Market Definition

A 5G optical transceiver is a communication module that transmits and receives data over optical fiber networks to support 5G infrastructure. It converts electrical signals from 5G base stations or network equipment into optical signals for transmission across fiber and then reconverts incoming optical signals back into electrical form. The transceiver enables high bandwidth, low latency, and reliable data transfer for 5G applications, including small cells, fronthaul, midhaul, and backhaul networks.

5G Optical Transceiver Market Overview

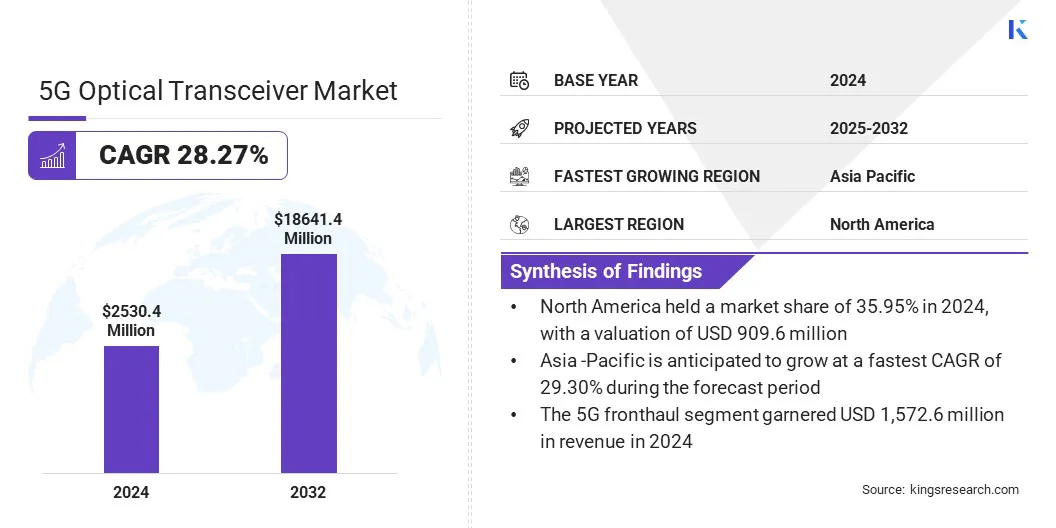

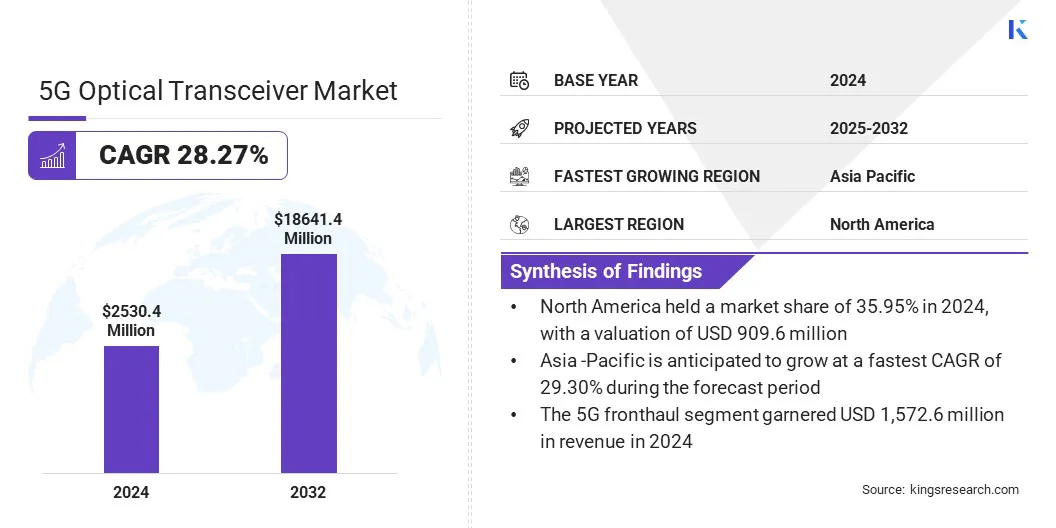

The global 5G optical transceiver market size was valued at USD 2,530.4 million in 2024 and is projected to grow from USD 3,236.4 million in 2025 to USD 18,641.4 million by 2032, exhibiting a CAGR of 28.27% over the forecast period. Rising deployment of 5G base stations is driving demand for high-speed optical transceivers, as these components are essential for connecting base stations to core networks and ensuring reliable, high-capacity data transmission.

The growing need for low-latency and high-bandwidth connectivity is supporting the adoption of optical transceivers, enabling seamless performance for applications such as real-time streaming, cloud computing, and immersive digital services.

Key Highlights:

- The 5G optical transceiver industry size was recorded at USD 2,530.4 million in 2024.

- The market is projected to grow at a CAGR of 28.27% from 2025 to 2032.

- North America held a market share of 35.95% in 2024, with a valuation of USD 909.6 million.

- The 25G transceivers segment garnered USD 710.5 million in revenue in 2024.

- The SFP28 segment is expected to reach USD 6,137.9 million by 2032.

- The 1310 nm band segment is anticipated to witness the fastest CAGR of 28.41% over the forecast period.

- The upto 10 Km segment held a market share of 38.45% in 2024

- The 5G fronthaul segment garnered USD 1,572.6 million in revenue in 2024

- Asia Pacific is anticipated to grow at a CAGR of 29.30% over the forecast period.

Major companies operating in the 5G optical transceiver market are Coherent Corp, Broadcom, EPS GLOBAL, Lumentum Operations LLC, Amphenol Corporation, Accelink Technology Co. Ltd, Cisco Systems, Inc, Source Photonics, Eoptolink Technology Inc., Ltd., Furukawa FITEL Optical Components Co., Ltd, Smiths Interconnect Group Limited, Molex, LLC, Juniper Networks, Inc, Ciena Corporation, and HUBER+SUHNER.

