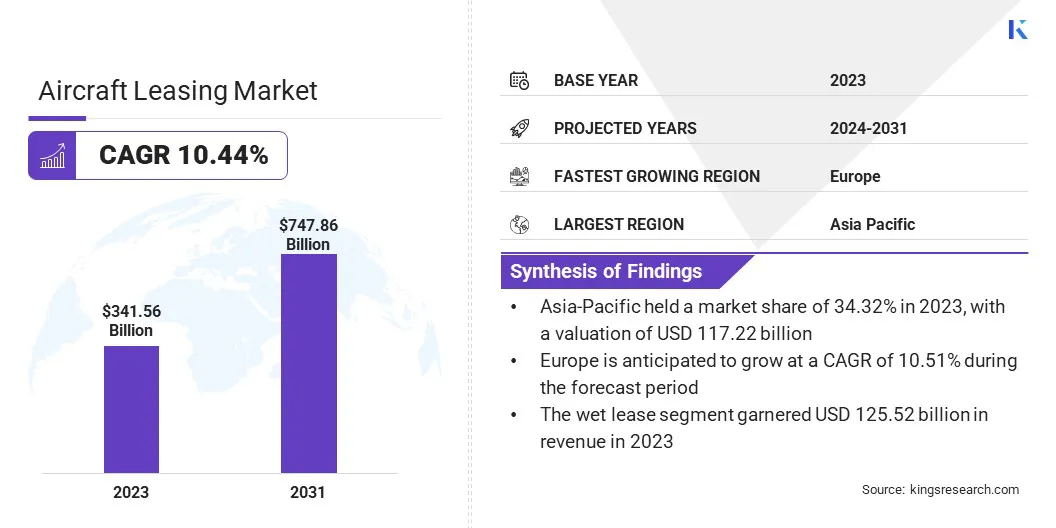

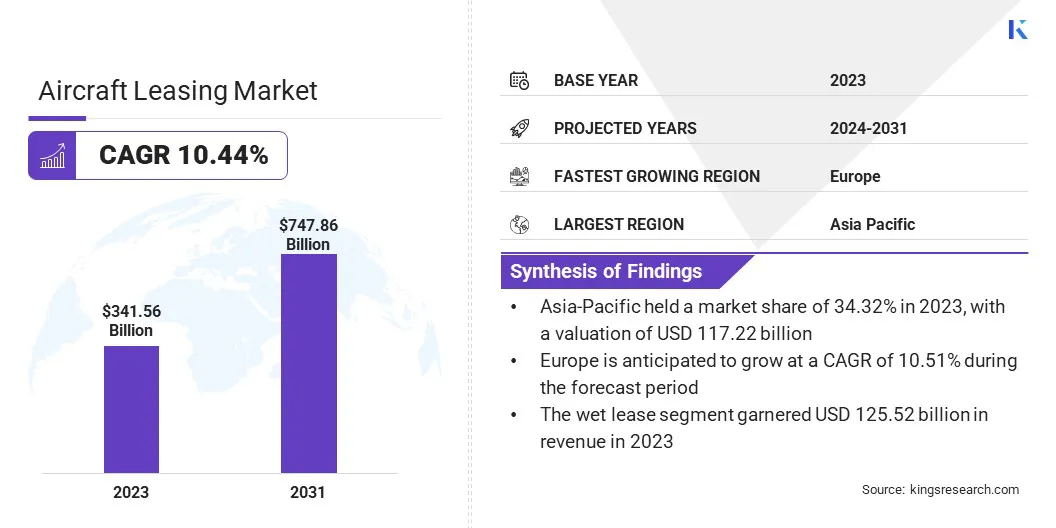

Aircraft Leasing Market Size

The global Aircraft Leasing Market size was valued at USD 341.56 billion in 2023 and is projected to grow from USD 373.27 billion in 2024 to USD 747.86 billion by 2031, exhibiting a CAGR of 10.44% during the forecast period. Rising popularity of sale-and-leaseback transactions and fleet modernization initiatives by airlines are propelling the growth of the market.

In the scope of work, the report includes services offered by companies such as AerCap Holdings N.V., Avolon, BBAM US LP, Air Lease Corporation, Dubai Aerospace Enterprise (DAE) Ltd., AviLease, BOC Aviation Limited, AVIAAM LEASING, A J Walter Aviation Limited, SMBC Aviation Capital, and others.

