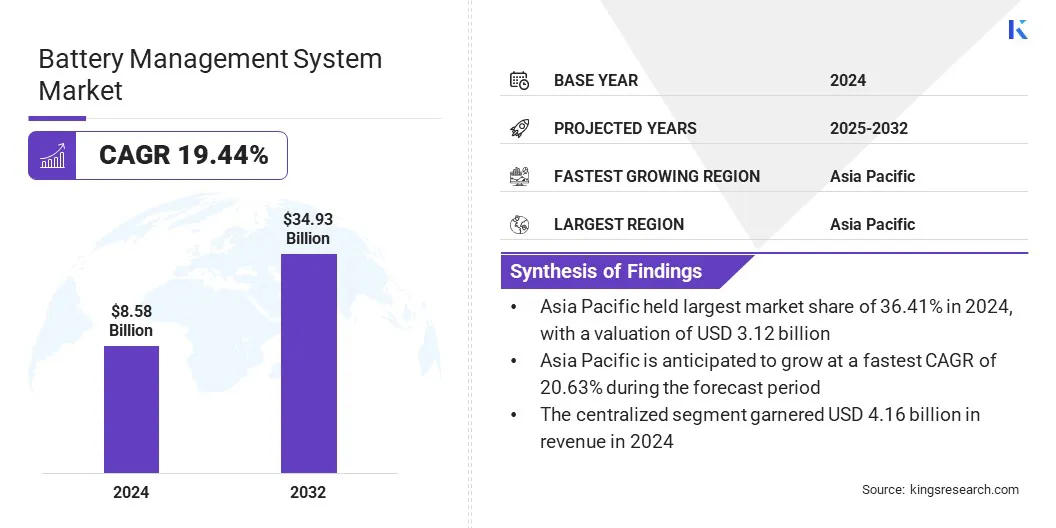

The global battery management system market size was valued at USD 8.58 billion in 2024 and is projected to grow from USD 10.07 billion in 2025 to USD 34.93 billion by 2032, exhibiting a CAGR of 19.44% during the forecast period.

The market is experiencing strong growth, driven by the global shift toward electric mobility and the rapid deployment of renewable energy storage systems. The rising production of electric vehicles (EVs), supported by government incentives and emissions regulations, is significantly boosting demand for advanced BMS solutions.

Key Highlights

- The battery management system industry size was valued at USD 8.58 billion in 2024.

- The market is projected to grow at a CAGR of 19.44% from 2025 to 2032.

- Asia Pacific held a share of 36.41% in 2024, valued at USD 3.12 billion.

- The lithium-ion based segment garnered USD 3.15 billion in revenue in 2024.

- The centralized segment is expected to reach USD 15.68 billion by 2032.

- The automotive segment is projected to generate a value of USD 12.26 billion by 2032.

- North America is anticipated to grow at a CAGR of 18.57% over the forecast period.

Major companies operating in the market are Contemporary Amperex Technology Co., Limited, Sensata Technologies, Inc., Analog Devices, Inc., Texas Instruments Incorporated, NXP Semiconductors, Infineon Technologies AG, Continental Engineering Services, Renesas Electronics Corporation, LG Energy Solution, Panasonic Holdings Corporation, SAMSUNG, Nuvation Energy, Gridstor, Eberspächer, and STARTEC ENERGY.

The growing integration of grid-scale energy storage, supported by the rising share of solar and wind power in electricity generation, is increasing the need for battery management systems to regulate variable energy inputs and maintain grid stability.

- In March 2025, LG Energy Solution signed an agreement with PGE Polska Grupa Energetyczna to supply 981 MWh of grid-scale energy storage system batteries between 2026 and 2027. The project includes building a battery energy storage facility in Żarnowiec, Poland, using LFP long-cell batteries manufactured at LG’s local plant.

Large-scale energy storage system (ESS) installations require robust battery management systems to ensure precise control over charge-discharge cycles, monitor system performance in real time, and maintain safety standards. As utility providers increasingly adopt grid-scale ESS, demand for advanced BMS platforms is rising.

