Market Definition

Wireless network topologies refer to the structural arrangement of wireless nodes and communication links within a network. Contrary to wired networks, which rely on physical cables for connectivity, wireless topologies utilize radio waves to enable data exchange between devices such as routers, access points, sensors, and end-user terminals.

The design of a wireless topology influences the network’s performance, scalability, reliability, and energy efficiency. Common wireless topologies include star, mesh, tree, and hybrid.

The choice of topology depends on the application, ranging from home Wi-Fi and enterprise networks to industrial automation and IoT deployments, along with factors such as network size, device mobility, and coverage requirements.

Wireless Network Topologies Market Overview

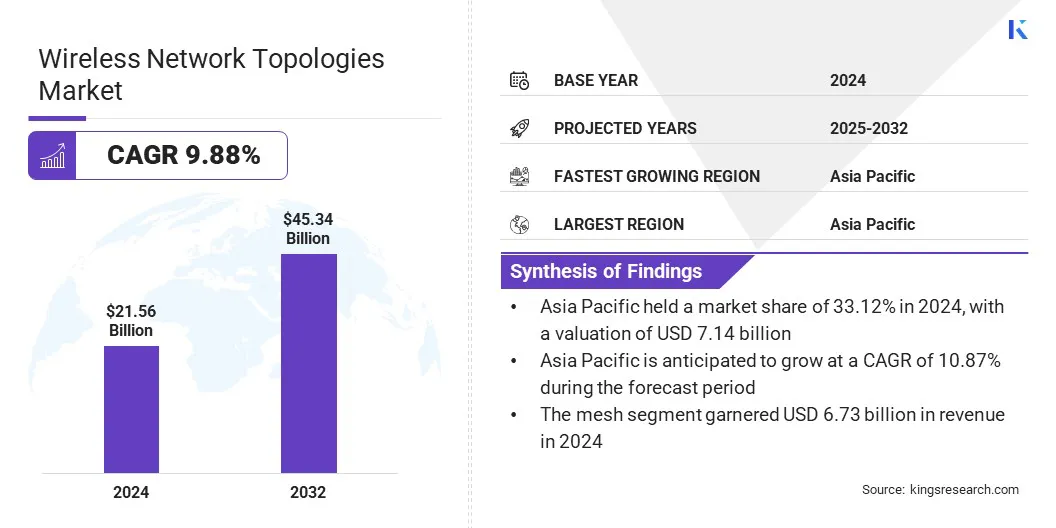

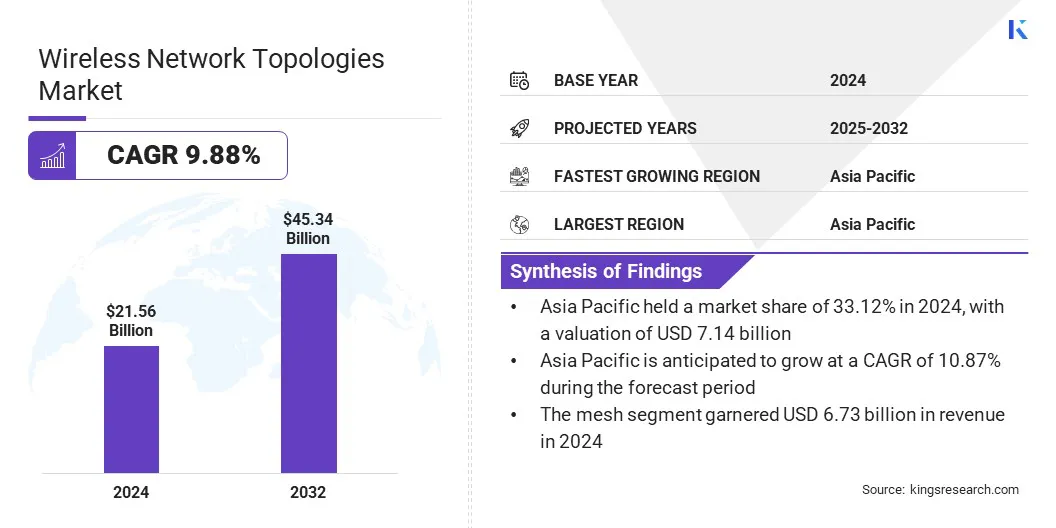

The global wireless network topologies market size was valued at USD 21.56 billion in 2024 and is projected to grow from USD 23.45 billion in 2025 to USD 45.34 billion by 2032, exhibiting a CAGR of 9.88% during the forecast period.

The market is expanding due to the rising adoption of IoT and smart infrastructure, which demand flexible, scalable, and energy-efficient connectivity solutions. Additionally, increasing deployment of industrial automation and AI-driven systems is driving demand for robust, low-latency wireless architectures.

Key Market Highlights:

- The wireless network topologies industry size was recorded at USD 21.56 billion in 2024.

- The market is projected to grow at a CAGR of 9.88% from 2025 to 2032.

- North America held a market share of 28.21% in 2024, with a valuation of USD 6.08 billion.

- The point-to-point technology segment garnered USD 3.71 billion in revenue in 2024.

