Market Definition

The market focuses on ultra-high-speed wireless communication technologies operating in the 60 GHz frequency band, delivering multi-gigabit data transfer rates with low latency. It encompasses the development of WiGig (802.11ad/ay) chipsets, networking equipment, and integrated solutions for seamless, high-bandwidth connectivity.

Key focus areas include millimeter-wave technology, signal processing, and hardware miniaturization. Applications span enterprise networking, high-definition video streaming, augmented reality (AR), virtual reality (VR), and wireless docking stations.

Wireless Gigabit Market Overview

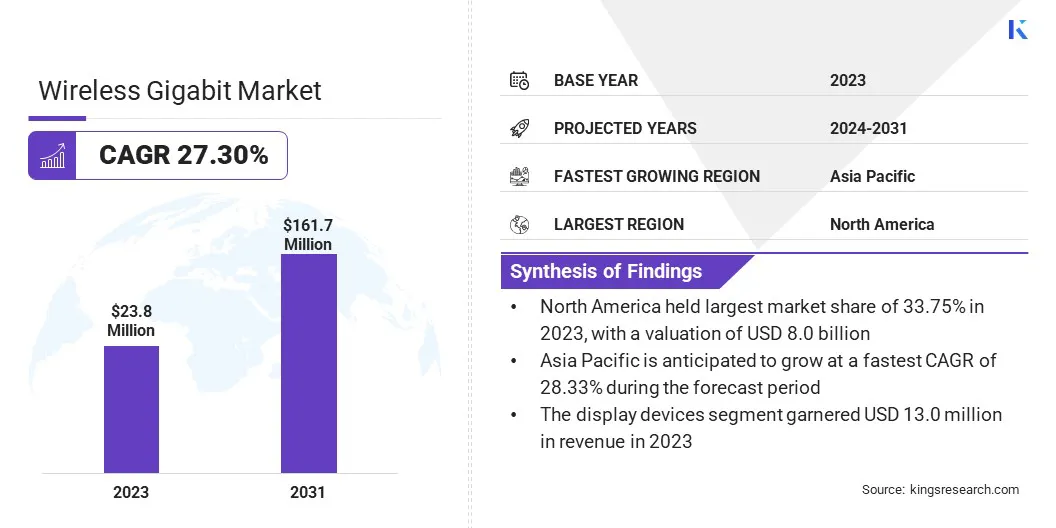

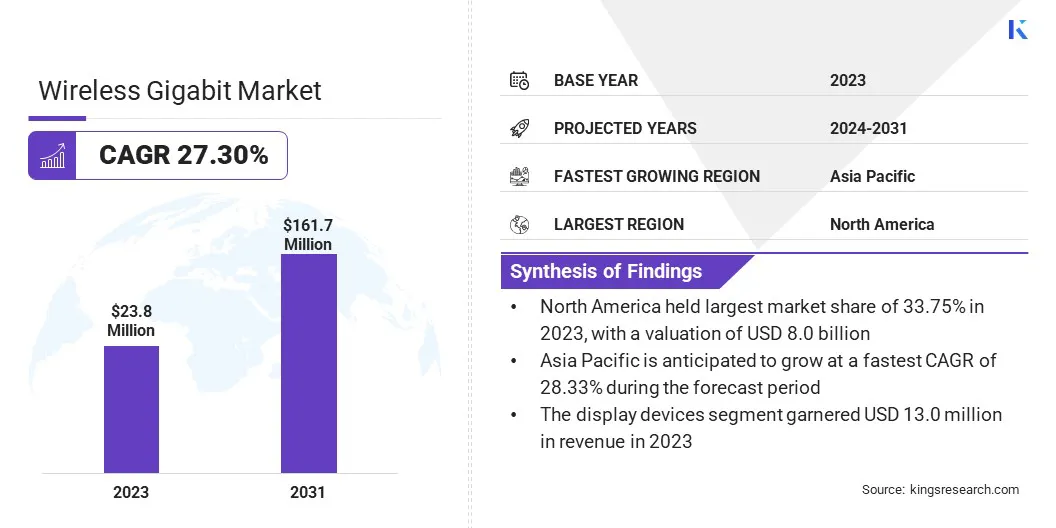

The global wireless gigabit market size was valued at USD 23.8 million in 2023 and is projected to grow from USD 29.8 million in 2024 to USD 161.7 million by 2031, exhibiting a CAGR of 27.30% during the forecast period.

