Market Definition

The market involves technologies and systems that automate the process of handling and transferring liquids in various applications, particularly in laboratory and research environments.

These systems are designed to precisely and efficiently handle liquids such as chemicals, reagents, solvents, and biological samples in processes like pipetting, mixing, dispensing, and dilution.

Automated Liquid Handling Market Overview

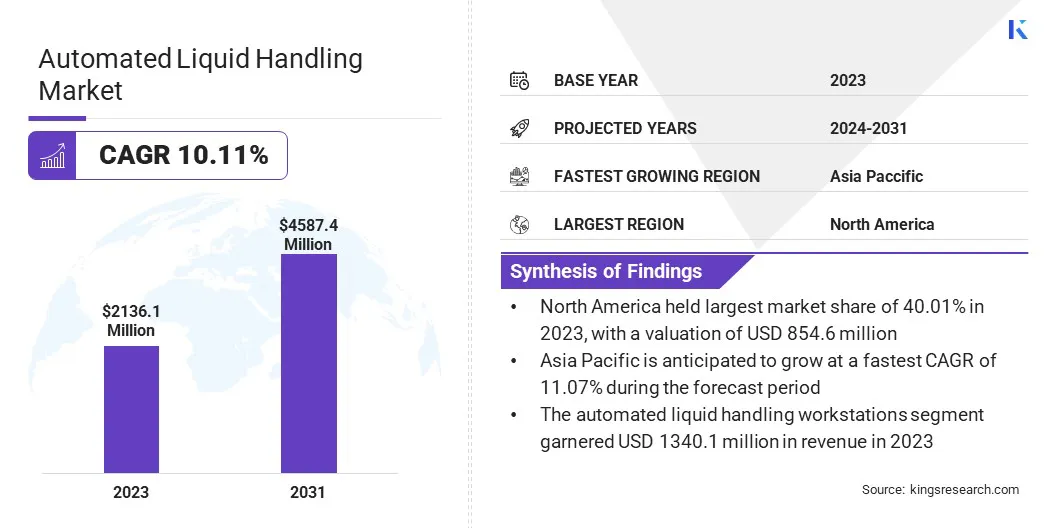

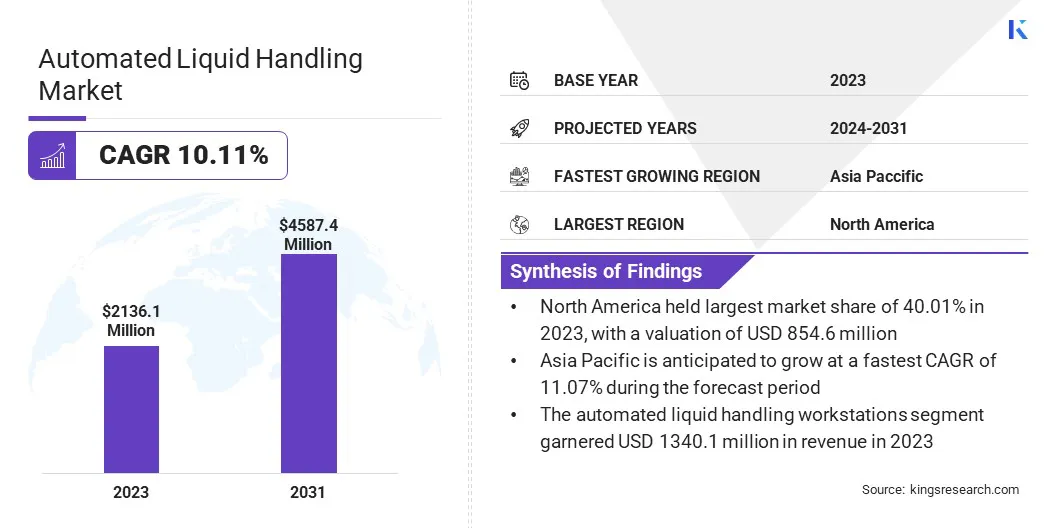

The global automated liquid handling market size was valued at USD 2136.1 million in 2023, which is estimated to be USD 2337.0 million in 2024 and reach USD 4587.4 million by 2031, growing at a CAGR of 10.11% from 2024 to 2031.

The need for precise and reliable results in research and diagnostics drives the adoption of automated liquid handling systems, ensuring consistent, error-free outcomes essential for high-quality scientific and medical applications.

Major companies operating in the automated liquid handling industry are Thermo Fisher Scientific Inc., Endress+Hauser Group Services AG, Aurora Instruments Ltd., Hamilton Company, DH Life Sciences, LLC., Agilent Technologies, Inc., Eppendorf SE, FORMULATRIX, Gilson Incorporated, Hudson Lab Automation, Beckman Coulter, Inc., Lonza Group Ltd., QIAGEN, Tecan Trading AG, and Revvity.