The emergence of electric and hybrid aircraft is revolutionizing the aviation industry and creating promising opportunities in the aircraft leasing market. These next-generation aircraft, powered by sustainable energy sources, are gaining immense traction as the industry advances toward carbon neutrality and reduced dependency on fossil fuels.

Electric and hybrid aircraft offer lower operational costs by reducing fuel consumption and maintenance requirements, making them attractive leasing options for airlines. Leasing companies can capitalize on this shift by diversifying their portfolios to include these environmentally-friendly models, meeting the growing demand from airlines committed to global sustainability goals.

- For instance, in June 2024, GE Aerospace advanced hybrid electric engine development with NASA by integrating electric motor/generators into a high-bypass turbofan under the Hybrid Thermally Efficient Core (HyTEC) project. This effort, part of the CFM International RISE program, represents GE’s commitment to advancing sustainable technologies for electric aircraft engines, marking a pivotal step in aviation innovation.

Moreover, governments and regulatory bodies worldwide are incentivizing the adoption of green aviation technologies, accelerating the market transition.

However, challenges remain, including high initial costs and infrastructure limitations, highlighting the critical role of leasing firms in bridging the affordability gap. Investing in electric and hybrid aircraft allows lessors to address sustainability concerns and tap into new revenue streams from environmentally-conscious airlines.

Aircraft leasing is a financial arrangement where airlines acquire the right to operate aircraft without purchasing them outright, providing flexibility and reducing capital expenditure. This practice allows airlines to scale their fleet based on demand and operational requirements.

Two primary types of leases dominate the market: dry leases and wet leases. Dry leasing involves providing the aircraft without crew, maintenance, or insurance, typically used for long-term needs. In contrast, wet leasing offers a comprehensive package, including crew, maintenance, and insurance, catering to short-term demands such as seasonal spikes or emergencies.

Lessors generally focus on narrow-body and wide-body categories. Narrow-body aircraft, such as the Airbus A320 and Boeing 737, are preferred for short-haul and regional routes due to their fuel efficiency. Wide-body aircraft, like the Boeing 777 and Airbus A350, are leased for long-haul operations requiring greater passenger and cargo capacity.

This leasing diversity allows airlines to adapt to market fluctuations and maintain operational efficiency.

Analyst’s Review

The aircraft leasing market is witnessing robust growth, mainly driven by innovative strategies and operational imperatives adopted by leading industry players. Companies are focusing on fleet diversification, integrating next-generation aircraft to align with sustainability objectives and cater to evolving airline demands.

Furthermore, they are capitalizing on sale-and-leaseback arrangements, a strategy that enables airlines to liquidate assets and improve cash flow while retaining operational flexibility. The ongoing digital transformation in lease management, characterized by blockchain-based smart contracts and AI-powered analytics, is further enhancing lessors’ efficiency and decision-making capabilities.

- For instance, in October 2024, AviLease, a fast-growing aircraft lessor backed by PIF, acquired its first Boeing 787-9 aircraft from BBAM, a global leader managing $18 billion in aviation assets. This collaboration with BBAM introduces a new airline customer from the Americas to AviLease’s portfolio, strengthening its global footprint and expanding its fleet with next-generation aircraft.

Furthermore, key players are expanding their presence in emerging markets, particularly in Asia-Pacific, to tap into the rising air traffic and growing regional connectivity initiatives. Moreover, strategic partnerships with aircraft manufacturers and financial institutions are enhancing their market position by securing access to advanced models and favorable financing terms.

To sustain growth, companies must address challenges such as interest rate volatility and airline financial instability while continuously adapting to regulatory and market dynamics.

Aircraft Leasing Market Growth Factors

The integration of digital platforms into lease management processes is transforming the aircraft leasing market, offering enhanced efficiency and transparency. Digital tools such as blockchain, AI-driven analytics, and cloud-based systems enable lessors to streamline contract management, maintenance tracking, and payment collections.

These platforms facilitate real-time data sharing between lessors and lessees, ensuring compliance and minimizing disputes.

- For instance, in May 2024, Hanwha introduced Hanwha Aviation, a global engine leasing platform with operations in Singapore, Ireland, and the U.S. Leveraging its expertise in aero-engine manufacturing and MRO, the platform aims to deliver innovative, integrated solutions for aircraft and engine leasing, emphasizing operational flexibility and addressing the growing demand for digital lease management.