The integration of WiGig with 5G networks is driving market growth by enabling ultra-fast, low-latency connectivity for high-bandwidth applications such as AR/VR, cloud computing, and industrial automation.

Advancements in millimeter-wave technology further support this growth by improving data transmission efficiency and expanding the adoption of high-frequency wireless solutions across sectors such as telecommunications, enterprise networking, and smart cities.

Major companies operating in the wireless gigabit industry are Peraso Technologies Inc., Qualcomm Technologies, Inc., Intel Corporation, Broadcom Inc., Cisco, Panasonic Holdings Corporation, Samsung, Ubiquiti Inc., Tensorcom, Inc., Microsoft, NVIDIA, NEC Corporation, Cambium Networks, Ltd., MediaTek Inc., Boingo Wireless, Inc., and others.

Enterprises and consumers are increasingly adopting high-speed wireless solutions to support bandwidth-intensive applications, accelerating market growth. Businesses require seamless connectivity for cloud computing, video conferencing, and data-heavy remote work environments.

Households are demanding high-performance wireless networks to support 4K streaming, online gaming, and smart home devices. The need for ultra-fast, low-latency communication is leading to the widespread adoption of WiGig technology, enabling more efficient and uninterrupted data transmission across various industries.

Key Highlights:

- The wireless gigabit industry size was recorded at USD 23.8 million in 2023.

- The market is projected to grow at a CAGR of 27.30% from 2024 to 2031.

- North America held a share of 33.75% in 2023, valued at USD 8.0 million.

- The system-on-chip (SoC) segment garnered USD 13.5 million in revenue in 2023.

- The display devices segment is expected to reach USD 89.6 million by 2031.

- The IEEE 802.11ad segment secured the largest revenue share of 61.86% in 2023.

- The commercial is set to grow at a robust CAGR of 27.63% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 28.33% over the forecast period.

Market Driver

"Integration of WiGig with 5G Networks"

The ongoing expansion of 5G networks is boosting the expansion of the wireless gigabit market by enabling seamless backhaul connectivity and faster data transmission speeds. WiGig supports multi-gigabit performance for 5G small cells and fixed wireless access solutions.

Telecom providers are leveraging 60 GHz wireless backhaul to improve coverage and capacity in dense urban areas. The convergence of WiGig and 5G is creating new opportunities for ultra-fast wireless communication, fueling market growth across various industries.

- In April 2024, NTT Corporation developed a technology that enables seamless switching between 60 GHz band wireless LAN (WiGig), a non-mobile wireless communication system, and 5G/LTE, a mobile wireless system, by estimating distance using radio waves. The company successfully demonstrated this innovation in an ultra-high-speed mobile environment. This advancement allows mobile terminals to utilize high-frequency non-mobile wireless systems as offloading destinations for mobile networks, enhancing overall wireless communication capacity and improving network efficiency.

Market Challenge

"High Deployment Costs and Infrastructure Limitations"

The high cost of deploying technology and the need for extensive infrastructure upgrades present a major challenge to the expansion of the wireless gigabit market. Implementing multi-gigabit wireless networks requires advanced hardware, dense small-cell infrastructure, and optimized backhaul solutions, leading to higher investment requirements for service providers.

To overcome this challenge, companies are adopting cost-effective deployment strategies, including the use of existing fiber infrastructure, development of energy-efficient chipsets, and advancement of network virtualization.

Additionally, partnerships with telecom operators and cloud service providers further help distribute costs and boost the adoption of wireless gigabit solutions in urban and enterprise settings.

