AI in Manufacturing Market Snapshot

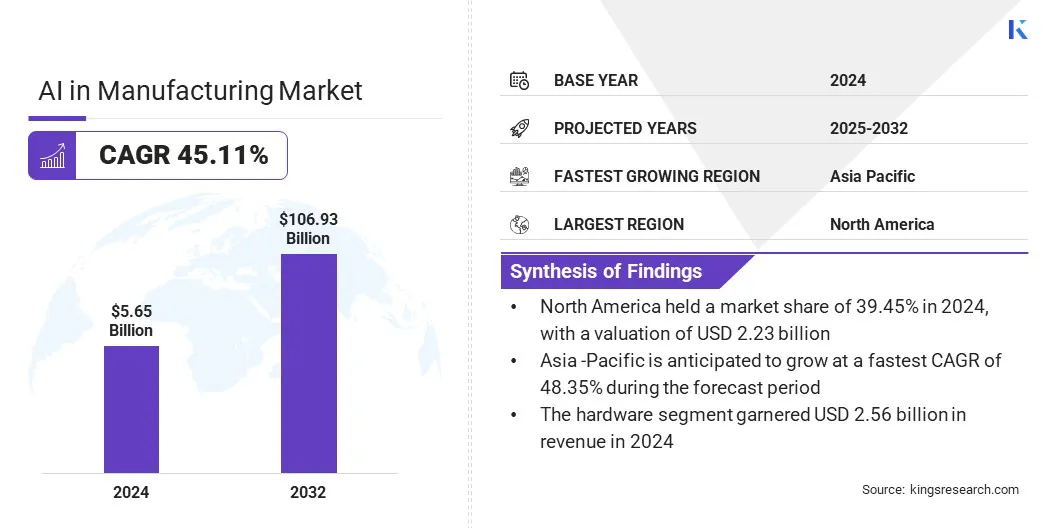

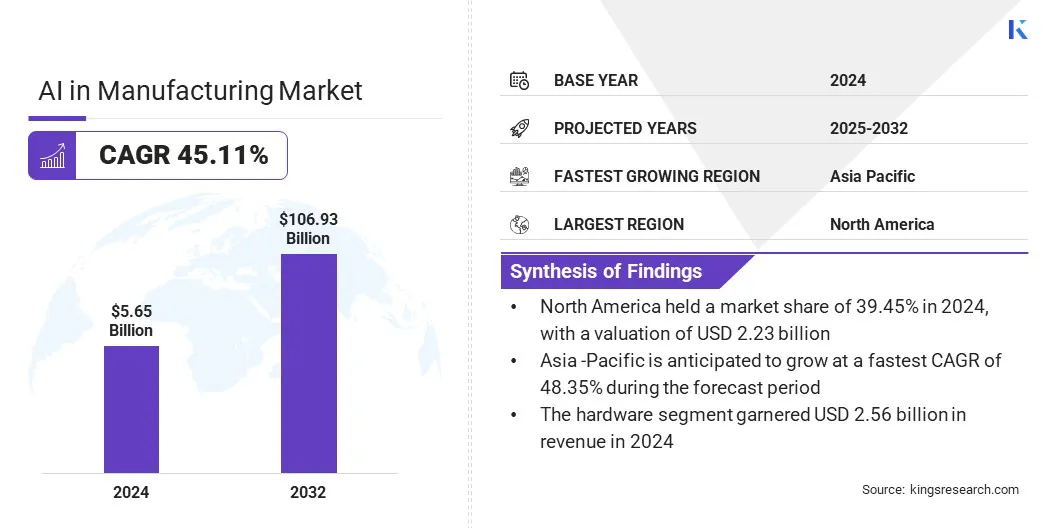

The global AI in manufacturing market size was valued at USD 5.65 billion in 2024 and is projected to grow from USD 7.89 billion in 2025 to USD 106.93 billion by 2032, exhibiting a CAGR of 45.11% during the forecast period. The market growth is attributed to the increasing focus on AI-driven quality control solutions that improve inspection accuracy and minimize defect rates in high-speed production lines.

The market is further progressing as companies adopt integrated quality management platforms that provide real-time insights, streamline corrective actions, and support data-driven continuous improvement across operations.

Key Highlights:

- The global market size was valued at USD 5.65 billion in 2024.

- The market is projected to grow at a CAGR of 45.11% from 2025 to 2032.

- North America held a market share of 39.45% in 2024, with a valuation of USD 2.23 billion.

- The hardware segment garnered USD 2.56 billion in revenue in 2024.

- The computer vision segment is expected to reach USD 48.88 billion by 2032.

- The production planning segment is anticipated to grow at a CAGR of 48.87% over the forecast period.

- The automotive segment held a market share of 34.33% in 2024.

- The market in Asia Pacific is anticipated to grow at a CAGR of 48.35% through the forecast period.

Major companies operating in the AI in manufacturing industry are IBM, NVIDIA Corporation, Siemens, Rockwell Automation, General Electric Company, Intel Corporation, Google LLC, Mitsubishi Electric Corporation, SAP SE, Amazon Web Services, Inc, Microsoft, Cisco Systems, Inc, Sight Machine, Oracle, and Bosch GmbH.