The market is rapidly growing, driven by the demand for precision, efficiency, and reproducibility in laboratory processes. Automation systems, such as liquid handling robots and reagent kits, are transforming research and diagnostics by streamlining tasks like sample preparation, dispensing, and genetic sequencing.

Key sectors like pharmaceuticals, biotechnology, and genomics rely on these technologies to accelerate discovery, reduce manual errors, and improve throughput. The market is evolving with innovations in robotics, AI integration, and high-throughput applications for various scientific fields.

- In October 2024, BD (Becton, Dickinson and Company) introduced a new automated solution in partnership with Hamilton Company to optimize single-cell research workflows. This system automates traditionally manual steps, improving the speed and consistency of generating material for genetic sequencing. The solution features the newly launched BD OMICS-One XT WTA Assay and the Hamilton Microlab NGS STAR automated liquid handling platform, enhancing overall efficiency in genomic studies.

Key Highlights:

Key Highlights:

- The automated liquid handling industry size was valued at USD 2136.1 million in 2023.

- The market is projected to grow at a CAGR of 10.11% from 2024 to 2031.

- North America held a market share of 40.01% in 2023, with a valuation of USD 854.6 million.

- The automated liquid handling workstations segment garnered USD 1340.1 million in revenue in 2023.

- The drug discovery & ADME-tox research segment is expected to reach USD 1947.3 million by 2031.

- The pharmaceutical & biotechnology companies segment is anticipated to register the fastest CAGR of 10.47% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 11.07% during the forecast period.

Market Driver

"Increased Demand for Precision and Accuracy"

The growing demand for precision and accuracy in scientific research and diagnostics is driving the automated liquid handling market. Automation provides consistent and reproducible results, eliminating the variability and human error often associated with manual liquid handling processes.

This ensures higher reliability in critical applications like genomic sequencing, drug development, and clinical diagnostics. The need for automation in liquid handling increases to meet stringent quality standards and improve overall efficiency in laboratory workflows as research becomes more data-driven.

- In December 2023, ABB Robotics partnered with XtalPi to establish intelligent, automated laboratories in China, enhancing R&D in biopharmaceuticals and new materials. ABB’s GoFa cobots perform complex tasks in demanding environments, like glove boxes, including liquid handling, sample addition, filtration, and UPLC testing. These cobots handle hundreds of experiments with minimal supervision and autonomously transfer samples between workstations, increasing efficiency and reducing operational costs.

Market Challenge

"Training and Skill Requirements"

A significant challenge in the automated liquid handling market is the training and skill requirements for lab staff. Specialized training is essential to operate and maintain advanced automated systems effectively, leading to increased operational costs and time investments.

Labs may face difficulties in upskilling their workforce, which can slow down the adoption of automation. The solution lies in providing comprehensive training programs, user-friendly interfaces, and ongoing support to minimize the learning curve, while manufacturers can develop intuitive systems to reduce dependency on extensive training.

Market Trend

"Compact and User-friendly Solutions"

A notable trend in the automated liquid handling market is the development of compact and user-friendly solutions. Systems like the Microlab Prep exemplify this shift, offering a small, easy-to-operate platform that can be used effectively by both novice and experienced lab personnel.

These compact solutions are designed to fit into limited lab spaces while maintaining high performance and efficiency. Simplifying automation enables a wide range of laboratories to adopt advanced technologies, improving workflow and overall productivity.

- In July 2024, Hamilton Company launched two innovative products: the Microlab Prep compact, easy-to-use automated liquid handler and the Prep CAP HEPA/UV device. These solutions streamline laboratory workflows, reducing manual pipetting tasks and ensuring clean, contaminant-free environments, improving sample integrity, and boosting efficiency for scientists across all skill levels.

Automated Liquid Handling Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Automated Liquid Handling Workstations, Reagents & Consumables

|

|

By Application

|

Drug Discovery & ADME-Tox Research, Cancer & Genomic Research, Bioprocessing/Biotechnology, Others

|

|

By End-user

|

Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Contract Research Organizations

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK , Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E. , Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Automated Liquid Handling Workstations, Reagents & Consumables): The automated liquid handling workstations segment earned USD 1340.1 million in 2023, due to the increasing demand for high-throughput automation, precision, and time efficiency in laboratory workflows.

- By Application (Drug Discovery & ADME-Tox Research, Cancer & Genomic Research, Bioprocessing/Biotechnology, Others): The drug discovery & ADME-tox Research segment held 42.19% share of the market in 2023, due to the growing need for efficient screening and faster drug development processes in pharmaceutical research.

- By End-user (Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Contract Research Organizations): The pharmaceutical & biotechnology companies segment is projected to reach USD 2752.9 million by 2031, owing to the increasing adoption of automation in drug development, clinical trials, and large-scale production processes.

