Market Definition

The market focuses on the development, manufacturing, and distribution of devices used to deliver medications, substances, or particles in aerosol form to the respiratory system.

These devices are commonly used for treating respiratory conditions such as asthma, chronic obstructive pulmonary disease (COPD), and other lung diseases. The report entails major factors driving the market along with key trends and regulatory implications posed to dictate the growth rate over the forecast period.

Aerosol Delivery Devices Market Overview

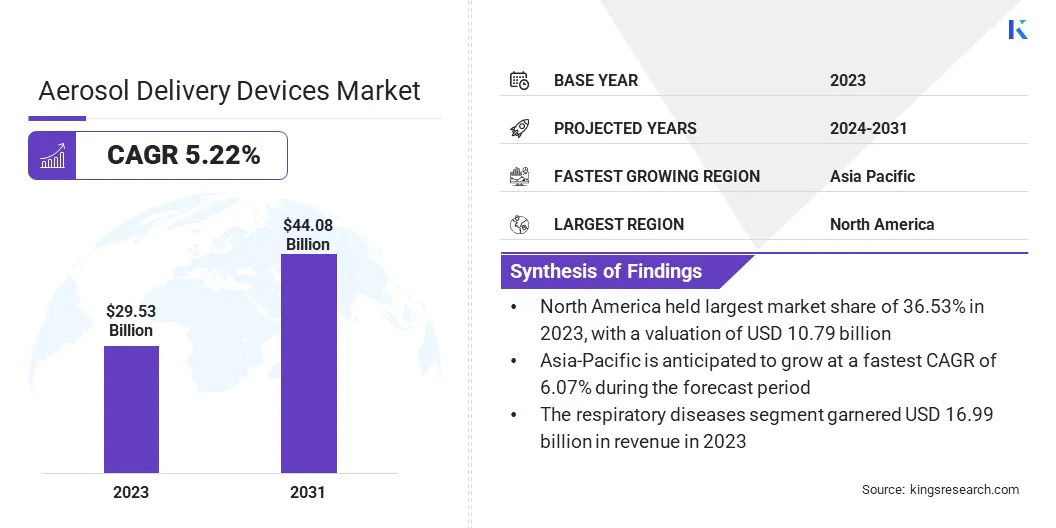

The global aerosol delivery devices market size was valued at USD 29.53 billion in 2023 and is projected to grow from USD 30.88 billion in 2024 to USD 44.08 billion by 2031, exhibiting a CAGR of 5.22% during the forecast period.

This growth is attributed to the increasing prevalence of respiratory diseases, advancements in aerosol devices, and the rise of more efficient and portable drug delivery systems. The expanding healthcare infrastructure in emerging markets and the growing focus on personalized medicine are expected to further drive the market.

Major companies operating in the aerosol delivery devices industry are AptarGroup, Inc., Aerogen Ltd, PARI Respiratory Equipment, Inc., Koninklijke Philips N.V., GSK plc., Teva Pharmaceutical Industries Ltd., AstraZeneca, Novartis AG, AirLife, INSTRUMENTATION INDUSTRIES, INC., Vectura Group Ltd, Flexicare (Group) Limited, Beurer GmbH, Pfizer Inc., and Catalent, Inc.

Regulatory developments are also influencing the market as various regions introduce new standards to ensure the safety and effectiveness of aerosol delivery devices. Furthermore, the market is shifting to non-invasive treatments and home-based healthcare, which is expected to contribute to the adoption of aerosol delivery devices.

- In July 2023, Viatris Inc., in collaboration with Kindeva Drug Delivery, announced the U.S. launch of Breyna (budesonide and formoterol fumarate dihydrate) Inhalation Aerosol, marking the first FDA-approved generic alternative to Symbicort.

Key Highlights

- The aerosol delivery devices industry size was recorded at USD 29.53 billion in 2023.

- The market is projected to grow at a CAGR of 5.22% from 2024 to 2031.

- North America held a market share of 36.53% in 2023, with a valuation of USD 10.79 billion.

- The metered dose inhalers (MDIs) segment garnered USD 14.06 billion in revenue in 2023.

- The respiratory diseases segment is expected to reach USD 23.71 billion by 2031.

- The online stores segment is anticipated to witness the fastest growth at a CAGR of 6.40% during the forecast period

- The Asia Pacific market is anticipated to grow at a CAGR of 6.07% during the forecast period.

Market Driver

"Advancements in Aerosol Delivery Technology"

Advancements in aerosol delivery technology are enhancing drug administration, patient adherence, and treatment outcomes. Smart inhalers with Bluetooth connectivity enable real-time tracking, while fine-particle and nanoparticle formulations improve lung deposition.

Ultrasonic and mesh nebulizers offer quieter operation and shorter treatment times, and breath-actuated inhalers optimize drug release, reducing medication wastage. Furthermore, to address environmental concerns, manufacturers are transitioning to eco-friendly propellants, replacing traditional hydrofluoroalkane (HFA) propellants with sustainable alternatives.

