Market Definition

Fluorinated Ethylene Propylene (FEP) heat shrink medical tubing is a specialized fluoropolymer (Fluorinated Ethylene Propylene) tubing used in medical applications. It provides a protective, biocompatible, and heat-shrinkable layer around medical instruments, catheters, and other devices.

It to the production and use of heat-shrinkable FEP tubing for medical applications. It is employed to provide protective, biocompatible, and flexible coatings for medical devices such as catheters, surgical tools, and other healthcare equipment.

This tubing is crucial in ensuring high performance, chemical resistance, and sterilization capabilities, serving various stakeholders, including manufacturers, medical device companies, healthcare providers, and research institutions.

FEP Heat Shrink Medical Tubing Market Overview

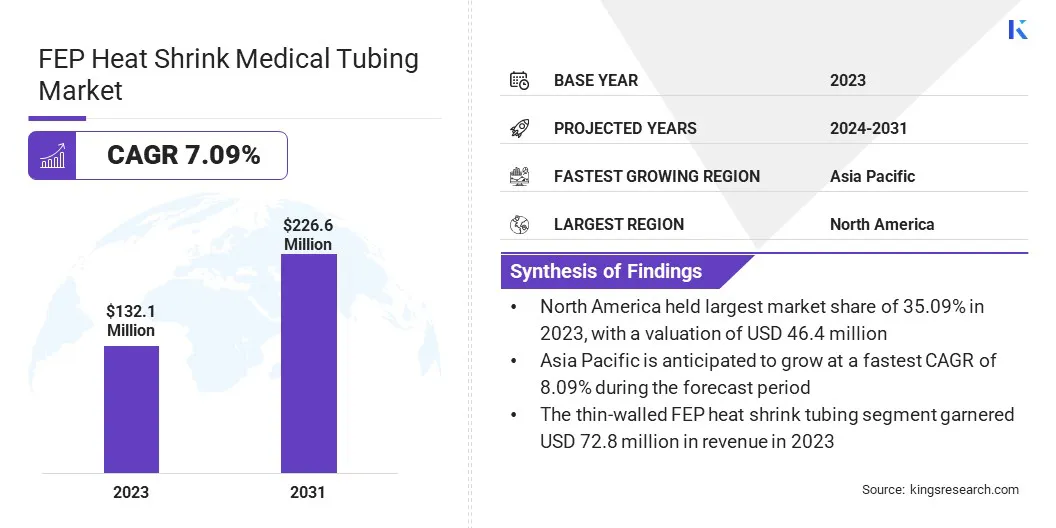

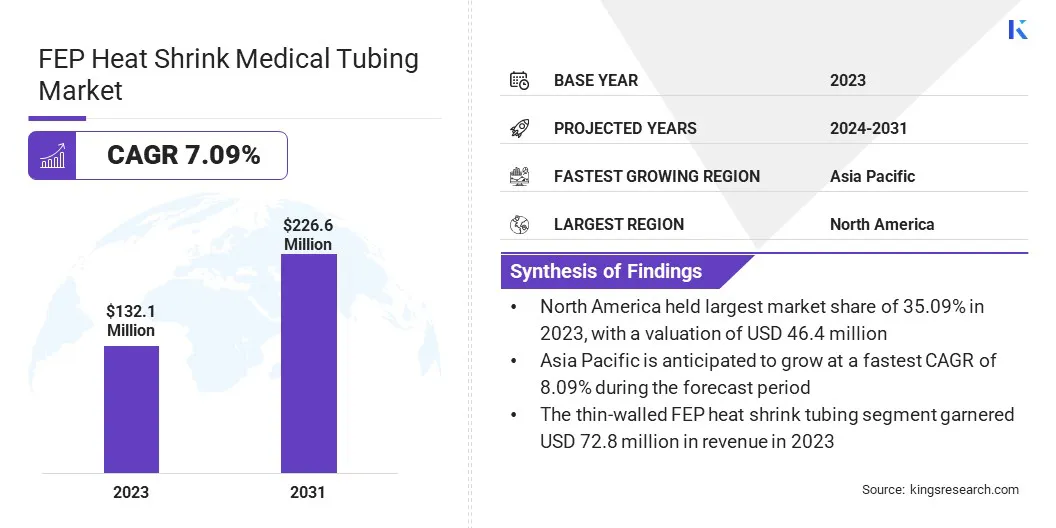

The global FEP heat shrink medical tubing market size was valued at USD 132.1 million in 2023 and is projected to grow from USD 140.3 million in 2024 to USD 226.6 million by 2031, exhibiting a CAGR of 7.09% during the forecast period.

This market is registering steady growth, driven by the increasing demand for minimally invasive medical procedures, advancements in catheter-based technologies, and the rising prevalence of chronic diseases.

FEP tubing is valued for its biocompatibility, chemical resistance, and low-friction properties. These characteristics make it an ideal choice for catheters, guidewires, and surgical instruments, ensuring safety, durability, and ease of use in medical procedures.

Major companies operating in the global FEP heat shrink medical tubing Industry are Zeus Company LLC, TE Connectivity Corporation, Parker-Hannifin Corporation, Teleflex Incorporated, Junkosha Inc., Eriksson Capital Ab, Nordson Corporation, Fluoron, AccuPath Group Co., Ltd., AP Technologies Group Pte Ltd., Ningbo Micro-tube Polymer Materials Co., 3M Company, Merck KGaA, CHUKOH CHEMICAL INDUSTRIES, LTD., and Polyfluor Plastics B.V.

The market benefits from the growing need for heat-shrinkable protective layers in medical device manufacturing, ensuring precision, durability, and safety. The market is projected to expand further in the coming years, due to technological advancements and rising focus on patient safety.

