Market Definition

Aortic valve replacement devices are artificial valves used to replace a diseased or damaged aortic valve. These devices are categorized into mechanical valves and biological valves based on their materials. Implantation can be performed through open-heart surgery or transcatheter aortic valve replacement (TAVR).

A multidisciplinary heart team, comprising a cardiologist, cardiac surgeon, and other specialists, collaborates to determine the optimal valve type and implantation method for each patient.

Aortic Valve Replacement Devices Market Overview

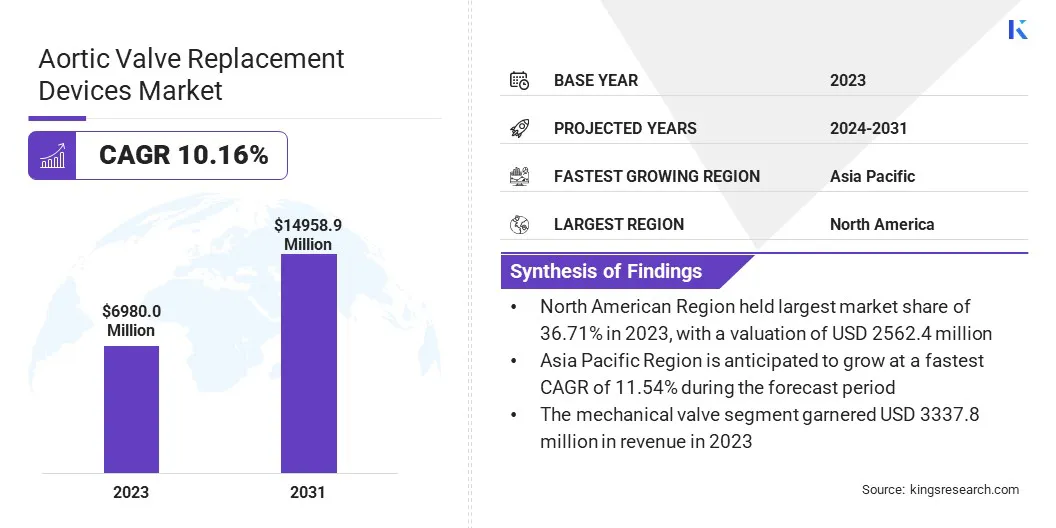

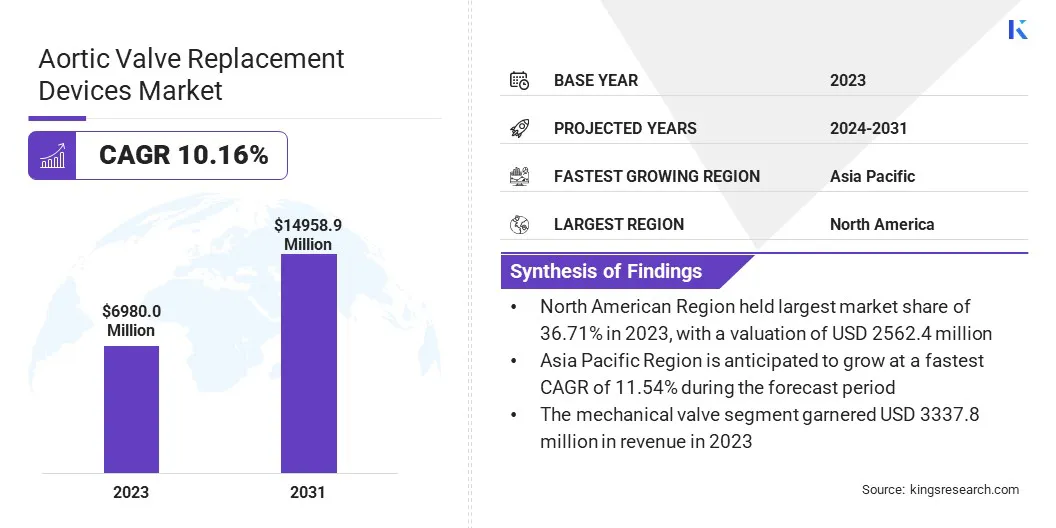

Global aortic valve replacement devices market size was valued at USD 6980.0 million in 2023 and is projected to grow from USD 7598.0 million in 2024 to USD 14958.9 million by 2031, exhibiting a CAGR of 10.16% during the forecast period.

The demand for aortic valve replacement devices is fueled by the rising prevalence of aortic stenosis worldwide, continuous technological advancements, and ongoing improvements in valve design and materials that are leading to enhanced patient outcomes and increased adoption of these life-saving devices.

