Market Definition

The market involves the production of aluminum hydroxide, primarily produced through the Bayer process. This involves refining bauxite into alumina, which is then converted into aluminum hydroxide. It serves various industries, including flame retardants, pharmaceuticals, water treatment, and electronics.

Aluminum Hydroxide Market Overview

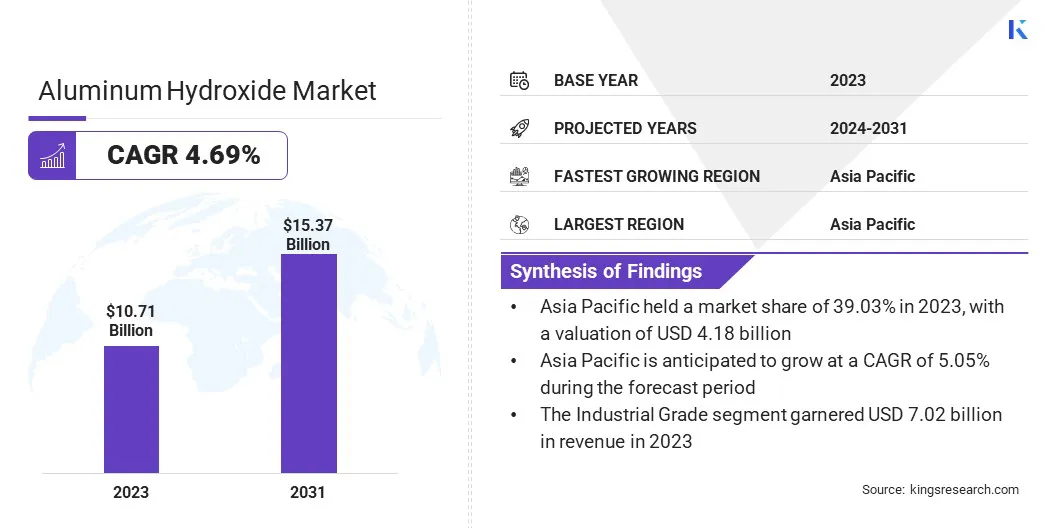

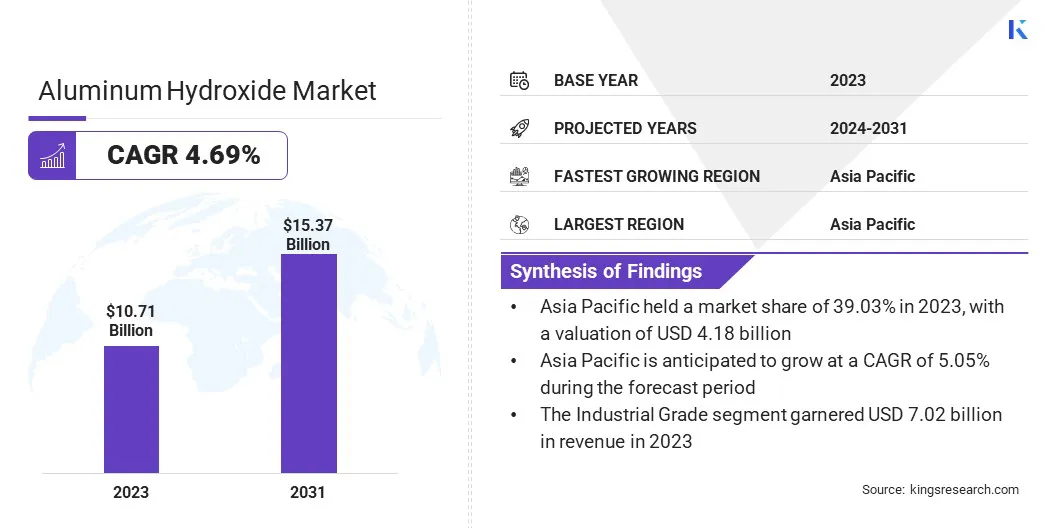

Global aluminum hydroxide market size was valued at USD 10.71 billion in 2023, which is estimated to grow from USD 11.15 billion in 2024 to USD 15.37 billion by 2031, growing at a CAGR of 4.69% from 2024 to 2031.

The rising demand for aluminum hydroxide in the pharmaceutical industry, particularly as an antacid and phosphate binder, is driving market growth. Rising cases of gastrointestinal disorders and kidney diseases are further increasing demand for these applications.

Major companies operating in the aluminum hydroxide industry are ALUMINA CHEMICALS & CASTABLES, Aluminium Corp, Silkem Hungary, Sumitomo Chemical Co., Ltd., J.M. HUBER, Sibelco, LKAB Minerals, Shijiazhuang Jinghuang Technology Co., Ltd., TOR Minerals, Henan Qingjiang Industrial Co., Ltd., Gujarat Credo Alumina Chemicals Ltd, Nippon Light Metal Co., Ltd, KC, Sandoo Pharmaceuticals and Chemicals Co., Ltd., and Osian Marine Chemicals Pvt.Ltd.

The market is witnessing steady growth, driven by a growing emphasis on eco-friendly products. As industries and consumers shift toward sustainable, non-toxic materials, aluminum hydroxide is gaining prominence in applications such as flame retardants, pharmaceuticals, and water treatment.

Its environmentally safe properties align with the shift toward sustainable solutions, making it a preferred choice in sectors aiming to reduce environmental impact and enhance product safety.

Key Highlights:

- The aluminum hydroxide industry size was recorded at USD 10.71 billion in 2023.

- The market is projected to grow at a CAGR of 4.69% from 2024 to 2031.

