Market Definition

The market includes cloud-based security solutions that enable centralized, scalable management of physical and logical access to premises and systems. Driven by digital transformation, increasing cybersecurity threats, and the demand for flexible, subscription-based models, the market is growing in commercial, government, healthcare, and education segments.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Access Control as a Service Market Overview

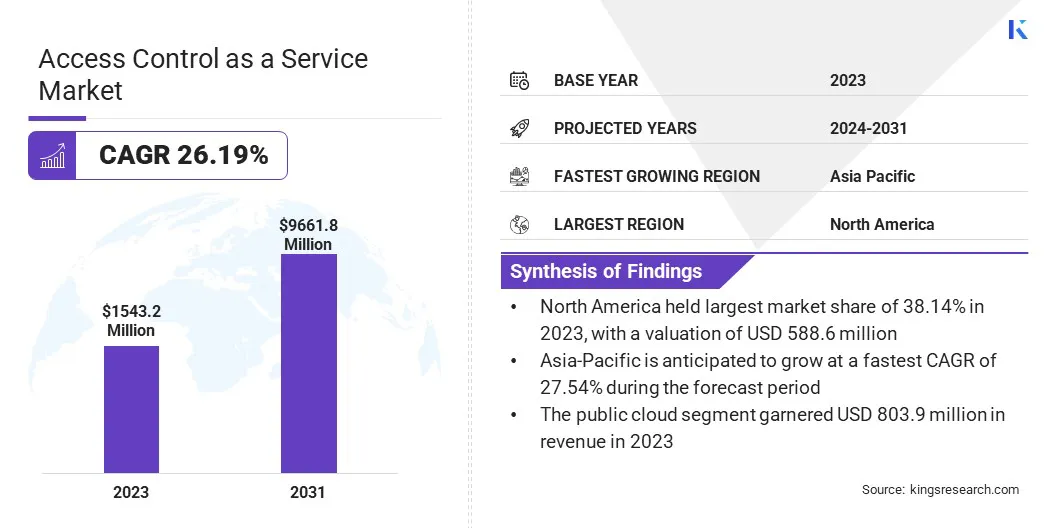

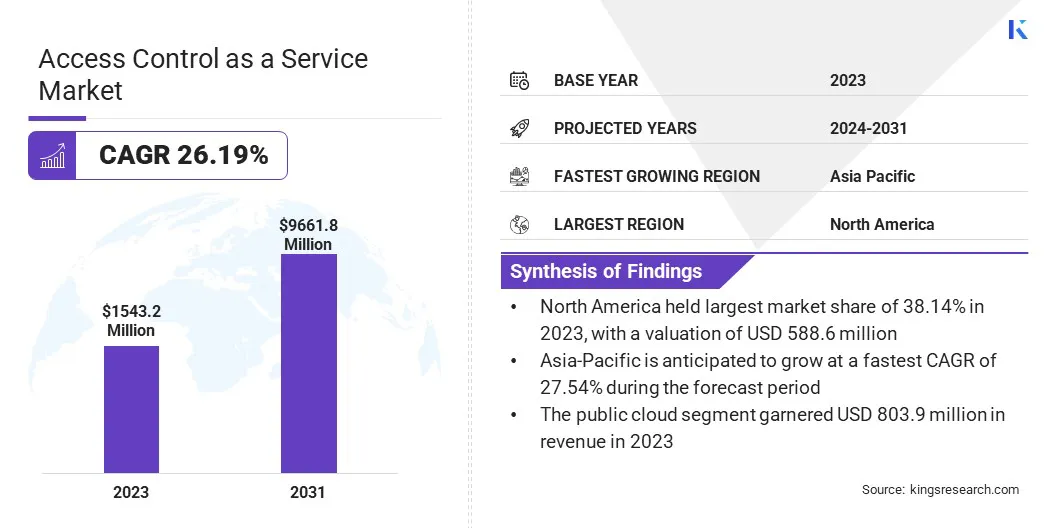

The global access control as a service market size was valued at USD 1543.2 million in 2023 and is projected to grow from USD 1895.7 million in 2024 to USD 9661.8 million by 2031, exhibiting a staggering CAGR of 26.19% over the forecast period.

The market is growing rapidly, driven by rising demand for cloud-based, scalable security solutions, remote access management, and enterprise-wide digital transformation. Organizations seek flexible, cost-efficient systems that align with Zero Trust and hybrid work models.

Major companies operating in the access control as a service industry are Johnson Controls, Honeywell International Inc., Thales, ASSA ABLOY, dormakaba Group, Hirsch Secure, Inc., HID Global Corporation, Kastle, AMAG, Brivo Systems LLC., Cloudastructure Inc, Genetec Inc., Securitas Technology, DataWatch Systems, and Telcred.

The market is growing with the increasing need for remote access management and real-time monitoring. As businesses expand across multiple locations and adopt hybrid work environments, managing access permissions remotely has become critical.

