Market Definition

Xylitol is a naturally extracted, sugar alcohol derived from sources such as fruits, vegetables and hardwoods, specifically from birch and corn. The production, distribution, and sale of xylitol is done globally, as it widely utilized as a low-calorie sweetener.

It is a popular option for sugar-free products, due to its lower glycemic index and acknowledged advantages for tooth health when compared to conventional sugars.

Xylitol Market Overview

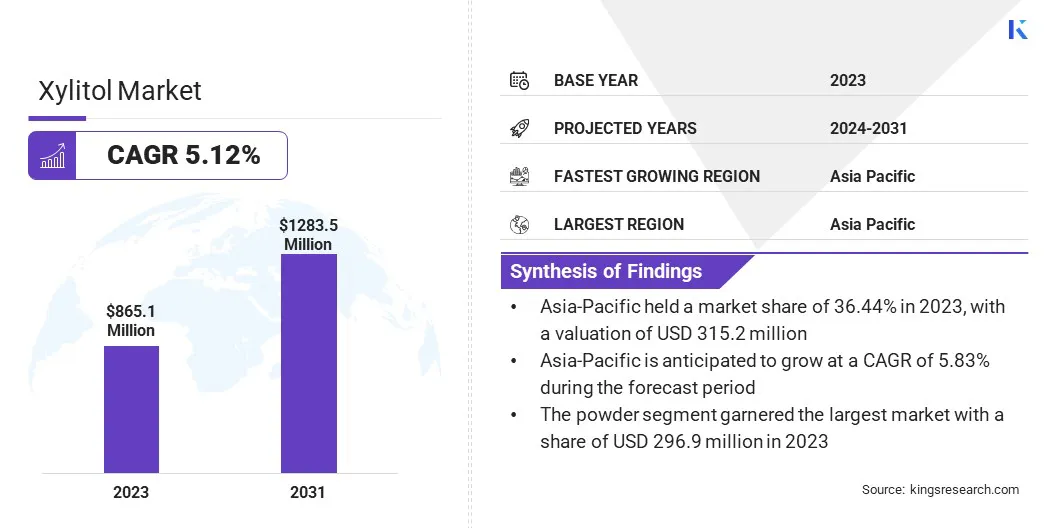

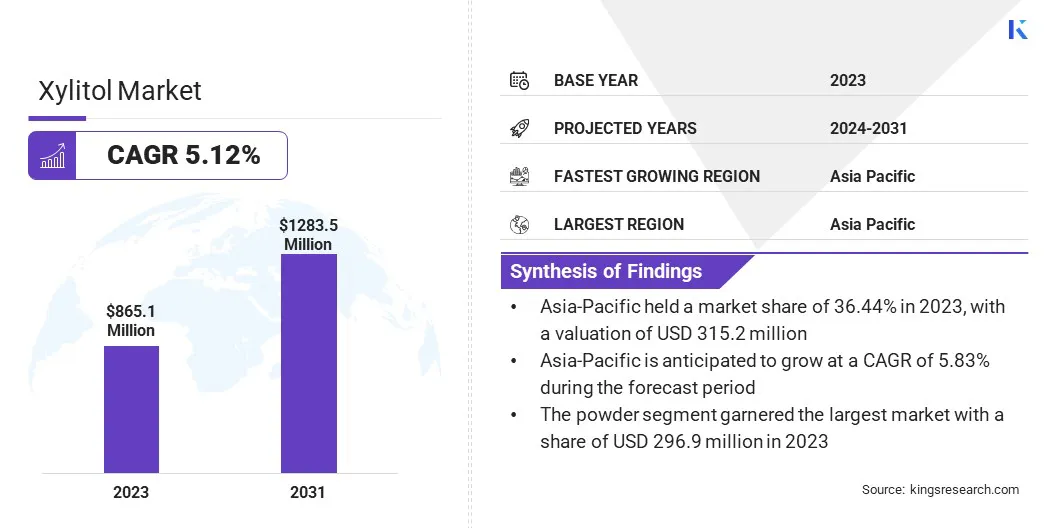

The global xylitol market size was valued at USD 865.1 million in 2023, which is estimated to be valued at USD 904.9 million in 2024 and reach USD 1283.5 million by 2031, growing at a CAGR of 5.12% from 2024 to 2031.

This growth is accelerated by the rising demand for natural sweeteners in the food & beverage industry. This shift is supported by growing health concerns related to obesity. The need for xylitol as a healthy option is projected to rise as people become more aware of the effects of sugar on their health.

Major companies operating in the market are Cargill, Incorporated, DuPont, Roquette Frères, zuChem, Mitsubishi Corporation Life Sciences Limited, Zhejiang Huakang Pharmaceutical Co., Ltd., DFI Corporation, Futaste Pharmaceutical Co., Ltd, Foodchem International Corporation, Jining Hengda Green Engineering Co., Ltd., Shandong Longlive Bio-technology Co., Ltd, Spectrum Chemical, YUSWEET CO.,LTD., A & Z FOOD ADDITIVES CO. LTD., and Herboveda India.

The increasing prevalence of lifestyle-related health issues, including obesity and diabetes, is further propelling this shift. Companies are recognizing the importance of xylitol as a sugar, due to its beneficial properties, such as its low glycemic index and dental health advantages.

- For instance, in September 2024, according to Harvard Health Publishing, xylitol is noted for having approximately 2.4 calories per gram and a glycemic index (GI) score of just 7, making it a compelling alternative for those looking to manage their weight and blood sugar levels effectively.

Key Highlights:

- The global xylitol industry size was recorded at USD 865.1 million in 2023.

- The market is projected to grow at a CAGR of 5.12% from 2024 to 2031.

- Asia Pacific held a market share of 36.44% in 2023, with a valuation of USD 315.2 million.

