Market Definition

The market encompasses the development, manufacturing, and supply of braking systems that utilize compressed air to generate the necessary force for vehicle deceleration and stopping.

These systems consist of key components such as air compressors, reservoirs, valves, and brake chambers, ensuring efficient braking performance in heavy-duty vehicles. Air brake systems are primarily used in commercial trucks, buses, and railways due to their ability to deliver consistent braking power and withstand high loads.

Advanced formulations, including air disc and drum brakes, enhance durability and safety. Their application extends to freight transportation, construction equipment, and defense vehicles, ensuring operational reliability.

Air Brake System Market Overview

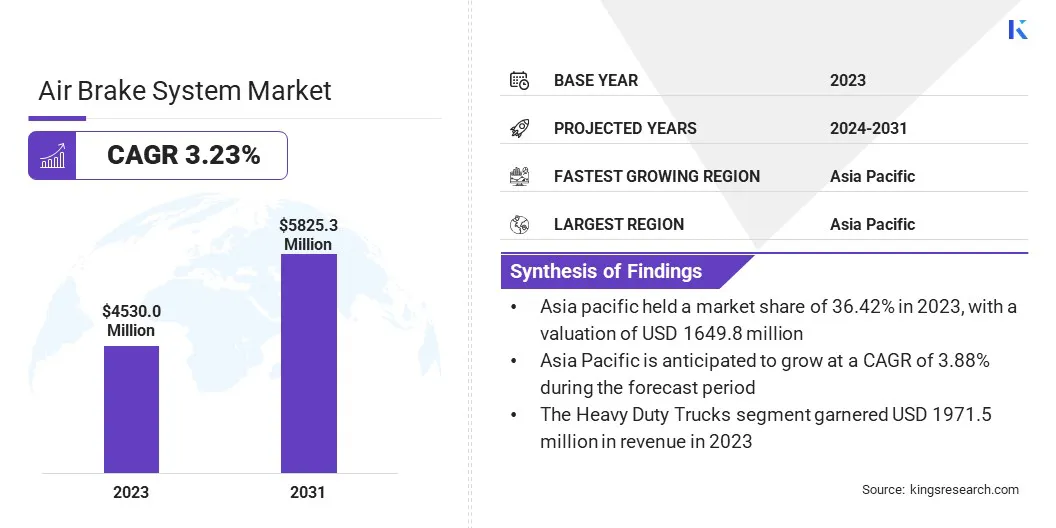

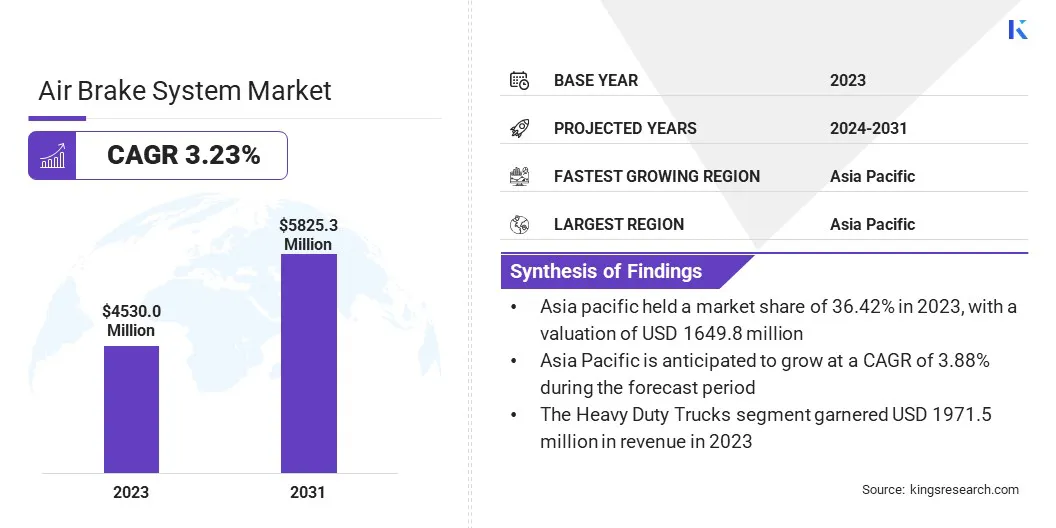

According to Kings Research, the global air brake system market size was valued at USD 4,530.0 million in 2023 and is projected to grow from USD 4,661.8 million in 2024 to USD 5,825.3 million by 2031, exhibiting a CAGR of 3.23% during the forecast period.

This growth is driven by the growing adoption of commercial vehicles, particularly in logistics and transportation, where reliable braking performance is essential for safety and efficiency.

Additionally, stringent government regulations mandating advanced braking technologies to enhance road safety are accelerating market growth. The increasing preference for air disc brakes for their superior stopping power and lower maintenance is further fueling market expansion.

Key Market Highlights:

- The air brake system industry size was recorded at USD 4,530.0 million in 2023.

- The market is projected to grow at a CAGR of 3.23% from 2024 to 2031.

- Asia Pacific held a share of 36.42% in 2023, valued at USD 1,649.8 million.

- The brake chambers and slack adjusters segment garnered USD 1,588.0 million in revenue in 2023.

- The heavy-duty trucks segment is expected to reach USD 2,656.5 million by 2031.

- The Air Drum Brakes segment secured the largest revenue share of 58.79% in 2023.

- North America is anticipated to grow at a CAGR of 2.82% over the forecast period.

Major companies operating in the air brake system market are Wabtec Corporation, New York Air Brake LLC, Haldex, Cummins Inc., TSE Brakes, In, ZF Friedrichshafen AG, Hendrickson Holdings, L.L.C., AKEBONO BRAKE INDUSTRY CO., LTD., Brembo N.V., SORL Auto Parts, Inc., Knorr-Bremse AG, Bendix Commercial Vehicle Systems LLC, and others.