- In October 2023, Junkosha introduced its new range of FEP Peelable Heat Shrink Tubing at MD&M Minneapolis. The product, designed for larger diameter catheters used in complex medical procedures, offers cut-to-length and pre-slit options, helping manufacturers streamline production, enhance yields, and reduce assembly steps.

Key Highlights:

- The global FEP heat shrink medical tubing market size was valued at USD 132.1 million in 2023.

- The market is projected to grow at a CAGR of 7.09% from 2024 to 2031.

- North America held a market share of 35.09% in 2023, with a valuation of USD 46.4 million.

- The thin-walled FEP heat shrink tubing segment garnered USD 72.8 million in revenue in 2023.

- The medical devices segment is expected to reach USD 92.1 million by 2031.

- The medical device manufacturers segment is expected to reach USD 110.2 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.09% during the forecast period.

Market Driver

"Technological Advancements and Material Performance Driving the Market"

Growing demand for minimally invasive procedures in the FEP heat shrink medical tubing market is driving the use of FEP heat shrink tubing. Minimally invasive techniques are typically used in surgeries.

This heightens the need for precise, flexible, and durable materials like FEP heat shrink tubing, which are essential for constructing medical devices such as catheters and stents. Additionally, advancements in medical device technologies continue to propel the adoption of FEP heat shrink tubing.

Innovations in the design and performance of medical devices, such as catheters, guidewires, and diagnostic tools, require materials that provide superior protection, insulation, and enhanced performance.

FEP heat shrink tubing, with its high shrink ratio and ability to meet stringent medical standards, is increasingly relied upon to deliver the reliability and precision needed in modern medical devices.

- In February 2024, Junkosha unveiled its latest 1.8:1 shrink ratio Translucent FEP Peelable Heat Shrink Tubing (PHST) solution at the MD&M West show. The new product enhances catheter manufacturing by improving bonding and welding efficiency, simplifying complex shape additions, and reducing lead times.

Market Challenge

"High Manufacturing Costs and Material Availability Barriers in the Market"

The FEP heat shrink medical tubing market faces several challenges, such as high manufacturing costs and complexity in meeting regulatory requirements. The production of FEP tubing is more expensive than traditional medical tubing, due to the specialized materials required and the precision needed in the manufacturing process.