Collaborations between research institutes and national telecom organizations to develop indigenous high-bandwidth optical transceiver chipsets for next-generation networks are driving the market growth. These initiatives accelerate deployment, enhance network performance, and expand demand for optical transceiver technologies.

- In February 2025, the Centre for Development of Telematics (C-DOT) and IIT Bombay entered into a partnership to develop an indigenous high-bandwidth optical transceiver chipset for 6G networks, driving demand for advanced optical technologies that support last-mile connectivity.

Market Driver

Expansion of 5G Subscriptions

A major driver propelling the growth of the 5G optical transceiver market is the rapid expansion of 5G subscriptions across OECD countries. Rising 5G adoption is creating greater demand for high-speed, low-latency optical transceivers that support next-generation network connectivity.

This demand is prompting telecom operators and equipment providers to deploy advanced transceivers, enhance network capacity, and upgrade fiber infrastructure to handle growing data traffic efficiently, in turn, driving market growth.

- In May 2025, the Organization for Economic Co-operation and Development (OECD) reports that the total 5G subscriptions grew by 48% in 2024, driving demand for high-speed optical transceivers to support expanding 5G networks.

Market Challenge

Complex Integration with Existing Network Systems

A key challenge hindering the expansion of 5G optical transceiver market is the complex integration with existing network systems. Ensuring compatibility with legacy infrastructure, multiple vendors, and diverse network protocols increases deployment complexity and operational costs. This requires additional planning, testing, and coordination, which can delay network upgrades and slow the adoption of advanced optical transceivers.

To address this challenge, market players are adopting modular and interoperable optical transceiver designs that simplify deployment across diverse network infrastructures. They are developing standardized interfaces, plug-and-play modules, and software-driven management tools to ensure seamless compatibility with legacy equipment. Additionally, vendors are offering end-to-end solutions, comprehensive technical support, and training programs for network operators.

