Market Definition

The market refers to the global trade and production of bauxite, a primary raw material used in the production of aluminum. It includes the extraction, processing, and supply of bauxite, which is refined into alumina before being converted into aluminum metal. The market is influenced by factors like demand for aluminum, production capacity, and global trade dynamics.

Bauxite Market Overview

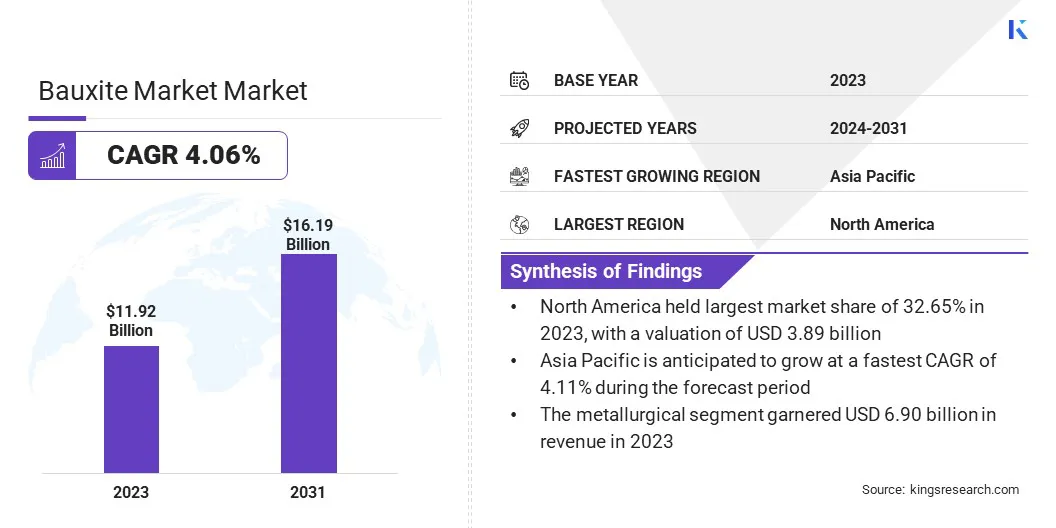

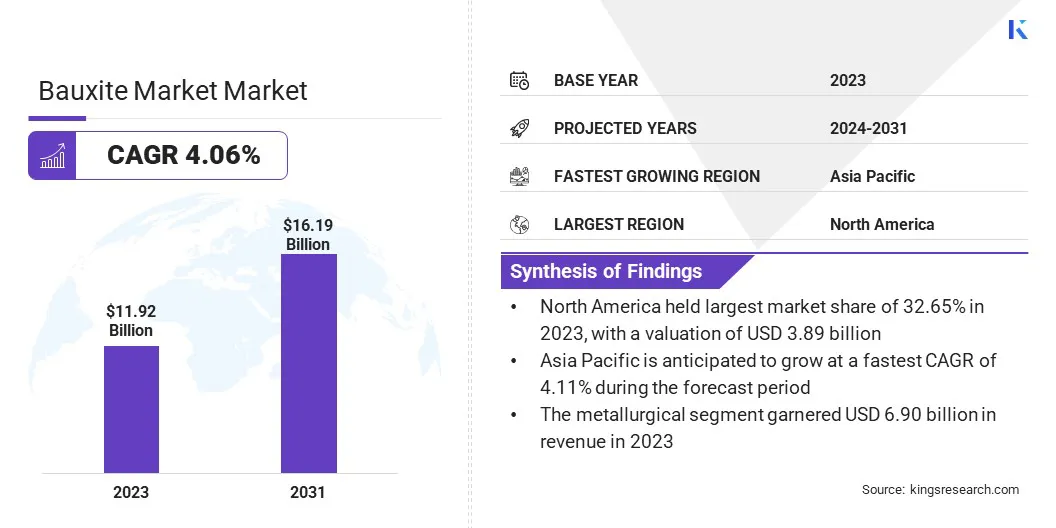

The global bauxite market size was valued at USD 11.92 billion in 2023, which is estimated to be valued at USD 12.26 billion in 2024 and reach USD 16.19 billion by 2031, growing at a CAGR of 4.06% from 2024 to 2031.

The rising demand for aluminum across industries like automotive, construction, and packaging is a key growth driver for the market. Aluminum has several beneficial properties like lightweight, durable, and corrosion-resistant. Thus, the need for bauxite to produce aluminum continues to grow.