The process demands advanced equipment and skilled labor, which significantly adds to production costs. Moreover, FEP tubing is used in critical medical applications, requiring exceptional quality control to meet the stringent standards for biocompatibility and durability. Manufacturers can invest in advanced technologies, such as automation and material innovation, to improve production efficiency.

Another challenge in the market is limited material availability, which can impact production capabilities. FEP material is not as widely available as other materials used for medical tubing, which can result in supply chain disruptions or higher material costs.

The restricted availability of high-quality FEP materials, especially those that meet medical-grade specifications, can delay production timelines and limit the ability of manufacturers to scale. Manufacturers can establish long-term partnerships with suppliers to secure a steady supply of materials and negotiate better pricing.

Market Trend

"Customization and Biocompatibility in the FEP Heat Shrink Medical Tubing Market"

The trend of customizing tubing to meet the specific requirements of medical devices is growing in the market. Manufacturers are increasingly offering tailored solutions, such as customized sizes, shrink ratios, and biocompatibility, to align with the evolving demands of healthcare providers and regulatory standards for applications like catheter construction and surgical tools.

Additionally, there is a shift toward high-performance and biocompatible materials, as patient safety and device longevity become more critical. With its excellent chemical resistance, high thermal stability, and biocompatibility, FEP heat shrink tubing is increasingly favored by medical device manufacturers seeking materials that ensure durability and compatibility with human tissues.

- In April 2024, Putnam Plastics Corporation expanded its portfolio to include FEP heat shrink tubing, manufactured without processing aids like silicone oil, reducing bonding and contamination risks. The new tubing features less than 5% linear shrinkage and offers faster turnaround times, with custom sizes and wall thicknesses available.

FEP Heat Shrink Medical Tubing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Thin-walled FEP Heat Shrink Tubing, Heavy-walled FEP Heat Shrink Tubing

|

|

By Application

|

Medical Devices, Surgical Instruments, Diagnostic Equipment, Drug Delivery Systems, Orthopedic Implants

|

|

By End User

|

Hospitals and Clinics, Medical Device Manufacturers, Research & Development Institutions

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Thin-walled FEP Heat Shrink Tubing, Heavy-walled FEP Heat Shrink Tubing): The thin-walled FEP heat shrink tubing segment earned USD 72.8 million in 2023, due to its widespread use in catheter and guidewire applications, offering flexibility and precision.

- By Application (Medical Devices, Surgical Instruments, Diagnostic Equipment, and Drug Delivery Systems): The medical devices segment held 40.12% share of the market in 2023, due to the increasing demand for heat shrink tubing in minimally invasive procedures and device protection.

- By End User (Hospitals and Clinics, Medical Device Manufacturers, Research & Development Institutions): The medical device manufacturers segment is projected to reach USD 110.2 million by 2031, owing to the rising production of advanced medical equipment and the need for high-performance protective tubing.

