Market Definition

The market includes the hardware, software, and services required to support wireless communication networks. This involves the physical components such as cell towers, antennas, routers, and base stations, along with technologies enabling wireless data transmission, such as cellular networks, Wi-Fi, Bluetooth, and satellite communication.

Wireless Infrastructure Market Overview

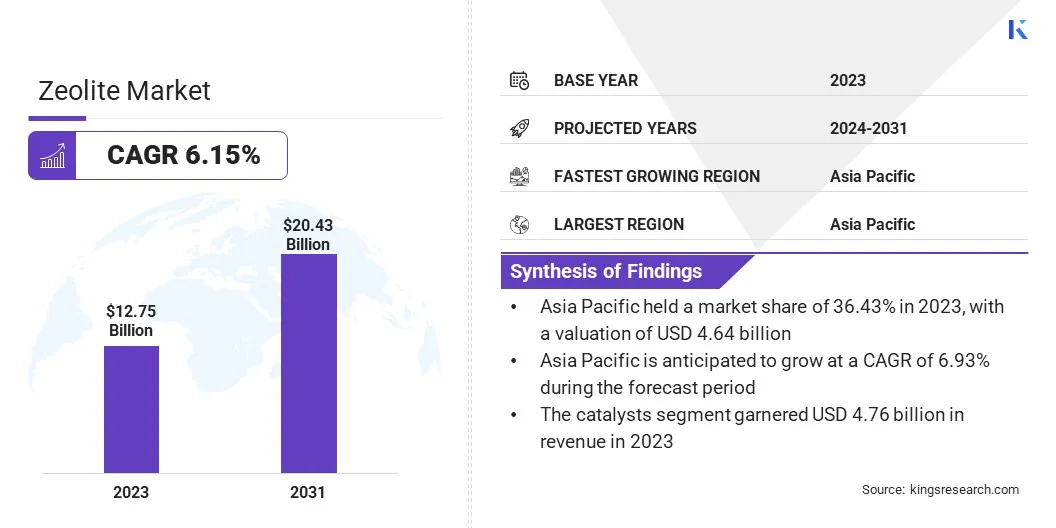

Global wireless infrastructure market size was valued at USD 124.70 billion in 2023, which is projected to grow from USD 128.93 billion in 2024 to USD 172.01 billion by 2031, growing at a CAGR of 4.20% from 2024 to 2031.

The increasing data traffic driven by streaming services, IoT devices, and cloud computing is creating a heightened demand for faster and more reliable networks, in turn driving the growth of the market.

Major companies operating in the wireless infrastructure industry are Belden Inc., Wireless Infrastructure Group, LS Cable & System Ltd, NEXANS, Prysmian S.p.A, Southwire Company, LLC, Sumitomo Electric Industries, Ltd., TE Connectivity, Zhuhai Hansen Technology Co., Ltd., Capgemini, Ciena Corporation, Cisco Systems, Inc., American Tower Corporation, Huawei Technologies Co., Ltd., and NEC Corporation of America.

The market is witnessing robust growth, driven by the global expansion of 5G networks. As telecom operators and service providers roll out 5G technology, there is a heightened demand for advanced infrastructure components such as base stations, antennas, small cells, and fiber-optic networks.

This growth presents significant opportunities for infrastructure providers, equipment manufacturers, and service companies, while driving advancements in network capabilities. The market is poised for continued expansion, fueled by the rising demand for high-speed connectivity and data-driven applications.

- In February 2025, NEC introduced solutions to modernize network infrastructure construction, reducing the time to build mobile infrastructure by approximately 60%. These new solutions enhance the efficiency of 5G network deployment, supporting faster rollouts and optimizing the lifecycle of wireless infrastructure.

Key Highlights:

- The wireless infrastructure industry size was recorded at USD 124.70 billion in 2023.

- The market is projected to grow at a CAGR of 4.20% from 2024 to 2031.