Blockchain technology, in particular, is revolutionizing lease agreements by enabling secure, tamper-proof smart contracts and reducing administrative overhead. AI-powered predictive analytics monitor aircraft performance and anticipate maintenance needs, thereby extending asset lifespans and reducing downtime.

For lessors, these innovations reduce operational costs and improve decision-making, while for airlines, they simplify compliance and optimize fleet management. As the aviation industry grows increasingly complex, adopting digital platforms becomes imperative to maintain a competitive edge.

Companies investing in these technologies position themselves as customer-centric and forward-thinking, capable of meeting the evolving demands of the modern leasing environment, particularly in high-growth regions with dynamic market conditions.

The high dependency on airline financial stability presents a significant challenge to the development of the aircraft leasing market, as lessors’ revenues depend on timely lease payments from airline operators. Economic downturns, geopolitical events, or unforeseen disruptions, such as pandemics, can significantly impact airlines’ cash flow, leading to payment defaults or renegotiations.

This dependency exposes leasing companies to revenue volatility and asset repossession risks, affecting their financial health and operational planning. To mitigate this challenge, lessors are increasingly diversifying their portfolios by partnering with financially robust airlines and expanding into emerging markets with stable demand.

Strengthening risk management frameworks through comprehensive credit evaluations and predictive financial modeling enhances resilience. Additionally, developing contingency strategies, such as asset reallocation or sale-and-leaseback options, ensures business continuity during economic downturns.

Collaborating with financial institutions to create tailored lease structures further helps reduce default risks, enabling leasing firms to sustain growth and profitability in a volatile market.

Aircraft Leasing Market Trends

The aviation industry is witnessing a significant shift toward sustainable aircraft models, fueled by rising regulatory pressures and increasing environmental awareness. Leasing companies are actively incorporating newer, fuel-efficient aircraft such as the Boeing 737 MAX and Airbus A320neo into their fleets to reduce carbon emissions and operating costs.

This transition aligns with airlines’ efforts to meet net-zero carbon emission targets while enhancing profitability through lower fuel consumption. Additionally, lessors are exploring partnerships with manufacturers to facilitate the introduction of alternative propulsion systems, including electric and hydrogen-powered aircraft.

- For instance, in June 2024, International Air Transport Association (IATA) highlighted that Sustainable Aviation Fuel (SAF) could meet 65% of the emissions reduction target required for aviation to achieve net-zero CO2 emissions by 2050. With increased production and global policy support expected in the 2030s, SAF’s competitiveness against fossil kerosene is expected to drive its adoption as a key component in sustainable aviation.

This trend aligns with the aviation sector’s sustainability goals, enhancing the marketability of leased assets as airlines prioritize environmentally friendly options to improve brand perception. For lessors, this shift represents an opportunity to future-proof their portfolios by addressing the growing demand for green aviation solutions.

By adopting sustainable models, the leasing market is poised to play a pivotal role in supporting the industry’s environmental transformation.

Segmentation Analysis

The global market has been segmented based on aircraft, type, and geography.

By Aircraft

Based on aircraft, the aircraft leasing market has been segmented into narrow body, wide body, and regional aircraft. The narrow body segment captured the largest share of 39.67% in 2023. This prominence is primarily attributed to their operational efficiency and growing demand for short- to medium-haul routes.

Narrow-body aircraft, such as the Boeing 737 and Airbus A320 families, are highly sought after for their fuel efficiency, lower operating costs, and versatility, making them a cost-effective option for airlines. These aircraft are especially popular among low-cost carriers (LCCs) and regional operators, which rely heavily on leasing to manage fleet growth and optimize cash flow.

- For instance, in August 2024, AerCap Holdings delivered the first three of fifteen new Airbus A321neo aircraft to AirAsia Group under a long-term lease, with the remaining deliveries planned for 2024 and 2025. This fleet expansion enhances AirAsia’s operational efficiency and regional capabilities, reinforcing their 30-year partnership.

Additionally, advancements in narrow-body models, including improved aerodynamics and engine technology, have extended their range and payload capabilities, attracting airlines looking to expand route networks without the higher costs of wide-body aircraft.

By Type

Based on type, the market has been classified into wet lease, dry lease, and damp lease. The dry lease segment is set to record a staggering CAGR of 10.89% through the forecast period. This growth is largely propelled by airlines’ preference for dry leasing due to its cost-effectiveness and flexibility.

