Market Definition

An market focuses on the development, production, and deployment of robotic arms with multiple joints, enabling movement in various directions. These robots are designed to emulate the human arm's range of motion, providing increased flexibility and precision for a wide range of applications.

The report outlines the major factors driving the market, along with key drivers and the competitive landscape expected to influence market growth over the forecast period.

Articulated Robot Market Overview

Global articulated robot market size was valued at USD 9.12 billion in 2023, which is estimated to be valued at USD 9.95 billion in 2024 and reach USD 19.66 billion by 2031, growing at a CAGR of 10.21% from 2024 to 2031.

The increasing demand for automation across industries is driving the adoption of articulated robots. These robots enhance production efficiency, reduce labor costs, and support higher quality standards, making them crucial for modern manufacturing processes.

Major companies operating in the articulated robot industry are ABB, KUKA AG, Mitsubishi Electric Corporation, FANUC CORPORATION, Kawasaki Heavy Industries, Ltd., DENSO WAVE INCORPORATED, OMRON Corporation, NACHI-FUJIKOSHI CORP, Yaskawa America, Inc, Seiko Epson Corporation, Elite Robots, Delta Electronics, Inc., igus, Hiwin Corporation, and Robotphoenix LLC.

The demand for articulated robots is driven by the growing need for automation in the e-commerce and logistics sectors. The rapid expansion of online retail has led to increased requirements for automation in sorting, packaging, and order fulfillment processes.

Articulated robots are increasingly being adopted for their precision, flexibility, and efficiency in handling repetitive tasks. This adoption enhances operational efficiency, supporting the need for faster delivery times and contributing to the optimization of warehouse and distribution operations.

- In October 2024, Amazon unveiled its next-generation fulfillment center in Shreveport, Louisiana. This facility is powered by over 750,000 robots, including advanced articulated robotic arms and mobile systems for sorting, packaging, and order fulfillment.

Key Highlights

- The articulated robot industry size was recorded at USD 9.12 billion in 2023.

- The market is projected to grow at a CAGR of 10.21% from 2024 to 2031.