Real-time visibility into access events enhances situational awareness, accelerates incident response, and ensures compliance. These capabilities are essential for protecting assets, maintaining operational continuity, and supporting the agility required in today’s decentralized and digitally driven enterprises.

- In January 2025, Hanwha Vision launched the Wisenet Access Control System, combining intelligent door control and video surveillance. Designed for enterprises of all sizes, it enables real-time monitoring, remote access management, and enhanced situational awareness. Key features include dual-authentication, interlocking doors, event bookmarking, and advanced reporting, ensuring robust, flexible, and scalable access control across diverse environments.

Key Highlights:

- The access control as a service industry size was recorded at USD 1543.2 million in 2023.

- The market is projected to grow at a CAGR of 26.19% from 2024 to 2031.

- North America held a market share of 38.14% in 2023, with a valuation of USD 588.6 million.

- The role-based access control segment garnered USD 649.5 million in revenue in 2023.

- The software segment is expected to reach USD 3856.7 million by 2031.

- The public cloud segment is anticipated to witness a CAGR of 28.40% during the forecast period.

- The hosted ACaaS segment is forecasted to have a market share of 42.94% in 2031.

- Asia Pacific is anticipated to grow at a CAGR of 27.54% during the forecast period.

Market Driver

"Rising Need for Scalable, Cloud-Driven Identity Security Solutions"

The access control as a service market is experiencing significant growth, due to the increasing demand for scalable, cloud-based identity security solutions.

As AI adoption, automation, and hybrid work models gain more acceptance, organizations are prioritizing flexible and cost-effective access control systems for managing diverse identity types, including human, machine, and AI agents. Cloud-native platforms offer centralized oversight, real-time access monitoring, and seamless integration across distributed environments.

This shift aligns with Zero Trust security principles, enabling enterprises to enhance protection, reduce risk, and support evolving digital and operational landscapes.

- In April 2025, CyberArk partnered with Accenture to integrate its Identity Security Platform with Accenture’s AI Refinery, enhancing identity security for AI agents. This collaboration enables organizations to implement Zero Trust access controls, manage machine identities at scale, and secure AI agent interactions across cloud environments addressing rising identity-centric risks in rapidly expanding AI-driven infrastructures.

Market Challenge

"Data Privacy and Cybersecurity Concerns"

Data privacy and cybersecurity concerns related to cloud infrastructure present a significant challenge for the access control as a service market. As access control systems increasingly migrate to cloud environments, organizations face heightened risks around unauthorized access, data breaches, and regulatory non-compliance.

As a result, companies are taking measures so that the sensitive identity and access data stored and transmitted via cloud platforms stays protected with robust encryption, authentication, and monitoring protocols.

These concerns can hinder adoption, particularly in highly regulated industries, making it essential for ACaaS providers to demonstrate strong security measures and transparent data governance practices.

Market Trend

"Enterprise Adoption of Cloud-Managed Access Control Solutions"

The access control as a service market is witnessing a strong trend of cloud-managed access control solutions. As organizations seek to reduce IT infrastructure costs and increase operational efficiency, cloud-based systems offer a scalable, flexible alternative to traditional on-premises setups.

These solutions enable seamless updates, centralized management, and enhanced security without the complexity of maintaining physical servers. With rising cloud adoption across enterprise platforms, companies are integrating access control into their broader cloud strategies, aligning with digital transformation and cybersecurity goals and improving agility in dynamic business environments.

- In July 2024, LenelS2, a part of Honeywell, launched OnGuard Cloud, its advanced access control system delivered via Amazon Web Services (AWS). This managed cloud service reduces IT overhead while offering full control over system configurations. With 82% of organizations planning cloud transitions, OnGuard Cloud meets rising enterprise demand for scalable, secure, and efficient access control solutions.

Access Control as a Service Market Report Snapshot

|

Segmentation

|

Details

|

|

By Access Control Model

|

Role-Based Access Control, Attribute-Based Access Control, Mandatory Access Control, Discretionary Access Control

|

|

By Component

|

Hardware, Software, Services

|

|

By Deployment Mode

|

Public Cloud, Private Cloud, Hybrid Cloud

|

|

By Service Model

|

Hosted ACaaS, Managed ACaaS, Hybrid ACaaS

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Access Control Model (Role-Based Access Control, Attribute-Based Access Control, Mandatory Access Control, Discretionary Access Control): The role-based access control segment earned USD 649.5 million in 2023 due to its scalability, ease of implementation, and strong alignment with enterprise security needs.

- By Component (Hardware, Software, Services): The software held 28.57% of the market in 2023, due to increasing demand for scalable, flexible, and cloud-based access control solutions with centralized management.

- By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud): Public cloud is projected to reach USD 4677.6 million by 2031, due to cost-effectiveness, scalability, seamless integration, and the increasing demand for remote, flexible access control solutions.

- By Service Model (Hosted ACaaS, Managed ACaaS, Hybrid ACaaS): The Hosted ACaaS segment held 42.94% market in 2031, due to its lower upfront costs, simplified deployment, and minimal IT maintenance requirements.