Unlike wet leases, dry leases involve only the aircraft without operational services such as crew or maintenance, allowing airlines to maintain operational autonomy and reduce costs. This arrangement is particularly beneficial for carriers seeking long-term fleet expansion with minimal capital expenditure.

- For instance, in September 2024, AviaAM Leasing delivered an Airbus A319 (MSN 1745) to Avion Express under a dry lease agreement. As part of Avia Solutions Group, this collaboration supports Avion Express’s growth while fostering strategic synergies within the group, emphasizing a commitment to fleet modernization and operational excellence.

The rise of low-cost carriers (LCCs) and their focus on lean operations further boosts the demand for dry leases. Additionally, the increased adoption of advanced and fuel-efficient aircraft, such as the Airbus A320neo and Boeing 737 MAX, has made dry leasing more attractive to airlines aiming to modernize their fleets.

Aircraft Leasing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, MEA, and Latin America.

Asia-Pacific aircraft leasing market accounted for a substantial share of 34.32% and was valued at USD 117.22 billion in 2023. This dominance is further facilitated by the region's rapid aviation sector growth and rising air passenger traffic.

Countries such as China, India, and Indonesia have emerged as key markets due to their expanding middle-class populations, rising disposable incomes, and increased connectivity initiatives. Low-cost carriers (LCCs) dominate the region, heavily relying on leased aircraft to support network expansion and manage operational costs.

Furthermore, government support for regional connectivity, coupled with infrastructure investments in secondary and tertiary airports, has fueled the demand for narrow-body aircraft leasing. Lessors are strategically targeting this market by establishing regional offices and collaborating with local airlines to tap into its immense growth potential.

The introduction of fuel-efficient models such as the Boeing 737 MAX and Airbus A320neo has further stimulated leasing activity as airlines modernize their fleets.

Europe market is projected to grow at a significant CAGR of 10.51% in the forthcoming years, bolstered by robust recovery and the increasing focus on fleet modernization. This growth is supported by the region’s mature aviation industry, characterized by strong demand for both narrow-body and wide-body aircraft leasing.

Airlines are actively leasing fuel-efficient models to meet stringent EU emissions regulations and reduce operating costs. Additionally, the sale-and-leaseback trend has gained momentum in Europe, enabling airlines to unlock liquidity and address financial challenges. The rise of low-cost carriers (LCCs) in countries such as Ireland, the UK, and Spain is further fostering leasing demand.

European lessors are leveraging innovative lease structures and digital solutions to boost competitiveness, aided by the region’s favorable regulatory framework. Moreover, strategic investments in sustainable aviation, including electric and hybrid aircraft leasing, position Europe as a key region in the global market.

Competitive Landscape

The global aircraft leasing market report will provide valuable insights with a specialized emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as the expansion of services, investments in research and development (R&D), the establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Aircraft Leasing Market

- AerCap Holdings N.V.

- Avolon

- BBAM US LP

- Air Lease Corporation

- Dubai Aerospace Enterprise (DAE) Ltd.

- AviLease

- BOC Aviation Limited

- AVIAAM LEASING

- A J Walter Aviation Limited

- SMBC Aviation Capital

Key Industry Developments

- November 2024 (Expansion): SMBC Aviation Capital signed lease agreements with Breeze Airways for three Airbus A220-300 aircraft, marking the addition of this model to its portfolio. Deliveries are scheduled for November and December 2024, with the final aircraft arriving in early 2025, strengthening SMBC's leasing capacity and diversifying its fleet.

- October 2024 (Expansion): AerCap Holdings secured lease agreements with Azerbaijan Airlines for six Airbus CFM LEAP-powered aircraft, comprising three A320neos and three A321neos, set for delivery in 2026. This fleet expansion aligns with AerCap's strategy to support airline modernization, enhance passenger comfort, and facilitate route network growth.

- September 2024 (Acquisition): AviaAM Leasing acquired an Airbus A320-200 aircraft (serial number MSN 5089) from TrueAero Asset Management Ireland. The acquisition underscores AviaAM’s commitment to fleet growth and strategic partnerships, leveraging TrueAero’s expertise in asset management and capital solutions to strengthen its market position.

The global aircraft leasing market is segmented as:

By Aircraft

- Narrow Body

- Wide Body

- Regional Aircraft

By Type

- Wet Lease

- Dry Lease

- Damp Lease

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America