Market Definition

The market encompasses the production, distribution, and application of this crucial chemical intermediate, widely used in pharmaceuticals, plastics, agrochemicals, and resins. It is crucial for manufacturing epichlorohydrin, essential in epoxy resins, adhesives, and water treatment chemicals.

The report outlines major factors driving market growth, along with key drivers, regional analysis, and regulatory frameworks that are set to shape its growth over the forecast period.

Allyl Chloride Market Overview

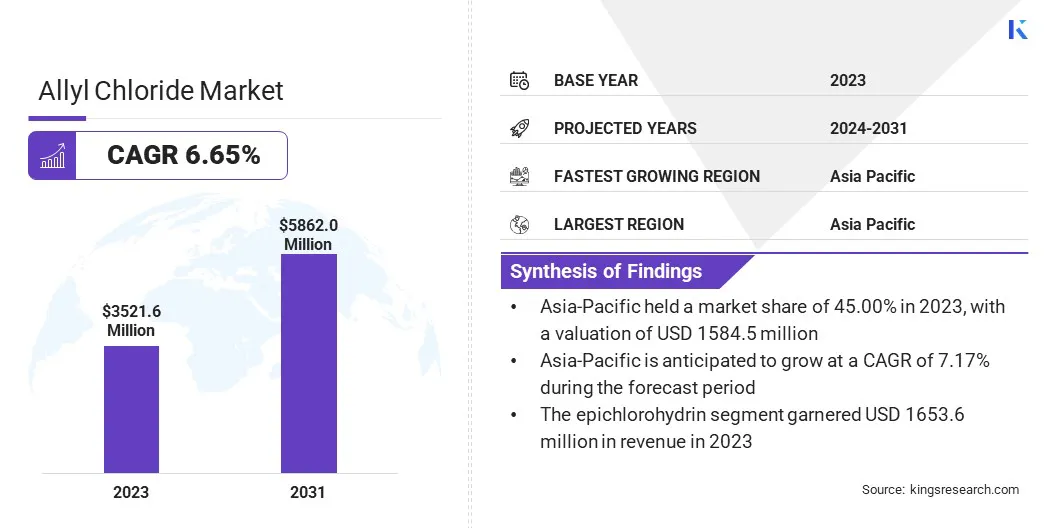

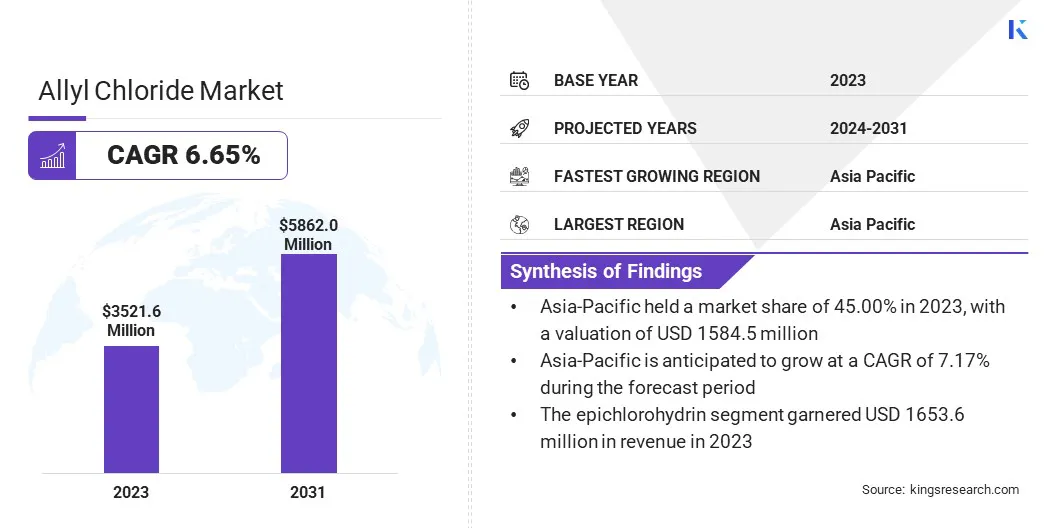

The global allyl chloride market size was valued at USD 3521.6 million in 2023 and is projected to grow from USD 3736.2 million in 2024 to USD 5862.0 million by 2031, exhibiting a CAGR of 6.65% during the forecast period.

Increasing demand for allyl chloride in the production of epichlorohydrin is boosting market growth, supported by its use in epoxy resins, adhesives, and water treatment chemicals. Additionally, expanding applications in pharmaceuticals, agrochemicals, and plastics further contribute to market expansion.

Major companies operating in the allyl chloride industry are OSAKA SODA CO., LTD, Kashima Chemical Co., LTD., Olin Corporation., Sumitomo Chemical Co., Ltd., Befar Group Co., Ltd, Gelest Inc., vizagchemical.com, VRIK PHARMA, INEOS AG, ALPHA CHEMIKA, AccuStandard, Central Drug House, SIELC Technologies., BASF, and Thermo Fisher Scientific Inc.

Rising investments in infrastructure, automotive, and electronics sectors are fueling demand for high-performance materials, boosting allyl chloride consumption. Advancements in chemical manufacturing and the development of sustainable production processes are expected to create new opportunities for the development of the market.

Key Highlights:

- The allyl chloride industry size was recorded at USD 3521.6 million in 2023.

- The market is projected to grow at a CAGR of 6.65% from 2024 to 2031.

- Asia-Pacific held a market share of 44.56% in 2023, with a valuation of USD 1584.5 million.

- The epichlorohydrin segment garnered USD 1653.6 million in revenue in 2023.

- The market in North America is anticipated to grow at a CAGR of 6.64% during the forecast period.

