Market Definition

The market focuses on the development and manufacturing of gas detection systems that use wireless technology to monitor the presence of harmful or hazardous gases in the environment.

These wireless gas detectors are often used in industries such as oil and gas, mining, manufacturing, and chemical plants, where safety is a major concern due to the risk of gas leaks or hazardous air quality.

The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Wireless Gas Detection Market Overview

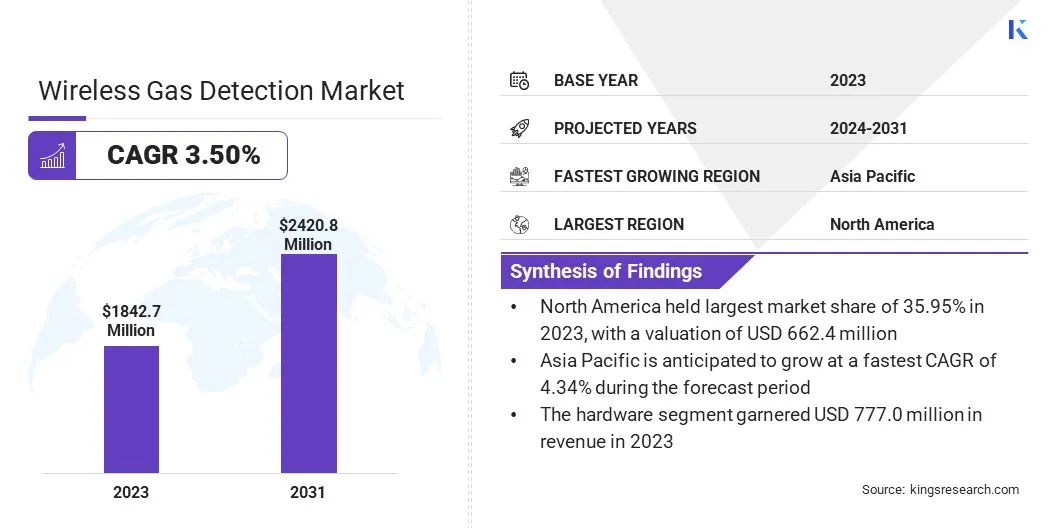

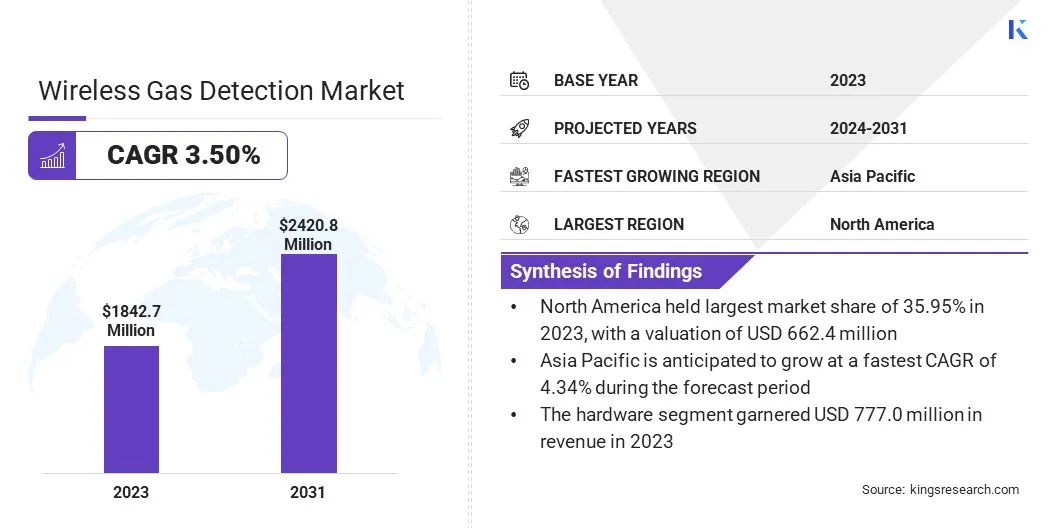

Global wireless gas detection market size was USD 1842.7 million in 2023, which is estimated to be valued at USD 1902.8 million in 2024 and reach USD 2420.8 million by 2031, growing at a CAGR of 3.50% from 2024 to 2031.

Improved sensor performance, achieved through recovery methods that restore efficiency, enhances the reliability and longevity of wireless gas detectors, thereby their effectiveness in real-time monitoring and driving adoption across industries.

Major companies operating in the wireless gas detection industry are Honeywell International Inc., Drägerwerk AG & Co. KGaA, MSA, Agilent Technologies, Inc., Teledyne Technologies Incorporated, Siemens, United Electric Controls, SCHAUENBURG International GmbH, Otis Instruments Inc., GAO Tek & GAO Group Inc., Emerson Electric Co., AMBETRONICS ENGINEERS Pvt. Ltd., Global Detection Systems Corp., R.C. Systems, Inc., OleumTech, and others.

The market is experiencing significant growth due to increasing safety regulations, technological advancements, and the rising need for real-time monitoring across industries such as oil & gas, manufacturing, mining, and chemicals.

Wireless gas detectors offer advantages such as remote monitoring, real-time alerts, and reduced installation costs, making them highly efficient and cost-effective. As safety awareness grows and industrial operations become more automated, the market is expected to expand, with innovations in wireless communication technologies boosting global adoption.

