Market Definition

Atopic dermatitis is a chronic, inflammatory skin condition characterized by red, itchy rashes, predominantly affecting individuals with a predisposed immune system.

The market encompasses the development and sale of treatments topical, oral, and biologic therapies designed to manage symptoms and improve patient outcomes, driven by innovations and growing demand for effective solutions.

Atopic Dermatitis Drugs Market Overview

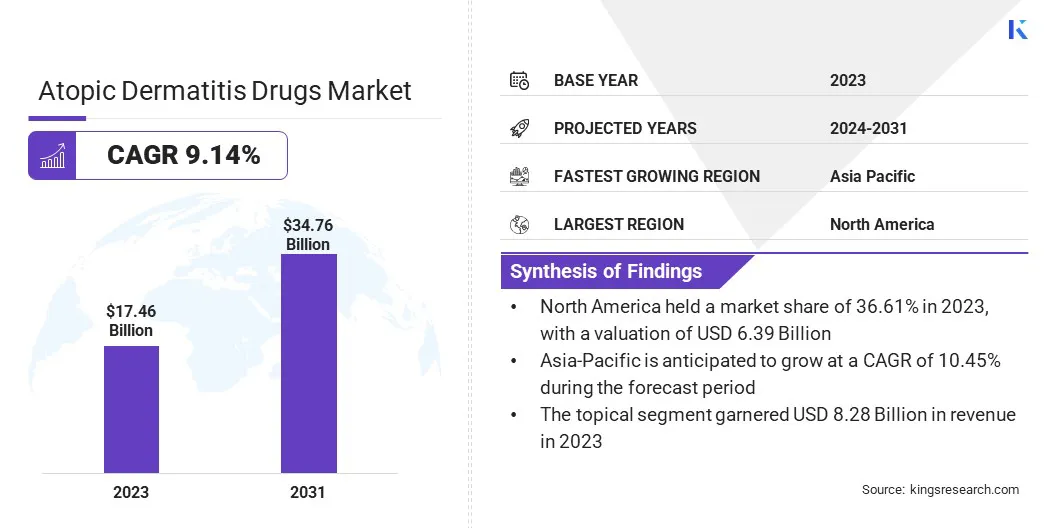

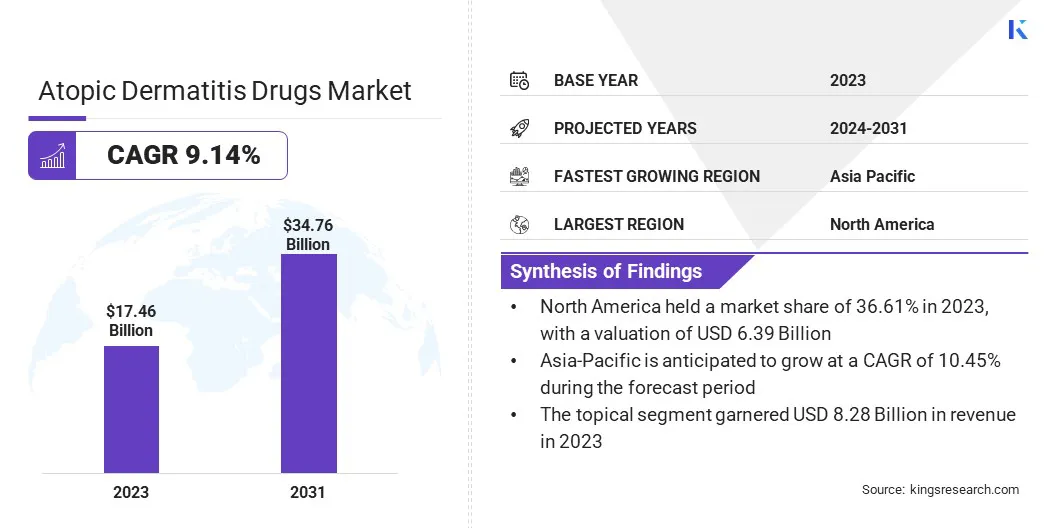

Global atopic dermatitis drugs market size was valued at USD 17.46 billion in 2023 and is projected to grow from USD 18.85 billion in 2024 to USD 34.76 billion by 2031, exhibiting a CAGR of 9.14% during the forecast period.

The market is experiencing significant growth, primarily fueled by by the rising global prevalence of the condition and increasing demand for effective treatments.

Innovations in drug development, particulalry in biologics and targeted therapies, are enhancing treatment efficacy. The trend toward personalized medicine is enabling tailored treatment plans that improve patient outcomes and adherence.

Major companies operating in the atopic dermatitis drugs market are AbbVie Inc., Bausch Health Companies Inc., GSK group of companies., Pfizer Inc., Regeneron Pharmaceuticals Inc., Sanofi, Eli Lilly and Company, Novartis AG, LEO Pharma Inc., Teva Pharmaceutical Industries Ltd., Bristol-Myers Squibb Belgium SA/NV, AstraZeneca, Astellas Pharma Inc., Otsuka Pharmaceutical Co., Ltd., Galderma, and others.