Major companies operating in the aortic valve replacement devices market are Edwards Lifesciences Corporation, Medtronic, Boston Scientific Corporation, Abbott, Artivion, Inc., LivaNova PLC, MicroPort Scientific Corporation, Foldax Inc., Novostia SA, Meril Life Sciences Pvt. Ltd., Corcym Group., JenaValve, Anteris Technologies, Aegis Surgical Limited, and others.

Companies in the aortic valve replacement device market are actively conducting clinical trials and seeking regulatory approvals to expand the use of transcatheter aortic valve replacement (TAVR) for patients with lower surgical risk profiles.

This expansion significantly broadens the potential market for this minimally invasive procedure, presenting substantial opportunities for companies specializing in TAVR technology. Regulatory bodies, such as the FDA in the United States and the EMA in Europe, rigorously evaluate clinical trial data before approving expanded indications for TAVR devices.

- In May 2024, Medtronic received FDA approval for its Evolut transcatheter aortic valve replacement (TAVR) system, designed to treat symptomatic aortic stenosis by facilitating coronary access and ensuring optimal valve performance.

Key Highlights:

- The global aortic valve replacement devices market size was recorded at USD 6980.0 million in 2023.

- The market is projected to grow at a CAGR of 10.16% from 2024 to 2031.

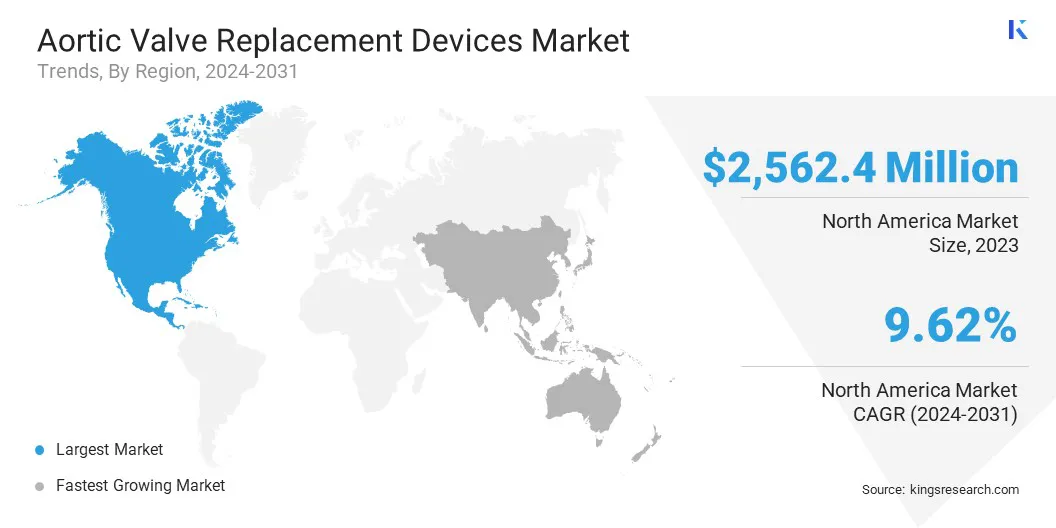

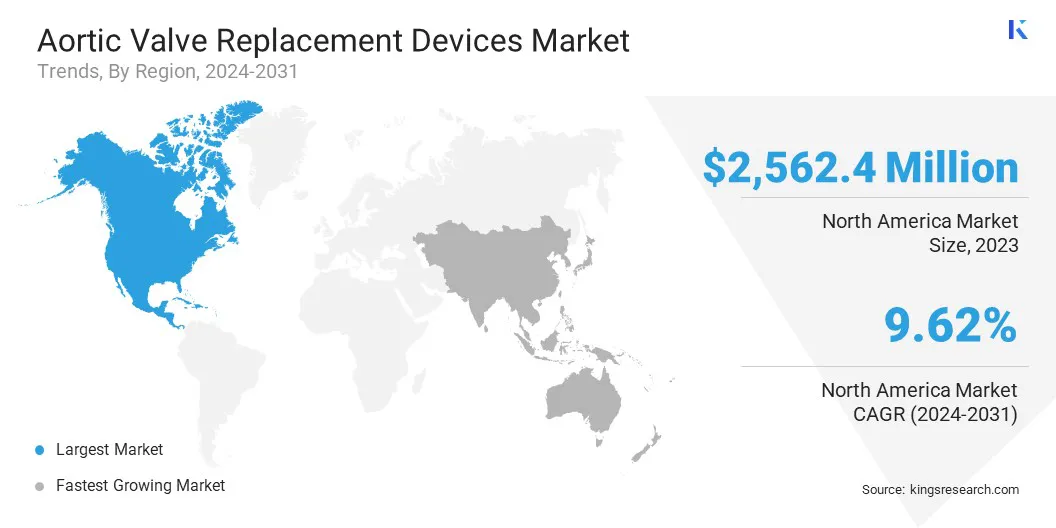

- North America held a share of 36.71% in 2023, valued at USD 2562.4 million.