Additionally, the shift to eco-friendly propellants addresses environmental concerns, and 3D printing allows for personalized inhaler designs. These innovations drive market growth by improving efficiency, convenience, and treatment precision.

- In February 2025, Pneuma Respiratory introduced a novel aerosol generation technology that enhances the efficiency of medication delivery to the lungs.

Market Challenge

"Device Misuse and Patient Compliance"

Device misuse and patient compliance issues remain significant challenges in the aerosol delivery devices market, as many patients struggle with proper inhaler techniques, leading to inconsistent drug delivery and reduced treatment effectiveness.

Misuse of aerosol delivery devices is a common issue that can significantly impact treatment efficacy. Patients often struggle with proper inhaler technique, leading to inadequate medication delivery to the lungs.

Patient non-compliance, whether due to forgetfulness, misinterpretation of instructions, or reluctance to use the device as prescribed, further impairs treatment outcomes.

Incorrect inhalation timing, inadequate breath coordination, and failure to shake or prime the device can result in poor disease management. Lack of patient education and limited access to healthcare support further exacerbate these issues.

To address these issues, manufacturers are integrating digital features like dose tracking, usage reminders, and audio-visual guidance in smart inhalers. Comprehensive training programs and instructional materials can help patients understand proper inhaler techniques, reducing errors in drug administration.

Expanding telemedicine services and mobile health applications can help patients by providing remote assistance and instructional demonstrations. Healthcare providers play a key role in monitoring patient progress and offering personalized guidance during follow-ups.

Market Trend

"Shift Toward Eco-Friendly Propellants"

The shift toward eco-friendly propellants in aerosol delivery devices is driven by growing environmental concerns and regulatory pressures to reduce greenhouse gas emissions. Traditional inhalers use hydrofluoroalkane (HFA) propellants, which contribute to global warming.

In response, manufacturers are developing inhalers with lower-carbon or propellant-free alternatives, such as dry powder inhalers (DPIs) and soft mist inhalers (SMIs).

Regulatory bodies, such as the U.S. FDA and the European Medicines Agency (EPA), are encouraging the adoption of sustainable inhaler technologies. Pharmaceutical companies are investing in research to develop next-generation propellants with minimal environmental impact while maintaining drug efficacy.

- In March 2025, Aerogen, an Irish leader in aerosol drug delivery, announced its India headquarters in New Delhi. The expansion aims to improve respiratory care, particularly for the 55 million Indians with COPD, by introducing its advanced vibrating mesh nebulizer technology.

Aerosol Delivery Devices Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Metered Dose Inhalers (MDIs), Dry Powder Inhalers (DPIs), Nebulizers

|

|

By Application

|

Respiratory Diseases, Non-Respiratory Diseases

|

|

By Distribution Channel

|

Retail Pharmacies, Hospital Pharmacies, Online Stores

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Metered Dose Inhalers (MDIs), Dry Powder Inhalers (DPIs), Nebulizers): The metered dose inhalers (MDIs) segment earned USD 14.06 billion in 2023 due to their widespread use, ease of operation, and effectiveness in managing respiratory diseases.

- By Application (Respiratory Diseases, Non-Respiratory Diseases): The respiratory diseases segment held 57.54% of the market in 2023, driven by the high prevalence of asthma, COPD, and other lung conditions, along with increasing adoption of aerosol-based treatments.

- By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Stores): The hospital pharmacies are projected to reach USD 20.48 billion by 2031, driven by the rising number of hospital admissions for respiratory diseases, increasing availability of advanced inhalation therapies, and robust healthcare infrastructure.

Aerosol Delivery Devices Market Regional Analysis

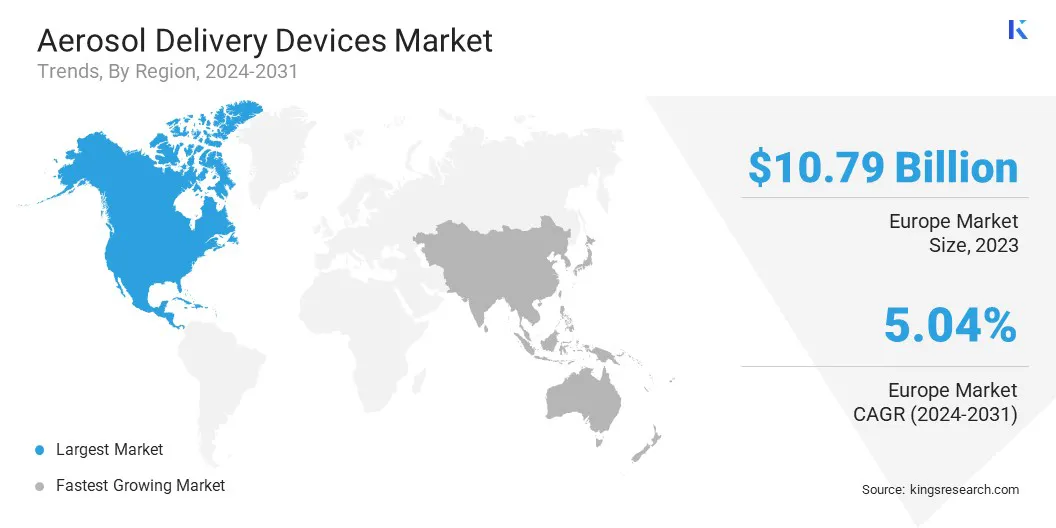

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America aerosol delivery devices market share stood at 36.53% in 2023 in the global market, with a valuation of USD 10.79 billion. This dominance is driven by the high prevalence of respiratory diseases, advanced healthcare infrastructure, and strong adoption of innovative drug delivery technologies.