- In August 2024, according to the National Institute of Allergy and Infectious Diseases reported that 2 to 10 percent of adults and 10 to 30 percent of children in the U.S. are affected by the condition.

Key Highlights:

- The atopic dermatitis drugs industry size was recorded at USD 17.46 billion in 2023.

- The market is projected to grow at a CAGR of 9.14% from 2024 to 2031.

- North America held a share of 36.61% in 2023, valued at USD 6.39 billion.

- The topical corticosteroids segment garnered USD 4.09 billion in revenue in 2023.

- The hospital pharmacies segment is expected to reach USD 10.87 billion by 2031.

- The topical segment is anticipated to witness the fastest CAGR of 8.94% over the forecast period

- Asia Pacific is estimated to grow at a CAGR of 10.45% through the projection period.

Market Driver

"Rising Global Prevalence of Atopic Dermatitis and Advancements in Drug Development"

The rising global prevalence of atopic dermatitis (AD) is a major driver fuelling demand for more effective treatment options. With millions of individuals affected worldwide, the chronic nature of AD necessitates long-term management strategies, increasing the need for innovative therapies.

The growing patient population is driving market expansion, pushing pharmaceutical firms to fast-track R&D for advanced, high-demand treatment solutions.

Furthermore, advancements in drug development, particularly the emergence of biologics and targeted therapies, are revolutionizing treatment approaches. These innovative therapies offer improved efficacy and safety profiles compared to traditional treatments, further propelling market growth.

- For instance, in December 2024, Castle Biosciences announced advancements in its atopic dermatitis (AD) pipeline with a precision medicine test. Set to launch by late 2025, this innovative test aims to help patients avoid trial-and-error treatment cycles, improving therapeutic outcomes and streamlining treatment decisions for moderate-to-severe AD.

Market Challenge

"High Treatment Costs and Access Disparities"

The atopic dermatitis (AD) market faces significant challenges that hinder treatment accessibility and market growth. High treatment costs, particularly for biologics, limit affordability for financially constrained patients, restricting market penetration.

To address this, pharmaceutical companies can implement tiered pricing models, expand patient assistance programs, and promote biosimilars to offer cost-effective alternatives. Additionally, stringent regulatory requirements prolong development timelines, delaying market entry for innovative treatments.

Engaging proactively with regulatory agencies, leveraging accelerated approval pathways, and utilizing real-world evidence can expedite approvals and reduce delays. Geographic disparities in healthcare access further exacerbate unequal treatment availability, increasing the burden on affected individuals.

Expanding telemedicine, enhancing distribution networks, and collaborating with healthcare policymakers can improve accessibility and ensure broader treatment coverage.

Market Trend

"Growing Shift Toward Biologics and Personalized Medicine"

The atopic dermatitis drugs market is witnessing notable trends, including a shift toward biologics and targeted therapies, which offer more effective treatments for moderate-to-severe cases.

Biologics, such as monoclonal antibodies and JAK inhibitors, are gaining prominence due to their ability to target the underlying immune mechanisms of the disease. Additionally, there is an increasing focus on personalized medicine to optimize treatment outcomes.

Furthermore, oral therapies and combination treatments are gaining attention for their improved efficacy and convenience. The rising global prevalence of atopic dermatitis, particularly in emerging markets, and advancements in drug development are expected to foster market expansion.

- In March 2024, Sanofi showcased positive Phase 2b results for amlitelimab in moderate-to-severe atopic dermatitis (AD), demonstrating sustained improvement over 28 weeks, high responder rates post-treatment, and a consistent safety profile. Presented at the 2024 AAD Conference, these findings support quarterly dosing and strenghthen amlitelimab’s potential in the competitive atopic dermatitis drugs industry, advancing its Phase 3 OCEANA program.

Atopic Dermatitis Drugs Market Report Snapshot

| Segmentation |

Details |

| By Drug Class |

Topical Corticosteroids, Calcineurin Inhibitors, Phosphodiesterase 4 (PDE4) Inhibitors, Biologics, Others |

| By Distribution Channel |

Hospital Pharmacies, Online Pharmacies, Dermatology Clinics |

| By Route of Administration |

Topical, Oral, Injectable |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Drug Class (Topical Corticosteroids, Calcineurin Inhibitors, Phosphodiesterase 4 (PDE4) Inhibitors, Biologics, and Others): The topical corticosteroids segment earned USD 4.09 billion in 2023 due to their widespread use as first-line treatments for managing inflammation and itchiness associated with atopic dermatitis, providing rapid relief and effectiveness.

