Market Definition

X band radar is a high‑frequency radar system operating in the 8–12 GHz frequency range of the electromagnetic spectrum. It is used for detecting, tracking, and imaging objects with high resolution, offering fine target discrimination.

The market encompasses the design, development, manufacturing, and integration of X band radar systems and components. It includes applications such as missile tracking, weather monitoring, air traffic control, and maritime navigation.

X Band Radar Market Overview

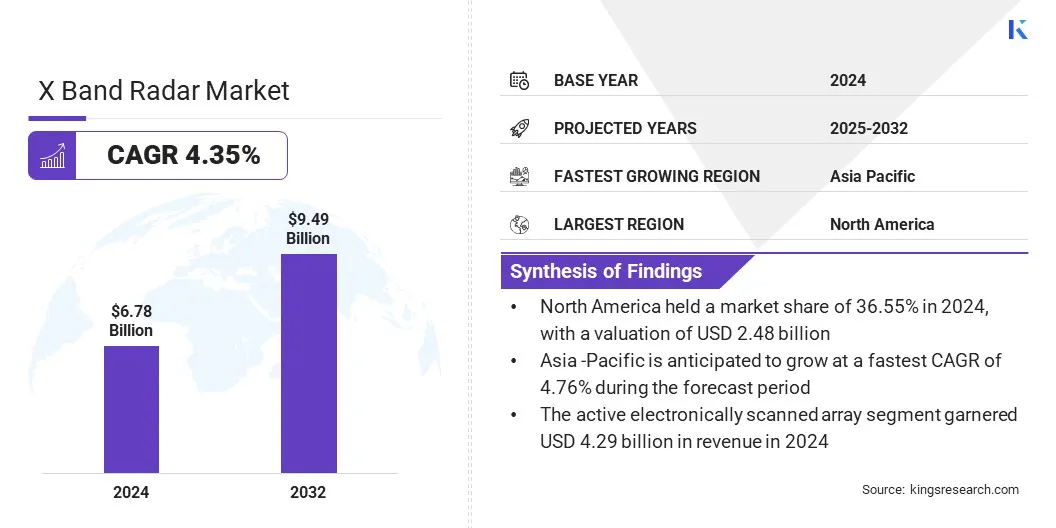

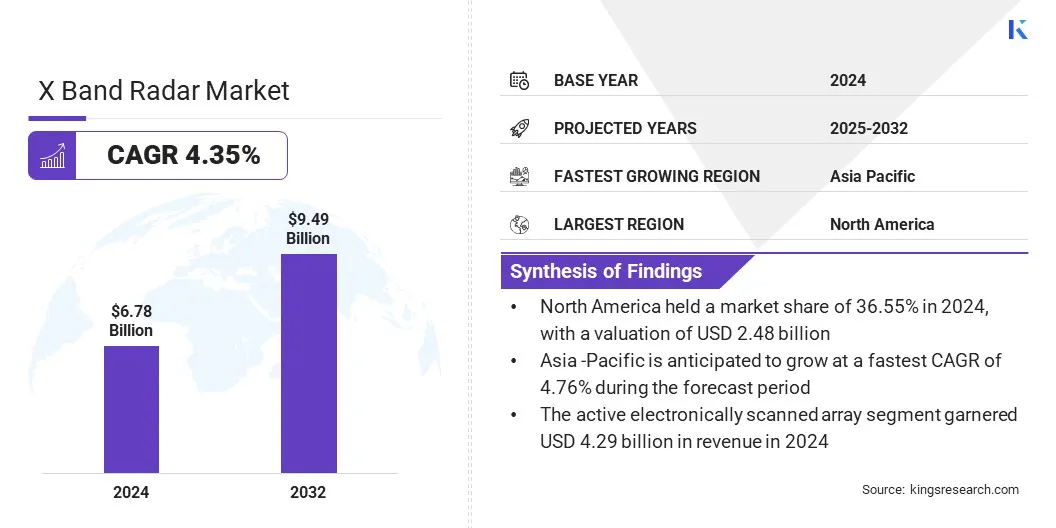

The global X band radar market size was valued at USD 6.78 billion in 2024 and is projected to grow from USD 7.04 billion in 2025 to USD 9.49 billion by 2032, exhibiting a CAGR of 4.35% over the forecast period.

Market growth is driven by the rising demand for high‑resolution imaging in military surveillance and missile defense systems. The increasing use of X band radar in weather monitoring and disaster management is further supporting its integration across defense, navigation, and environmental monitoring applications.