AI in Manufacturing Market Overview

The global market is registering growth as manufacturers increasingly adopt AI-powered quality control systems that provide real-time insights and adaptive feedback to improve production accuracy and efficiency.

This shift toward intelligent quality assurance is strengthening manufacturing competitiveness and accelerating the broader adoption of AI across industrial production lines.

- In May 2025, Hexion launched SmartQuality, an AI-powered platform developed by its Smartech division to enhance real-time quality control in wood panel manufacturing. SmartQuality can increase line speed by up to 3% and reduce raw material usage by delivering continuous and adaptive insights. The platform reflects the growing adoption of AI for intelligent process optimization and advanced quality assurance in manufacturing environments.

Market Driver

Integrated AI Platforms Driving Industrial Efficiency

The AI in manufacturing market is registering growth as manufacturers are increasingly adopting integrated AI platforms that combine advanced computing, digital twin, and automation technologies to streamline factory operations.

These systems enable real-time data analysis, improve decision-making, and enhance collaboration across the production lifecycle. Manufacturers are improving efficiency, reducing waste, and accelerating innovation in manufacturing processes by embedding AI into product design, execution, and performance monitoring.

This shift toward intelligent and connected manufacturing environments is supporting the broader digital transformation and driving the demand for industrial AI solutions.

- In June 2025, Siemens and NVIDIA expanded their partnership to accelerate AI adoption in manufacturing and enable the next generation of AI-powered factories. The collaboration integrates NVIDIA’s accelerated computing and AI capabilities with the Siemens Xcelerator platform, supporting manufacturers in improving efficiency, quality, and real-time decision-making. By combining digital twin technology, generative AI, and industrial automation, the partnership empowers global manufacturers to drive digital transformation, enhance collaboration, and achieve greater productivity & sustainability across factory operations.

Market Challenge

High Costs of AI Deployment

High implementation costs are limiting the adoption of AI in manufacturing among small and medium enterprises. Deploying AI requires investment in infrastructure, software integration, and skilled personnel.

Firms face additional expenses related to training, data preparation, and system customization, which further increase the total cost of ownership and slow the scaling of AI solutions across manufacturing operations. These financial demands can delay decision-making and restrict AI deployment to pilot projects.

Companies are turning to scalable AI platforms and cloud-based solutions that help reduce initial infrastructure costs by offering flexible deployment models and eliminating the need for expensive on-premise systems. They are collaborating with technology providers to access ready-to-use models and tools that simplify implementation, reduce development time, and ensure compatibility with existing manufacturing environments.

Additionally, manufacturers are investing in workforce training to build internal expertise and support long-term adoption by equipping employees with the skills needed to operate and adapt AI systems.

Market Trend

Edge AI Transforming Manufacturing Operations

The expansion of edge AI reflects a broader move toward decentralized and real-time intelligence in manufacturing operations. By processing data directly at the point of generation, edge AI enables immediate response to operational changes without relying on cloud connectivity.

This allows manufacturers to detect issues, make adjustments, and maintain consistent output with minimal delay. Companies are adopting edge AI to improve equipment uptime, ensure process stability, and reduce latency in fast-paced environments.

This shift also supports localized decision-making that strengthens overall efficiency and operational resilience by enabling faster on-site responses and reducing dependency on centralized systems.

- In February 2024, GE Vernova launched Proficy for Sustainability Insights, an AI-based software solution aimed at helping industrial manufacturers achieve sustainability and operational goals. The platform integrates operational and environmental data to optimize resource utilization, monitor utility consumption, and support regulatory compliance. The solution enables real-time analytics, supports SCADA integration, and helps manufacturers reduce costs while advancing climate and efficiency objectives.

AI in Manufacturing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Technology

|

Computer Vision, Machine Learning, Natural Language Processing, Context Awareness

|

|

By Application

|

Production Planning, Predictive Maintenance & Machinery Inspection, Logistics and Inventory Management, Quality Management, Others

|

|

By End-Use Industry

|

Automotive, Semiconductor & Electronics, Pharmaceuticals & Biotechnology, Energy & Power, Heavy Metals & Machinery, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Hardware, Software and Services): The hardware segment earned USD 2.56 billion in 2024, due to the rising adoption of AI-enabled sensors, edge devices, and robotics for automated manufacturing operations.

- By Technology (Computer Vision, Machine Learning, Natural Language Processing, and Context Awareness): The machine learning segment held 40.23% of the market in 2024, due to its critical role in predictive analytics, anomaly detection and process optimization across factory settings.

- By Application (Production Planning, Predictive Maintenance & Machinery Inspection, Logistics and Inventory Management, and Quality Management): The predictive maintenance & machinery inspection segment is projected to reach USD 48.23 billion by 2032, owing to the increasing demand for minimizing equipment downtime and extending asset life using AI-based monitoring tools.

