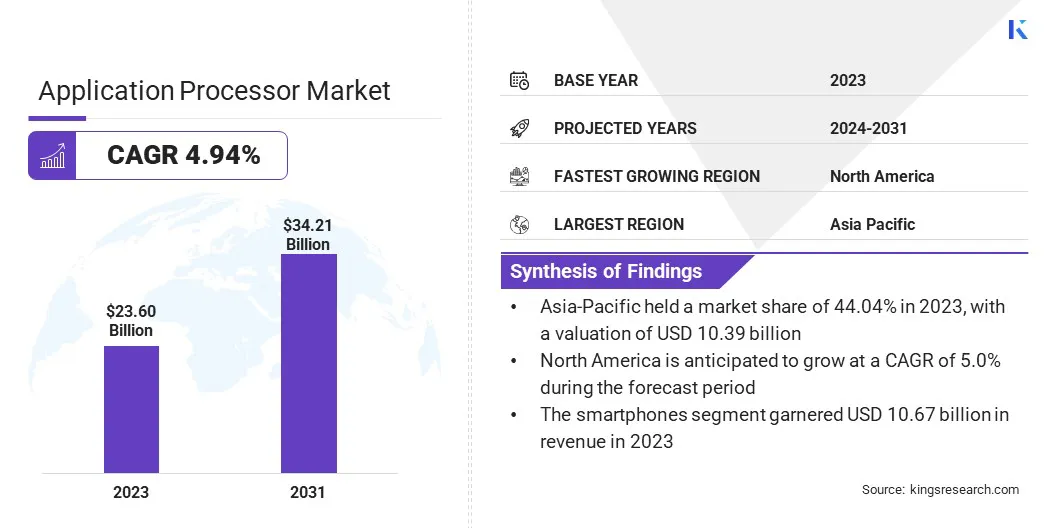

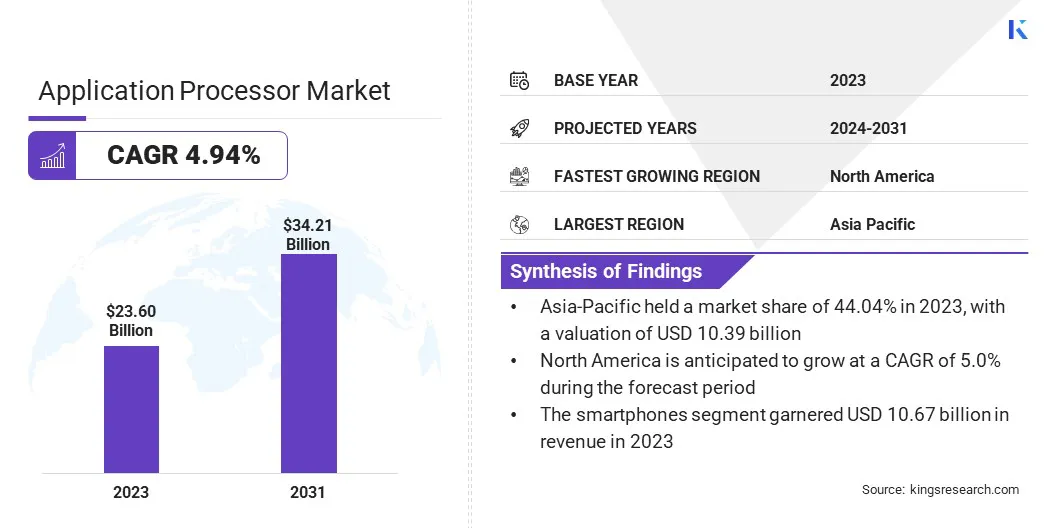

Application Processor Market Size

The global application processor market size was valued at USD 23.60 billion in 2023 and is projected to grow from USD 24.41 billion in 2024 to USD 34.21 billion by 2031, exhibiting a CAGR of 4.94% during the forecast period.

The rising adoption of wearable devices, including smartwatches, fitness trackers, and augmented reality (AR) headsets, is fueling the demand for compact, power-efficient application processors. These devices require processors that enable real-time data processing, health monitoring, and communication, all while maintaining energy efficiency.

The wearables market is expanding as consumers increasingly seek health and fitness tracking solutions, which is contributing to the expansion of the market.

In the scope of work, the report includes solutions offered by companies such as Qualcomm Technologies, Inc., Intel Corporation, NVIDIA Corporation, Advanced Micro Devices, Inc., IBM Corporation, Apple Inc., NXP Semiconductors, HiSilicon Technologies, Samsung, Texas Instruments, and others.

Moreover, the increasing global demand for smartphones and tablets is influencing the application processor market. Consumers are seeking devices with enhanced processing capabilities to support advanced functionalities such as gaming, multitasking, and multimedia consumption.

- A march 2024 report by 5G Americas in March 2024 states that global IoT subscriptions reached 3.1 billion, while smartphone subscriptions totaled 6.6 billion. By 2026, IoT subscriptions is expected to increase to 4.5 billion, with smartphone subscriptions projected to grow to 7.4 billion.