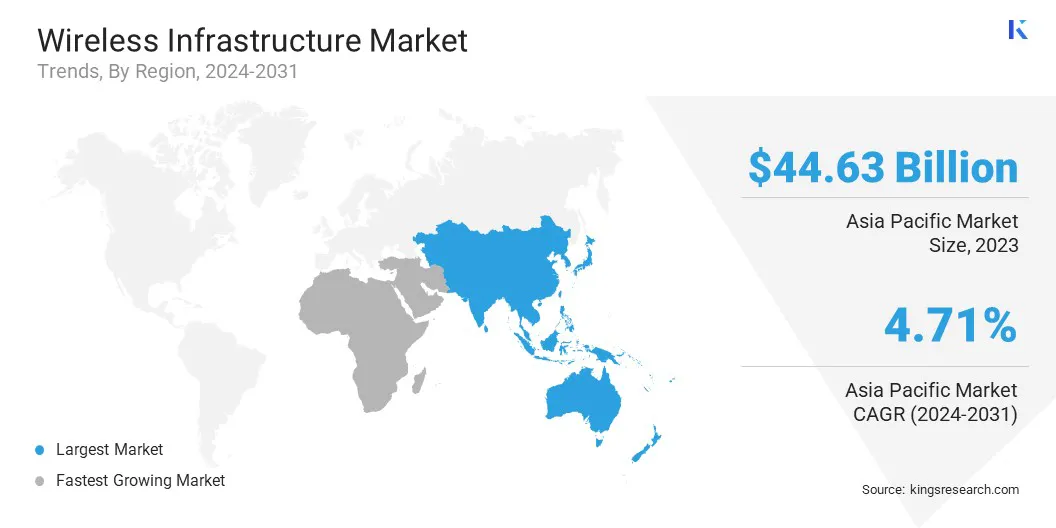

- Asia Pacific held a market share of 35.79% in 2023, with a valuation of USD 44.63 billion.

- The macrocell RAN segment garnered USD 32 billion in revenue in 2023.

- North America is anticipated to grow at a CAGR of 4.20% during the forecast period.

Market Driver

Rising Data Traffic

The growing demand for high-speed data fueled by streaming services, IoT devices, and cloud computing is a major driver of the wireless infrastructure market.

As network traffic increases, telecom operators are investing in advanced infrastructure to support higher data capacity and faster connectivity. This has accelerated the deployment of next-generation technologies, including 5G networks, fiber optics, and high-capacity wireless systems for reliable and efficient data transmission.

- In September 2024, Verizon and Vertical Bridge finalized a USD 3.3 billion deal for the lease and management of 6,339 wireless communication towers, enhancing their wireless infrastructure to support growing demand driven by AI and 5G technologies.

Market Challenge

Spectrum Scarcity and Network Limitations

Limited spectrum availability poses a major challenge to wireless network expansion, restricting the capacity needed to support increasing data traffic from 5G, IoT, and streaming services. Insufficient bandwidth leads to congestion, reduced network speeds, and coverage limitations.

To address this, key players are investing in dynamic spectrum sharing (DSS) and advanced signal optimization technologies to maximize existing spectrum usage. Regulatory bodies are facilitating spectrum auctions and reallocating underused frequencies, while companies are exploring satellite-based connectivity to enhance network capacity and efficiency.

Market Trend

Accelerated Deployment of Wireless Infrastructure

The market is experiencing a significant trend toward faster deployment, driven by the adoption of turnkey hardware solutions and evaluation kits. These integrated platforms simplify prototyping and accelerate the deployment of wireless systems, especially in 5G and OpenRAN networks. Moreover, they streamline development, reduce time-to-market, and enable telecom operators to scale their networks faster.

- In February 2023, Renesas Macrocell RAN collaborated with AMD to showcase a full RF front-end solution for 5G Active Antenna Systems. This new solution is designed to optimize power and efficiency, supporting the growing demand for mobile network infrastructure in the wireless communication sector.

Wireless Infrastructure Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type Outlook

|

Macrocell RAN, Small Cells, RRH, DAS, Cloud RAN, Carrier WiFi, Mobile Core, Backhaul

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type Outlook (Macrocell RAN, Small Cells, RRH, DAS, Cloud RAN, Carrier WiFi, Mobile Core, Backhaul): The macrocell RAN segment earned USD 36.32 billion in 2023, driven by expanding network coverage demands.