Market Trend

Development of Next-generation 25G Optical Transceivers

A key trend influencing the 5G optical transceiver market is the development of next-generation 25G optical transceivers. Companies are integrating advanced electrical dispersion compensation (EDC) and mixed-signal technologies into compact, energy-efficient modules.

This enables reliable, low-latency fiber links for fronthaul and backhaul networks. It also supports scalable network upgrades and prompts innovation in optical module design, network efficiency, and cost-effective deployment of next-generation wireless and broadband infrastructure.

- In March 2025, Sumitomo Electric Industries Ltd and Point2 Technology signed a Memorandum of Understanding to develop next-generation 25G optical transceivers. The modules will use advanced EDC technology to enhance fiber upgrades and support 5G/6G fronthaul and backhaul networks.

5G Optical Transceiver Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

25G Transceivers, 50G Transceivers, 100G Transceivers, 200G Transceivers, 400G Transceivers

|

|

By Form Factor

|

SFP28, SFP56, QSFP28, Others

|

|

By Wavelength

|

850 nm Band, 1310 nm Band, Others

|

|

By Distance

|

Upto 10 Km, 11 to 100 Km, Above 100 Km

|

|

By Infrastructure

|

5G Fronthaul, 5G Midhaul/Backhaul

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (25G Transceivers, 50G Transceivers, 100G Transceivers, 200G Transceivers, and 400G Transceivers): The 25G transceivers segment earned USD 710.5 million in 2024 due to increasing deployment of 5G networks and demand for high-speed, low-latency connectivity.

- By Form Factor (SFP28, SFP56, QSFP28, and Others): The SFP28 segment held 33.24% of the market in 2024, due to its compact design, energy efficiency, and wide adoption in data centers and telecom networks.

- By Wavelength (850 nm Band, 1310 nm Band, and Others): The 850 nm band segment is projected to reach USD 7,777.9 million by 2032, owing to its suitability for short-distance, high-speed data transmission in intra-data center applications.

- By Distance (Upto 10 Km, 11 to 100 Km, and Above 100 Km): The above 100 Km segment is anticipated to witness the fastest CAGR of 28.36% over the forecast period, due to growing demand for long-haul optical networks and backbone connectivity.

- By Infrastructure (5G Fronthaul, and 5G Midhaul/Backhaul): The 5G fronthaul segment garnered USD 1,572.6 million in revenue in 2024, due to increasing deployment of base stations and the need for high-speed fiber connectivity between radio units and baseband units.

5G Optical Transceiver Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America 5G optical transceiver market share stood at around 35.95% in 2024, with a valuation of USD 909.6 million. This dominance is attributed to the rapid deployment of 5G base stations across the region, which increases demand for high-speed optical transceivers that handle massive data traffic with low latency.

The increasing need for energy-efficient, high-bandwidth connectivity in enterprise and service provider networks further accelerates the adoption of 5G optical transceivers. Expansion of cloud services and data centers in the region fuels adoption of advanced transceivers supporting robust fiber infrastructure.

Additionally, strategic acquisitions by regional market players and integration of specialized optical transceiver technologies by major network solution providers enhance product offerings and enable faster rollout of next-generation 5G networks, further driving market expansion in the region.

- In May 2024, Belden acquired Precision Optical Technologies for USD 290 million in cash. The acquisition is expected to enhance Belden’s enterprise and service provider solutions by adding Precision Optical’s expertise in optical transceivers, proprietary software, firmware configurations, and related components, strengthening fiber infrastructure deployments, expansions, and network upgrades.

Asia Pacific 5G optical transceiver industry is set to grow at a robust CAGR of 29.30% over the forecast period. This growth is attributed to the increasing rollout of 5G networks across China, Japan, South Korea, and India, which drives demand for high-speed and low-latency optical transceivers.

Rising government investments in telecom infrastructure and fiber backhaul projects accelerate the adoption of optical transceivers. Increasing requirements for compact and energy-efficient devices in urban and enterprise networks further fuel market growth.

