Market Definition

Air separation plants are industrial systems designed to separate atmospheric air into its primary components: oxygen, nitrogen, and argon. These plants use cryogenic and non-cryogenic processes to achieve high purity levels for industrial applications.

Their applications include metal production, energy processing, chemical synthesis, and medical oxygen generation for healthcare facilities. The report scope covers processes, gas types, and end-use industries including iron and steel, oil and gas, chemicals, and healthcare.

Air Separation Plant Market Overview

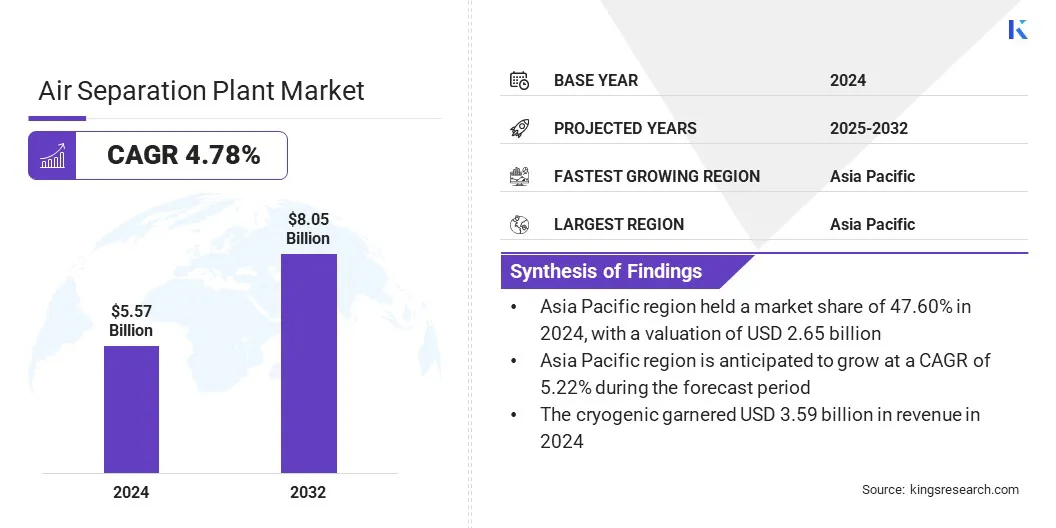

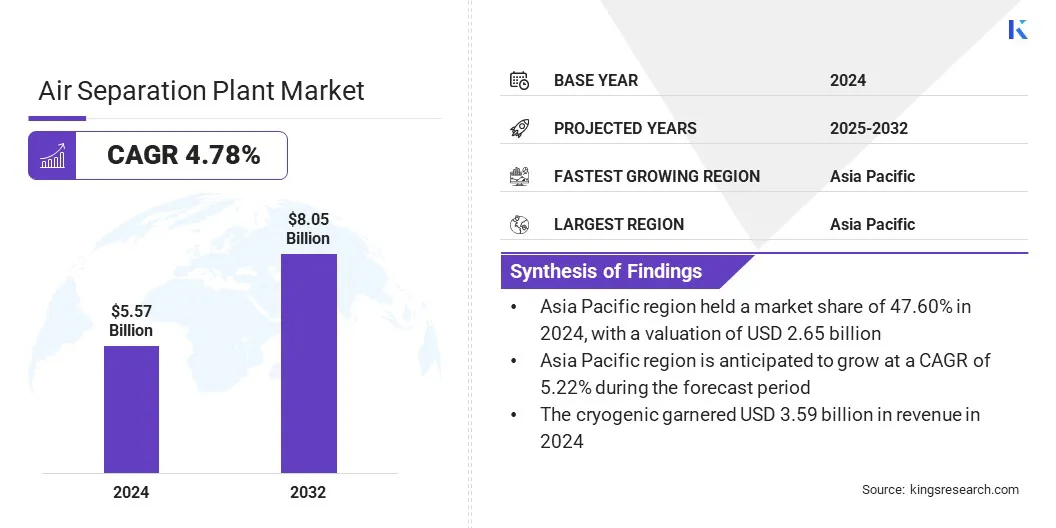

The global air separation plant market size was valued at USD 5.57 billion in 2024 and is projected to grow from USD 5.81 billion in 2025 to USD 8.05 billion by 2032, exhibiting a CAGR of 4.78% during the forecast period.