Favorable reimbursement policies and ongoing research into smart inhalers and eco-friendly propellants further support market growth. The presence of key industry players and increasing demand for home-based respiratory care solutions also contribute to the region’s market expansion.

- In June 2024, Savara Inc's nebulizer solution, molgramostim, achieved statistical significance in both primary and multiple secondary endpoints in the Phase 3 IMPALA-2 clinical trial for autoimmune pulmonary alveolar proteinosis (aPAP).

Asia-Pacific aerosol delivery devices industry is poised for significant growth at a robust CAGR of 6.07% over the forecast period. This market expansion is fueled by rising respiratory disease prevalence, increasing healthcare expenditures, and growing awareness of advanced inhalation therapies.

Rapid urbanization, air pollution, and expanding access to healthcare in emerging economies like China and India further contribute to market demand. Additionally, government initiatives to improve respiratory care and the presence of local manufacturers producing cost-effective devices are fueling market growth in the region.

Regulatory Frameworks

- The U.S. Food and Drug Administration (FDA) has issued the Reviewer Guidance for Nebulizers, Metered Dose Inhalers, Spacers, and Actuators, providing regulatory recommendations for evaluating these aerosol delivery devices. The guidline outlines requirements for performance testing, labeling, and quality standards to ensure the safety, efficacy, and reliability of inhalation products.

- The FDA has also issued the Metered Dose Inhaler (MDI) and Dry Powder Inhaler (DPI) Drug Products – Chemistry, Manufacturing, and Controls Documentation, which provides guidelines for the development, manufacturing, and quality control of inhalation drug products.

- The International Organization for Standardization (ISO) has issued the ISO 20072:2009 , which establishes standardized criteria for the design, performance, and testing of aerosol drug delivery devices

- The European Union (EU) has issued the regulation Medical Device Regulation (MDR) (EU) 2017/745, which establishes stricter requirements for the safety, performance, and post-market surveillance of medical devices

Competitive Landscape

The aerosol delivery devices industry is characterized by the presence of key players focusing on innovation, strategic collaborations, and geographic expansion. Leading companies invest in research and development to introduce advanced inhalation technologies, smart inhalers, and eco-friendly propellants. Mergers, acquisitions, and partnerships with healthcare providers and pharmaceutical firms further strengthen market positioning. Additionally, regulatory approvals and product launches play a crucial role in gaining a competitive edge.

List of Key Companies in Aerosol Delivery Devices Market:

- AptarGroup, Inc.

- Aerogen Ltd

- PARI Respiratory Equipment, Inc.

- Koninklijke Philips N.V.,

- GSK plc.

- Teva Pharmaceutical Industries Ltd.

- AstraZeneca

- Novartis AG

- AirLife

- INSTRUMENTATION INDUSTRIES, INC.

- Vectura Group Ltd

- Flexicare (Group) Limited

- Beurer GmbH

- Pfizer Inc.

- Catalent, Inc

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In December 2024, Intertek Group plc partnered with CrystecPharma to advance formulation science and accelerate the development of dry powder inhaler (DPI) products. The partnership aims to enhance the efficiency and performance of DPI formulations, ultimately speeding up the availability of inhaled therapies for patients.

- In November 2024, Aptar Pharma announced an exclusive partnership with Cambridge Healthcare Innovations (CHI) to commercialize the Quattrii Dry Powder Inhaler (DPI) platform. This collaboration strengthens Aptar Pharma’s respiratory product portfolio by introducing a device designed to efficiently deliver medium to high doses of medication to the lungs.

- In May 2024, Medline Industries, Inc. announced the Hudson RCI TurboMist, a small volume nebulizer that delivers medication 2.5 times faster than standard nebulizers, reducing treatment times to approximately three minutes.

- In November 2023, GSK plc announced the advancement of its low-carbon Ventolin (salbutamol) metered dose inhaler (MDI) to Phase III trials in 2024. The reformulated inhaler, using a next-generation propellant, aims to reduce greenhouse gas emissions by approximately 90%, supporting GSK’s net-zero climate goals.

- In August 2023, Honeywell and Recipharm announced a partnership to accelerate the development of pressurized metered dose inhalers (pMDIs) using Honeywell’s Solstice Air, a propellant with near-zero global warming potential (GWP). Solstice Air reduces GWP by 99.9% compared to conventional hydrofluoroalkanes (HFAs), aiming to minimize the environmental impact of inhalers for respiratory patients.