Market Definition

The market refers to the global industry focused on the production, distribution, and use of ATH across various grades, applications, and end-use industries.

The market includes a wide range of end-use industries such as building and construction, electrical and electronics, automotive, packaging, where ATH is used for its flame resistance, chemical stability, and cost-effectiveness. The report presents an overview of the primary growth drivers, supported by a regional analysis and regulatory frameworks that will impact market development over the forecast period.

Alumina Trihydrate Market Overview

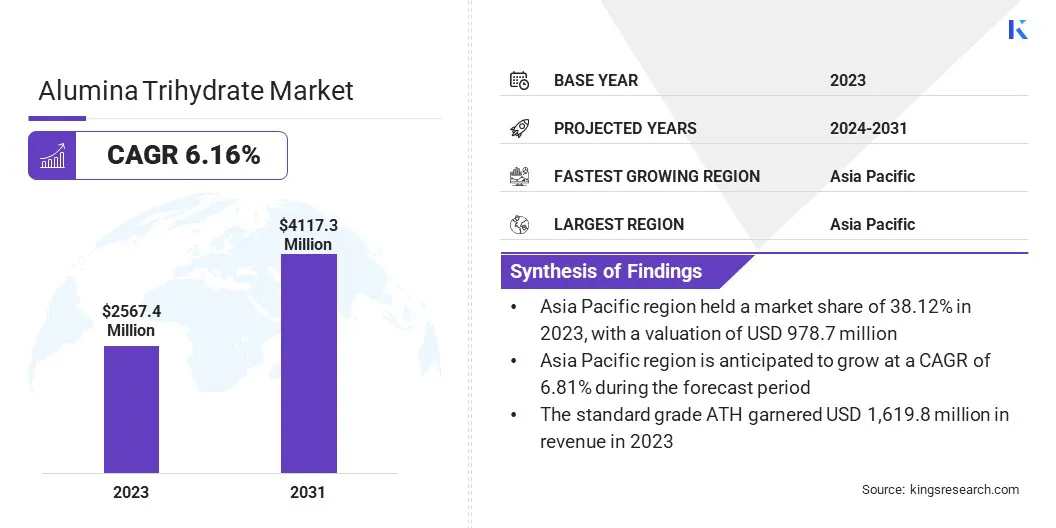

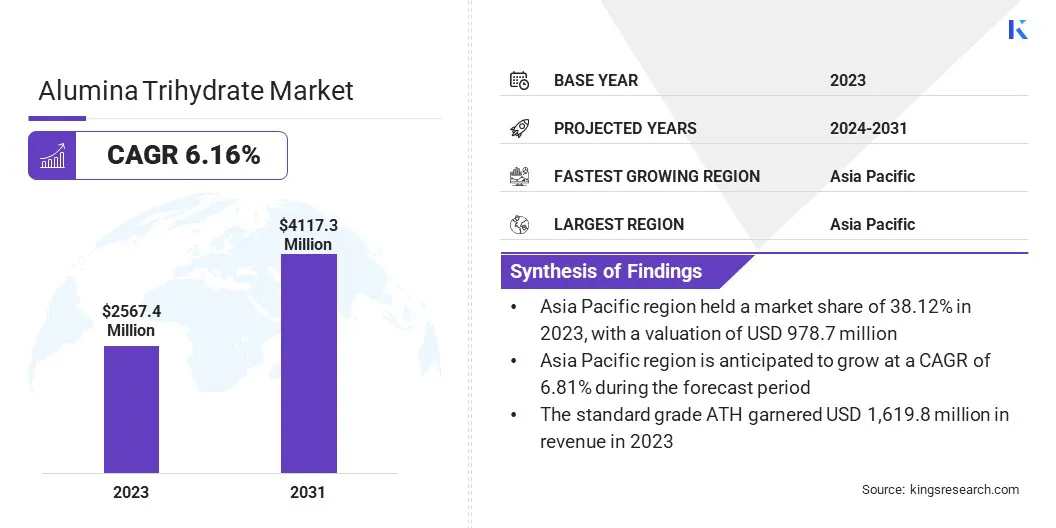

The global alumina trihydrate market size was valued at USD 2,567.4 million in 2023 and is projected to grow from USD 2,709.6 million in 2024 to USD 4,117.3 million by 2031, exhibiting a CAGR of 6.16% during the forecast period.