The market is growing due to a high demand from the iron and steel industry and rising preference for high-purity rare gases, including argon, neon, krypton, and xenon, in electronics, semiconductors, and specialized manufacturing applications.

Key Market Highlights:

- The air separation plant industry size was recorded at USD 5.57 billion in 2024.

- The market is projected to grow at a CAGR of 4.78% from 2025 to 2032.

- Asia Pacific held a market share of 47.60% in 2024, with a valuation of USD 2.65 billion.

- The cryogenic segment garnered USD 3.59 billion in revenue in 2024.

- The oxygen segment is expected to reach USD 4.41 billion by 2032.

- The iron & steel segment is expected to reach USD 2.98 billion by 2032.

- North America is anticipated to grow at a CAGR of 4.67% during the forecast period.

Major companies operating in the air separation plant market are Linde PLC, Air Liquide Engineering & Construction, Air Products and Chemicals, Inc., MITSUBISHI HEAVY INDUSTRIES, LTD., Messer, INOX-Air Products Inc., MATHESON Tri-Gas, Inc., POSCO Holdings Inc., Universal Industrial Gases, LLC, Cryostar, NIKKISO, Sanghi Oxygen, Honeywell International Inc., AIR WATER INC., and Technex.

The increasing use of low-carbon electricity in air separation procedures to reduce carbon footprint is further supporting market growth. Operators are making use of solar and wind power to supply electricity for energy-intensive processes.

This supports sustainability targets and aligns with global emission reduction initiatives. Investments in green energy-powered facilities are expanding, enabling producers to achieve lower operational emissions while maintaining high production efficiency.

- In June 2024, ExxonMobil and Air Liquide agreed to support the production of low-carbon hydrogen and ammonia. The partnership includes the transportation of low-carbon hydrogen through Air Liquide’s pipeline network and the construction of four large modular air separation units to supply oxygen and nitrogen. These units will primarily use low-carbon electricity to reduce the project’s carbon footprint.

Market Driver

Growing Demand from the Iron and Steel Industry

The increasing demand from the iron and steel industry is a major driver of the market. The growth in global steel production, supported by infrastructure projects and industrial development, is creating strong demand for continuous oxygen supply.

Oxygen is a critical input in steel manufacturing, particularly for blast furnace operations and basic oxygen furnaces, where it supports combustion and impurity removal. This rising requirement establishes air separation plants as an essential component in ensuring efficient and large-scale gas production for steelmaking operations.

- In January 2025, INOX Air Products commissioned its largest-ever air separation unit with an installed capacity of 2,150 tons per day at Steel Authority of India’s Bokaro Plant. This is INOXAP’s biggest greenfield oxygen plant and the largest ASU ever installed at any SAIL facility. The unit will supply oxygen, nitrogen, and argon, significantly enhancing INOXAP’s total production capacity to over 6,300 tons per day across all gases.

Market Challenge

High Capital Investment Limiting New Installations

A major challenge in the air separation plant market is the substantial capital investment required for setting up and maintaining these facilities. Building large-scale cryogenic units involves significant costs for equipment, land, and advanced safety systems, which restricts new entrants and makes expansion difficult.

This financial burden slows capacity addition and impacts overall market growth. To overcome this challenge, companies are focusing on modular plant designs, leasing options, and strategic partnerships to share investment costs. Businesses are also adopting build-own-operate models to reduce upfront expenses and ensure long-term returns.

Market Trend

Shift Toward High-Purity Rare Gas Production

The market is witnessing a notable shift toward high-purity rare gas production. Gases such as argon, neon, krypton, and xenon are increasingly used in advanced electronics, semiconductor manufacturing, and lighting applications.

These gases support critical processes that demand ultra-high purity levels. This trend is driving plant operators to adopt advanced cryogenic separation technologies and invest in specialized systems for precise extraction and purification of these rare gases.