- The powder segment garnered USD 496.9 million in revenue in 2023.

- The healthcare segment is expected to reach USD 487.1 million by 2031.

- The xylitol industry in Asia Pacific is anticipated to grow at a CAGR of 5.83% over the forecast period.

Market Driver

"Health Awareness and Wellness Trends"

The xylitol market is driven by the growing consumer demand for more health-conscious alternatives to sugar, catalyzed by growing obesity and diabetes cases. Expanding applications in several divisions, encompassing food & beverages, pharmaceuticals, and personal care, further support this growth.

This trend is likely to provide strong market growth in the near future. Health-savvy consumers are seeking out natural sweeteners that are low in calories. Xylitol, with a low-glycemic index, is one such sweetener. Its recognized benefits in dental health add to its marketability, as more people give greater attention to oral hygiene.

- For instance, in June 2023, according to The Food and Drug Administration (FDA), sugar alcohols, including xylitol and sorbitol, are low-calorie sweeteners used in sugar-free products, offering dental health benefits and minimal impact on blood glucose levels, appealing to health-conscious consumers.

Market Challenge

"Raw Material Volatility and Consumer Acceptance Issues"

The xylitol market faces some challenges that might slow down growth. Strict regulations on the use of the product as a sweetener can delay product launches and raise compliance costs. Additionally, volatile raw material costs and high prices of pure xylose, which is needed for production, may hamper profitability.

Consumer acceptance is also impacted by gastrointestinal problems after the intake of large doses of xylitol, therefore necessitating careful marketing strategies to deal with these issues. Moreover, competition from other natural sweeteners, especially stevia and erythritol, threatens to hamper market share.

Thus, xylitol manufacturers have to innovate and differentiate themselves in order to stay relevant in the marketplace.

- For instance, in June 2024, according to Cleveland Clinic, the excessive consumption of sugar alcohols as sugar substitutes has been reported to lead to adverse effects in certain individuals. Common issues include bloating, gas, gastrointestinal discomfort, diarrhea, and potential weight gain.

Market Trend

"Demand for Low-calorie Sweeteners and Sustainable Practices"

The xylitol market is registering significant growth, due to rising health consciousness among consumers. Xylitol can be a preferred alternative to traditional sugars, due to the demand for low-calorie and natural sweeteners.

A focus on sustainability is prompting companies to adopt eco-friendly sourcing practices, while ongoing innovation in product development is essential to meet evolving consumer preferences and match the competition.

Xylitol is used across food & beverages, pharmaceuticals, and personal care products, particularly in oral health items. Additionally, the shift to online retail is enhancing accessibility for consumers seeking xylitol products.

Xylitol Market Report Snapshot

| Segmentation |

Details |

| By Form |

Powder, Liquid |

| By Application |

Food & Beverages, Healthcare, Personal Care |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Form (Powder, Liquid): The powder segment earned USD 496.9 million in 2023, due to its widespread use in food and dental products.

- By Application (Food & Beverages, Healthcare, Personal Care): The food & beverages segment held 46.23% share of the market in 2023, due to the rising demand for sugar alternatives in health-conscious consumer segments.

Xylitol Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Asia Pacific accounted for 36.44% share of the global xylitol market in 2023, and is anticipated to register the fastest growth, at a projected CAGR of 5.83%, due to increasing health awareness and rising demand for sugar-free products.

China and India’s strong production capabilities also aids in the growth of the market. The growing popularity of xylitol in various applications, including food & beverages, pharmaceuticals, and oral care products, further supports this expansion.

Th xylitol market in North America is poised for significant growth over the forecast period at a CAGR of 4.23%, due to the rising prevalence of obesity and diabetes, which has led to an increased demand for healthier food options and sugar substitutes, such as xylitol.

The robust food & beverage industry is incorporating xylitol into a wide range of products, further fueling the need for advanced packaging solutions. Additionally, the growing consumer awareness about healthier lifestyles and an increasing focus on convenience foods are contributing to the demand for innovative and efficient packaging machinery in the region.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The U.S. follows Federal Food, Drug, and Cosmetic Act (FD&C Act) under the Food and Drug Administration (FDA) to regulate xylitol which comes under sugar alcohols.

- In Europe, the European Food Safety Authority (EFSA) evaluates the safety of food additives, including sugar alcohols, and establishes guidelines such as Acceptable Daily Intake (ADI) levels.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) regulates sugar alcohols like xylitol. Products containing xylitol can be classified as FOSHU (Food for Specified Health Uses), which requires safety assessments and efficacy approval for health claims.

Competitive Landscape

The global xylitol market is highly competitive and characterized by a diverse range of participants, including both well-established corporations and emerging companies. Major players in the market are focusing on expanding their product portfolios, leveraging innovative production methods, and enhancing their distribution networks to maintain a competitive edge.

The market is also witnessing an influx of new entrants, particularly from regions such as Asia Pacific, where the growing demand for sugar substitutes in food & beverages is driving expansion.

Major companies are investing in research and development (R&D) to explore new applications of xylitol in products like oral care, pharmaceuticals, and personal care items.

List of Key Companies in Xylitol Market:

- Cargill, Incorporated

- DuPont

- Roquette Frères

- zuChem

- Mitsubishi Corporation Life Sciences Limited

- Zhejiang Huakang Pharmaceutical Co., Ltd.

- DFI Corporation

- Futaste Pharmaceutical Co., Ltd

- Foodchem International Corporation

- Jining Hengda Green Engineering Co., Ltd.

- Shandong Longlive Bio-technology Co., Ltd

- Spectrum Chemical

- YUSWEET CO.,LTD.

- A & Z FOOD ADDITIVES CO. LTD.

- Herboveda India, and

- Others