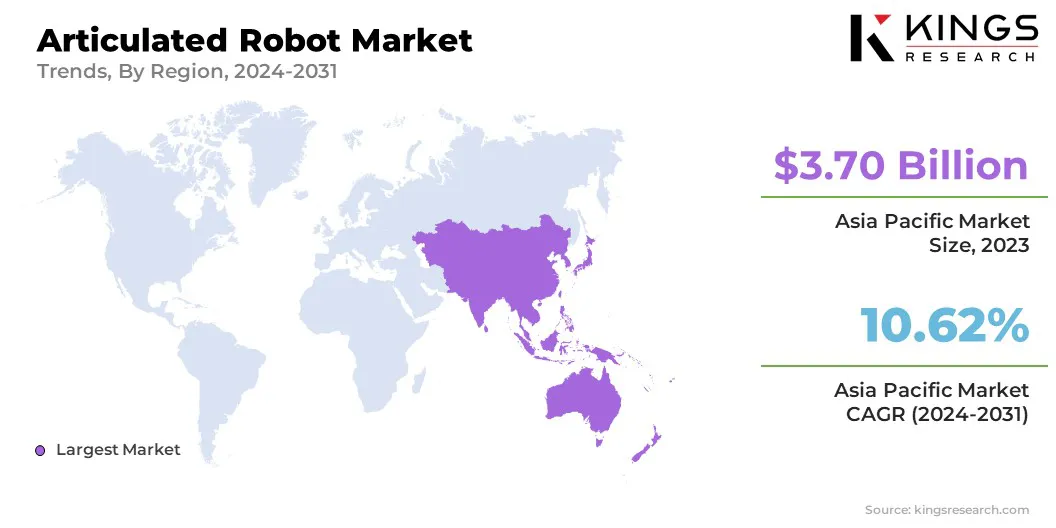

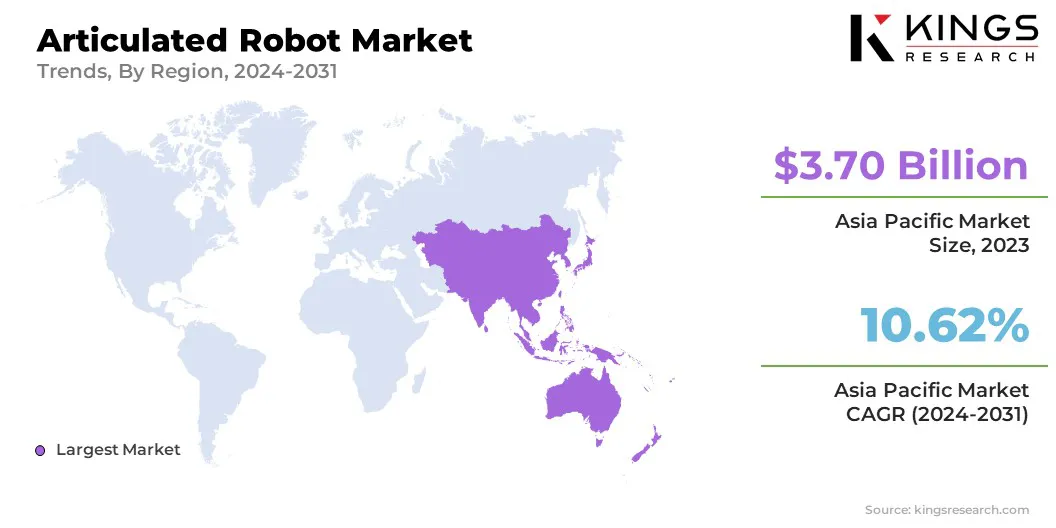

- Asia Pacific held a market share of 40.56% in 2023, with a valuation of USD 3.70 billion.

- The up to 16.00 Kg segment garnered USD 21 billion in revenue in 2023.

- The handling segment is expected to reach USD 8.26 billion by 2031.

- The pharmaceuticals & cosmetics segment is anticipated to witness the fastest CAGR of 12.38% during the forecast period.

- North America is anticipated to grow at a CAGR of 10.27% during the forecast period.

Market Driver

"Increasing Demand for Automation"

The increasing demand for automation across various industries is driving the global articulated robot market. Companies are adopting articulated robots to enhance production efficiency, reduce labor costs, and improve product quality.

These robots provide flexibility, precision, and the ability to handle repetitive tasks, helping businesses streamline operations and maintain high standards. Articulated robots are particularly beneficial in sectors like automotive, electronics, and manufacturing, where speed and quality control are crucial to meeting market demands and maintaining competitiveness.

- In November 2024, Mobile Industrial Robots (MiR) introduced the MC600, a mobile collaborative robot (cobot) combining the MiR600 autonomous mobile robot with Universal Robots' UR20/UR30 robotic arms. This system automates tasks like palletizing, box handling, and machine tending to improve productivity and reduce worker strain.

Market Challenge

"Skill Gap"

The articulated robot market faces a significant challenge due to a shortage of skilled technicians. The demand for specialists to program, maintain, and repair robotic systems exceeds the available workforce, especially in regions with limited access to skilled labor. This gap restricts the broader adoption of robotics, particularly among smaller businesses.

Solutions include investing in training programs, upskilling existing employees, and partnering with educational institutions to address this skills deficit. Additionally, developing user-friendly interfaces and providing remote support can reduce dependency on highly specialized personnel.

Market Trend

"Collaborative Robots (Cobots)"

A key trend in the articulated robot market is the rise of collaborative robots (cobots), which work alongside humans in shared workspaces. These robots are designed to enhance productivity while prioritizing safety and flexibility, allowing humans and robots to collaborate seamlessly.

Cobots are equipped with advanced sensors and safety features, enabling them to work safely in close proximity to workers. This trend is expanding the range of applications across industries, including manufacturing, logistics, and healthcare, leading to improved efficiency and fostering innovation.

- In October 2024, Universal Robots introduced its AI Accelerator, a hardware and software toolkit designed to enhance AI-powered cobot applications. This innovation accelerates development, enabling faster deployment and expanding the capabilities of articulated robots in industrial settings.

Articulated Robot Market Report Snapshot

|

Segmentation

|

Details

|

|

By Payload

|

Up to 16.00 Kg, 16.01 – 60.00 Kg, 60.01 – 225.00 Kg, More Than 225.00 Kg

|

|

By Function

|

Handling, Welding, Dispensing, Assembly, Processing, Others

|

|

By Industry

|

Automotive, Electrical & Electronics, Chemicals, Rubbers & Plastics, Metal & Machinery, Food & Beverages, Precision Engineering and Optics, Pharmaceuticals & Cosmetics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Payload (Up to 16.00 Kg, 16.01 – 60.00 Kg, 60.01 – 225.00 Kg, More Than 225.00 Kg): The up to 16.00 Kg segment earned USD 3.21 billion in 2023 due to increasing demand for lightweight robots in manufacturing automation.