FEP Heat Shrink Medical Tubing Market Regional Analysis

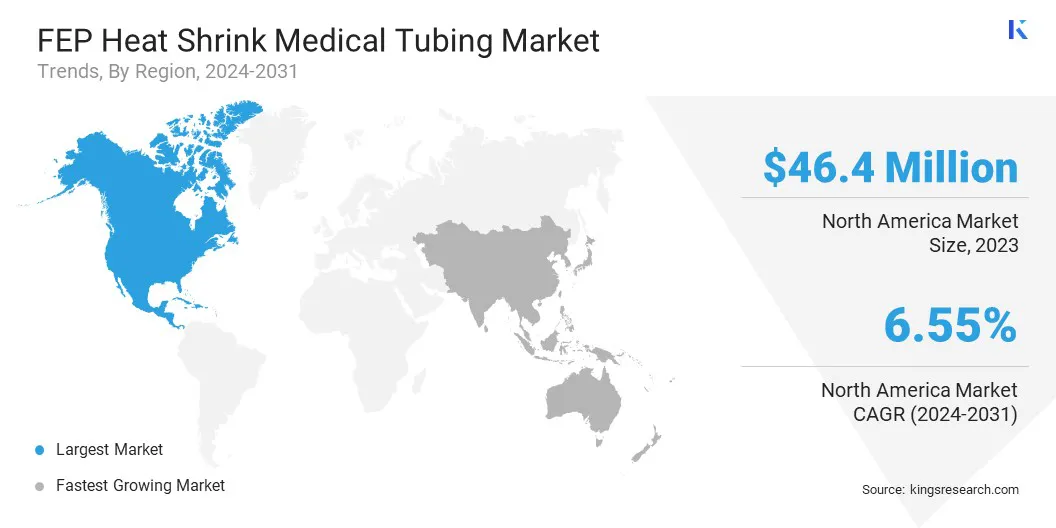

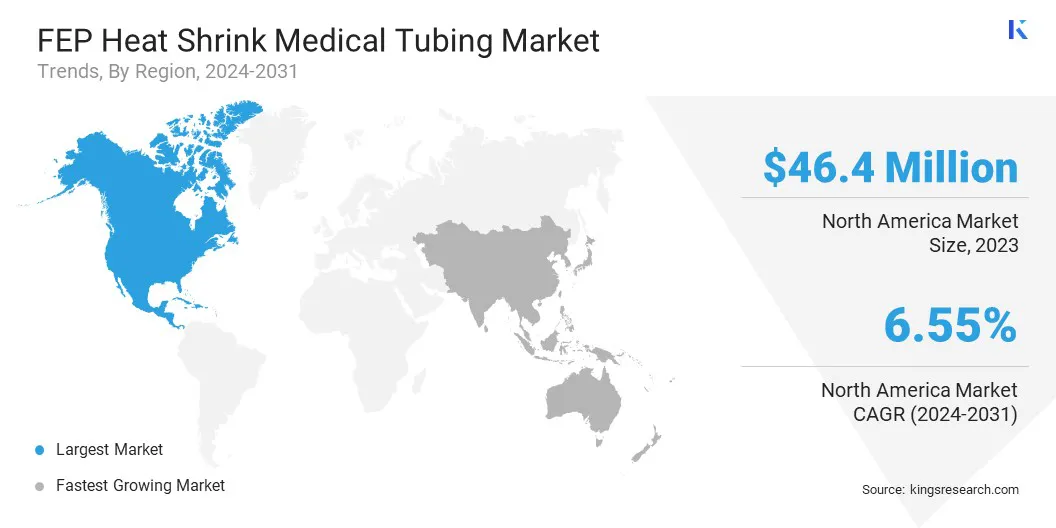

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a substantial FEP heat shrink medical tubing market share of 35.09% in 2023, with a valuation of USD 46.4 million. This is attributed to the strong healthcare infrastructure, high adoption of advanced medical technologies, and the presence of key medical device manufacturers in the region.

The increasing demand for minimally invasive procedures, along with stringent regulatory standards promoting high-quality medical tubing, further strengthens the region's position in the global market.

Additionally, the growing prevalence of chronic diseases, increasing healthcare expenditures, and continuous advancements in medical device manufacturing are propelling the market in the region.

The FEP heat shrink medical tubing Industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 8.09% over the forecast period. This is attributed to the rapid expansion of the healthcare sector, increasing medical device production, and rising government initiatives to enhance healthcare accessibility.

Countries such as China, Japan, and India are registering significant growth, due to the rising demand for high-performance medical tubing in surgical and diagnostic applications.

Additionally, the presence of a growing number of local manufacturers and contract manufacturing organizations (CMOs) is driving the adoption of FEP heat shrink medical tubing in the region.

- In April 2024, Cobalt Polymers announced an exclusive, multi-year agreement with HnG Medical Inc. to distribute its heat shrink tubing products in Asia. The partnership will enhance customer access to tubing samples and inventory in Asia Pacific, leveraging HnG's local expertise in marketing, sales, and customer service.