Key Highlights:

- The X band radar industry size was recorded at USD 6.78 billion in 2024.

- The market is projected to grow at a CAGR of 4.35% from 2025 to 2032.

- North America held a share of 36.55% in 2024, valued at USD 2.48 billion.

- The space-based segment garnered USD 1.04 billion in revenue in 2024.

- The active electronically scanned array segment is expected to reach USD 6.17 billion by 2032.

- The space & satellite segment is anticipated to witness the fastest CAGR of 5.19% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 4.76% over the forecast period.

Major companies operating in the X band radar market are Northrop Grumman, RTX Corporation, Reutech Radar Systems, ProSensing, Detect Inc, Saab AB, Thales Group, Leonardo S.p.A, Hensoldt AG, Terma Group, GEM ELETTRONICA srl, Japan Radio Co., Ltd, FURUNO ELECTRIC CO., LTD, Mitsubishi Electric Corporation, and Bharat Electronics Limited.

Growing need for accurate and timely detection of aerial, maritime, and ground threats is driving the adoption of advanced X-band radar systems. Manufacturers are responding by developing next-generation radar platforms with enhanced detection precision, extended range, and improved target tracking capabilities.

Additionally, key players are investing in comprehensive lifecycle services including upgrades, maintenance, and technical support to ensure consistent performance and reliability, thereby strengthening market demand.

In June 2025, the U.S. Navy (USN) awarded RTX’s Raytheon a contract valued at USD 536 million to provide continued support for the SPY-6 family of radars for the United States Navy. The AN/SPY-6 radar system features an X-band radar engineered for horizon monitoring, missile communication, precise target tracking, and terminal guidance support. The contract covers training, engineering services, ship installation, and integration and testing, as well as software upgrades aimed at enhancing radar performance and operational capabilities.

Market Driver

Increasing Global Defense Budgets

A key factor propelling the growth of the X band radar market is the increasing global defense budgets, which are enabling nations to enhance surveillance and missile defense capabilities. Rising defense spending is allowing militaries to adopt advanced radar technologies that improve operational readiness, situational awareness, and threat response.

Governments and defense agencies are prioritizing high‑resolution, reliable radar systems to strengthen national security and support strategic defense initiatives to address evolving threats and maintain technological superiority in modern warfare.

- According to the Stockholm International Peace Research Institute (SIPRI), global military spending increased by 9.4% after adjusting for inflation, reaching USD 2,718 billion in 2024.

Market Challenge

High Development and Maintenance Costs of Advanced Radar Systems

A key challenge impeding the growth of the X band radar market is the high development and maintenance cost of advanced radar systems. The design and production of next-generation solid-state radars require expensive components, specialized engineering, and significant R&D investments. Moreover, ongoing expenses related to calibration, software upgrades, and skilled technical support further increase operational costs.

To address this challenge, market players are focusing on innovating cost-efficient radar designs and leveraging advanced technology that reduces lifecycle expenses compared to traditional magnetron-based systems. Companies are investing in modular architectures that simplify upgrades and lower integration costs for vessel operators, defense agencies, and weather monitoring authorities.

Market Trend

Development of Compact Radar Systems Designed for Tactical Operations

A key trend shaping the X band radar market is the development of compact radar systems designed for tactical operations. These systems offer enhanced portability, rapid deployment, and adaptability across diverse operational environments, including naval, airborne, and land-based missions.

Advances in solid‑state technology, miniaturized components, and efficient power management are enabling smaller, lighter, and lower-maintenance designs without compromising performance.

- In April 2024, Wärtsilä ANCS unveiled the NACOS Platinum Solid State X Band Radar to advance marine navigation safety and reliability. The launch strengthens Wärtsilä’s portfolio in high-demand areas such as compact, low-maintenance radar systems and advanced solid-state X band technology for superior target detection and tracking.

X Band Radar Market Report Snapshot

|

Segmentation

|

Details

|

|

By Platform

|

Space-Based, Sea-Based, Ground-Based, Airborne

|

|

By Technology

|

Active Electronically Scanned Array, Passive Electronically Scanned Array

|

|

By Application

|

Defense & Military, Aviation & Air Traffic Control, Weather Monitoring, Space & Satellite, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Platform (Space-Based, Sea-Based, Ground-Based, and Airborne): The space-based segment earned USD 1.04 billion in 2024 due to its capability to provide global surveillance, missile tracking, and early warning over vast areas.