This market is primarily driven by the growing construction and infrastructure activities. Increasing fire safety regulations, especially in developing regions, have accelerated the adoption of alumina trihydrate as an effective flame retardant additive in plastics, rubber, and insulation materials.

Major companies operating in the alumina trihydrate industry are Nabaltec AG, Astrra Chemicals, Hindalco Industries Ltd., ACURO ORGANICS LIMITED, Resonac Asia Pacific Pte Ltd., J.M. HUBER, KC, Sumitomo Chemical Co., Ltd., Sasol, Alcoa Corporation, Nippon Light Metal Co., Ltd, Zibo Ton Year Chemical Technology Co., Ltd., TOR Minerals, CHALCO Shandong Co., Ltd and National Aluminium Company Limited.

Moreover, the growing use of fine and ultra-fine ATH grades is shaping the current market landscape. These grades are preferred due to their better dispersion, surface finish, and performance in high-end electronics, coatings, and advanced polymer applications.

Key Highlights:

- The alumina trihydrate market size was valued at USD 2,567.4 million in 2023.

- The market is projected to grow at a CAGR of 6.16% from 2024 to 2031.

- Asia Pacific held a market share of 38.12% in 2023, with a valuation of USD 978.7 million.

- The standard grade ATH segment garnered USD 1,619.8 million in revenue in 2023.

- The flame retardants segment is expected to reach USD 1,804.3 million by 2031.

- The building & construction segment is expected to reach USD 1,200.4 million by 2031.

- North America is anticipated to grow at a CAGR of 6.17% during the forecast period.

Market Driver

Growth in Construction and Infrastructure Activities

The market is experiencing strong growth due to the rising demand from the construction and infrastructure industry. As more residential, commercial, and industrial projects are being developed across the Asia Pacific, the Middle East, and Latin America, the need for high-performance construction materials continues to grow.

ATH is widely used in building products, such as sealants, insulation, and coatings, as a flame retardant and filler. With the construction sector focusing on fire safety and material durability, the use of ATH is becoming more common in infrastructure applications. The increasing reliance on ATH-based products in construction activities plays a key role in driving the market forward.

- In April 2025, according to the India Brand Equity Foundation, under the Union Budget 2025-26, the capital investment outlay for infrastructure reached USD 128.64 billion, accounting for 3.1% of India’s GDP.

Market Challenge

Limited Heat Resistance

One of the key challenges in the alumina trihydrate market is its limited heat resistance during processing. ATH starts to break down and release water at around 200°C, which makes it less suitable for high-temperature plastic manufacturing. This limits use with engineering plastics and other heat-demanding materials.

Due to this, manufacturers opt for other flame retardants that can handle more heat, even if they are costlier or less environmentally friendly. A solution to the limited heat resistance of alumina trihydrate (ATH) is to combine it with other materials that have better heat resistance.

By creating combined formulations, ATH can be enhanced to maintain its flame-retardant properties and improve its performance at elevated temperatures. Additionally, surface treatments or coatings can be applied to ATH particles to improve their heat resistance and dispersion in polymer matrices.

Market Trend

Increasing Use of Fine and Ultra-fine ATH Grades

In the market, the demand for fine and ultra-fine ATH grades is increasing. These grades are popular in high-performance applications such as advanced plastics, coatings, and cable compounds. Fine and ultra-fine ATH grades are known for their smaller particle size, which allows better dispersion, making them more effective in flame retardant applications.

This leads to more consistent coverage and improved surface properties, which is crucial for industries that require precise and high-quality materials. As the need for efficient and high-performing products grows, the use of fine and ultra-fine grades of ATH is expected to grow, driving market growth.

Alumina Trihydrate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Grade

|

Standard Grade ATH, Fine/Precipitated Grade, Ultra-fine/Nano ATH

|

|

By Application

|

Flame Retardants, Filler (Plastics & Rubber), Adhesives & Sealants, Paper Industry, Pharmaceuticals & Others

|

|

By End Use Industry

|

Building & Construction, Electrical & Electronics, Automotive, Packaging, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Grade (Standard Grade ATH, Fine/Precipitated Grade, Ultra-fine/Nano ATH): The Standard Grade ATH segment earned USD 1,619.8 million in 2023, due to its widespread use in applications such as flame retardants and fillers, across construction and plastics industries.

