Market Definition

Aircraft exhaust systems are engineered components that channel and manage gases produced by aircraft engines to ensure efficient propulsion and optimal engine performance. They help control temperature, reduce noise, and limit harmful emissions during flight operations.

Applications include engine maintenance, performance optimization, and compliance with environmental and safety standards, supporting safe and efficient aircraft operation. Commercial, military, and general aviation sectors rely on these systems to improve reliability, operational efficiency, and adherence to regulatory requirements.

Aircraft Exhaust Systems Market Overview

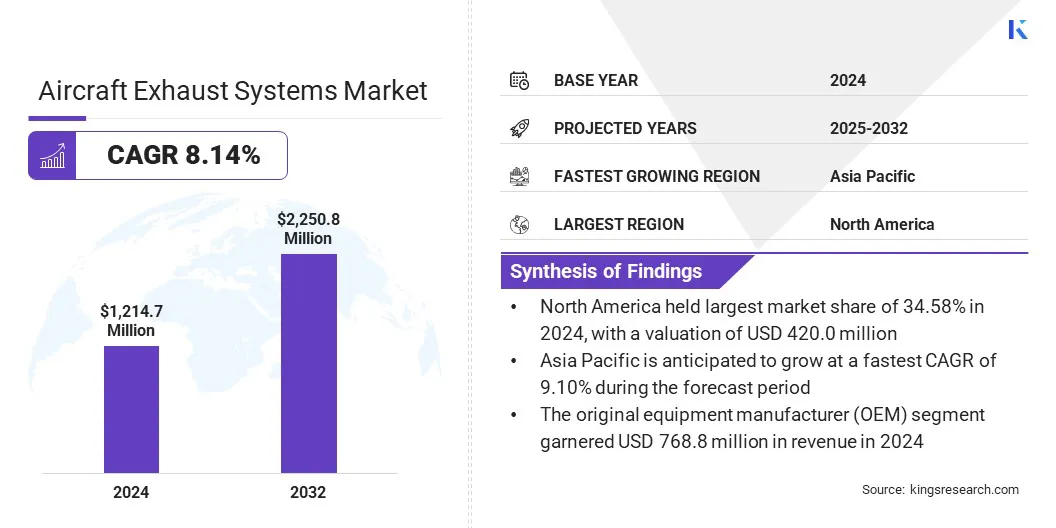

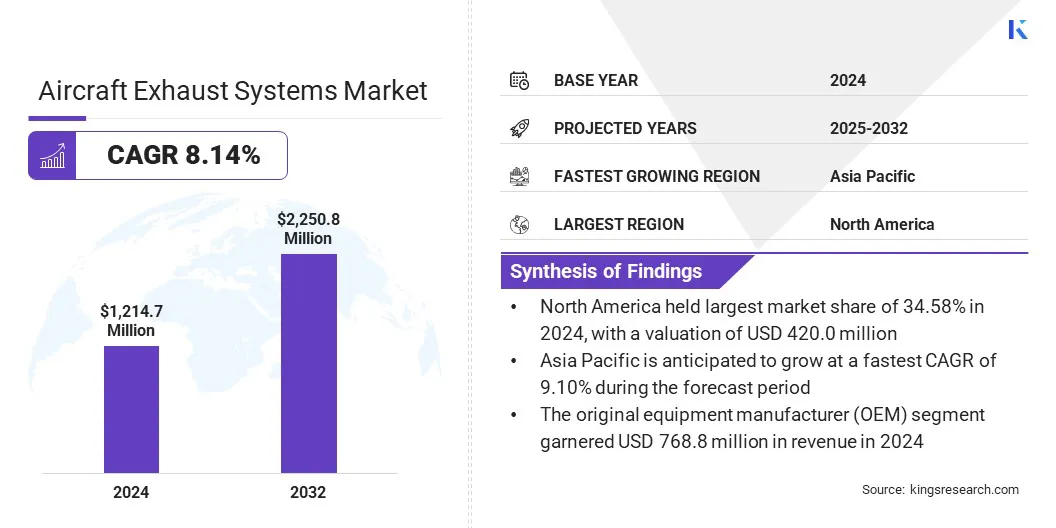

The global aircraft exhaust systems market size was valued at USD 1,214.7 million in 2024 and is projected to grow from USD 1,301.4 million in 2025 to USD 2,250.8 million by 2032, exhibiting a CAGR of 8.14% over the forecast period.