Market Driver

Rising Demand for Epichlorohydrin

The growing demand for epichlorohydrin is fueling the growth of the market, as allyl chloride serves as a key raw material in its production. The growing emphasis on high-performance, lightweight, and durable materials in these sectors is boosting the demand for epoxy resins, thereby increasing epichlorohydrin consumption and, in turn, allyl chloride.

Additionally, epichlorohydrin is essential in water treatment, being used in ion exchange resins and purification chemicals. Infrastructure development and stringent environmental regulations further contribute to its growing demand, fostering the growth of the market.

Market Challenge

Occupational Hazards and Safety Concerns

Occupational hazards and safety concerns are hampering the expansion of the allyl chloride market due to its toxic, flammable, and potentially carcinogenic properties. Exposure can lead to respiratory issues, skin irritation, and neurological effects, necessitating strict handling, storage, and transportation protocols.

Its classification as a potential carcinogen raises concerns over prolonged exposure, complicating its widespread use. These health risks make allyl chloride highly regulated, posing challenges for industries reliant on its applications while increasing legal liabilities and workplace hazards.

Compliance with regulations such as OSHA, REACH, and EPA increases operational costs and limits market expansion, particularly in regions with stringent chemical safety laws.

To mitigate these challenges, industries must implement strict safety protocols, advanced handling technologies, regulatory compliance measures, and automated processes to reduce exposure risks.

Closed-system manufacturing, enhanced ventilation, and specialized storage and transportation solutions, including real-time monitoring, help prevent leaks, fires, and explosions. Investment in safer production alternatives and continuous worker training programs further strengthens operational safety.

Market Trend

Increasing Demand in Pharmaceuticals and Agrochemicals and Water Treatment

A notable trend in the market is the increasing demand in pharmaceuticals and agrochemicals, as it serves as a key intermediate in the production of various active pharmaceutical ingredients (APIs), pesticides, and herbicides.

In pharmaceuticals, allyl chloride is used in antibiotics, anti-inflammatory drugs, and cardiovascular medications, fueled by increasing healthcare needs and chronic disease prevalence. In agrochemicals, it is essential for pesticides and herbicides, addressing food security challenges by enhancing crop yields.

Advancements in chemical synthesis technologies are improving the efficiency and cost-effectiveness of allyl chloride-based applications in these sectors.

Furthermore, the growing demand for clean and safe water is leading to the increased use of allyl chloride-derived chemicals in water treatment. Allyl chloride is a key raw material in the production of ion exchange resins, coagulants, and disinfectants, which are essential for removing contaminants, heavy metals, and organic pollutants from water sources.

Rising concerns over water scarcity, industrial wastewater management, and stringent environmental regulations are prompting industries and municipalities to adopt advanced purification technologies.

Additionally, the expansion of urban infrastructure and rapid industrialization, particularly in developing regions, is fueling the demand for efficient and sustainable water treatment solutions, reinforcing allyl chloride’s role in this sector.

Allyl Chloride Market Report Snapshot

|

Segmentation

|

Details

|

|

By Application

|

Allyl Amines, Allyl Sulfonates, Epichlorohydrin, Glycidyl Ether, Water Treatment Chemicals, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Application (Allyl Amines, Allyl Sulfonates, Epichlorohydrin, Glycidyl Ether, Water Treatment Chemicals, and Others): The epichlorohydrin segment earned USD 1653.6 million in 2023 due to its high demand in epoxy resins, adhesives, and water treatment chemicals across key industries.

Allyl Chloride Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific allyl chloride market share stood at around 45.00% in 2023, valued at USD 1584.5 million. This dominance is reinforced by rapid industrialization, expanding chemical manufacturing, and increasing demand for epichlorohydrin and agrochemicals.

Strong infrastructure development, rising automotive production, and growing pharmaceutical sectors are further boosting this growth. Additionally, favorable government policies, cost-effective production, and abundant raw material availability support regional market growth.

North America market is likely to grow at a CAGR of 6.64% over the forecast period. This rapid growth is facilitated by the region’s strong industrial base, advanced chemical manufacturing infrastructure, and increasing demand for epoxy resins in construction and automotive applications.

The expansion of the pharmaceutical and agrochemical sectors, coupled with rising investments in water treatment solutions, is further fueling regional market growth. Additionally, environmental regulations are prompting manufacturers to adopt safer production processes and sustainable alternatives.

Regulatory Frameworks

- In the EU, the European Chemicals Agency (ECHA) regulates allyl chloride under REACH Regulation, oversseing its registration, evaluation, and restriction to ensure compliance , risk assessments, and environmental protection.

- In the U.S., the National Institute for Occupational Safety and Health (NIOSH) sets workplace exposure limits for allyl chloride, providing guidelines on permissible concentrations, protective measures, and health risk assessments.

- In India, the Manufacture, Storage, and Import of Hazardous Chemicals (MSIHC) Rules, 1989 regulate allyl chloride, outlining safety standards for handling, storage, and transportation to ensure industrial and environmental safety.

Competitive Landscape

The allyl chloride industry is characterized by continuous technological advancements and a strong focus on capacity expansion. Leading companies are engaging in strategic mergers, acquisitions, and partnerships to strengthen their market position and expand their global footprint.

They are prioritizing cost efficiency, supply chain optimization, and innovation in product applications to gain a competitive edge in this evolving industry.

List of Key Companies in Allyl Chloride Market:

- OSAKA SODA CO., LTD

- Kashima Chemical Co., LTD.

- Olin Corporation.

- Sumitomo Chemical Co., Ltd.

- Befar Group Co., Ltd

- Gelest Inc.

- vizagchemical.com

- VRIK PHARMA

- INEOS AG

- ALPHA CHEMIKA

- AccuStandard

- Central Drug House

- SIELC Technologies.

- BASF

- Thermo Fisher Scientific Inc.