Access Control as a Service Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America access control as a service market share stood at around 38.14% in 2023 in the global market, with a valuation of USD 588.6 million. North America's dominance in this market is driven by factors such as rapid technological advancements, high adoption of cloud-based solutions, and stringent security regulations.

The region's focus on integrated security systems and increasing demand for scalable and remote access control, further fuels growth. Additionally, the presence of key market players and significant investment in smart infrastructure and IoT drives innovation.

The region’s robust enterprise base, rising security concerns, and a shift towards flexible security solutions, reinforces its leadership in the ACaaS sector.

- In January 2025, Acre Security announced the acquisition of REKS, an innovative generative AI solution designed for access control environments.

Asia Pacific is poised for significant growth at a robust CAGR 27.54% over the forecast period. A major factor driving the growth of the access control market in Asia Pacific is the rising demand for contactless, AI-powered biometric solutions to enhance hygiene, safety, and operational efficiency.

As organizations across education, retail, manufacturing, and corporate segments prioritize secure and seamless access management, the adoption of facial recognition and touch-free technologies is accelerating.

This trend is further supported by increasing digital transformation initiatives, growing awareness of workplace safety, and the need for efficient attendance and access solutions that align with post-pandemic health protocols and evolving regulatory standards.

- In May 2023, Hikvision India launched the MinMoe DS-K1T320, a value series attendance and access control terminal featuring advanced face recognition powered by deep learning. Designed for touch-free operation, it addresses the demand for contactless solutions in India. Post-pandemic, such technology is essential for the safe reopening of schools, offices, factories, and retail establishments.

Regulatory Framework

- In the U.S., access control is regulated by Federal Information Security Management Act (FISMA), which mandates strong security measures for federal agencies, and National Institute of Standards and Technology (NIST), which provides comprehensive standards and guidelines to ensure consistent, compliant, and effective access control practices across sectors.

- In Japan, the Personal Information Protection Commission (PPC) oversees access control involving personal data, ensuring compliance with the Act on the Protection of Personal Information (APPI). As the primary regulatory authority, PPC enforces privacy standards and monitors data protection practices.

- In India, access control as a service is regulated under the Information Technology Act, 2000, supported by government security guidelines. Key oversight is provided by the Department of Electronics and Information Technology (DeIT) and the National Cyber Security Policy (NCSP).

Competitive Landscape

The access control as a service industry is characterized by a large number of participants, including both established corporations and rising organizations. Key players in the market are actively pursuing strategic initiatives such as mergers and acquisitions, partnerships, and new product launches to accelerate market growth and enhance competitive positioning.

These efforts aim to strengthen technological capabilities, expand solution offerings, and increase global reach. By adopting such growth strategies, companies are addressing evolving security demands, driving innovation, and capturing a larger share of the expanding ACaaS market across various industry verticals.

- In June 2024, Honeywell acquired Carrier’s Global Access Solutions division, a Florida-based provider of advanced access control and security technologies for commercial buildings. The acquisition strengthens Honeywell’s portfolio with capabilities in electronic access control, video surveillance, and integrated security management, aligning with its strategy to expand smart building and enterprise security solutions.

List of Key Companies in Access Control as a Service Market:

- Johnson Controls

- Honeywell International Inc.

- Thales

- ASSA ABLOY

- dormakaba Group

- Hirsch Secure, Inc.

- HID Global Corporation

- Kastle

- AMAG

- Brivo Systems, LLC.

- Cloudastructure Inc

- Genetec Inc.

- Securitas Technology

- DataWatch Systems

- Telcred

Recent Developments

- In March 2025, dormakaba showcases its latest scalable, integrated access solutions designed to secure every access point from perimeter to high-security areas. Highlights include advanced door systems, turnstiles, and electronic locks like Saffire EVO and CenconX, emphasizing reliability, flexibility, and seamless connectivity to protect people, assets, and infrastructure across today’s evolving security landscapes.

- In January 2025, HID, a global leader in trusted identity solutions, acquired 3millID Corporation and Third Millennium Systems Ltd. This will enhance HID’s physical access control portfolio, broadening its range of readers and credentials while introducing new products and expanding its footprint in complementary regions.

- In September 2023, ASSA ABLOY launched the Aperio KL100, a wireless access control solution designed for lockers and cabinets. Compatible with over 100 existing access control systems, it offers secure management of smaller access points. The KL100 features single-battery operation, supports multiple credential technologies, and enables seamless integration with minimal infrastructure changes, enhancing flexibility and security in compact spaces.

- In June 2023, Thales launched its CipherTrust Data Security Platform as a cloud-based, subscription-based service. This move reflects Thales' commitment to offering customers flexibility in data discovery, classification, encryption, key management, and secrets management. The platform provides various deployment options, including virtual, physical, hybrid clusters, and cloud-based services, with CipherTrust Cloud Key Management as the first available offering.