Market Driver

Global Expansion of EV Manufacturing Infrastructure

The battery management system market is witnessing significant growth, primarily attributable to the rapid expansion of EV and battery manufacturing infrastructure on a global scale. The ongoing efforts by leading automotive manufacturers to scale up EV production have necessitated the development of integrated battery facilities, thereby increasing the demand for advanced BMS solutions.

These systems are critical for maintaining battery safety, ensuring operational efficiency, and enabling optimal performance through real-time monitoring and control functionalities. Furthermore, the localization of battery production and the integration of automation and data-driven technologies within manufacturing processes are reinforcing the requirement for intelligent BMS architectures.

- For instance, in March 2025, Hyundai Motor Group inaugurated its Metaplant America in Ellabell, Georgia, representing the largest economic development project in the state’s history. With a total investment of USD 12.6 billion, the facility aims to produce up to 500,000 electric and hybrid vehicles under the Hyundai, Kia, and Genesis brands.

This large-scale production of EV is boosting demand for robust, scalable battery management systems to ensure safety, performance optimization, and compliance with energy efficiency standards.

Market Challenge

Integration With Diverse Energy Storage Applications

A key challenge hampering the development of the battery management system market is integrating BMS solutions with a wide range of energy storage systems used in industrial, grid-scale, and renewable energy applications.

These systems often vary in voltage, capacity, and environmental operating conditions, requiring highly adaptable and reliable BMS architectures. Additionally, ensuring real-time monitoring and fault-tolerant communication in remote or harsh environments remains a technical barrier.

To address this challenge, companies are developing platform-agnostic and highly modular BMS solutions that can be tailored for multiple ESS configurations. Edge computing-based BMS, which enables real-time analytics and decision-making at the battery site, is gaining traction. Moreover, cloud-integrated BMS platforms are being adopted for centralized monitoring and predictive maintenance across distributed storage assets, enhancing operational continuity and scalability in non-automotive applications.

- For instance, in February 2025, Enersponse partnered with Molecule Systems to streamline the integration of commercial and industrial (C&I) battery storage. battery storage. The collaboration combines Enersponse’s VPP and DERMS platforms with Molecule’s MosFusion technology to simplify deployment, enhance grid connectivity, and expand access to demand response programs, thereby improving asset performance and accelerating market participation.

These advancements are collectively enabling broader adoption of BMS technologies, ensuring reliable performance, improved asset management, and long-term system resilience across diverse energy storage applications.

Market Trend

Emergence of Wireless Battery Management Solutions

The battery management system market is witnessing a notable shift toward the increasing adoption of wireless battery management systems (wBMS) in electric vehicles. This trend is supported by the growing demand for more compact, energy-efficient, and cost-effective battery architectures, particularly in the high-volume EV manufacturing landscape.

By eliminating the need for extensive wiring harnesses, wireless BMS solutions reduce vehicle weight, simplify assembly, enhance energy density, and offer the flexibility needed to accelerate design cycles and streamline maintenance processes.

- For instance, in November 2024, NXP Semiconductors unveiled the industry’s first wireless battery management system solution featuring Ultra-Wideband technology. The solution enables robust wireless communication within EV battery packs, simplifies assembly, enhances energy density, and reduces development complexity and cost. Integrated into NXP’s FlexCom chipset, the system supports both wired and wireless BMS configurations using a shared software architecture and safety libraries.

The introduction of advanced wireless communication technologies by leading semiconductor firms is accelerating the transition from traditional wired systems to wireless platforms in battery management systems (BMS). Consequently, wireless BMS (wBMS) is becoming a key component in the development of next-generation electric mobility solutions.

Battery Management System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Battery Type

|

Lithium-ion based, Lead-acid based, Nickel-based, Others

|

|

By Topology

|

Centralized, Modular, Distributed

|

|

By End-user Industry

|

Automotive, Renewable Energy, Consumer Electronics, Telecommunications, Aerospace & Defense, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Battery Type (Lithium-ion based, Lead-acid based, Nickel-based, and Others): The lithium-ion based segment earned USD 3.15 billion in 2024, largely due to its widespread use in electric vehicles and portable electronics, supported by high energy density and long cycle life.

- By Topology (Centralized, Modular, and Distributed): The centralized segment held a share of 48.44% in 2024, propelled by its cost-efficiency and simplified architecture in applications with uniform battery configurations.