- The mechanical valves segment garnered a revenue of USD 3337.8 million in 2023.

- The minimally invasive surgery segment is expected to reach USD 8300.1 million by 2031.

- The hospitals and clinics segment is expected to generate a revenue of USD 3539.5 million in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 11.54% through the forecast period.

Market Driver

"Rising Prevalence of Aortic Valve Diseases Fuel Demand for Replacement Devices"

The increasing prevalence of aortic valve diseases, including aortic stenosis, congenital heart defects, and rheumatic fever, is fueling the growth of the aortic valve replacement devices market. Additionally, the global rise in life expectancy is contributing to a rapidly growing elderly population, leading to a higher incidence of age-related aortic stenosis.

This expanding patient base is further acceleratingresearch and development efforts aimed at improving existing devices and developing new, more effective treatment options.

- According to the U.S. Centers for Disease Control and Prevention (CDC), heart disease continues to be the leading cause of death in the United States. In 2022 alone, 702,880 deaths were attributed to heart disease, representing one in every five deaths nationwide. This alarming statistic underscores the urgent need for continued advancements in cardiovascular research, prevention, and treatment.

Market Challenge

"Regulatory Challenges Impact the market"

The aortic valve replacement devices market faces challenges due to stringent regulatory requirements across various countries. Obtaining approvals for new devices and expanding indications for existing devices requires rigorous clinical trials and extensive documentation.

Meeting regulatory requirements is time-consuming and expensive, delaying market entry and increasing development costs. To address this challenge, companies are actively engaging in collaborations with prominent research institutions and clinicians to conduct robust clinical trials and compile comprehensive data sets.

- In October 2024, Edwards Lifesciences revealed the results of the EARLY TAVR trial, the first randomized, controlled trial to evaluate the optimal treatment strategy for asymptomatic severe aortic stenosis (AS). The trial demonstrated that patients undergoing Edwards' transcatheter aortic valve replacement (TAVR) achieved better outcomes, including lower rates of stroke and slower symptom progression.

Market Trend

"Ongoing TAVR Innovation Drives the Market Growth"

Ongoing innovations in transcatheter aortic valve replacement (TAVR) technology, including advancements in valve design, delivery systems, and imaging techniques, are enhancing its safety, efficacy, and procedural efficiency.

Numerous clinical trials have demonstrated the safety and efficacy of TAVR, including reduced mortality rates, lower stroke rates, and faster recovery times compared to surgical aortic valve replacement (SAVR). These advantages have led to TAVR rapidly becoming the preferred treatment modality for many patients with aortic stenosis, including those in lower-risk categories, fueling market growth.

- In May 2024, the University of Alabama at Birmingham Cardiovascular Institute's heart team achieved a significant milestone by performing a valve-in-valve procedure using a novel transcatheter aortic valve replacement system. This advanced system provides surgeons with an enlarged coronary access window and increased spatial flexibility.

Aortic Valve Replacement Devices Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Mechanical Valves, Biological Valves (Porcine, Bovine, Homografts, Xenotransplantation), Transcatheter Aortic Valve Replacement (TAVR) Systems (Self-expanding, Balloon-expandable)

|

|

By Procedure

|

Open-Heart Surgery, Minimally Invasive Surgery

|

|

By End-User

|

Hospitals & Clinics, Ambulatory Surgical Centers, Cardiovascular Centers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Mechanical Valves, Biological Valves, and Transcatheter Aortic Valve Replacement (TAVR) Systems): The mechanical valves segment generated a revenue of USD 3337.8 million in 2023, mainly due to their durability, longevity, cost-effectiveness, proven track record, and verstality across diverse patient needs.

- By Procedure (Open-Heart Surgery and Minimally Invasive Surgery): The minimally invasive surgery segment held a share of 57.79% in 2023, fueled by ongoing advancements in catheter-based technologies and imaging techniques.

- By End-User (Hospitals & Clinics, Ambulatory Surgical Centers, and Cardiovascular Centers): The hospitals and clinics segment is projected to reach USD 7078.6 million by 2031, largely attributed to advanced infrastructure and comprehensive post-operative care, including monitoring, medication and others.

Aortic Valve Replacement Devices Market Regional Analysis

North America aortic valve replacement devices market accounted for a substantial share of 36.71% and was valued at USD 2562.4 million in 2023. The aging demographic in North America contributes to a high prevalence of aortic stenosis, the most common form of aortic valve disease.