- By End-Use Industry (Automotive, Semiconductor & Electronics, Pharmaceuticals & Biotechnology, Energy & Power and Others): The semiconductor & electronics segment is anticipated to grow at a CAGR of 48.73% over the forecast period, due to rapid digitalization and need for precision-driven manufacturing supported by AI solutions.

AI in Manufacturing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 39.45% share of the AI in manufacturing market in 2024, with a valuation of USD 2.23 billion. This market dominance is attributed to the early adoption of advanced automation technologies and strong investment in digital transformation across the region.

Key players are enhancing their operational efficiency by embedding intelligent systems into existing workflows and driving continuous innovation across factories. Additionally, the market is registering steady growth as firms increasingly deploy AI solutions for real-time quality monitoring and issue resolution across supply chains.

Companies are adopting AI-powered platforms with integrated quality management capabilities, helping manufacturers reduce operational costs while improving product reliability and supporting the expansion of the regional market.

- In February 2025, ServiceNow acquired the Quality 360 solution from Advania to expand its AI-powered manufacturing capabilities. Built natively on the ServiceNow platform, Quality 360 enables manufacturers to proactively identify and resolve quality issues across production and service delivery. The acquisition enhances ServiceNow’s Manufacturing Commercial Operations solution, helping reduce operational costs and reputational risks through AI-driven root cause analysis, issue detection, and structured resolution frameworks.

The AI in manufacturing industry in Asia Pacific is set to grow at a robust CAGR of 48.35% over the forecast period. This growth is attributed to rising investments in automation infrastructure and the increasing adoption of intelligent technologies across the region.

Countries in Asia Pacific are actively promoting the integration of AI with robotics and virtual reality to enhance production capabilities. The market is also benefiting from the expansion of regional centers that allow manufacturers to test and adopt advanced solutions within realistic industrial settings.

The region is witnessing a steady increase in digital transformation initiatives, driven by the manufacturing sector’s growing contribution to national economies as governments and industries collaborate to modernize production systems and enhance global competitiveness.

Key market players are also prioritizing workforce development and skill enhancement to support AI deployment across operations, further contributing to the regional market growth.

- In March 2024, Rockwell Automation launched a new Customer Experience Centre (CEC) in Singapore to advance the adoption of AI, robotics, and virtual reality in smart manufacturing across Southeast Asia. The center showcases cutting-edge technologies and supports customer education, helping manufacturers visualize and implement intelligent production solutions.

Regulatory Frameworks

- In the U.S., the National Institute of Standards and Technology (NIST) oversees the development of standards and best practices for AI integration in manufacturing. It ensures that AI systems are secure, transparent, and interoperable across industrial sectors.

- In China, the Ministry of Industry and Information Technology (MIIT) regulates AI adoption across China's industrial sectors, including manufacturing. MIIT also monitors data usage, cybersecurity compliance, and ethical deployment of AI systems within the intelligent manufacturing ecosystem.

- In India, the Ministry of Electronics and Information Technology (MeitY) oversees AI policy formulation and encourages AI integration in sectors like manufacturing through innovation hubs and regulatory frameworks. It ensures that AI is deployed ethically, data is protected, and domestic industries benefit from AI adoption while aligning with national digital transformation goals.

Competitive Landscape

Major players in the AI in manufacturing market are expanding their capabilities by integrating simulation tools with intelligent computing technologies. They are enhancing product development through smart engineering platforms that support faster prototyping and real-time process optimization.

By embedding AI into design workflows, firms are enabling predictive insights that help manufacturers reduce errors and improve overall performance. These strategies are allowing production teams to respond more efficiently to complex demands and accelerate innovation across diverse manufacturing environments.

- In March 2025, Siemens acquired Altair Engineering for USD 10 billion to expand its AI and simulation capabilities within the manufacturing sector. This strategic acquisition integrates Altair’s expertise in mechanical simulation, high-performance computing, and industrial AI into Siemens' Xcelerator platform. The move enables Siemens to offer the world’s most comprehensive AI-powered design, engineering, and simulation portfolio. It supports manufacturers in accelerating product development, optimizing system performance, and driving innovation at scale through intelligent, simulation-driven workflows.

Key Companies in AI in Manufacturing Market:

- IBM

- NVIDIA Corporation

- Siemens

- Rockwell Automation

- General Electric Company

- Intel Corporation

- Google LLC

- Mitsubishi Electric Corporation

- SAP SE

- Amazon Web Services, Inc

- Microsoft

- Cisco Systems, Inc

- Sight Machine

- Oracle

- Bosch GmbH.

Recent Developments (Product Launch)

- In June 2025, Mitsubishi Electric developed a domain-specific language model designed for manufacturing applications on edge devices. Branded under its Maisart AI technology the model is pre-trained with internal factory automation data and optimized using proprietary data-augmentation techniques.

- In April 2024, SAP made AI-driven advancements in its supply chain solutions aimed at enhancing productivity, efficiency and precision in manufacturing. The solutions leverage real-time data to optimize decision-making, streamline product development, and improve operational resilience.