- By End-user Industry (Automotive, Renewable Energy, Consumer Electronics, Telecommunications, Aerospace & Defense, and Others): The automotive segment is projected to reach USD 12.26 billion by 2032, owing to the increasing global adoption of electric vehicles and supportive government policies for sustainable transportation.

Battery Management System Market Regional Analysis

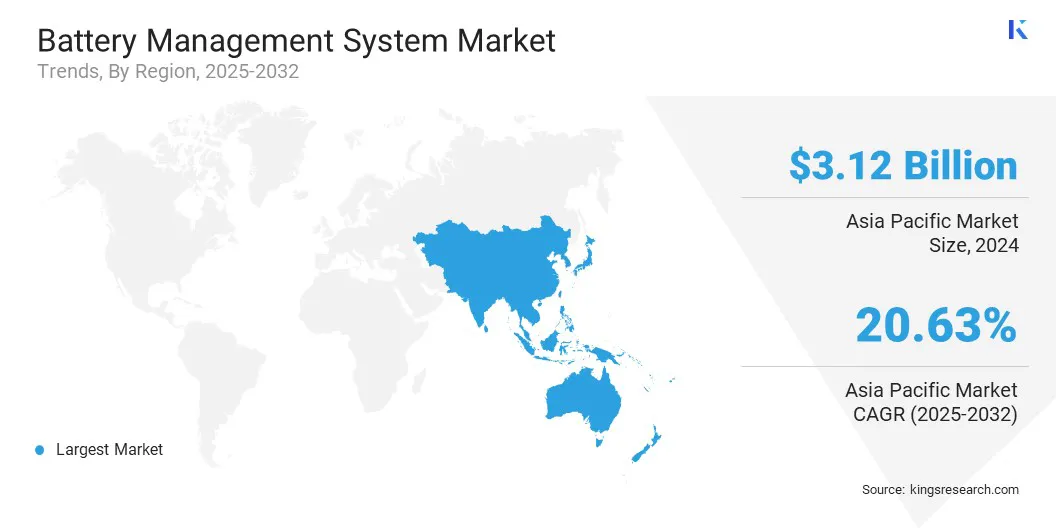

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia-Pacific battery management system market accounted for a substantial share of 36.41% in 2024, valued at USD 3.12 billion. The region’s dominance is reinforced by strong demand for electric vehicles, growing deployment of energy storage systems, and expanding industrial applications of lithium-ion batteries.

The rapid electrification of public transport fleets, including buses and last-mile delivery vehicles, is creating sustained demand for reliable battery systems equipped with intelligent management platforms that ensure safety, efficiency, and longer operational life.

Additionally, the increasing use of stationary storage solutions to support grid stability and renewable energy integration is highlighting the need for BMS technologies capable of managing high-capacity battery installations.

- In September 2024, LG Energy Solution launched ‘B.around,’ a dedicated brand for Battery Management Total Solution (BMTS) services. Featuring advanced BMS software and hardware, the offerings include safety diagnostics, battery degradation monitoring, and solutions optimized for software-defined vehicles (SDVs). Developed using real-world battery data, B.around supports enhanced battery performance, safety, and lifecycle management, aligning with the company’s broader Battery-as-a-Service (BaaS) strategy.

The shift toward digitalized energy infrastructure and the growing need for real-time diagnostics, fault detection, and predictive maintenance are accelerating the adoption of advanced BMS solutions across both mobile and stationary applications.

The North America battery management system industry is expected to register the fastest CAGR of 18.57% over the forecast period. A key factor contributing to this growth is the expansion of domestic manufacturing facilities dedicated to battery components, including battery management systems. Companies are increasingly localizing the production of battery modules, enclosures, thermal systems, and BMS hardware.

- In May 2025, Fluence Energy, Inc. began production of battery management system (BMS) hardware and enclosures at its new manufacturing facility in Goodyear, Arizona. The initiative aligns with the company's strategy to localize key components of its grid-scale energy storage systems, enhancing supply chain resilience, energy security, and large-scale deployment across U.S. power markets.

This shift toward regional manufacturing reduces dependence on global supply chains, lowers lead times, and ensures better integration of BMS solutions into energy storage systems tailored for the regional grid.