Major companies operating in the bauxite market are Alcoa Corporation, Rio Tinto, Norsk Hydro ASA, South32, RusAL, NALCO India, Hindalco Industries Ltd, Ma’aden, Jamalco, Vedanta Aluminium & Power, PT ANTAM Tbk, Ashapura Group, Bosai Minerals Group Co., Ltd, Valbaux Minetech, and RAWMIN.

The market is characterized by its essential role in the global aluminum production chain. It operates within a highly competitive environment, where supply and demand dynamics, production capacities, and geopolitical factors significantly influence market conditions.

The market remains sensitive to shifts in industrial requirements, geopolitical tensions, and advancements in technology. The market faces evolving challenges in meeting the growing demand while maintaining efficient, sustainable production processes as industries increasingly rely on aluminum for its versatility and sustainability.

- According to a report by the International Aluminum Institute (IAI), the global demand for aluminum is expected to rise by nearly 40% by 2030. The primary sectors driving this growth include transportation, electrical, packaging, and construction.

Key Highlights:

- The global bauxite market size was valued at USD 11.92 billion in 2023.

- The market is projected to grow at a CAGR of 4.06% from 2024 to 2031.

- North America held a market share of 32.65% in 2023, with a valuation of USD 3.89 billion.

- The metallurgical segment garnered USD 6.90 billion in revenue in 2023.

- The alumina segment is expected to reach USD 5.95 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 4.11% during the forecast period.

Market Driver

"Impact of Infrastructure Development on Bauxite Market"

Infrastructure development, driven by increasing urbanization and large-scale construction projects globally, is a significant growth driver for the market.

- According to the United Nations, nearly two-thirds of the global population is projected to reside in urban areas by 2050.

Aluminum, with its lightweight, strength, and corrosion-resistant properties, is widely used in construction materials, transportation, and other infrastructure components.

As cities expand and new infrastructure projects emerge, the demand for aluminum rises, directly influencing the need for bauxite, the primary raw material in aluminum production. This surge in demand for aluminum in infrastructure development will continue to propel the bauxite industry.

- In September 2024, Vedanta Aluminium introduced high-quality products for the power and transmission industry, including the AL59 Ingot and EC-grade Wire Rod. These innovations support the growing demand for aluminum in infrastructure development, enhancing efficiency and sustainability in the energy sector.

Market Challenge

"Supply Chain Disruptions"

Supply chain disruptions, caused by geopolitical tensions, transportation issues, and natural disasters, pose a significant challenge to the bauxite market. These disruptions can lead to delays in production, supply shortages, and price volatility.

A potential solution lies in diversifying the supply chain by establishing alternative sourcing regions, investing in resilient infrastructure, and improving logistics networks. Additionally, fostering partnerships between producers and consumers can help mitigate risks and ensure a more stable and secure supply of bauxite globally.

- In September 2024, PT Aneka Tambang Tbk (ANTAM) commenced the first bauxite injection phase at the Smelter Grade Alumina Refinery (SGAR) Mempawah Project. This milestone, supported by ANTAM and PT Indonesia Asahan Aluminium (INALUM), strengthens Indonesia's aluminum supply chain and supports the government’s mineral downstream agenda.

Market Trend

"Technological advancements"

Technological advancements are significantly transforming the bauxite market by enhancing the efficiency and cost-effectiveness of bauxite extraction and alumina production. Innovations in refining technologies, such as more energy-efficient processes and the development of cleaner methods, are reducing operational costs and environmental impacts.

Additionally, advanced exploration techniques are improving resource identification, enabling better management of bauxite reserves. These technological improvements are helping meet the rising global demand for aluminum while optimizing the overall bauxite production process.

- In April 2024, Rio Tinto partnered with Founders Factory to invest USD 14.4 million in global pre-seed and seed stage start-ups. The focus is on developing breakthrough technologies in safe mine operations, decarbonisation, exploration, processing, and automation, advancing the mining industry.

Bauxite Market Report Snapshot

|

Segmentation

|

Details

|

|

By Grade

|

Metallurgical, Refractory

|

|

By Application

|

Alumina, Abrasives, Cement, Chemical, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Grade (Metallurgical, Refractory): The metallurgical segment earned USD 6.90 billion in 2023, due to the increasing demand for aluminum in industries such as automotive, aerospace, and construction, which use metallurgical-grade bauxite.

- By Application (Alumina, Abrasives, Cement, Chemical, Others): The alumina segment held 36.80% share of the market in 2023, due to its crucial role as the primary raw material for aluminum production, driving demand across multiple industries.

Bauxite Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 32.65% share of the bauxite market in 2023, with a valuation of USD 3.89 billion. North America continues to dominate the market, largely due to its well-established infrastructure, strong aluminum production capabilities, and demand from industries like aerospace, automotive, and construction.