- The wi-fi segment is expected to reach USD 15.96 billion by 2032.

- The telecommunications segment is anticipated to witness the fastest CAGR of 9.48% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 10.87% over the forecast period.

Major companies operating in the wireless network topologies market are Cisco Systems, Inc., Hewlett Packard Enterprise Development LP, ABB, Telefonaktiebolaget LM Ericsson, Motorola Solutions, Inc., Qualcomm Technologies, Inc., UNICOM, Firetide, Inc., Rajant Corporation., Wirepas Ltd, Telit Cinterion, Ceragon, Proxim Wireless, RADWIN, and Cambium Networks, Ltd.

The growing emphasis on intelligent, secure, and future-ready wireless infrastructure by government and market players is a key driver shaping the wireless network topologies market. Enterprises are increasingly adopting advanced wireless access points and unified licensing models that enable rapid deployment of smart spaces while ensuring robust security and performance.

These solutions are designed to address rising connectivity demands and support flexible, scalable network architectures capable of handling emerging workloads such as IoT integration and AI-driven operations.

Additionally, the need for simplified management and assurance in dynamic workplace environments is pushing organizations to transition toward wireless topologies for higher reliability, lower latency, and better control, thereby accelerating market growth.

- In November 2024, Cisco introduced a suite of intelligent and secure wireless innovations, including smart Wi-Fi 7 access points and a unified subscription licensing model. These solutions were designed to support out-of-the-box smart space deployment, helping customers address challenges related to connectivity, security, and assurance.

Market Driver

Infrastructure Modernization Driving Adoption of Resilient Wireless Topologies

Rapid urbanization, coupled with increased investment in smart city infrastructure, is driving the demand for scalable and resilient wireless network topologies.

The expansion of connected urban ecosystems is increasing the need for robust communication frameworks capable of supporting real-time data transmission across applications such as intelligent traffic systems, surveillance, environmental monitoring, and public safety.

Mesh and hybrid topologies are gaining preference due to their flexibility and ability to maintain seamless connectivity in dense environments. Public and private stakeholders are accelerating deployments of advanced wireless networks that deliver low-latency performance and ensure infrastructure readiness for smart cities.

- In May 2024, Motorola Solutions introduced the DIMETRA Connect solution alongside the MXP660 TETRA radio, designed to support seamless switching between land mobile radio (LMR) and broadband networks. This advancement aimed to enhance connectivity for front-line responders by ensuring uninterrupted communication across different network types.

Market Challenge

Interoperability Challenges Complicate Multi-Protocol Network Deployments

A key challenge in the wireless network topologies market is managing interoperability across multiple communication protocols, such as Wi-Fi, Zigbee, LoRaWAN, and LTE.

Inconsistent compatibility between legacy infrastructure and newer, protocol-specific devices leads to performance inefficiencies, data loss, and increased network latency. This complexity requires significant coordination and technical expertise, especially in large-scale deployments.

To address this issue, market players are developing unified network management platforms and adaptive topologies that support cross-protocol communication. They are also implementing standardized frameworks and intelligent gateways to streamline integration across diverse device ecosystems, ensure consistent performance, and reduce operational complexity.

- In May 2025, Rajant Corporation introduced LTE Enhance, an industrial-grade device that combines its Kinetic Mesh wireless network with LTE capabilities into a single edge-compute-enabled platform. This is designed to support real-time automation and remote operations by enabling seamless integration between private LTE networks and select public LTE carriers.

Market Trend

Rising Adoption of Self-Optimizing Wireless Topologies

A key trend shaping the market is the shift toward automation and self-optimizing networks. Intelligent network management systems are being deployed by market players to dynamically adapt to changing conditions, maintain performance, and reduce manual intervention.

Enterprises are prioritizing tools that enable real-time analytics, automated fault detection, and predictive maintenance to enhance operational efficiency. AI and machine learning are enabling these capabilities, particularly in environments requiring low-latency, high-reliability connectivity such as smart manufacturing, logistics hubs, and mission-critical infrastructure.

Network topologies that support autonomous adjustments, such as mesh and hybrid architectures, are gaining traction due to their flexibility and resilience.

Wireless Network Topologies Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Point-to-Point, Mesh, Star, Hybrid, Others

|

|

By Technology

|

Wi-Fi, Zigbee, LTE, Bluetooth, Others

|

|

By End-Use Industry

|

Telecommunications, Manufacturing and Industrial, Utilities and Energy, Retail and Hospitality, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Point-to-Point, Mesh, Star, Hybrid, and Others): The mesh segment earned USD 7.38 billion in 2024 due to its ability to offer high reliability, self-healing capabilities, and extensive coverage in dynamic and large-scale network environments.

- By Technology (Wi-Fi, Zigbee, LTE, Bluetooth, and Others): The Wi-Fi segment held 34.22% of the market in 2024, due to its widespread adoption across residential, commercial, and industrial settings, supported by continuous advancements in speed, security, and device compatibility.