Additionally, localized production supports greater customization for specific utility and automotive applications and enhances responsiveness to market needs, positioning North America as a key hub for the development and deployment of high-performance, application-specific BMS technologies.

Regulatory Frameworks

- In the U.S., the Consumer Product Safety Commission (CPSC) regulates battery safety standards to prevent risks such as overheating and fire, the Environmental Protection Agency (EPA) oversees battery disposal and recycling, particularly for hazardous materials; and the Department of Transportation (DOT) governs the packaging, labeling, and transport of batteries, with specific rules for lithium-based chemistries.

- In Europe, battery regulation is led by the European Commission through the EU Battery Regulation, the European Chemicals Agency (ECHA) enforces chemical safety standards under REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), and national transport authorities oversee the safe handling and transportation of batteries in line with UN guidelines.

- In Japan, the Ministry of Economy, Trade and Industry (METI) is the regulatory authority responsible for overseeing battery safety, performance standards, and compliance with technical regulations.

Competitive Landscape

The battery management system industry is characterized by key players undertaking strategic initiatives to reinforce their market position and advance technological capabilities. Leading manufacturers are actively collaborating with automotive original equipment manufacturers (OEMs) to co-develop customized BMS solutions that align with the evolving requirements of electric vehicle architectures.

These partnerships facilitate long-term supply agreements, accelerate system integration, and strengthen market presence. Additionally, companies are engaging in targeted acquisitions to access advanced software for battery analytics, diagnostics, and monitoring, thereby enhancing their competitive edge.

- In June 2025, Eberspaecher and Farasis Energy Europe entered into an exclusive partnership to offer integrated battery systems combining battery management technologies with lithium-ion cell expertise. The collaboration focuses on developing 12V to 48V complete battery solutions for starter, back-up, and mild hybrid systems in vehicles, aiming to simplify integration for automotive OEMs and accelerate the adoption of next-generation battery platforms.

- In January 2025, GridStor and Capacity Power Group entered into an acquisition agreement under which GridStor acquired a 100 MW / 400 MWh battery energy storage project in Arizona. The project aims to support rising regional power demand and improve grid reliability. This marks GridStor’s third acquisition within a year, reinforcing its strategy to expand utility-scale energy storage capacity in high-growth U.S. markets.

These strategies are fostering innovation and expanding the adoption of BMS technologies across high-growth application areas.

List of Key Companies in Battery Management System Market:

- Contemporary Amperex Technology Co., Limited

- Sensata Technologies, Inc.

- Analog Devices, Inc.

- Texas Instruments Incorporated

- NXP Semiconductors

- Infineon Technologies AG

- Continental Engineering Services

- Renesas Electronics Corporation

- LG Energy Solution

- Panasonic Holdings Corporation

- SAMSUNG

- Nuvation Energy

- Gridstor

- Eberspächer

- STARTEC ENERGY

Recent Developments (Product Launches/Collaboration/Partnership)

- In March 2025, Sichuan CAMY New Energy Co., Ltd. launched its next-generation KUINETIC battery pack for electric Ground Support Equipment (GSE) applications, featuring a contactless battery management system with cell-level intelligence. The system incorporates Dukosi’s Cell Monitoring System and C-SynQ technology to enable continous monitoring, accurate diagnostics, secure wireless communication, and lifetime data traceability to enhance safety and operational efficiency in airport environments.

- In March 2025, Renesas unveiled its Ready Battery Management System with Fixed Firmware (R‑BMS F), a complete Li‑ion BMS platform comprising fuel gauge ICs, MCU, analog front‑end, pre‑validated firmware, evaluation kits, GUI tools, and documentation designed to simplify and accelerate intelligent battery pack development.

- In December 2024, Infineon Technologies AG and EVE Energy Co., Ltd. signed a memorandum of understanding to jointly develop advanced battery management system solutions for electric vehicles, leveraging Infineon's comprehensive chipset portfolio to enhance the safety, reliability, and performance of EV battery packs.

- In December 2024, LG Energy Solution partnered with Qualcomm Technologies to develop and commercialize SoC-based battery management system diagnostic solutions for next-generation electric vehicles, leveraging the Snapdragon Digital Chassis to enhance safety and energy efficiency.