Regulatory Frameworks Also Play a Significant Role in Shaping the Market

- In the U.S., the Food and Drug Administration (FDA) regulates FEP heat shrink medical tubing under the Federal Food, Drug, and Cosmetic Act (FDCA). The FDA ensures that medical devices, including heat shrink tubing, meet safety and performance standards before they can be marketed and used in medical applications.

- In Europe, FEP heat shrink medical tubing is regulated by the European Medicines Agency (EMA) and the European Commission (EC), primarily under the Medical Device Regulation (MDR) and the In Vitro Diagnostic Medical Devices Regulation (IVDR). These regulatory bodies ensure that medical products, including FEP tubing, meet safety, quality, and performance requirements for use in healthcare.

- In China, the National Medical Products Administration (NMPA), formerly known as the China Food and Drug Administration (CFDA), is responsible for regulating medical devices, including FEP heat shrink tubing. The NMPA ensures that these products meet stringent standards for safety, effectiveness, and quality before they are approved for use in the medical field.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) oversees the regulation of medical devices, including FEP heat shrink medical tubing, under the Pharmaceutical and Medical Device Act (PMD Act). The PMDA ensures that medical products meet the necessary safety, quality, and performance criteria for approval in the healthcare sector.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates medical devices such as FEP heat shrink tubing under the Drugs and Cosmetics Act and the Medical Devices Rules. The CDSCO ensures that medical products comply with the country's safety, quality, and performance standards for medical use.

Competitive Landscape:

The global FEP heat shrink medical tubing market is characterized by a large number of participants, including established corporations and rising organizations. Key players in the market are focusing on expanding their product offerings and enhancing technological innovations to stay competitive.

Companies are investing heavily in Research and Development (R&D) to improve the functionality of FEP heat shrink tubing, including features such as increased shrink ratios, better temperature resistance, and enhanced biocompatibility for medical applications.

Strategic initiatives such as mergers, acquisitions, and collaborations are also being used to expand market reach, strengthen manufacturing capabilities, and tap into new geographic regions.

Additionally, customization of products to meet the specific needs of medical device manufacturers is becoming a critical differentiator. The market is further driven by the increasing demand for minimally invasive procedures, advancements in medical device technologies, and the rising need for high-quality, durable materials in medical applications.

- In February 2024, Medical Extrusion Technologies announced a partnership with Chamfr to offer over 30 sizes of FEP heat shrink. This collaboration aims to support research projects in medical device development by providing enhanced control of elongational growth and faster access to high-performance materials.

List of Key Companies in FEP Heat Shrink Medical Tubing Market:

- Zeus Company LLC

- TE Connectivity Corporation

- Parker-Hannifin Corporation

- Teleflex Incorporated

- Junkosha Inc.

- Eriksson Capital Ab

- Nordson Corporation

- Fluoron

- AccuPath Group Co., Ltd.

- AP Technologies Group Pte Ltd.

- Ningbo Micro-tube Polymer Materials Co.

- 3M Company

- Merck KGaA

- CHUKOH CHEMICAL INDUSTRIES, LTD.

- Polyfluor Plastics B.V.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In February 2025, Junkosha introduced its cut-to-length and slit Peelable Heat Shrink Tubing solution at MD&M West. The partnership focused on enhancing manufacturing processes for catheter-based medical devices, offering improved product performance, reduced scrap rates, and more efficient production, especially in complex procedures such as balloon dilation and drug delivery.

- In May 2024, Optinova announced the opening of its second production hall in Thailand, dedicated to producing medical extrusions such as PTFE liners, FEP heat shrink, and FEP IV tubing for catheters. The new facility, featuring a state-of-the-art 2000-square-meter cleanroom hall, is designed to meet the growing demand in the medical sector and reinforce Optinova’s position in the global healthcare ecosystem.

- In April 2024, Cordis partnered with Chamfr to offer a range of medical device components, including FEP heat shrink tubing, polymer tubing, and PTFE mandrels. This collaboration provides high-quality, precision components for medical device developers, supporting applications in coronary, peripheral vasculature, and neurovascular procedures.