This growth is attributed to the increasing demand for efficient & high-performance aircraft exhaust systems that boost engine efficiency, and reduce emissions. Growing use of advanced materials, noise-reduction technologies, and optimized exhaust designs is improving propulsion performance, operational reliability, and regulatory adherence, thereby driving market expansion.

Key Highlights

- The aircraft exhaust systems industry size was valued at USD 1,214.7 million in 2024.

- The market is projected to grow at a CAGR of 8.14% from 2025 to 2032.

- North America held a market share of 34.58% in 2024, valued at USD 420.0 million.

- The turbine engine exhaust systems segment generated USD 713.4 million in revenue in 2024.

- The exhaust pipes and tubes segment is expected to reach USD 790.6 million by 2032.

- The commercial aviation segment is anticipated to witness fastest CAGR of 8.67% over the forecast period.

- The original equipment manufacturer (OEM) segment generated USD 768.8 million in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 9.10% over the projection period.

Major companies operating in the aircraft exhaust systems market are Magellan Aerospace Corporation, Safran Group, Nicrocraft, Doncasters Group, General Electric Company, GKN Aerospace, Triumph Group, Franke Group, The NORDAM Group LLC, Power Flow Systems, Inc., Acorn Welding, TransDigm Group, Wall Colmonoy, Aerospace Welding Minneapolis, Inc., Pratt & Whitney, and Parker Hannifin Corp.

The rising focus on fuel efficiency, engine longevity, and operational safety across commercial, military, and general aviation is driving the integration of modern exhaust systems into new and retrofitted aircraft. Additionally, ongoing technological innovations, along with strategic collaborations and aircraft modernization initiatives are accelerating market growth.

- In March 2025, XTI Aerospace reported the completion of an updated air inlet and exhaust design for its TriFan engine. The revision boosts airflow in conventional flight, optimizes exhaust flow to reduce drag, and provides additional forward thrust. The company applied computational fluid dynamics and digital mock-ups to refine integration with its twin turboshaft engines. This update marks an engineering milestone in the ongoing development of the TriFan aircraft.

Market Driver

Rising Focus on Engine Efficiency and Fuel Optimization

Growth of the aircraft exhaust systems market is fueled by the rising focus on engine efficiency and fuel optimization across the aviation sector. These systems improve engine performance and reduce fuel consumption, while remaining compliant with environmental and safety regulations.

In February 2024, the U.S. Department of Energy announced a USD 15 million investment in projects developing high-energy storage solutions for domestic aircraft, to support energy-efficient aviation technologies. These projects aim to create storage systems achieving or exceeding 1,000 watt-hours per kilogram and per liter, improving energy density over current technologies.

Commercial, military, and general aviation operators are using advanced exhaust technologies to improve operational reliability, lower emissions, and extend engine life. This is reinforced by regulatory standards, rising fuel costs, and the focus on sustainable and cost-effective aviation operations. This shift is strengthening the industry’s ability to deliver high-performance, efficient, and environmentally compliant aircraft solutions.

Market Challenge

Complexities in System Integration and Compatibility

Complexities in system integration and compatibility create a significant barrier to the growth of the aircraft exhaust systems market. Modern exhaust systems must interface seamlessly with diverse engine types, airframes, and auxiliary components, which often requires custom engineering, precise regulation, and extensive testing. Retrofitting or upgrading existing aircraft fleets can be time-consuming and costly, particularly for older models with varied configurations.