Automated Liquid Handling Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America automated liquid handling market share stood at around 40.01% in 2023, with a valuation of USD 854.6 million. North America dominates the market, due to its well-established pharmaceutical and biotechnology industries, high investments in research and development, and advanced healthcare infrastructure.

North America automated liquid handling market share stood at around 40.01% in 2023, with a valuation of USD 854.6 million. North America dominates the market, due to its well-established pharmaceutical and biotechnology industries, high investments in research and development, and advanced healthcare infrastructure.

The presence of key market players like Hamilton Company and Thermo Fisher Scientific contributes to the region’s leadership, driving the demand for automation in labs. Additionally, the rising focus on personalized medicine and genomics in the U.S. further boosts the adoption of automated liquid handling systems, ensuring North America’s dominant market share.

The automated liquid handling industry in Asia Pacific is poised for significant growth at a robust CAGR of 11.07% over the forecast period. Asia-Pacific is the fastest-growing market for automated liquid handling, driven by rapid advancements in biotechnology, increasing government investments in healthcare, and a growing number of pharmaceutical companies in emerging markets like China and India.

The region's increasing focus on research, drug development, and clinical trials accelerates the demand for automation in labs. Moreover, the growing awareness of precision medicine and the expansion of healthcare infrastructure contribute to the rising adoption of automated liquid handling technologies, ensuring robust market growth in the region.

Regulatory Frameworks

- In the U.S., the FDA ensures public health by regulating the safety, efficacy, and security of drugs, biological products, medical devices, food, cosmetics, and radiation-emitting products, while providing science-based health information.

- In India, the Indian Medical Device Rules, 2017 (IMDR) mandate that medical systems in medical and diagnostic labs comply with standards, ensuring their safety, efficacy, and quality for market approval and usage.

- In the European Union (EU), CE marking is required for automated liquid handling systems to demonstrate conformity with health, safety, and environmental standards, enabling free market access across EU member states.

Competitive Landscape:

Companies in the market are focusing on enhancing efficiency, precision, and scalability by developing advanced systems that integrate AI, real-time data analytics, and modular designs.

They are striving to provide solutions that streamline complex workflows, reduce manual errors, and ensure regulatory compliance across various industries. Additionally, the emphasis on offering user-friendly platforms that cater to both small and large labs is growing, enabling them to boost productivity while minimizing operational disruptions and supporting scientific research advancements.

- In January 2025, Tecan introduced Veya, a revolutionary liquid handling platform designed to enhance lab automation with efficiency, precision, and compliance. Veya streamlines complex workflows using AI-driven automation, prebuilt workflows, and real-time data analytics, boosting productivity and reducing errors. Its versatility and modular design make it ideal for labs of all sizes, ensuring compliance with industry standards like CE-IVD and IVDR, further democratizing automation and advancing healthcare innovation globally.

List of Key Companies in Automated Liquid Handling Market:

- Thermo Fisher Scientific Inc.

- Endress+Hauser Group Services AG

- Aurora Instruments Ltd.

- Hamilton Company

- DH Life Sciences, LLC.

- Agilent Technologies, Inc.

- Eppendorf SE

- FORMULATRIX

- Gilson Incorporated

- Hudson Lab Automation

- Beckman Coulter, Inc.

- Lonza Group Ltd.

- QIAGEN

- Tecan Trading AG

- Revvity

Recent Developments (Partnerships/Product Launches)

- In November 2023, SPT Labtech launched enhancements to its firefly platform, optimizing liquid handling for NGS-based Laboratory Developed Tests (LDTs). Designed for clinical labs, firefly delivers rapid setup, high precision, compact design, and user-friendly software, addressing throughput, compliance, and flexibility challenges in regulated genomic testing environments.

- In July 2023, Revvity introduced the Fontus Automated Liquid Handling Workstation, engineered to streamline NGS library prep and diagnostics. With pre-configured protocols, enhanced ergonomics, and intuitive software, Fontus addresses throughput demands while reducing user burden, offering scalable automation to pharmaceutical, biotech, academic, and diagnostic labs globally.

- In February 2023, Biosero and Analytik Jena entered a co-marketing agreement to promote integrated laboratory automation solutions. By combining Green Button Go software with Analytik Jena’s liquid handling instruments, the collaboration aims to enhance workflow efficiency, reduce manual intervention, and accelerate research throughput across clinical and scientific laboratories globally.

Key Highlights:

Key Highlights: North America automated liquid handling market share stood at around 40.01% in 2023, with a valuation of USD 854.6 million. North America dominates the market, due to its well-established pharmaceutical and biotechnology industries, high investments in research and development, and advanced healthcare infrastructure.

North America automated liquid handling market share stood at around 40.01% in 2023, with a valuation of USD 854.6 million. North America dominates the market, due to its well-established pharmaceutical and biotechnology industries, high investments in research and development, and advanced healthcare infrastructure.