The shift toward air disc brakes is boosting market expansion. Fleet owners are investing in advanced braking technologies that offer improved heat dissipation, reduced brake fade, and enhanced stopping power.

Air disc brakes provide shorter braking distances and lower maintenance costs, making them a preferred choice for commercial vehicles. Growing awareness of performance advantages and regulatory support for efficient braking systems are accelerating this transition.

Manufacturers are focusing on product innovations to enhance the durability and reliability of air disc brakes, ensuring long-term operational efficiency. For instance, WABCO offers the PAN series of Air Disc Brakes (ADB) for commercial vehicles, enhancing braking performance while significantly reducing weight.

These brakes utilize patented single-piston technology with an optimized design, lowering the weight by up to 25 kg per wheel for heavy-duty vehicles. To support Indian original equipment manufacturers (OEMs) in expanding air disc brake adoption across their vehicle models, WABCO India has localized ADB production, ensuring cost competitiveness in the market.

Expansion of Public Transportation Networks

Urbanization and population growth are driving investments in public transport infrastructure, positively impacting the air brake systems market. Governments are expanding bus fleets and metro networks to address urban mobility challenges, increasing the demand for efficient and high-performance braking systems.

Air brakes are widely used in city buses and rapid transit vehicles for their ability in stop-and-go operations. The focus on passenger safety and transport efficiency is prompting manufacturers to develop air brake systems with enhanced reliability. Additionally, smart city projects and sustainable mobility initiatives are boosting regional market growth.

- According to the American Public Transport Association's 2023 report, the percentage of accessible buses rose from 93% to 99.9% between 2003 and 2023. Commuter rail accessibility increased from 68% to 82%, light rail from 82% to 92%, and trolleybus achieved full accessibility, rising from 70% to 100% over the same period.

High Initial Costs and Complex Installation

The high initial costs and complex installation of air brake systems pose a significant challenge to market growth, particularly for small and medium-sized fleet operators. Advanced components and technology lead to higher upfront investments than conventional braking solutions.