- In August 2024, POSCO Holdings and Zhongtai Cryogenic Technology launched POSCO Zhongtai Air Solution through a joint venture to enter the high-purity rare gas production business. The company plans to build a rare gas production plant on a 39,000㎡ site in Gwangyang, with commercial production scheduled to start in Q4 2025. The facility will produce high-purity neon, xenon, and krypton for semiconductor companies, aiming to localize supply and strengthen the rare gas value chain.

Air Separation Plant Market Report Snapshot

|

Segmentation

|

Details

|

|

By Process

|

Cryogenic, Non-cryogenic

|

|

By Gas

|

Oxygen, Nitrogen, Argon, Others

|

|

By End-use Industry

|

Iron & Steel, Oil & Gas, Chemical, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Process (Cryogenic, and Non-cryogenic): The cryogenic segment earned USD 3.59 billion in 2024 due to its ability to produce high-purity gases for large-scale industrial applications.

- By Gas (Oxygen, Nitrogen, Argon, and Others): The oxygen segment held 52.40% of the market in 2024, due to its extensive use in steelmaking, chemical processing, and medical applications.

- By End-use Industry (Iron & Steel, Oil & Gas, Chemical, Healthcare, and Others): The iron & steel segment is projected to reach USD 2.98 billion by 2032, owing to rising steel production and growing demand for oxygen in blast furnace operations.