- Asia Pacific held a market share of 39.03% in 2023, with a valuation of USD 4.18 billion.

- The industrial grade segment garnered USD 7.02 billion in revenue in 2023.

- The electronics segment is expected to reach USD 4.75 billion by 2031.

- North America is anticipated to grow at a CAGR of 4.86% during the forecast period.

Market Driver

Rising Demand in the Pharmaceutical Industry

The pharmaceutical industry is driving the demand for aluminum hydroxide, particularly for its use as an antacid and phosphate binder. Its effectiveness in neutralizing stomach acid and managing phosphate levels makes it essential in treating gastrointestinal disorders and kidney-related conditions.

As healthcare needs expand, the increasing prevalence of these medical conditions is boosting the adoption of aluminum hydroxide, contributing to the growth of the market.In June 2023, research by California Northstate University highlighted the rising demand for aluminum hydroxide in the pharmaceutical industry.

The study emphasized its role as an antacid and phosphate binder, essential for treating acid indigestion and kidney-related conditions.

Market Challenge

Fluctuating Raw Material Prices

Fluctuating raw material prices, particularly for bauxite, pose a significant challenge for the aluminum hydroxide market. Price volatility increases production costs and uncertainty for manufacturers. To address this, companies are diversifying supply chains and securing long-term contracts to stabilize pricing.

Additionally, advancements in recycling technologies and alternative raw materials are expected to reduce reliance on bauxite. Collaborating with suppliers and improving production efficiency further help mitigate these challenges.

Market Trend

Nano-sized Aluminum Hydroxide

A key trend in the market is the growing adoption of nano-sized aluminum hydroxide in high-performance coatings, electronics, and biomedical applications. Due to its enhanced properties, such as high thermal stability, flame retardancy, and mechanical strength, nano-aluminum hydroxide is becoming increasingly valuable across these industries.

In electronics, it’s used for better heat resistance in components, while in the biomedical sector, it is being explored for drug delivery and vaccine applications.

Researchers at the University of Texas discovered that aluminum hydroxide nanoparticles (112 nm) triggered stronger antibody responses than traditional microparticles (9.3 µm). These nanoparticles also caused less inflammation at injection sites, making them a safer and more effective vaccine adjuvant.

Aluminum Hydroxide Market Report Snapshot

|

Segmentation

|

Details

|

|

By Grade

|

Pharma Grade, Industrial Grade, Other Grade

|

|

By End-Use Industry

|

Construction, Pharmaceuticals, Automotive, Electronics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Grade (Pharma Grade, Industrial Grade, Other Grade): The Industrial Grade segment earned USD 7.02 billion in 2023 due to its high demand in flame retardants and chemical production.

- By End-Use Industry (Construction, Pharmaceuticals, Automotive, Electronics, Others): The Electronics segment held 29.66% of the market in 2023, due to the growing use of aluminum hydroxide in semiconductors and electronic components.

Aluminum Hydroxide Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific aluminum hydroxide market share stood around 39.03% in 2023 in the global market, with a valuation of USD 4.18 billion. The region’s dominance is driven by rapid industrialization in countries like China and India, where aluminum hydroxide is widely used in manufacturing, construction, and pharmaceuticals.

Additionally, the growing demand for aluminum hydroxide in the production of flame retardants, ceramics, and plastics further propels market growth in this region.

North America is poised for significant growth at a robust CAGR of 4.86% over the forecast period.North America's fast-growing market is driven by its increasing use in high-performance applications such as flame retardants, water treatment, pharmaceuticals, advanced polymers, and electronics, fueled by technological advancements and rising demand for sustainable and fire-resistant materials.

The pharmaceutical sector, which uses aluminum hydroxide for antacid production, along with the rising automotive and electronics industries, contributes to this growth. The region is witnessing increased investments in research and development along with strong regulatory support. As a result, the market is expected to expand rapidly in the coming years, particularly in the U.S. and Canada.

Regulatory Frameworks

- In India, the Environment (Protection) Act of 1986 regulates waste disposal from aluminum hydroxide production, empowering authorities to enforce environmental standards and address region-specific pollution issues, with amendments made in 1991

- In the U.S., the Environmental Protection Agency (EPA) protects public health, enforces regulations on waste disposal, and manages the environmental impact of aluminum hydroxide production through research and regulatory enforcement.

Competitive Landscape:

Companies in the aluminum hydroxide industry are focusing on technological innovations to improve product quality and expand applications. They are enhancing production processes to create high-purity, ultra-fine particles, catering to diverse industries like electronics, energy, and healthcare.

Additionally, these companies are adopting sustainable practices, reducing environmental impact, and meeting the growing demand for advanced materials.

- In August 2023, Sumitomo Chemical announced a new production technology for ultra-fine alumina products, derived from aluminum hydroxide. These products are designed for use in applications in energy, ICT, and life sciences, and aim to drive innovation and expand business opportunities in various industries.

List of Key Companies in Aluminum Hydroxide Market:

- ALUMINA CHEMICALS & CASTABLES

- Aluminium Corp

- Silkem Hungary

- Sumitomo Chemical Co., Ltd.

- M. HUBER

- Sibelco

- LKAB Minerals

- Shijiazhuang Jinghuang Technology Co., Ltd.

- TOR Minerals

- Henan Qingjiang Industrial Co., Ltd.

- Gujarat Credo Alumina Chemicals Ltd

- Nippon Light Metal Co.,Ltd

- KC

- Sandoo Pharmaceuticals and Chemicals Co.,Ltd.

- Osian Marine Chemicals Pvt.Ltd