To address this challenge, companies are adopting cost-effective manufacturing, localizing production, and offering financing options. Additionally, advancements in modular air brake systems are simplifying installation, reducing downtime, and enhancing accessibility, supporting market expansion.

Growing Electrification of Commercial Vehicles

The transition to electric commercial vehicles is emerging as a notable trend in the air brake systems market. The expansion of electric trucks and buses leads to the rising demand for braking solutions compatible with electrified drivetrains while maintaining high performance.

Manufacturers are developing regenerative braking-compatible air brake systems to optimize energy recovery and braking efficiency. Government incentives promoting zero-emission transportation are accelerating electric vehicle adoption, increasing demand for specialized air brake solutions.

Additionally, investments in electric mobility infrastructure are prompting commercial fleet operators to incorporate advanced braking technologies, supporting market expansion and the advancement of sustainable transportation.

- In December 2024, Karsan revealed plans to launch Sweden’s first Level-4 autonomous bus for passenger service in Gothenburg by August 2025. The Karsan Autonomous e-ATAK will operate between Gothenburg’s Central Station and Liseberg Station, improving transit efficiency in the Gårda region. As the only Level-4 autonomous bus designed for ticketed passengers in open traffic, it will be incorporated into Sweden’s public transport system in partnership with Västtrafik, Vy Buss, ADASTEC, and Applied Autonomy.

Air Brake System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Air Compressors, Hoses and Fittings, Valves, Brake Chambers and Slack Adjusters, Others

|

|

By Vehicle Type

|

Heavy-Duty Trucks, Bus, Trailers and Semi-Trailers

|

|

By Brake Type

|

Air Disc Brakes, Air Drum Brakes

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Air Compressors, Hoses and Fittings, Valves, Brake Chambers and Slack Adjusters, and Others): The brake chambers and slack segment earned USD 1,588.0 million in 2023 due to its critical role in ensuring precise braking force distribution, enhancing vehicle safety, and meeting stringent regulatory requirements for commercial vehicle braking performance.

- By Vehicle Type (Heavy-Duty Trucks, Bus, Trailers and Semi-Trailers): The heavy-duty trucks segment held a share of 43.52% in 2023, primarily fueled by the increasing demand for robust braking solutions in freight transportation, supported by the expansion of logistics, construction, and mining industries requiring enhanced safety, load-carrying capacity, and regulatory compliance.

- By Brake Type (Air Disc Brakes and Air Drum Brakes): The air drum brakes segment is projected to reach USD 3,400.2 million by 2031, owing to its cost-effectiveness, durability, and widespread adoption in heavy-duty commercial vehicles requiring high braking force and low maintenance for long-haul operations.

Air Brake System Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific air brake system market captured a share of around 36.42% in 2023, valued at USD 1,649.8 million. Governments across Asia Pacific are investing in modernizing public transportation systems, creating a robust demand for efficient braking solutions in buses and mass transit vehicles. Countries such as China, India, and Japan are expanding rail networks and bus rapid transit (BRT) systems, supporting regional market growth.

- In June 2024, China's Ministry announced a USD 10 million initiative to develop the Pan-Asia Central Railway, connecting Malaysia to China via Thailand and Laos, with an extension to Singapore. The project aims to link Kunming in southern China to Singapore, enhancing regional connectivity.

Smart city initiatives are prompting fleet operators to upgrade to advanced braking technologies for improved safety and efficiency. Manufacturers are responding by developing region-specific air brake solutions that meet the evolving needs of urban mobility. Additionally, the rapid growth of the logistics and e-commerce industries in Asia Pacific is fueling demand for commercial vehicles equipped with efficient braking systems.

The rise in online shopping, coupled with last-mile delivery services, has led to an increase in the deployment of trucks and trailers for freight transportation. Countries such as China, India, and Southeast Asian nations are witnessing significant investments in logistics infrastructure, leading to higher fleet expansion. To ensure safe and reliable transportation, fleet operators are adopting advanced air brake systems, reinforcing regional market growth.