Wireless Infrastructure Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific wireless infrastructure market share stood around 35.79% in 2023 in the global market, with a valuation of USD 44.63 billion. Asia Pacific is the dominating region in the market due to the rapid adoption of advanced technologies and the growing demand for reliable, high-speed connectivity.

Asia Pacific leads the global 5G rollout, with substantial investments in network infrastructure to support the increasing consumption of data and digital services. Countries across the Asia Pacific are focusing on expanding their wireless networks, particularly in urban areas and underserved regions for reliable connectivity.

- In November 2024, U Mobile formed a strategic partnership with Straits Mobile Investment, a subsidiary of ST Telemedia, to jointly develop Malaysia's second 5G network. This collaboration aims to diversify the country's telecommunications landscape, moving away from a single wholesale network model to a more competitive environment.

North America is poised for significant growth at a robust CAGR of 4.20% over the forecast period. North America has emerged as one of the fast-growing regions in the wireless infrastructure industry, driven by rapid advancements in technology and increasing demand for high-speed connectivity.

Telecommunications companies in the region are heavily investing in network infrastructure to meet the growing demand for wireless services. The continued rollout of 5G networks and the development of next-generation wireless solutions are further driving the market in this region.

- In May 2024, T-Mobile acquired UScellular's wireless operations for USD 4.4 billion, including customers, retail stores, and certain spectrum assets. This acquisition aims to enhance T-Mobile's 5G network, particularly in underserved rural areas, by providing UScellular customers with improved coverage and access to T-Mobile's value-oriented plans.

Regulatory Frameworks

- In the U.S., the Wireless Telecommunications Bureau (WTB) under the Federal Communications Commission (FCC) regulates wireless communications, spectrum management, and infrastructure deployment to ensure compliance for wireless services, devices, facilities, and 5G networks

- In India, the Government launched the National Broadband Mission 2.0 in January 2025, aiming to accelerate the expansion of digital communication infrastructure, bridge the digital divide, and promote digital empowerment and inclusion, ensuring high-speed broadband and meaningful connectivity for all..

Competitive Landscape:

Companies in the wireless infrastructure market are focusing on enhancing network capabilities by developing advanced optical transceiver modules, low-power solutions, and high-speed communication systems.

These innovations support the growth of 5G and 6G networks, enabling faster data transmission, efficient energy use, and cost-effectiveness. Collaborations between tech firms are driving performance optimization, infrastructure upgrades, and meeting growing bandwidth demands.

- In March 2025, Point2 Technology and Sumitomo Electric Industries formed a strategic collaboration to develop 25G optical transceiver modules, enhancing fiber optic infrastructure for 5G and 6G networks. This partnership aims to improve performance and cost-efficiency in wireless infrastructure.

List of Key Companies in Wireless Infrastructure Market:

- Belden Inc.

- Wireless Infrastructure Group

- LS Cable & System Ltd

- NEXANS

- Prysmian S.p.A

- Southwire Company, LLC

- Sumitomo Electric Industries, Ltd.

- TE Connectivity

- Zhuhai Hansen Technology Co., Ltd.

- Capgemini

- Ciena Corporation

- Cisco Systems, Inc.

- American Tower Corporation

- Huawei Technologies Co., Ltd.

- NEC Corporation of America.

Recent Developments (M&A/Partnerships/New Product Launch)

- In October 2024, NEC launched an end-to-end private 5G solution in collaboration with Cisco. This offering integrates Cisco’s 5G SA Core with NEC’s validated radio network and systems integration services. NEC aims to provide enterprises with customized, secure 5G networks for digital transformation in industries like logistics, warehousing, and event management.

- In October 2024, Wireless Infrastructure Group (WIG) partnered with Vodafone to upgrade the Trafford Centre’s mobile infrastructure by introducing ultrafast 5G and enhanced 4G coverage. This collaboration aims to provide better customer experiences, improve operational efficiency, and support business operations like real-time analytics and inventory management.

- In July 2024, Belden Inc. completed the acquisition of Precision Optical Technologies, expanding its presence in the optical transceiver industry. This move boosts Belden’s fiber and network products, supporting faster fiber deployments and network upgrades for higher bandwidth.