Operators in commercial, military, and general aviation face additional challenges as integration must ensure compliance with strict safety, performance, and environmental regulations. Limited availability of skilled engineers to manage complex installations also increases these difficulties.

To address this, manufacturers and operators are increasingly adopting standardized modular designs, advanced simulation tools, and professional integration services. These approaches aim to simplify compatibility, reduce installation complexity, and accelerate the use of high-performance exhaust systems across different aircraft platforms.

Market Trend

Advancement in Noise-Reduction Technologies

Advancement in noise-reduction technologies is transforming the aircraft exhaust systems market by allowing quieter and more environmentally compliant operations. This trend is driven by strict global noise regulations, increasing passenger comfort expectations, and the need to minimize community noise impact near airports.

Innovative solutions such as acoustic liners, optimized ducting, and vibration-damping materials improve sound attenuation while maintaining engine efficiency. These features are particularly valuable for commercial, military, and general aviation operators, where performance, safety, and regulatory compliance are critical.

Aircraft manufacturers and operators are adopting advanced noise-reduction designs to enhance operational reliability and reduce environmental impact. Integration of these technologies helps lower noise levels, improve public perception, and support sustainable aviation initiatives. The growing focus on acoustic optimization establishes these advancements as essential drivers for modern, high-performance, and compliant aircraft exhaust systems.

- In July 2025, a study by the University of Lucerne, Switzerland examined high-bypass turbofan engines, chevron nozzles, and blended winglets to reduce engine and aerodynamic noise. It also evaluated Continuous Descent Approach (CDA) and electric taxing systems to limit ground noise.

Aircraft Exhaust Systems Market Report Snapshot

|

Segmentation

|

Details

|

|

By System

|

Turbine Engine Exhaust Systems, Piston Engine Exhaust Systems, and Auxiliary Power Unit (APU) Exhaust Systems

|

|

By Component

|

Exhaust Pipes and Tubes, Exhaust Cones, Exhaust Nozzles, Exhaust Liners and Shields, and Sensors and Monitoring Devices

|

|

By Aviation Type

|

Commercial Aviation, Military Aviation, General Aviation, and Business Aviation

|

|

By End User

|

Original Equipment Manufacturer (OEM), and Maintenance, Repair & Overhaul (MRO)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By System (Turbine Engine Exhaust Systems, Piston Engine Exhaust Systems, and Auxiliary Power Unit (APU) Exhaust Systems): The turbine engine exhaust systems segment earned USD 713.4 million in 2024 primarily due to increasing demand for commercial and military aircraft requiring high-performance propulsion solutions.

- By Component (Exhaust Pipes and Tubes, Exhaust Cones, Exhaust Nozzles, Exhaust Liners and Shields, and Sensors and Monitoring Devices): The exhaust pipes and tubes held 35.27% of the market in 2024, due to their essential role in channeling engine gases efficiently while ensuring durability and thermal resistance.

- By Aviation Type (Commercial Aviation, Military Aviation, General Aviation, and Business Aviation): The commercial aviation segment is projected to reach USD 1,118.3 million by 2032, owing to growing air travel demand and fleet expansion in passenger airlines worldwide.

- By End User (Original Equipment Manufacturer (OEM), and Maintenance, Repair & Overhaul (MRO)): The original equipment manufacturer (OEM) segment anticipated to grow at a CAGR of 8.27% over the projected period, fueled by rising aircraft production and increasing demand for integrated, high-performance exhaust systems.

Aircraft Exhaust Systems Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The North America aircraft exhaust systems market share stood at 34.58% in 2024, valued at USD 420.0 million. This strong position is reinforced by a well-established commercial and military aviation ecosystem, fleet modernization programs, and strict environmental and noise regulations.

Additionally, the market benefits from the increasing use of advanced exhaust system technologies, including lightweight materials, acoustic solutions, and thermal management components, across diverse aircraft types.