- By Application (Flame Retardants, Filler (Plastics & Rubber), Adhesives & Sealants, and Paper Industry): The flame retardants segment held 45.09% of the market in 2023, due to increasing fire safety regulations and the growing demand for non-halogenated fire-resistant materials.

- By End Use Industry (Building & Construction, Electrical & Electronics, Automotive, and Packaging): The building & construction segment is projected to reach USD 1,200.4 million by 2031, owing to the rising use of ATH-based materials in insulation panels and fire-resistant components.

Alumina Trihydrate Market Regional Analysis

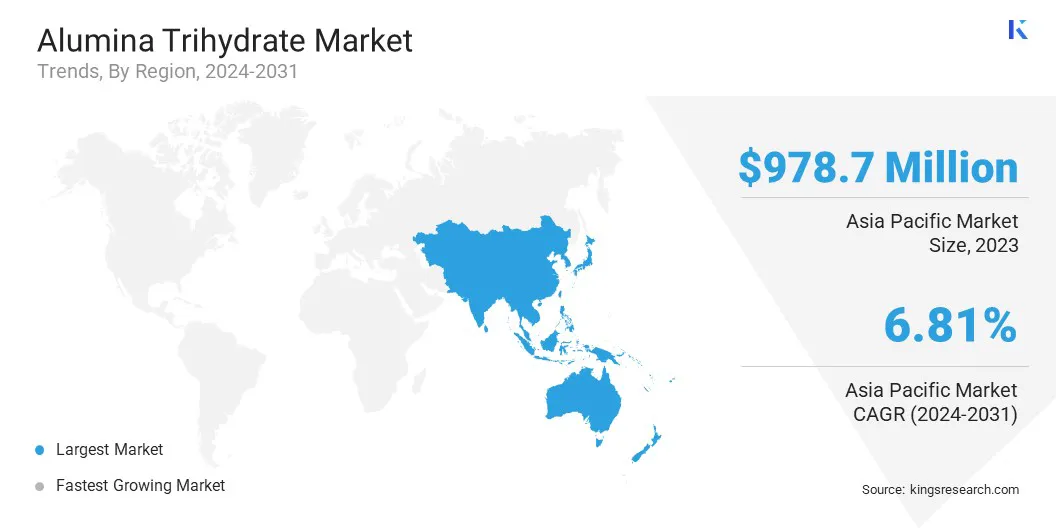

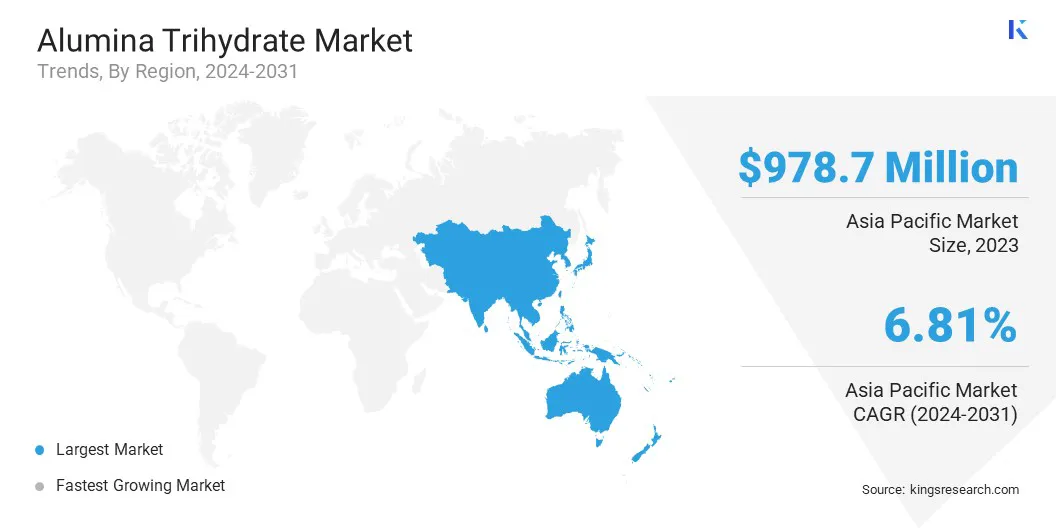

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific alumina trihydrate market share stood around 38.12% in 2023 in the global market, with a valuation of USD 978.7 million. This growth is primarily driven by strong demand from end-use industries such as construction, electronics, and automotive across countries like China, India, Japan, and South Korea.