- By End-Use Industry (Telecommunications, Manufacturing and Industrial, Utilities and Energy, Retail and Hospitality, and Others): The telecommunications segment is projected to reach USD 14.24 billion by 2032, owing to the growing demand for high-speed connectivity, expanding 5G infrastructure, and increased reliance on wireless networks for data-intensive applications and real-time communication.

Wireless Network Topologies Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific wireless network topologies market share stood at 33.12% in 2024 in the global market, with a valuation of USD 7.14 billion. The market growth in the region is supported by rapid urbanization, increasing digital penetration, and large-scale government investments in smart city infrastructure.

Countries such as China, India, Japan, and South Korea are actively expanding their wireless communication capabilities through nationwide 5G rollouts, public Wi-Fi initiatives, and private industrial networks. The market growth in the region is also driven by the rising adoption of smart manufacturing, utilities digitization, and the expansion of industrial IoT applications.

- In June 2024, AsiaRF announced the development of Wi-Fi HaLow Mesh technology, a significant advancement in long-range, low-power wireless connectivity. This innovation was designed to enhance IoT and industrial applications by delivering extended coverage, improved penetration, and stable performance in dense environments.

North America is poised for significant growth at a robust CAGR of 10.31% over the forecast period. The growth is driven by robust digital infrastructure, early adoption of advanced wireless technologies, and strong investment in smart city initiatives.

The region benefits from the presence of major technology providers and network operators, that are actively deploying next-generation solutions such as Wi-Fi 7, private LTE, and 5G-based mesh networks to enhance connectivity and reduce latency.

Moreover, increasing demand for scalable and secure wireless topologies from industries such as telecommunications, manufacturing, and energy for remote monitoring, automation, and real-time analytics is further driving market growth in this region.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) governs wireless communications by allocating unlicensed spectrum bands for Wi-Fi, Zigbee, and other technologies, while ensuring compliance with interference and device certification standards. Critical infrastructure applications must also comply with NIST cybersecurity frameworks and the FCC’s Part 15 regulations for unlicensed devices.

- In the EU, wireless network technologies are regulated under the Radio Equipment Directive (RED), which ensures safety, electromagnetic compatibility, and spectrum efficiency. The Body of European Regulators for Electronic Communications (BEREC) oversees network integrity, while the EU Cybersecurity Act reinforces data protection standards for industrial and public-sector wireless deployments.

- In APAC, China’s Ministry of Industry and Information Technology (MIIT) and South Korea’s MSIT supervise frequency allocation and industrial wireless deployment. Following rapid IoT adoption, China updated spectrum management laws in 2023 to support Wi-Fi 6E and industrial mesh networks. Countries like Singapore and Japan have adopted national 5G and smart manufacturing strategies that prioritize secure wireless infrastructure.

- In Japan, the Ministry of Internal Affairs and Communications (MIC) regulates wireless network equipment under the Radio Law, with strict type approvals and interoperability testing for mesh and point-to-point systems used in industrial automation and public services.

- Globally, the International Telecommunication Union (ITU) and IEEE provide harmonized standards for wireless network topologies. Global frameworks promote spectrum coordination, device interoperability, and cybersecurity best practices, which are essential for cross-border wireless infrastructure and IoT integration.

Competitive Landscape

The wireless network topologies market is characterized by a large number of participants, including both established corporations and rising organizations. Major players in the market are pursuing strategies such as technology integration, innovation in mesh architecture, and cross-industry collaborations to enhance network performance and scalability.

Companies are developing topology solutions that support high device density, real-time data flow, and low-latency communication. Moreover, market players are forming strategic alliances with IoT platform providers and industrial automation firms for seamless deployment and improved interoperability.

- In March 2025, Wirepas showcased its Wirepas Mesh technology at Embedded World by deploying a live network comprising 40 heterogeneous devices from 18 leading industry partners. This demonstration underscored the maturity, scalability, and multi-vendor interoperability of Wirepas Mesh, reinforcing its potential as a robust solution for large-scale industrial IoT applications.

Key Companies in Wireless Network Topologies Market:

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Development LP

- ABB

- Telefonaktiebolaget LM Ericsson

- Motorola Solutions, Inc.

- Qualcomm Technologies, Inc.

- UNICOM

- Firetide, Inc.

- Rajant Corporation.

- Wirepas Ltd

- Telit Cinterion

- Ceragon

- Proxim Wireless.

- RADWIN

- Cambium Networks, Ltd

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In February 2025, Ceragon unveiled its next-generation products IP-100E, IP-50GP, and EtherHaul 8020FX at Mobile World Congress (MWC) 2025. These launches are designed to enhance Ceragon’s global portfolio across both its core and private networks business, addressing evolving customer demands for scalable, high-capacity, and future-ready wireless infrastructure.

- In January 2024, Telit Cinterion introduced a new connectivity solution integrating both cellular and satellite services on its ME910G1 and ME310G1 modules. It is developed in collaboration with floLIVE and Skylo Technologies to enable continuous tracking and monitoring of mobile assets such as shipping containers, agricultural machinery, and freight trucks, regardless of location, including remote and hard-to-reach environments like deserts and oceans.