Additionally, the integration of innovative optical transmission technologies and enhanced product capabilities by key regional players strengthens product portfolios and supports faster deployment of next-generation 5G networks, further boosting market growth in the region.

- In September 2024, SANWA Technologies Co., Ltd. acquired the optical device business of YOKOWO Co., Ltd. The acquisition includes intellectual property, product rights, and production assets for high-speed optical transmission devices, enabling SANWA to enhance its optical transceiver lineup, strengthen miniaturization and low-power technologies, and expand its market presence in optical communications.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) regulates spectrum allocation, licensing, and technical standards for 5G networks, including optical transceivers. It ensures safe and interference-free operation, compliance with electromagnetic emission limits, and alignment with national broadband policies. The FCC also oversees network infrastructure deployments, equipment approvals, and promotes innovation while maintaining consumer protection and cybersecurity standards.

- In the UK, the Office of Communications (Ofcom) manages spectrum allocation, licensing, and technical standards for 5G networks and associated optical components. It ensures safe operation, minimal interference, and network compatibility.

- In China, the Ministry of Industry and Information Technology (MIIT) manages spectrum management, technology standards, and licensing for 5G network equipment, including optical transceivers. It ensures compliance with national telecom regulations, supervises network quality, cybersecurity, and interoperability, and promotes domestic innovation and strategic development of fiber infrastructure and high-performance optical devices.

- In India, the Department of Telecommunications (DoT) regulates licensing, spectrum allocation, and technical standards for telecom networks, including optical transceivers in 5G infrastructure. It oversees equipment certification, network security, and compliance with emission and interoperability norms, while promoting innovation, nationwide connectivity, and adherence to cybersecurity and public interest policies.

Competitive Landscape

Major players operating in the 5G optical transceiver industry are expanding their product portfolios through strategic acquisitions of specialized optical component providers. They are integrating ruggedized and high-performance transceivers into their offerings to support high-bandwidth communication across diverse network environments.

Players are focusing on enhancing digitalization capabilities, improving compact and energy-efficient designs, and enabling reliable connectivity for next-generation 5G applications. Additionally, market participants are accelerating technology development to meet evolving network demands, strengthen market presence, and provide comprehensive solutions for enterprises.

- In May 2024, Moog Inc. acquired COTSWORKS Inc. for USD 63 million. The acquisition strengthens Moog’s aerospace and defense portfolio by adding COTSWORKS’ ruggedized fiber optic transceivers and assemblies, which deliver high-bandwidth communication across space, air, land, and sea platforms, enabling next-generation connectivity, digitalization, and compact high-performance systems.

Key Companies in 5G Optical Transceiver Market:

- Coherent Corp

- Broadcom

- EPS GLOBAL

- Lumentum Operations LLC

- Amphenol Corporation

- Accelink Technology Co. Ltd

- Cisco Systems, Inc

- Source Photonics

- Eoptolink Technology Inc., Ltd.

- Furukawa FITEL Optical Components Co., Ltd

- Smiths Interconnect Group Limited

- Molex, LLC

- Juniper Networks, Inc

- Ciena Corporation

- HUBER+SUHNER.

Recent Developments (Product Launch)

- In June 2025, Cisco launched the AI-Ready Optics Transceivers Partner Enablement Campaign to provide partners with training, technical resources, and engagement opportunities, supporting the adoption of optical transceivers and promoting reliable, scalable, and high-performance solutions for data center networks.

- In April 2025, Jabil Inc. launched 1.6T pluggable optical transceivers to support high-speed intra-data center connectivity, AI/ML workloads, and high-performance computing. The transceivers offer high bandwidth, low power consumption, and compatibility with existing infrastructure.

- In May 2024, Samtec launched a new Optical Transceiver Center of Excellence (CoE) to provide engineers with design support, consulting, testing platforms, and technical resources.

by government