Enquire Now

X-Ray Inspection System Market Size, Share, Growth & Industry Analysis, By Function (Manual Systems, Automated Systems), By Dimension (2D Systems, 3D Systems), By Technology (Digital Imaging, Film-based Imaging), By End-Use Industry, and Regional Analysis, 2025-2032

Pages: 170 | Base Year: 2024 | Release: October 2025 | Author: Swati J.

Key strategic points

An X-ray inspection system is a form of non-destructive testing (NDT) technology, a methodology that uses low-dose X-ray radiation to examine the internal structure, composition, or integrity of products, materials, and assemblies without causing damage.

These systems generate high-resolution images that allow operators to detect defects, contaminants, voids, cracks, misalignments, or structural inconsistencies that are not visible to the naked eye. They are widely employed across industries such as food and beverage, pharmaceuticals, electronics, and automotive and aerospace.

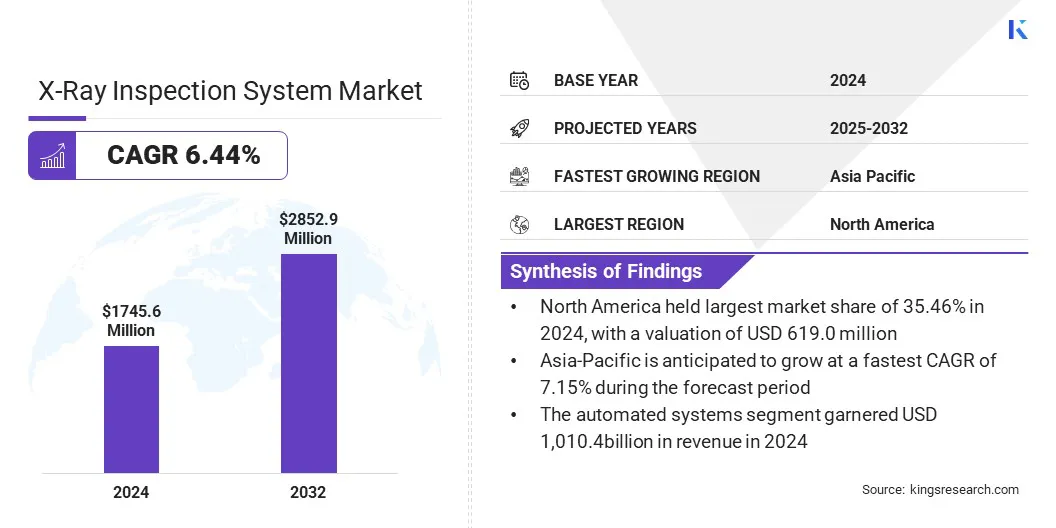

The global X-ray inspection system market size was valued at USD 1,745.6 million in 2024 and is projected to grow from USD 1,843.6 million in 2025 to USD 2,852.9 million by 2032, exhibiting a CAGR of 6.44% over the forecast period.

The market is expanding steadily, supported by stricter safety regulations, rising automation in manufacturing, and increasing demand for goros quality control across critical industries. The growth is further driven by advanced imaging technologies and the adoption of inline inspection systems that enhance efficiency and reduce operational risks.

Major companies operating in the global X-ray inspection system market are METTLER TOLEDO, Nordson Corporation, Comet, Viscom SE, Nikon Corporation Industrial Solutions, ISHIDA CO., LTD., OMRON Corporation, Toshiba Unified Technologies Corporation, GE HealthCare, Smiths Detection Group Ltd., VJ Electronix, 3DX-RAY Ltd, Creative Electron, Inc., FT System S.r.l., and GLENBROOK TECHNOLOGIES.

A key driver in the X-ray inspection system market is the transition from conventional film-based inspection methods to digital and 3D imaging solutions. Manufacturers are actively investing in the development of high-resolution digital detectors and advanced 3D imaging platforms to address the demand for faster processing, greater accuracy, and more detailed structural analysis.

These factors are leading end-users to meet stringent quality requirements and improve operational efficiency across industries such as electronics, aerospace, and medical devices.

Rising Demand for Quality Assurance and Regulatory Compliance

The global X-ray inspection system market is being driven by stringent quality and safety regulations across industries such as food and beverages, pharmaceuticals, automotive, and electronics.

Increasing regulatory oversight by agencies including the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the International Organization for Standardization (ISO) requires manufacturers to adopt advanced non-destructive testing (NDT) methods to ensure product integrity and safety.

X-ray inspection systems enable real-time defect detection, contamination control, and structural verification without damaging the product, making them an indispensable tool in compliance-driven industries.

High Cost of Adoption and Operation

Advanced digital and 3D systems require significant capital expenditure for procurement and installation, and additional costs arise from maintenance, calibration, and compliance with radiation safety standards. These financial demands can restrict adoption among small and medium-sized enterprises, limiting broader market penetration.