Ongoing investments in research and development and the integration of simulation-driven design tools contribute to the steady deployment of high-performance exhaust systems. Technological advancements and operational efficiency initiatives also boost regional market expansion.

- In May 2023, Magellan Aerospace extended its contract with Boeing to supply nacelle exhaust systems for the 767 program. The agreement covers acoustic plug and nozzle assemblies manufactured at Magellan’s Middletown, Ohio facility, which has been producing exhaust components for Boeing for seven decades.

The Asia Pacific aircraft exhaust systems industry is set to grow at a CAGR of 9.10% over the forecast period. This growth is fueled by rising air travel demand, expanding commercial airline fleets, and increasing defense modernization initiatives.

Expanding aviation sectors are using advanced exhaust systems to improve engine performance, and fuel efficiency. Collaborations between aircraft manufacturers and global technology providers are helping the deployment of high-performance exhaust solutions.

Additionally, the emphasis on lightweight materials, noise-reduction technologies, and thermal management, combined with industrial and defense sector growth, supports long-term adoption. Ongoing investments in aircraft production and maintenance infrastructure also strengthen the market for aircraft exhaust systems.

Regulatory Frameworks

- In the U.S., 40 CFR (Code of Federal Regulations) Part 87 regulates emissions from aircraft gas turbine engines. It establishes standards for nitrogen oxides and particulate matter for engines with rated thrust above 26.7 kilonewtons, aligning with international standards to support sustainable aircraft operations.

- Internationally, ICAO (International Civil Aviation Organization) Annex 16, Volume II regulates aircraft engine emissions. It sets limits on nitrogen oxides, carbon monoxide, hydrocarbons, and non-volatile particulate matter during the landing and take-off cycle, ensuring environmental compliance for engines used in commercial and civil aviation.

Competitive Landscape

Companies operating in the aircraft exhaust systems industry are maintaining competitiveness through investments in advanced materials and technologies, along with collaborations and acquisitions. They are developing exhaust systems for improved engine performance, fuel efficiency, emission reduction, and regulatory compliance across commercial, military, and general aviation sectors.

Market players are improving their products with lightweight alloys, thermal management solutions, and simulation-driven designs to meet evolving performance and safety requirements.

They are establishing regional manufacturing and service facilities and collaborating with aircraft OEMs to improve system integration. Additionally, companies are providing technical support, maintenance services, and performance monitoring solutions to ensure reliability and sustain competitive positioning.

- In June 2024, Nicrocraft announced McFarlane Aviation Products as its new distribution partner. This collaboration aims to expand Nicrocraft’s reach in delivering aircraft exhaust systems to a broader customer base. McFarlane’s established distribution channels and industry presence are expected to support Nicrocraft's growth in the aviation sector.

Top Key Companies in Aircraft Exhaust Systems Market:

- Magellan Aerospace Corporation

- Safran Group

- Nicrocraft

- Doncasters Group

- General Electric Company

- GKN Aerospace

- Triumph Group

- Franke Group

- The NORDAM Group LLC

- Power Flow Systems, Inc.

- Acorn Welding

- TransDigm Group

- Wall Colmonoy

- Aerospace Welding Minneapolis, Inc.

- Pratt & Whitney

- Parker Hannifin Corp

Recent Developments (M&A)

- In October 2024, Wall Colmonoy Oklahoma City completed the acquisition of an HK Laser & Systems R3R Laser Tube Cutting Machine. The equipment increases quality, efficiency, and safety in producing FAA-PMA approved aircraft exhaust systems, strengthening the company’s position in the aerospace sector.

- In October 2023, Arcline Investment Management acquired Hartzell Aviation from Tailwind Technologies. Hartzell, which designs and manufactures aircraft subsystems and aftermarket components, operates through Hartzell Propeller and Hartzell Engine Tech. This acquisition supports Arcline’s strategy of investing in key suppliers for critical industries and aims to drive Hartzell’s next phase of growth.