Market Definition

The market encompasses the global industry dedicated to the design, manufacturing, and supply of oxygen delivery systems utilized across various aircraft types, including commercial, military, and general aviation platforms. The market includes a broad range of components such as oxygen cylinders, regulators, masks, and control systems.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Aircraft Oxygen System Market Overview

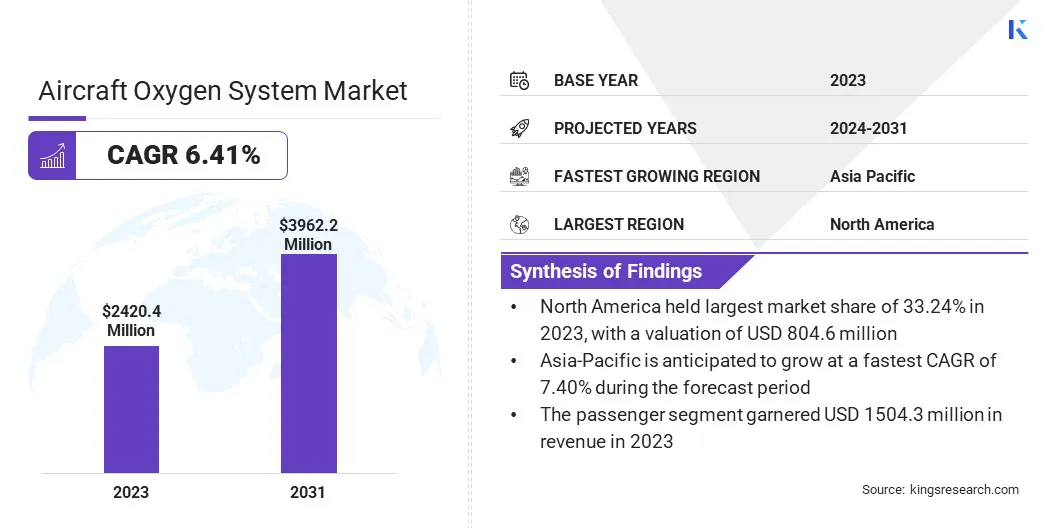

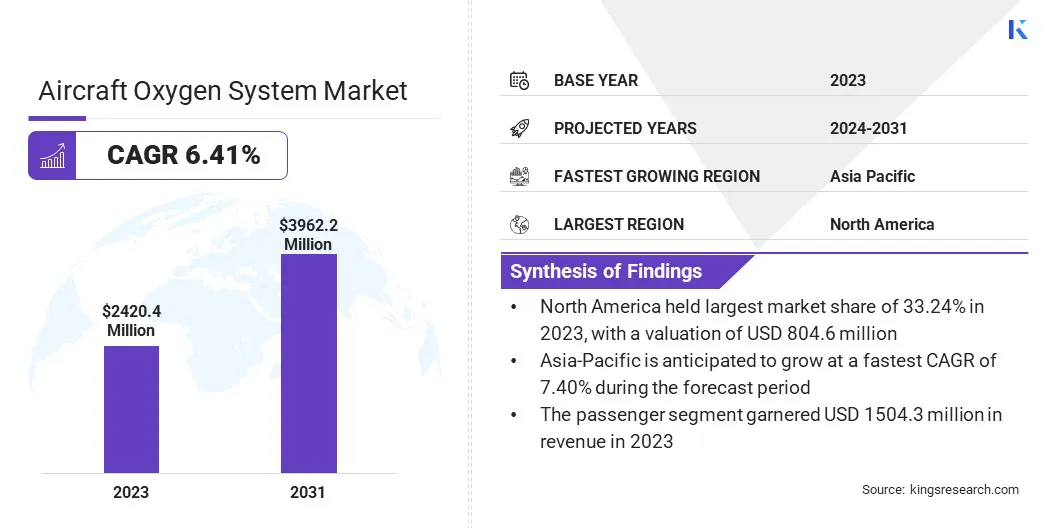

The global aircraft oxygen system market size was valued at USD 2420.4 million in 2023 and is projected to grow from USD 2564.9 million in 2024 to USD 3962.2 million by 2031, exhibiting a CAGR of 6.41% during the forecast period.