This substantial patient population generates significant demand for aortic valve replacement devices. Furthermore, the widespread availability of advanced diagnostic tools, such as echocardiography, facilitates early and accurate detection of the condition.

- The U.S. Centers for Disease Control and Prevention (CDC) reported in its 2022-2023 publication that heart disease imposes a substantial economic burden, costing approximately USD 252.20 billion inn healthcare services, medications, and lost productivity due to mortality.

Asia Pacific aortic valve replacement devices market is anticipated to grow at the fastest CAGR of 11.54% over the forecast period.Several Asia-Pacific countries are making substantial investments in strengthening their healthcare infrastructure, expanding access to advanced medical technologies, and enhancing the training of healthcare professionals.

The rise of medical tourism in countries such as India, China, Singapore, and Japan is attracting patients seeking affordable and high-quality care. These developments are fostering a more conducive environment for the adoption of advanced procedures such as TAVR.

- Medical tourism from West Asia to India is on the rise, with 22.7% of West Asian tourists visiting India for medical reasons in 2023, according to the Indian Ministry of Tourism. The primary factors contributing to this growth are the affordability and accessibility of healthcare services in India compared to Western countries.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The Food and Drug Administration (FDA) regulates the safety and effectiveness of medical devices, including aortic valve replacement devices, in the United States. It classifies these devices by risk category, gramts premarket approval (PMA), and monitors performance through post-market surveillance.

- In Europe, medical devices are regulated under the Medical Device Regulation (MDR), requiring manufacturers to provide robust clinical data to prove safety and performance, particularly for newer technologies such as TAVR.

- The Pharmaceuticals and Medical Devices Agency (PMDA) in Japan ensures the safety, efficacy, and quality of pharmaceuticals and medical devices. The PMDA reviews new aortic valve replacement devices (mechanical, biological, and TAVR) prior to market approval.

- In Australia, the Therapeutic Goods Administration (TGA) governs the regulation of aortic valve replacement devices, requiring compliance with the Essential Principles outlined in the Therapeutic Goods (Medical Devices) Regulations 2002

Competitive Landscape:

The aortic valve replacement devices market is characterized by a number of participants, including both established corporations and rising organizations.

Manufacturers of aortic valve replacement devices are investing in research and development to create next-generation transcatheter aortic valve replacement (TAVR) systems with enhanced features, including reduced paravalvular leak, improved placement accuracy, and smaller delivery systems. These advancements are driven by increased investments in infrastructure and advancements in clinical trials.

- In March 2024, Emory University Hospital expanded its heart and vascular facilities in Georgia with an $87.7 million investment in state-of-the-art care spaces. The expanded facilities feature new and technologically advanced operating rooms, catheterization labs, and electrophysiology labs, solidifying Emory's position as a leading provider of cardiovascular services.

List of Key Companies in Aortic Valve Replacement Devices Market:

- Edwards Lifesciences Corporation

- Medtronic

- Boston Scientific Corporation

- Abbott

- Artivion, Inc.

- LivaNova PLC

- MicroPort Scientific Corporation

- Foldax Inc.

- Novostia SA

- Meril Life Sciences Pvt. Ltd.

- Corcym Group.

- JenaValve

- Anteris Technologies

- Aegis Surgical Limited

Recent Developments:

- In January 2025, Boston Scientific Corporation acquired Bolt Medical, Inc., a leading developer of an advanced laser-based intravascular lithotripsy (IVL) platform. This acquisition expands Boston Scientific's offerings in the rapidly growing market for minimally invasive treatment of coronary and peripheral artery disease.

- In November 2024, Edwards Lifesciences reported outstanding one-year outcomes for over 9,000 patients treated with the SAPIEN 3 Ultra RESILIA valve. These results demonstrated remarkably low mortality and reintervention rates, underscoring the valve's efficacy and positive impact on patient well-being.

- In August 2024, Boston Scientific Corporation received approval for its TAVR technology ACURATE Prime Aortic Valve System. This new system is designed to restore proper function and normal blood flow through a narrowed aortic valve in patients with severe aortic stenosis across low, intermediate, and high surgical risk categories.

- In July 2024, Edward Lifesciences acquired Innovalve Bio Medical Ltd., an early-stage transcatheter mitral valve replacement (TMVR) company, to expand its treatable population. The acquisition enhances Edward's portfolio of transcatheter repair and replacement therapies, advancing the treatment of mitral and tricuspid patients.

- In January 2024, Artivion, Inc. secured USD 350 million in senior secured credit facilities to support its growth and innovation. The company attributed its strong financial performance and positive clinical data as key factors in securing this funding, which will be used to advance clinical trials and improve patient outcomes.