North America air brake system industry is set to grow at a CAGR of 2.82% over the forecast period. The growing freight and logistics industry in North America is generating a strong demand for advanced air brake systems in heavy-duty trucks and trailers. The rise in e-commerce and cross-border trade between the U.S., Canada, and Mexico has increased the need for efficient braking solutions in long-haul transportation.

Fleet operators are adopting air brake systems to ensure compliance with safety regulations and enhance vehicle reliability. Additionally, the expansion of distribution centers and last-mile delivery networks is accelerating the deployment of commercial vehicles equipped with high-performance braking technologies.

Furthermore, regulatory bodies in North America, including the National Highway Traffic Safety Administration (NHTSA) and Transport Canada, have implemented strict braking regulations for commercial vehicles. Mandates for advanced braking technologies such as anti-lock braking systems (ABS) and electronic stability control (ESC) are boosting the adoption of air brake systems.

The U.S. Federal Motor Carrier Safety Administration (FMCSA) has set rigorous safety compliance measures, compelling fleet operators to upgrade their braking systems. These regulations are reinforcing fostering demand for technologically advanced and regulatory-compliant air brake solutions across the region.

Regulatory Frameworks

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) enforces Federal Motor Vehicle Safety Standard (FMVSS) No. 121, which establishes performance and equipment requirements for air brake systems in trucks, buses, and trailers to ensure safety under various conditions.

- In Europe, the European Union mandates advanced braking systems for commercial vehicles, including Advanced Emergency Braking Systems (AEBS), as outlined in specific EU directives and regulations aimed at enhancing road safety..

- China's Ministry of Industry and Information Technology (MIIT) enforces national standards for vehicle braking systems, mandating specific requirements for air brake systems in commercial vehicles to enhance road safety.

- In Japan, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) regulates braking system standards, imposing stringent requirements for air brake systems in commercial vehicles to ensure reliability and road safety.

Competitive Landscape

The air brake system market is characterized by a number of participants, including both established corporations and rising organizations. Market players are implementing strategies focused on investments and the expansion of production capacity, strengthening their market position.

Companies are allocating resources to establish new manufacturing facilities and upgrade existing production lines to meet rising demand. Strategic investments in advanced technologies enhance operational efficiency and ensure compliance with evolving regulatory standards.

Additionally, firms are expanding their geographical footprint to tap into emerging markets and cater to a growing customer base, boosting production output and improving supply chain resilience.

- In October 2024, Cummins Inc. committed over USD 190 million to enhance production capacity for air disc brakes (ADBs) and rear axles. Driven by rising demand for advanced braking solutions in commercial vehicles, the initiative includes facility upgrades in North America and the UK, enhancing innovation and efficiency to strengthen market presence.

Key Companies in Air Brake System Market:

- Wabtec Corporation

- New York Air Brake LLC

- Haldex

- Cummins Inc.

- TSE Brakes, In

- ZF Friedrichshafen AG

- Hendrickson Holdings, L.L.C.

- AKEBONO BRAKE INDUSTRY CO., LTD.

- Brembo N.V.

- SORL Auto Parts, Inc.

- Knorr-Bremse AG

- Bendix Commercial Vehicle Systems LLC

Recent Developments (Agreements/ Product Launch)

- In January 2024, Wabtec Corporation secured a USD 157 million contract to provide brake systems for Siemens India, supporting the 9,000-horsepower (HP) locomotive project for Indian Railways. The initiative aims to enhance operational performance, efficiency, and safety by integrating advanced braking technology into a new fleet of 1,200 electric locomotives.

- In October 2024, Haldex launched its Heavy Duty (HD) specification for its brake adjuster range. This enhanced version of the automatic brake adjuster is designed to meet the increased demands of modern braking components and transmissions, ensuring improved durability and performance..