This growth is attributed to the rising demand for advanced safety systems across commercial, military, and general aviation sectors, driven by increased air passenger traffic and growing aircraft production worldwide. The need for reliable oxygen delivery systems, particularly in high-altitude operations, is further contributing to the market expansion.

Key Market Highlights

- The aircraft oxygen system industry size was valued at USD 2420.4 million in 2023.

- The market is projected to grow at a CAGR of 6.41% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 804.6 million.

- The storage system segment garnered USD 1020.6 million in revenue in 2023.

- The passenger segment is expected to reach USD 2438.7 million by 2031.

- The commercial aviation segment garnered USD 930.7 million in revenue in 2023.

- The compressed oxygen system segment is anticipated to witness the fastest CAGR of 6.43% during the forecast period

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.40% during the forecast period.

Major companies operating in the aircraft oxygen system market are Safran Group, Diehl Stiftung & Co. KG, Precise Flight Inc., AIR LIQUIDE, Essex Industries, Inc., East/West Industries, Inc., Aerox Aviation Oxygen Systems, Aithre Inc, Eaton, Collins Aerospace, Meggitt PLC, AIR TEAM, s.r.o., AEROCONTACT, SK AeroSafety Group, and Life Flight Network.

Furthermore, technological advancements in lightweight and energy-efficient oxygen systems, along with stringent international aviation safety regulations, are driving market growth. The modernization of existing aircraft fleets and the rising adoption of lightweight and efficient oxygen systems also contribute to the market’s positive outlook over the forecast period.

- In February 2025, the CSIR-National Chemical Laboratory (CSIR-NCL), in partnership with the Indian Air Force’s 11 Base Repair Depot (BRD), resolved a critical challenge in the On-Board Oxygen Generation System (OBOGS) of MiG-29 fighter jets. By developing an advanced rejuvenation process for the zeolite material integral to OBOGS, the collaboration significantly improved oxygen production and boosted performance during high-altitude operations.

Rising Air Passenger Traffic and Aircraft Deliveries

The market is expanding steadily, fueled by the continuous rise in global air passenger traffic and the resulting increase in commercial aircraft deliveries across both developed and emerging markets.

As demand for air travel intensifies, airlines are rapidly expanding and modernizing their fleets to enhance capacity, operational efficiency, and passenger safety, thereby fueling the need for reliable onboard oxygen systems. Aircraft oxygen systems play a critical role in ensuring crew and passenger safety, especially in high-altitude environments or emergency scenarios, making them a mandatory component in all newly manufactured aircraft.

Moreover, the resurgence of the aviation sector post-pandemic, coupled with fleet renewal initiatives and growing investments in air travel infrastructure, is expected to further strengthen the demand for advanced oxygen systems in the coming years.

- In October 2024, Life Flight Network, in collaboration with Spectrum Aeromed, installed liquid oxygen (LOX) in a new Pilatus PC-12 aircraft, marking the first such modification to receive FAA Supplemental Type Certificate (STC) approval. The addition of LOX capabilities enhances the aircraft’s ability to support critically ill and injured patients, significantly increasing oxygen carrying capacity while improving operational efficiency during extended transports.

Weight and Space Constraints in Aircraft Design

Weight and space constraints in aircraft design pose a critical challenge for the aircraft oxygen system market, as modern aircraft demand highly efficient systems that occupy minimal space and contribute as little weight as possible to the overall structure.

Oxygen systems, comprising components such as cylinders, regulators, valves, and delivery mechanisms, must be integrated into aircraft without interfering with other onboard systems or compromising fuel efficiency targets. This challenge is further intensified by the need to maintain rigorous safety standards and system reliability under varying altitude and pressure conditions.