- By Function (Handling, Welding, Dispensing, Assembly, Processing, Others): The handling segment held 40.50% of the market in 2023, due to the growing use of articulated robots in material handling and logistics operations.

- By Industry (Automotive, Electrical & Electronics, Chemicals, Rubbers & Plastics, Metal & Machinery, Food & Beverages, Precision Engineering and Optics, Pharmaceuticals & Cosmetics, Others): The automotive segment is projected to reach USD 6.13 billion by 2031 owing to the increasing automation of production lines and advanced robotic assembly systems.

Articulated Robot Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific articulated robot market share stood around 40.56% in 2023 in the global market, with a valuation of USD 3.70 billion. In the market, the Asia-Pacific region is projected to dominate due to its strong industrial base and rapid adoption of automation technologies.

Countries in this region are heavily investing in advanced manufacturing technologies, particularly in the automotive and electronics sectors. These industries heavily rely on articulated robots for tasks such as welding, assembly, and material handling.

Additionally, the growing demand for cost-effective and efficient automation solutions is driving increased deployment of robots across industries in Asia-Pacific, in turn driving market growth.

- In Dec 2024, Kawasaki Heavy Industries introduced "neoROSET," a robot programming software that streamlines robot system design, reducing work hours and improving quality, addressing the growing demand for efficient solutions in the market, particularly in automation.

North America articulated robot industry is poised for significant growth at a robust CAGR of 10.27% over the forecast period. North America is emerging as the fast-growing region in the market, driven by advancements in manufacturing technologies and increased demand for automation across industries.

The region's strong focus on innovation, particularly in sectors such as automotive, electronics, and logistics, is boosting the rapid adoption of articulated robots. Additionally, the demand for greater operational efficiency, combined with a skilled workforce and substantial investments in smart manufacturing, is further driving the growth of the market in North America.

Regulatory Frameworks

- In EU, the Directive 2006/42/EC on machinery establishes health and safety requirements for the design, construction, and placement of machinery on the European market, ensuring safe use and operation.

- In the US, ANSI/RIA R15.06-2012 outlines safety requirements for industrial robots and systems, specifying design, protective measures, and hazard reduction to ensure safe operation and minimize associated risks.

Competitive Landscape:

Companies in the articulated robot industry are focusing on enhancing automation capabilities by developing robots with higher payload capacities, improved precision, and advanced AI integration.

They are also prioritizing energy efficiency, safety features, and ease of use. Additionally, key players are expanding their product ranges to cater to various industries, including automotive, electronics, and manufacturing, driving broader market adoption.

- In Oct 2024, Inovance launched its articulated and SCARA industrial robots at the SPS Nuremberg show in Europe. These robots are designed for various applications, including automotive and electronics manufacturing, with initial payloads of up to 20 kg.

List of Key Companies in Articulated Robot Market:

- ABB

- KUKA AG

- Mitsubishi Electric Corporation

- FANUC CORPORATION

- Kawasaki Heavy Industries, Ltd.

- DENSO WAVE INCORPORATED

- OMRON Corporation

- NACHI-FUJIKOSHI CORP

- Yaskawa America, Inc

- Seiko Epson Corporation

- Elite Robots

- Delta Electronics, Inc.

- igus

- Hiwin Corporation

- Robotphoenix LLC

Recent Developments (New Product Launch)

- In February 2025, KUKA launched the KR IONTEC ultra, a compact robotic arm designed for enhanced efficiency and flexibility in handling and welding applications. With a payload capacity of up to 120 kg and a reach of 2,700 mm, this versatile robotic arm is particularly well-suited for the automotive and electromobility sectors, offering precision and performance in demanding industrial environments.

- In May 2024, ABB expanded its modular large robot portfolio with the introduction of its latest articulated robots IRB 7710 and IRB 7720. These robots offer increased flexibility, energy efficiency, and enhanced productivity, particularly for industries like automotive, logistics, and construction.