Market Trend

"Advancements in Millimeter-Wave Technology"

Breakthroughs in 60 GHz millimeter-wave technology are enabling multi-gigabit wireless connectivity with minimal interference, supporting the expansion of the wireless gigabit market. Innovations in antenna design, beamforming, and signal processing are improving network efficiency and stability.

Enhanced spectrum availability in the 60 GHz band allows for faster and more reliable data transmission in enterprise and consumer applications. Companies developing next-generation wireless solutions are leveraging these advancements to deliver high-speed, low-latency communication.

- In November 2024, the Centre for Development of Telematics (C-DOT), under the Government of India, signed an agreement with the Indian Institute of Technology Roorkee to develop a "Millimeter Wave Transceiver for 5G Rural Connectivity." This project focuses on advancing millimeter wave backhaul technology by connectig a limited number of small cell-based stations (SBSs) to the gateway via fiber, aimed at enhancing rural connectivity.

Wireless Gigabit Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

System-on-Chip (SoC), Integrated Circuit Chip

|

|

By Product

|

Display Devices, Network Infrastructure Devices

|

|

By Technology

|

IEEE 802.11ad, IEEE 802.11ad

|

|

By End User

|

IT & Telecommunications, Consumer Electronics, Automotive, Commercial, Railway, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Offering (System-on-Chip (SoC) and Integrated Circuit Chip): The system-on-chip (SoC) segment earned USD 13.5 million in 2023 due to its ability to integrate multiple functions into a single chipset, enabling higher performance, reduced power consumption, and cost-efficient deployment in consumer electronics, networking devices, and enterprise applications.

- By Product (Display Devices and Network Infrastructure Devices): The display devices segment held a share of 54.42% in 2023, attributed to the growing demand for high-speed, low-latency connectivity in smart TVs, AR/VR headsets, and ultra-HD monitors, enabling seamless streaming, gaming, and immersive experiences.

- By Technology (IEEE 802.11ad and IEEE 802.11ad): The IEEE 802.11ad segment is projected to reach USD 99.8 million by 2031, fueled by its ability to deliver multi-gigabit speeds, low latency, and high data throughput, making it ideal for high-bandwidth applications in consumer electronics, enterprise networking, and wireless docking solutions.

- By End User (IT & Telecommunications, Consumer Electronics, Automotive, Commercial, Railway, and Others): The commercial segment is likely to grow at a CAGR of 27.63% through the forecast period, largely attributed to the rising demand for high-speed, low-latency connectivity in enterprise networks, retail, healthcare, and smart city infrastructure, leading to the widespread adoption of multi-gigabit wireless solutions.

Wireless Gigabit Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America wireless gigabit market share stood at around 33.75% in 2023, valued at USD 8.0 million. Increasing demand for high-capacity fixed wireless access (FWA) solutions, particularly among wireless Internet service providers (WISPs) aiming to expand broadband in underserved areas is contributing significantly to this growth.

The need for multi-gigabit connectivity without fiber, is boosting the adoption of 60 GHz wireless technologies. Urban and rural deployments are benefiting from FWA’s ability to provide cost-effective, high-speed internet with low latency. Regulatory backing for unlicensed mmWave spectrum and advancements in antenna technology are further regional market expansion.

- In March 2025, Peraso Inc., a leading U.S.-based company specializing in mmWave technology for 60 GHz unlicensed and 5G licensed networks, is set to participate in WISPAMERICA OKC to showcase its latest 60 GHz fixed wireless access (FWA) solutions designed for next-generation connectivity for wireless Internet service providers (WISPs).

Asia Pacific wireless gigabit industry is estimated to grow at a robust CAGR of 28.33% over the forecast period. Asia Pacific is a global hub for semiconductor manufacturing, with companies such as MediaTek, Samsung, and TSMC advancing WiGig chipsets and mmWave components.

The continuous innovation in high-frequency wireless chipsets is making WiGig increasingly accessible for consumer electronics, enterprise networking, and telecom applications.