To address this issue, manufacturers are increasingly turning to advanced lightweight materials, such as carbon fiber composites and titanium alloys, to reduce component mass. The use of compact and modular system designs also enhances space utilization and simplifies installation.

Moreover, early-stage collaboration with aircraft OEMs allows for seamless integration of oxygen systems into aircraft architecture, ensuring compatibility and minimizing design conflicts. Investments in R&D aimed at miniaturization, coupled with the incorporation of smart, sensor-based control units, further support the development of lightweight, space-efficient, and performance-driven oxygen systems.

Integration of Smart and Sensor-Based Technologies

Smart and sensor-based technologies are significantly transforming aircraft oxygen systems by enhancing functionality, safety, and operational efficiency. Modern systems now incorporate advanced sensors that continuously monitor oxygen pressure, flow rates, and cylinder levels, enabling real-time system diagnostics and performance tracking.

These intelligent features allow for immediate detection of anomalies, reducing the risk of system failure during flight and improving response time in emergency scenarios. Integration with aircraft health monitoring systems further enables predictive maintenance, minimizing unscheduled downtimes and optimizing maintenance schedules.

Additionally, digital control units equipped with data logging capabilities support regulatory compliance and streamline reporting procedures. As aircraft become increasingly connected and automated, the adoption of smart oxygen systems is playing a critical role in advancing safety standards, reducing manual intervention, and supporting the broader shift toward intelligent aviation infrastructure.

- In March 2024, Eaton received FAA approval for its nitrogen generation system (NGS) oxygen sensor replacement for the Boeing 737 Next Generation (NG) and 737 MAX. The new sensor offers increased oxygen sensing accuracy, enhanced aircraft performance, and cost savings through improved reliability and extended time-on-wing, complying with recent regulatory requirements.

Aircraft Oxygen System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Storage System, Delivery System, Mask

|

|

By Type

|

Passenger, Crew

|

|

By Aircraft

|

Commercial Aviation, Military Aviation, Others

|

|

By Mechanism

|

Chemical Oxygen Generator, Compressed Oxygen System

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Storage System, Delivery System, Mask): The storage system segment earned USD 1020.6 million in 2023 due to the critical need for reliable, high-capacity oxygen containment in both commercial and military aircraft.

- By Type (Passenger, Crew): The passenger segment held 62.15% of the market in 2023, due to the mandatory installation of oxygen systems for passenger safety in commercial aircraft, especially during high-altitude operations and emergency scenarios.

- By Aircraft (Commercial Aviation, Military Aviation, Others): The commercial aviation segment is projected to reach USD 1525.4 million by 2031, owing to the rising global air passenger traffic, increasing aircraft deliveries, and growing emphasis on passenger safety and regulatory compliance.

- By Mechanism (Chemical Oxygen Generator, Compressed Oxygen System): The compressed oxygen system segment is anticipated to grow at a CAGR of 6.43% during the forecast period, due to its advantages in providing a reliable, high-capacity oxygen supply, and its widespread use in both commercial and military aircraft for emergency and supplemental oxygen needs.

Aircraft Oxygen System Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America aircraft oxygen system market share stood at around 33.24% in 2023, with a valuation of USD 804.6 million. This dominance is attributed to the region’s advanced aviation infrastructure, high defense spending, and the presence of leading aircraft manufacturers and system suppliers. Furthermore, increasing investments in next-generation aircraft, along with a focus on passenger and crew safety, continue to drive market expansion.

The region's strong regulatory framework, including stringent safety standards for oxygen systems, supports continued growth in both commercial and military aviation sectors. Additionally, the rising demand for aircraft modernization, coupled with advancements in oxygen system technologies, further strengthens the market in North America.