Rapid urbanization, infrastructure development, and industrial growth, especially in plastics, rubber, and electrical components, have contributed to the increased consumption of ATH in this region. Additionally, the region’s growing focus on fire safety standards, along with the increasing adoption of sustainable and non-halogenated flame retardants, has boosted the demand for ATH.

The presence of key manufacturers, along with government policies that support industrial growth, further strengthens Asia Pacific’s position as the largest market for alumina trihydrate.

- In March 2025, the Bureau of Indian Standards (BIS) introduced new standards on Fall Prevention, Respiratory Protection, and Fire Safety to enhance occupational health and safety for workers. These standards are designed to reduce workplace risks, improve safety practices, and ensure the well-being of employees across various industries.

North America is poised to grow at a significant growth at a CAGR of 6.17% over the forecast period. This growth is driven by the increasing demand for sustainable materials, especially for manufacturing flame retardants and fillers.

The region's strong manufacturing base, particularly in construction, automotive, and electronics, along with growing regulatory pressures for more sustainable materials, is expected to fuel the adoption of alumina trihydrate. Additionally, the U.S. and Canada are focusing on advanced applications of ATH in various industries, which will contribute to a steady growth over the forecast period.

Regulatory Frameworks

- In the U.S., alumina trihydrate (ATH) is subject to regulations under the Environmental Protection Agency (EPA), particularly under the Toxic Substances Control Act (TSCA), which requires the evaluation and reporting of chemicals being used in manufacturing. The EPA monitors its use to ensure it meets safety standards.

- In Europe, ATH falls under the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which is managed by the European Chemicals Agency (ECHA). REACH ensures that all chemicals, including ATH, are safely used in industrial applications, with a particular focus on human health and the environment.

Competitive Landscape:

The alumina trihydrate market is highly competitive, with key players using various strategies to maintain and grow their market share. One of the major strategies is product differentiation, where companies focus on developing specialized ATH grades for flame retardants, fillers, and coatings.

Players are also expanding production capacity by investing in new manufacturing facilities, to meet rising demands, particularly in emerging markets. Geographical expansion plays a key role with companies that target high-growth regions like Asia Pacific to capitalize on local industrialization. Strategic alliances and partnerships are another common approach to enhance supply chain efficiency and gain access to new markets.

Companies prioritize sustainability by offering eco-friendly products and adopting sustainable manufacturing processes, aligning them with growing consumer and regulatory demands for greener solutions. To remain competitive, firms are also focusing on cost optimization and ensuring that their products are high quality and cost-effective.

- In March 2025, Hindalco Industries Ltd. rebranded itself into an engineered solutions provider. The new identity emphasizes Hindalco’s role as a co-creator in electric mobility, renewable energy, and high-end electronics. The company also announced plans to invest USD 5.27 billion across its aluminum, and specialty alumina businesses to drive the development of next-generation, high-precision engineered products.

List of Key Companies in Alumina Trihydrate Market:

- Nabaltec AG

- Astrra Chemicals

- Hindalco Industries Ltd.

- ACURO ORGANICS LIMITED

- Resonac Asia Pacific Pte Ltd.

- J.M. HUBER

- KC

- Sumitomo Chemical Co., Ltd.

- Sasol

- Alcoa Corporation

- Nippon Light Metal Co., Ltd

- Zibo Ton Year Chemical Technology Co., Ltd.

- TOR Minerals

- CHALCO Shandong Co., Ltd

- National Aluminium Company Limited

Recent Developments (M&A)

- In January 2024, Alcoa Corporation acquired Alumina Limited, strengthening its position as a leading upstream aluminum company. The acquisition fully consolidates the Alcoa World Alumina and Chemicals (AWAC) joint venture, which operates bauxite mines and alumina refineries across several countries.