Additionally, the growing middle-class population in emerging markets, coupled with the proliferation of premium devices, is fueling the demand for high-performance application processors. This trend underscores the need for continuous innovation in processor design to meet consumer expectations,therbey supporting sustained market expansion in both developed and developing economies.

Application processor (AP) is a specialized system-on-chip (SoC) designed to manage and execute the core functions of software applications in mobile devices and embedded systems.

It integrates critical components such as a central processing unit (CPU), graphics processing unit (GPU), memory controllers, and multimedia processors to support tasks such as app execution, user interface rendering, and multimedia handling.

Application processors are essential in smartphones, tablets, wearables, and IoT devices, providing high performance and energy efficiency for seamless operation, connectivity management, and enhanced user experiences. They serve as the central hub for running operating systems and applications.

Analyst’s Review

Ongoing advancements in system-on-chip (SoC) technology are reshaping the landscape of the application processor market. Modern devices, including smartphones, wearables, electric vehicles (EVs), and IoT systems, increasingly rely on sophisticated SoCs for enhanced functionality and performance.

These advanced SoCs integrate multiple processing units, AI capabilities, and improved connectivity features into a single chip, addressing the evolving demands of both consumers and industries.

- In June 2024, Intel introduced the OLEA U310 system-on-chip (SoC), a next-generation technology designed to enhance the performance of electric vehicles (EVs). This advanced SoC optimizes EV efficiency, simplifies design and manufacturing, and extends capabilities for seamless integration with various EV charging station platforms. The OLEA U310 represents a significant breakthrough, being the first comprehensive solution to integrate hardware and software into a single package tailored for powertrain domain control within distributed software-based electrical architectures.

This innovation in SoC technology is crucial for meeting future industry requirements. Companies are actively investing in research and development to advance SoC design, maintaining competitiveness and supporting emerging applications. These technological advancements are influencing the market by presenting potential opportunities and applications in the technology sector.

Application Processor Market Growth Factors

The integration of artificial intelligence (AI) and machine learning (ML) technologies into mobile and embedded devices is bolstering the growth of the application processor market. Processors with built-in AI capabilities are becoming essential for features such as facial recognition, voice assistants, and real-time data processing.

- At Hot Chips 2024, IBM presented architectural details of its upcoming IBM Telum II Processor and IBM Spyre Accelerator. These advanced technologies are engineered to significantly enhance processing capabilities in next-generation IBM Z mainframe systems. By introducing a novel ensemble AI method, they aim to accelerate the deployment of both traditional AI models and large language AI models, facilitating seamless integration.

The incorporation of dedicated neural processing units (NPUs) in modern processors is optimizing performance for AI-driven tasks, offering enhanced efficiency and speed. As industries increasingly leverage AI for automation and analytics, the demand for processors equipped with advanced AI functionalities is expected to fuel the expansion of the application processor market.

However, high development costs present a significant barrier to the growth of the market. This financial burden restricts competition and slows innovation, limiting the introduction of new technologies and products in the market. To mitigate this challenge, companies are increasingly investing in collaborative partnerships and joint ventures to share the financial risks associated with development.

Additionally, they are leveraging advancements in simulation and prototyping technologies to streamline the design process, thereby reducing time and costs. By focusing on agile methodologies and iterative development, organizations can enhance innovation and manage expenses more effectively, thereby sustaining market growth.

Application Processor Industry Trends

The global rollout of 5G networks is significantly impacting the application processor market. 5G technology offers increased data speeds, reduced latency, and enhanced connectivity, all of which require high-performance processors to support advanced applications such as real-time streaming, gaming, and augmented reality (AR).

The transition to 5G is accelrating the development of processors to efficiently handle higher data volumes and improved connectivity features.

Moreover, the growing popularity of mobile gaming is creating a strong demand for high-performance application processors. Consumers demand smooth gaming experiences and high-quality graphics, requiring advanced GPUs and optimized architectures in mobile processors.

The mobile gaming sector has seen significant growth, with increased engagement from both casual gamers and competitive players. This surge in demand for gaming-optimized processors is stimulating the expansion of the market .

- In August 2024, Qualcomm introduced the Snapdragon 7s Gen 3 mobile platform for mid-tier smartphones. This successor to the Snapdragon 7s Gen 2 enhances generative AI capabilities, camera performance, and gaming graphics rendering.

Segmentation Analysis

The global market has been segmented based on device type, core type, industry vertical, and geography.

By Device Type

Based on device type, the market has been segmented into smartphones, pc/tablets, smart wearables, automotive ADAS & infotainment systems, and others. The smartphones segment led the application processor market in 2023, reaching a valuation of USD 10.67 billion.

This growth is largely aatributed to the growing global demand for high-performance mobile devices. As consumers increasingly rely on smartphones for complex tasks such as gaming, AI-driven applications, video streaming, and multitasking, the demand for powerful processors that deliver seamless performance has grown significantly.