Taiwan and South Korea are leading R&D efforts in next-generation wireless gigabit solutions, contributing to cost reductions and improved integration with emerging technologies such as 5G and AI-driven connectivity.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) allocates the 57–64 GHz band for unlicensed use, facilitating applications such as WiGig. Additionally, the 71–76 GHz and 81–86 GHz bands are designated for licensed, non-exclusive use, primarily for point-to-point communications. These allocations are detailed in the FCC's Table of Frequency Allocations.

- The European Table of Frequency Allocations and Applications (ECA Table) governs spectrum usage within European (Conference of Postal and Telecommunications Administrations) CEPT countries. The 59–66 GHz band is allocated for mobile services, with specific sub-bands designated for applications such as Radio Local Area Networks (RLANs) and Broadband Mobile Systems.

- In Japan, the Ministry of Internal Affairs and Communications (MIC) manages spectrum allocation. The 59–66 GHz band is designated as unlicensed, promoting the development and deployment of WiGig technologies.

- In India, the Department of Telecommunications (DoT) oversees spectrum management. According to the National Frequency Allocation Plan, the 59.3–64 GHz band is allocated for fixed, inter-satellite, mobile, and radio location services, while the 64–66 GHz band is designated for Earth exploration satellite, inter-satellite, mobile (except aeronautical mobile), and space research services.

Competitive Landscape

Companies operating in the wireless gigabit industry are forming strategic partnerships to accelerate product development and optimize sensor connectivity for high-speed data transmission.

These initiatives are strengthening the adoption of multi-gigabit ethernet solutions across industries, improving network capabilities and supporting AI-driven applications.

The collaborative efforts in developing cutting-edge solutions are contributing to market expansion by addressing the growing demand for high-bandwidth, low-latency communication technologies.

- In March 2025, Leopard Imaging Inc., in partnership with Lattice Semiconductor and NVIDIA, planned to introduce its next-generation Multi-Gigabit Ethernet AI Perception Solution at NVIDIA GTC 2025. This advanced solution leverages Lattice CertusPro-NX FPGA and the NVIDIA Holoscan Sensor Bridge to enhance near real-time AI processing by efficiently integrating sensors with high-performance computing platforms.

List of Key Companies in Wireless Gigabit Market:

- Peraso Technologies Inc.

- Qualcomm Technologies, Inc.

- Intel Corporation

- Broadcom Inc.

- Cisco

- Panasonic Holdings Corporation

- Samsung

- Ubiquiti Inc.

- Tensorcom, Inc.

- Microsoft

- NVIDIA

- NEC Corporation

- Cambium Networks, Ltd.

- MediaTek Inc.

- Boingo Wireless, Inc.

Recent Developments (Partnerships/Agreements/Product Launch)

- In March 2025, Ericsson, NBN Co., and Qualcomm Technologies, Inc. successfully conducted live field trials of 5G millimeter wave (mmWave) technology within the NBN Fixed Wireless Access (FWA) network. The trials achieved wholesale download speeds surpassing 1 Gbps and upload speeds exceeding 100 Mbps at around 14 kilometers, demonstrating mmWave’s potential to enhance FWA broadband connectivity in regional and rural areas.

- In February 2025, Ubiquiti Inc. introduced three new 10-gigabit UniFi Cloud Gateways: the Dream Router 7 (UDR7), Cloud Gateway Fiber (UCG Fiber), and UniFi Express 7 (UX7). These devices enhance network performance with features such as Wi-Fi 7 support, multiple 10GbE ports, and integrated storage options, catering to both home and enterprise users.

- In April 2024, Peraso Inc. announced that Panasonic System Networks R&D Lab. Co., Ltd. integrated Peraso's X710 chipset into its latest 60GHz WLAN solution. This solution ensures seamless installation and operation, leveraging the unlicensed 60 GHz band for interference-free performance and enhanced connectivity through narrow beam directional antenna control.

- In February 2024, Microsoft began testing Wi-Fi 7 support in Windows 11, offering multi-gigabit speeds, along with enhanced throughput, lower latency, and enhanced reliability. Microsoft described Wi-Fi 7, or IEEE 802.11be Extremely High Throughput (EHT) as a significant advancement in delivering exceptional speed, stability, and efficiency for wireless devices.