- By Technology (Active Electronically Scanned Array and Passive Electronically Scanned Array): The active electronically scanned array segment held 63.23% of the market in 2024, due to its superior target detection, faster beam steering, and enhanced reliability.

- By Application (Defense & Military, Aviation & Air Traffic Control, Weather Monitoring, Space & Satellite, and Others): The defense & military segment is projected to reach USD 5.02 billion by 2032, owing to rising defense modernization efforts and increasing demand for advanced threat detection capabilities.

X Band Radar Market Regional Analysis

Based on region, market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America X band radar market share stood at 36.55% in 2024 in the global market, valued at USD 2.48 billion. This is driven by rising defense budgets that enable significant investments in advanced radar systems for surveillance, target tracking, and missile defense.

Increasing investments by governments and defense agencies in solid‑state radar technology is enhancing operational efficiency and reliability. Moreover, regional market players are strengthening indigenous radar production through long‑term procurement programs and strategic collaborations, thereby driving market growth in this region.

- In October 2024, the U.S. Navy awarded Leonardo DRS a USD 235 million contract to produce AN/SPQ‑9B ship protection radars, a high-performance X band radar system for air and surface target detection and tracking.

Asia Pacific is set to grow at a CAGR of 4.76% over the forecast period. This growth is driven by rising maritime security concerns and defense modernization initiatives that enhance naval fleets and coastal surveillance capabilities.

Rapid growth in port infrastructure and shipping traffic is driving the adoption of X band radars for enhanced navigation safety. Moreover, increasing government focus on disaster preparedness and climate resilience is encouraging the deployment of advanced radar systems for weather monitoring and environmental observation across the region.

- In August 2024, the Government of India announced plans to procure and install 10 X‑Band Doppler Weather Radars to improve weather monitoring and forecasting across the Northeastern states and the Lahaul & Spiti District of Himachal Pradesh. This initiative strengthens India’s meteorological infrastructure and expands the use of X band radar technology in disaster preparedness, climate monitoring, and weather prediction.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) regulates spectrum allocation for Xband radar systems to ensure efficient frequency use and prevent interference with other communications. It oversees licensing, technical compliance, safety standards, and operational authorizations for defense, navigation, and meteorological radar applications, ensuring reliability and protecting national and public interests.

- In the UK, the Office of Communications (Ofcom) manages spectrum allocation for Xband radar systems, overseeing licensing, compliance, and interference prevention. It regulates both defense and civilian radar applications, ensuring safe, efficient spectrum use. Ofcom also promotes innovation, coordinates with international regulatory bodies, and enforces environmental and operational safety standards.

- In China, the Ministry of Industry and Information Technology (MIIT) oversees spectrum management and technical standards for Xband radar systems. It regulates licensing, production, deployment, and compliance with technical requirements, while promoting innovation. MIIT ensures integration of radar technology into defense, civil navigation, and weather monitoring systems while safeguarding national security and operational efficiency.

- In India, the Wireless Planning & Coordination (WPC) Wing regulates spectrum allocation and licensing for Xband radar systems. It oversees equipment certification, technical compliance, and interference management, ensuring efficient use of spectrum. WPC also monitors deployment for defense, meteorology, and navigation, supporting technological advancement and national security.

Competitive Landscape

Major players in the X band radar industry are focusing on developing advanced solid‑state radar systems to enhance detection accuracy, reliability, and operational efficiency. They are expanding production capabilities and delivering high‑performance radar units to strengthen their technology portfolios and meet growing defense and surveillance demands.

Additionally, they are investing in research and innovation to integrate cutting‑edge materials and architectures, improving radar sensitivity and range while reducing lifecycle costs.

- In May 2025, Raytheon delivered the 13th AN/TPY 2 X band radar to the U.S. Missile Defense Agency, featuring a complete Gallium Nitride (GaN) populated array.

Top Key Companies in X Band Radar Market:

- Northrop Grumman

- RTX Corporation

- Reutech Radar Systems

- ProSensing

- Detect Inc

- Saab AB

- Thales Group

- Leonardo S.p.A

- Hensoldt AG

- Terma Group

- GEM ELETTRONICA srl

- Japan Radio Co., Ltd

- FURUNO ELECTRIC CO. LTD

- Mitsubishi Electric Corporation

- Bharat Electronics Limited.

Recent Developments

- In March 2024, HENSOLDT UK received Type Approval for its Manta NEO X-band radar system, designed for the commercial shipping sector. This approval adds a certified, solid-state X-band radar solution to HENSOLDT’s portfolio, supporting its presence in the commercial maritime radar industry.