The aircraft oxygen system industry in Asia-Pacific is poised for significant growth at a robust CAGR of 7.40% over the forecast period. This growth is propelled by the increasing demand for air travel, particularly in emerging markets like China and India. Additionally, the region’s expanding defense aviation industry and the modernization of military fleets are contributing to the demand for advanced oxygen systems.

Government initiatives to improve aviation safety standards, coupled with the rising number of aircraft deliveries and upgrades, are further fueling the market growth. Additionally, a heightened focus on passenger safety and regulatory compliance is accelerating the adoption of modern oxygen systems in both commercial and military aviation across the region.

- In March 2025, the Defence Research and Development Organisation (DRDO) of India completed successful high-altitude trials of its Indigenous Integrated Life Support System (ILSS), featuring an On-Board Oxygen Generating System (OBOGS), for the Light Combat Aircraft (LCA) Tejas aircraft. The system, tested on the LCA-Prototype Vehicle-3, demonstrated reliable performance at altitudes reaching 50,000 feet and during high-G flight maneuvers. Boasting 90% indigenous components and comprising 10 integrated Line Replaceable Units, the ILSS fulfilled all required aeromedical and flight performance criteria.

Regulatory Frameworks

- In the United States, aircraft oxygen systems are regulated under Federal Aviation Administration (FAA) guidelines, specifically 14 CFR Part 91.211, which mandates the use of supplemental oxygen for pilots and passengers at specific cabin pressure altitudes to prevent hypoxia and ensure in-flight safety.

- In Australia, aircraft oxygen systems are regulated under the Civil Aviation Safety Authority (CASA) Advisory Circular AC 21-39 v1.1, which provides guidance on the design, installation, and fitting of gaseous oxygen systems in aircraft.

- In the European Union, aircraft oxygen systems are addressed under EASA Rulemaking Task RMT.0458, which focuses on mitigating oxygen fire hazards in gaseous oxygen systems used in CS-23 and CS-25 aeroplanes.

Competitive Landscape

The aircraft oxygen system market is characterized by a moderately consolidated competitive landscape, with a blend of established global aerospace firms and specialized component manufacturers. Key market participants are focusing on strategies such as technological innovation, system miniaturization, and the integration of smart features to enhance product performance and align with evolving aircraft requirements.

Companies are also investing in R&D to develop lightweight and compact oxygen systems that comply with stringent safety and regulatory standards while improving efficiency and ease of installation. Furthermore, long-term partnerships with aircraft OEMs, along with mergers and acquisitions, are being leveraged to expand market reach, secure contracts, and diversify product offerings across commercial and defense aviation sectors.

- In June 2023, Safran entered into exclusive negotiations with Air Liquide to acquire its aeronautical oxygen activities. This strategic move aims to strengthen Safran’s position in the aerospace market by integrating Air Liquide’s advanced oxygen generation technology for both civil and military aircraft.

Key Companies in Aircraft Oxygen System Market:

- Safran Group

- Diehl Stiftung & Co. KG

- Precise Flight Inc.

- AIR LIQUIDE

- Essex Industries, Inc.

- East/West Industries, Inc.

- Aerox Aviation Oxygen Systems

- Aithre Inc

- Eaton

- Collins Aerospace

- Meggitt PLC

- AIR TEAM, s.r.o.,

- AEROCONTACT

- SK AeroSafety Group

- Life Flight Network

Recent Developments (M&A/Partnerships)

- In February 2024, Vietjet Aviation Joint Stock Company announced a strategic partnership with Safran Aerosystems for the supply of essential safety equipment for its B737MAX aircraft. The collaboration includes life rafts, protective breathing equipment, crew masks, life vests, and ongoing support services, enhancing passenger safety and security on board.

- In July 2023, Bridgepoint acquired SK AeroSafety Group, a prominent provider of maintenance, repair, and overhaul (MRO) services for aviation safety components. Through this acquisition, SK AeroSafety aims to accelerate its global expansion and broaden its service capabilities.

has