- By Distribution Channel (Hospital Pharmacies, Online Pharmacies, and Dermatology Clinics): The dermatology clinics held a share of 43.65% in 2023, fueled by their specialized focus on skin conditions, which offers patients direct access to expert care and tailored treatment plans that enhance adherence and outcomes.

- By Route of Administration (Topical, Oral, and Injectable): The topical segment is projected to reach USD 16.23 billion by 2031, largely attributed to consumer preference for non-invasive treatments that deliver localized care with minimal systemic side effects, leading to improved patient compliance and satisfaction.

Atopic Dermatitis Drugs Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America atopic dermatitis drugs market accounted for a significant share of around 36.61% in 2023, valued at USD 6.39 billion. This dominance is reinforced by the high prevalence of atopic dermatitis, increasing adoption of biologics, favorable reimbursement policies, advanced healthcare infrastructure, and significant investments in research and development for innovative therapies.

- For instance, in January 2024, the U.S. FDA updated the label for Dupixent’s (dupilumab) to include Phase 3 efficacy and safety data for patients aged 12+ with moderate-to-severe hand/foot atopic dermatitis. As the first biologic evaluated for this condition, this approval strengthens Dupixent’s position in the growing the market, with global regulatory submissions underway.

Asia-Pacific atopic dermatitis drugs industry is anticipated to grow at the fastes CAGR of 10.45% through the projection period. Leading countries such as China, India, and Japan are contributing significantly to this growth, supported by increasing awareness of atopic dermatitis, rising healthcare expenditure, and a growing patient population.

The regional market benefits from significant investments in healthcare infrastructure and ongoing research and development efforts aimed at innovative treatments. Additionally, the growing prevalence of atopic dermatitis, particularly among children and adults, further fuels demand, positioning Asia-Pacific as a key market for market.

- In January 2024, Glenmark and Pfizer partnered to launch abrocitinib, an advanced oral treatment for moderate-to-severe atopic dermatitis (AD), in India. Approved by CDSCO, U.S. FDA, EMA, and other global regulators, it will be co-marketed as JABRYUS (Glenmark) and CIBINQO (Pfizer). Already available in over 35 markets, it offers improved efficacy and patient convenience.

Regulatory Framework

- In the United States, the Food and Drug Administration (FDA) is responsible for regulating the approval and marketing of atopic dermatitis drugs. It assesses the safety, efficacy, and quality of drug candidates through rigorous clinical trials and data reviews. This regulatory oversight ensures that only safe and effective therapies for atopic dermatitis are available to patients, while upholding high standards in manufacturing and distribution.

- In Europe, the European Medicines Agency (EMA) regulatesmonitors atopic dermatitis drugs, evaluating their safety, efficacy, and quality through rigorous clinical assessments before granting marketing authorization.

- In APAC, the National Medical Products Administration (NMPA) regulates drugs in China, enforcing guidelines, policies, and decisions for their supervision and administration.

- In Japan, the pharmaceuticals and medical devices agency (PMDA) oversses atopic dermatitis drugs, ensuring their safety, efficacy, and quality through rigorous scientific assessments.

Competitive Landscape

The atopic dermatitis drugs industry is characterized by a number of participants, including both established corporations and emerging players. To gain a competitive edge in this rapidly evolving market, these organizations are implemeting strategic initiatives such as new product launches, collaborations, corporate expansions, and mergers and acquisitions.

- In July 2024, Johnson & Johnson Services, Inc. acquired Yellow Jersey Therapeutics, securing ownership of NM-26, an innovative treatment for atopic dermatitis, thus strengthening its dermatology pipeline and reinforcing its leadership in addressing unmet medical needs in dermatology.

List of Key Companies in Atopic Dermatitis Drugs Market

- AbbVie Inc.

- Bausch Health Companies Inc.

- GSK group of companies.

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

- Sanofi

- Eli Lilly and Company

- Novartis AG

- LEO Pharma Inc.

- Teva Pharmaceutical Industries Ltd.

- Bristol-Myers Squibb Belgium SA/NV

- AstraZeneca

- Astellas Pharma Inc.

- Otsuka Pharmaceutical Co., Ltd.

- Galderma

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In May 2024, Johnson & Johnson Services, Inc. acquired Proteologix, Inc. to enhance its dermatology portfolio, focusing on innovative bispecific antibodies for atopic dermatitis and asthma, and addressing unmet needs in targeted therapeutics.

- In October 2024, Organon group of companies acquired Dermavant, including the innovative dermatologic therapy VTAMA (tapinarof) cream, enhancing its portfolio to meet demands for atopic dermatitis and other inflammatory skin conditions.

- In April 2024, Incyte acquired Escient Pharmaceuticals to gain access to its atopic dermatitis treatment pipeline, bolstering its ability to develop innovative therapies for moderate-to-severe conditions .

- In September 2024, Lilly's EBGLYSSTM (lebrikizumab-lbkz) has received FDA approval for treating moderate-to-severe atopic dermatitis in adults and children aged 12 and up.