Air Separation Plant Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

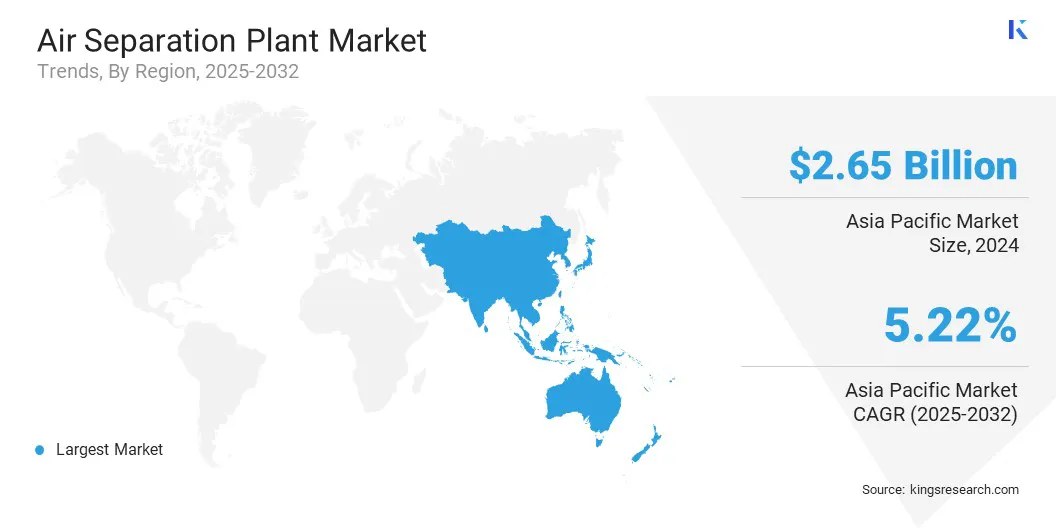

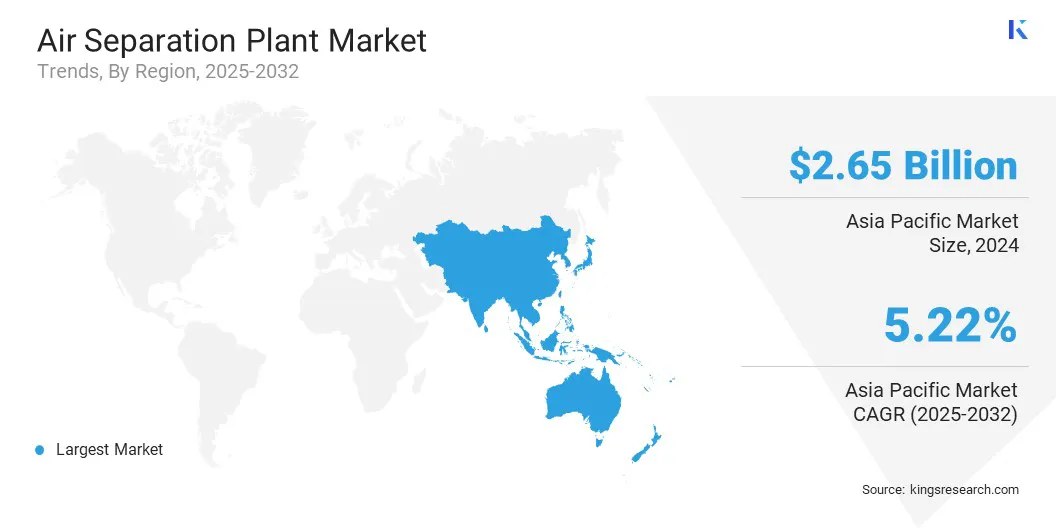

Asia Pacific air separation plant market share stood at 47.60% in 2024, with a valuation of USD 2.65 billion in the global market. The region's dominance can be attributed to a strong demand from the iron and steel industry in China, India, and Japan, driving large-scale consumption of industrial oxygen for steelmaking.

The growing presence of integrated steel plants combined with long-term industrial gas contracts is ensuring consistent capacity utilization. Rapid industrialization and infrastructure development have also accelerated steel production, creating a sustained requirement for high-capacity air separation units in the region.

North America is poised to grow at a CAGR of 4.67% over the forecast period. This growth is driven by new air separation projects and high capital investments by major industrial gas companies to meet rising demand from energy, chemical, and healthcare sectors.

The construction of advanced facilities in the United States and Canada is enhancing production capacity and improving supply chain resilience for critical industrial applications. Global players investing in large-scale projects and strategic partnerships are also accelerating market expansion in the region.

- In August 2025, Linde announced plans to invest USD 100 million in an air separation plant at Brownsville’s North Industrial Park to support SpaceX operations. The facility will produce liquid oxygen and nitrogen for SpaceX’s Starship program, enhancing supply chain efficiency by reducing delivery times and logistics costs. Construction is expected to begin soon, with the plant scheduled to be fully operational by 2026.

Regulatory Frameworks

- In the U.S, Occupational Safety and Health Administration (OSHA) regulates the air separation plants under 29 CFR 1910 Process Safety Management to ensure safe handling of hazardous chemicals.

- In Europe, plants must comply with the Pressure Equipment Directive (PED) 2014/68/EU and the Industrial Emissions Directive for environmental and safety standards.

- In Japan, the High Pressure Gas Safety Institute of Japan (KHK) regulates the air separation plants under the High Pressure Gas Safety Act, which mandates design approvals, inspections, and strict safety measures.

Competitive Landscape

Key players in the air separation plant market are prioritizing capacity expansion and geographic diversification to strengthen their competitive position. Market participants are commissioning new large-scale facilities and modernizing existing plants to enhance operational efficiency and ensure reliable supply.

Strategic investments in high-growth regions are being done through long-term agreements and partnerships, enabling local presence and operational resilience. These initiatives are focused on addressing increasing demand for industrial gases while securing a sustainable foothold in key regional markets.

- In August 2025, Matheson Tri-Gas, Inc., a U.S. operating company of Nippon Sanso Holdings Corporation, announced plans to build, own, and operate a new air separation plant in Las Vegas. The facility, scheduled for completion in 2027, will produce oxygen, nitrogen, and argon to meet growing demand from medical, fabrication, construction, and food processing industries across Nevada, California, Utah, and Arizona. The project aims to strengthen Matheson’s domestic network and enhance its capabilities in liquid and specialty gas supply.

Top Companies in Air Separation Plant Market:

Recent Developments (Agreements/ Investments)

- In June 2025, Linde announced a long-term agreement with Blue Point Number One, a joint venture between CF Industries, JERA, and Mitsui & Co., to supply industrial gases to a low-carbon ammonia facility in Louisiana. Linde will invest more than USD 400 million to build, own, and operate a world-scale air separation unit, which will provide oxygen and nitrogen for the 1.4 million metric tons ammonia plant.

- In May 2024, Air Products announced an investment of over USD 70 million to expand its manufacturing and logistics center in Maryland Heights, Missouri. The expansion, driven by rising demand for biogas, hydrogen recovery, aerospace nitrogen applications, and marine clean fuel solutions, will significantly increase production capacity.