The region benefits from a robust supply chain and advanced technologies in alumina refining. Additionally, government initiatives to support the growth of aluminum production, along with a stable economic environment, further solidify North America's position as a key player in the global market.

The bauxite industry in Asia Pacific is poised for significant growth at a robust CAGR of 4.11% over the forecast period. Asia Pacific is the fastest-growing market for bauxite, driven by rapid industrialization, urbanization, and increasing demand for aluminum in emerging economies like China, India, and Indonesia.

The region has vast bauxite reserves and is expanding its aluminum production capacity to meet the rising demand from industries such as construction, automotive, and electronics. Additionally, favorable government policies and investments in mining technologies further accelerate the growth of the market in Asia Pacific.

- In August 2024, Marubeni finalized the sale of low-carbon aluminum billets from Rio Tinto’s RenewAl brand to FUJISASH Group, a Japanese company. This collaboration enhances environmental values by promoting sustainable supply chains and carbon emission reduction through responsible sourcing and traceability and also impacts the bauxite market, which is a key raw material in aluminum production.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- OSHA is part of the United States Department of Labor. OSHA aims to assure America's workers about safe and healthful working conditions free from unlawful retaliation. OSHA carries out its mission by setting and enforcing standards; enforcing anti-retaliation provisions of the OSH Act and other federal whistleblower laws; providing and supporting training, outreach, education, and assistance; and working collaboratively with other state OSHA programs as well.

- The United State Environmental Protection Agency protects human health and the environment through various environmental laws

- In Japan, the Industrial Safety and Health Act ensures workers' safety and health in the workplace and facilitates the creation of comfortable work environments, by advancing comprehensive and systematic measures related to industrial injury prevention, in conjunction with the Labor Standards Act of Japan.

Competitive Landscape:

The bauxite industry is characterized by a large number of participants, including both established corporations and rising organizations. Partnerships in the market are often formed between mining companies, technology providers, and research institutions to enhance operational efficiency, develop sustainable mining techniques, and improve product quality.

These collaborations aim to address challenges such as environmental impact, supply chain optimization, and the development of innovative technologies for alumina extraction and bauxite processing.

- In November 2024, Emirates Global Aluminium, in collaboration with Mubadala Investment Company and Khalifa University, launched the UAE’s first national laboratory to advance high-temperature materials research, benefiting aluminum production, particularly in energy efficiency and bauxite residue management.

List of Key Companies in Bauxite Market:

- Alcoa Corporation

- Rio Tinto

- Norsk Hydro ASA

- South32

- RusAL

- NALCO India

- Hindalco Industries Ltd

- Ma’aden

- Jamalco

- Vedanta Aluminium & Power

- PT ANTAM Tbk

- Ashapura Group

- Bosai Minerals Group Co., Ltd

- Valbaux Minetech

- RAWMIN

Recent Developments (Acquisition/Partnership)

- In April 2023, Glencore finalized a binding agreement with Norsk Hydro ASA to acquire a 30% stake in Alunorte and a 45% stake in Mineracão Rio do Norte, valued at around USD 775 million, strengthening Glencore’s role in low-carbon alumina and bauxite production.

- In December 2024, Rio Tinto initiated a research program to extract gallium from bauxite processed at its Saguenay refinery in Canada. This project aims to boost the North American supply of critical minerals, contributing to advanced technologies like smartphones and electric cars.

- In October 2023, Odisha Mining Corporation (OMC) and Hindalco Industries Limited signed an MoU to ensure long-term raw material security for Hindalco's alumina refinery in Rayagada. This collaboration aligns with Odisha's strategy to foster sustainable industrial growth and enhance the state's business ecosystem, creating more employment opportunities.

- In March 2023, National Aluminium Company Limited (NALCO) collaborated with Bhabha Atomic Research Centre (BARC) to develop India’s first Bauxite Certified Reference Material (CRM), BARC B1201. This product will serve as a calibration standard for industries and research institutions, promoting innovation and supporting the Atmanirbhar Bharat initiative.

- In February 2023, Hydro Alunorte partnered with Wave Aluminium to establish a plant in Brazil for processing bauxite residue and recovering valuable materials. The facility will leverage innovative technologies to help Hydro meet its sustainability goals for 2030 and beyond.

- In August 2024, Emirates Global Aluminium unveiled the world’s first bauxite shipment transported via a Liquefied Natural Gas-powered vessel. This move supports EGA’s commitment to sustainability, working toward achieving net-zero emissions by 2050, encompassing supply chain emissions.