Manufacturers are focusing on integrating advanced processors that support faster data processing, enhanced graphics, and energy efficiency, crucial for extending battery life in these devices.

By Core Type

Based on core type, the market has been classified into single-core, dual-core, quad-core, hexa-core, and octa-core and higher. The octa-core and higher segment secured the largest revenue share of 45.14% in 2023. This expansion is mainly fueled by its superior performance and multitasking capabilities.

These processors are essential for modern devices that require robust computational power for demanding applications such as gaming, AI, and high-resolution video.

By efficiently distributing workloads across multiple cores, octa-core processors enhance user experiences while maintaining energy efficiency, which is essential for prolonging battery life in mobile devices. To meet rising consumer expectations for advanced functionalities, manufacturers are increasingly adopting octa-core and higher processors.

By Industry Vertical

Based on industry vertical, the market has been divided into consumer electronics, automotive, healthcare, telecommunication, and others. The consumer electronics segment is set to witness significant growth at a robust CAGR of 5.52% through the forecast period.

Consumers seek advanced functionalities and seamless user experiences, prompting manufacturers to integrate high-performance application processors that support multitasking, gaming, and multimedia capabilities.

The increasing number of connected devices in the Internet of Things (IoT) ecosystem further boosts the demand for efficient processing power in appliances and gadgets. Innovations in semiconductor technology enable the development of more powerful and energy-efficient processors, reinforcing the leading position of the consumer electronics segment.

Application Processor Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia Pacific application processor market accounted for a major share of around 44.04% in 2023, with a valuation of USD 10.39 billion. Advancements in semiconductor technology are significantly contributing to this considerable growth. Leading companies such as MediaTek, Samsung, and TSMC are prioritizing innovation, with a major focus on enhancing performance, energy efficiency, and chip architecture.

- The Asian Development Bank reported in May 2024 that East and Southeast Asia account for over 80% of global semiconductor manufacturing. Japan hosts several major companies supplying essential equipment and materials for the semiconductor industry, while China leads in photovoltaic cell production, a key segment of this sector.

Additionally, the adoption of smaller process nodes, including 5nm and 3nm, is enabling the development of more powerful and efficient processors. These technological breakthroughs are vital for maintaining competitiveness and fueling regional market expansion as manufacturers focus on addressing rising consumer and industrial demand for advanced processors.

North America is projected to witness significant growth, recording a robust CAGR of 5.00% over the forecast period. The widespread adoption of smart home devices is bolstering this expansion. As consumers increasingly integrate smart speakers, connected appliances, and home automation systems into their daily lives, the need for advanced processors capable of handling seamless connectivity, device control, and interactive functions is rising.

- According to the 2024 IoT M2M Council report, nearly 20% of U.S. households have six or more smart home devices. Additionally, the Smart Home Dashboard survey highlights that 45% of U.S. internet households own at least one smart home device, with 18% having six or more, reflecting a growing adoption of connected technologies in daily life.

Manufacturers are developing specialized processors to meet the growing complexity of these devices, ensuring efficient performance and real-time processing. This trend is fueling the demand for sophisticated application processors, significantly contributing to North America market expansion.

Competitive Landscape

The global application processor market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Application Processor Market

- Hamamatsu Photonics K.K.

- Carl Zeiss AG

- Olympus Corporation

- PerkinElmer, Inc.

- Becton, Dickinson and Company (BD)

- Thermo Fisher Scientific Inc.

- Bruker Corporation

- Nikon Corporation

- Leica Microsystems GmbH

- Agilent Technologies, Inc.

Key Industry Developments

- May 2024 (Product Launch): Apple unveiled the M4 chip, a system on a chip (SoC) that enhances the new iPad Pro's performance. Built on second-generation 3-nanometer technology, the M4 improves the power efficiency of Apple silicon while facilitating the iPad Pro's remarkably thin design.

- September 2024 (Technological Advancement): Qualcomm Technologies, Inc. expanded its Snapdragon X Series portfolio with the launch of the Snapdragon X Plus 8-core platform. This groundbreaking technology delivers multiday battery life, exceptional performance, and AI-powered Copilot+ experiences, making these advancements accessible to a wider audience.

- September 2024 (Product Launch): Intel introduced its most efficient line of x86 processors to date, the Intel Core Ultra 200V series. These processors provide superior performance, remarkable x86 power efficiency, a significant boost in graphics capabilities, full application compatibility, enhanced security features, and unparalleled AI computing power.

The global application processor market is segmented as:

By Device Type

- Smartphones

- PC/Tablets

- Smart Wearables

- Automotive ADAS & Infotainment Systems

- Others

By Core Type

- Single-Core

- Dual-Core

- Quad-Core

- Hexa-Core

- Octa-Core and Higher

By Industry Vertical

- Consumer Electronics

- Automotive

- Healthcare

- Telecommunication

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America