To address this challenge, manufacturers are introducing modular and scalable inspection solutions that reduce upfront investment while allowing phased upgrades. Companies are also offering leasing models and service-based contracts to make advanced inspection technologies more financially accessible, thereby supporting adoption across a wider customer base.

Integration of Artificial Intelligence and Machine Learning

A key trend in the X-ray inspection system market is the integration of artificial intelligence (AI) and machine learning (ML). Manufacturers are embedding AI-driven algorithms into inspection platforms to support automated defect recognition, anomaly detection, and predictive quality control. These enhancements are enabling faster and more precise identification of flaws while reducing false positives that traditionally slow down operations.

Additionally, reliance on human operators is minimized, allowing companies to improve inspection throughput and consistency. This convergence of AI with X-ray technology is reshaping quality assurance processes, particularly in electronics, automotive, and aerospace sectors, where precision and reliability are critical.

|

Segmentation |

Details |

|

By Function |

Manual Systems, Automated Systems |

|

By Dimension |

2D Systems, 3D Systems |

|

By Technology |

Digital Imaging, Film-based Imaging |

|

By End-Use Industry |

Electronics and Semiconductors, Automotive, Aerospace, Government Infrastructure, Oil and Gas, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

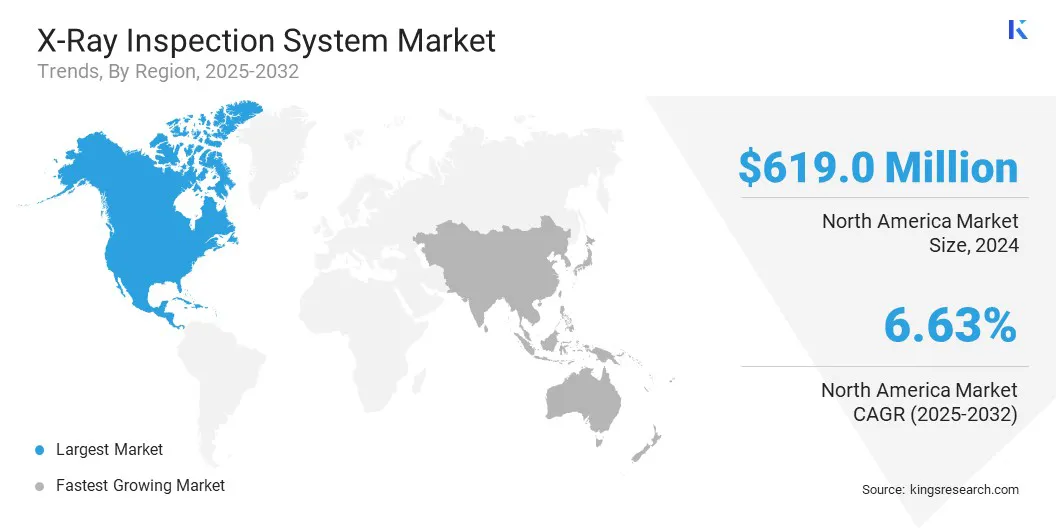

North America X-ray inspection system market share stood at 35.46% in 2024 in the global market, with a valuation of USD 619.0 million. This dominance is attributed to the region's strict regulatory frameworks, advanced industrial infrastructure, and widespread adoption of X-ray inspection systems across key sectors.

The presence of leading electronics and semiconductor manufacturers, particularly in the U.S., drives demand for X-ray inspection systems capable of handling the increasing complexity of miniaturized printed circuit boards and microelectronics.

The aerospace and automotive sectors rely heavily on X-ray inspection to ensure structural integrity and compliance with safety standards. These regulatory frameworks and industry-specific requirements are creating strong demand for advanced X-ray inspection systems in the region.

Asia-Pacific is poised for significant growth at a robust CAGR of 7.15% over the forecast period, driven by rapid industrial expansion, government-led infrastructure development, and increasing emphasis on product safety and quality assurance.

The region’s electronics, automotive, aerospace, and healthcare sectors are increasingly integrating advanced non-destructive testing solutions to ensure safety, precision, and compliance with international standards.Increased regulatory emphasis on food safety and pharmaceutical quality is boosting the adoption of inspection systems, particularly as governments strengthen consumer protection frameworks, thereby driving the market demand.

Major players in the X-ray inspection system market are adopting strategies such as technology innovation, targeted R&D, and strategic partnerships to enhance inspection accuracy and expand application scope. Companies are developing advanced digital and 3D imaging platforms integrated with AI-driven analytics to facilitating manufacturers to detect defects more precisely, streamline quality assurance, and reduce production downtime

Frequently Asked Questions