Key Highlights:

Key Highlights:

- The wireless gas detection industry size was recorded at USD 1842.7 million in 2023.

- The market is projected to grow at a CAGR of 3.50% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 662.4 million.

- The hardware segment garnered USD 777.0 million in revenue in 2023.

- The WiFi segment is expected to reach USD 661.7 million by 2031.

- The oil & gas segment is estimated to witness the fastest CAGR of 3.65% over the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 4.34% through the projection period.

Market Driver

"Enhanced Sensor Performance"

Enhanced sensor performance is propelling the growth of the wireless gas detection market. Innovations, such as recovery techniques that restore sensors to near 100% efficiency, ensure that gas detectors remain highly effective over extended periods.

This improvement reduces the need for frequent replacements and ensures continuous and reliable real-time monitoring, particularly in industries where safety and operational efficiency are paramount. As sensors become more durable and dependable, industries are more likely to invest in wireless detection solutions, thus accelerating market growth.

- In October 2024, researchers from Pusan National University and KAIST developed an optimized recovery method for palladium-based H2 gas sensors, addressing long-term stability issues. By identifying CO2 accumulation as the performance degradation cause, they achieved nearly 100% recovery through a cost-effective thermal treatment, enhancing sensor reliability.

Market Challenge

"High Initial Costs"

High initial costs pose a significant challenge to the progress of the wireless gas detection market, particularly for small and medium-sized businesses. The upfront investment in advanced sensors, wireless communication technology, and installation can be prohibitive.

To address this, manufacturers are developing more cost-effective solutions, such as modular and scalable systems that allow businesses to start with a smaller setup and expand as needed. Additionally, innovations in sensor technology are reducing costs, making wireless gas detection more affordable and accessible to a wider range of industries.

Market Trend

"Wearable Technology Integration"

The integration of wearable technology in the wireless gas detection market is rapidly growing, propelled by the demand for real-time healthcare and environmental monitoring. Wearable wireless gas sensors provide continuous, hands-free detection of hazardous gases such as ammonia, enhancing safety and health diagnostics.

These systems enable real-time monitoring without spatial or temporal limitations, making them ideal for individuals in hazardous environments or those with respiratory conditions. As sensor technology advanced, wearable systems are becoming more accurate, compact, and user-friendly, fostering their adoption across various industries.

- In December 2024, researchers from Yonsei University and Kyungpook National University developed a wearable wireless gas monitoring system. This system integrates a high-selectivity AgNW-SiNM sensor with a flexible Joule heater, enabling real-time ammonia detection. The system provides early evacuation warnings and supports noninvasive respiratory diagnosis.

Wireless Gas Detection Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Technology

|

WiFi, Bluetooth, License-free ISM band, Cellular technology, Others

|

|

By End User industry

|

Oil & Gas, Chemicals, Utilities and Power Generation, Mining & Metals, Water & Wastewater Treatment, Government & Defense, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Hardware, Software, and Services): The hardware segment earned USD 777.0 million in 2023 due to the increasing adoption of advanced sensors, wireless communication technologies, and the growing need for real-time monitoring in hazardous environments.

- By Technology (WiFi, Bluetooth, License-free ISM band, Cellular technology, and Others): The WiFi segment held a share of 27.30% in 2023, stimulated by the rising demand for seamless, high-speed wireless communication for real-time data transmission in industrial applications and safety monitoring systems.

- By End User industry (Oil & Gas, Chemicals, Utilities and Power Generation, Mining & Metals, Water & Wastewater Treatment, Government & Defense, and Others): The utilities and power generation segment is projected to reach USD 597.1 million by 2031, attributed to the growing need for continuous gas leak monitoring and enhanced safety protocols in energy production and distribution sectors.

Wireless Gas Detection Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America wireless gas detection market share stood at around 35.95% in 2023, valued at USD 662.4 million. This dominance is reinforced by safety regulations, technological advancements, and the presence of key market players.

North America wireless gas detection market share stood at around 35.95% in 2023, valued at USD 662.4 million. This dominance is reinforced by safety regulations, technological advancements, and the presence of key market players.

Industries such as oil & gas, manufacturing, and chemicals are adopting wireless gas detection systems to ensure real-time monitoring and compliance with safety standards.

The high demand for efficient and reliable safety solutions in hazardous environments, combined with innovations in wireless communication and sensor technology, further boosts regional market expansion.

Asia Pacific wireless gas detection industry is estimated to grow at a CAGR of 4.34% over the forecast period. This expansion is fueled by rapid industrialization, urbanization, and increasing safety awareness.

Countries such as China, India, and Japan are witnessing substantial growth in sectors such as manufacturing, mining, and construction, generating a strong demand for wireless gas detection systems.

Additionally, the rising focus on environmental safety and regulatory compliance is propelling domestic market expansion. With significant investments in smart technologies and the adoption of advanced sensor systems, the regionak market is likely to witness strong growth in the coming years.

Regulatory Frameworks

- In the US, the Occupational Safety and Health Administration (OSHA) provides guidance on calibrating and testing direct-reading monitors (DRMs), which are crucial for detecting toxic gases, oxygen-deficient, and combustible atmospheres in confined spaces, manholes, and other hazardous environments. Several OSHA standards, including 29 CFR 1910.146 for confined spaces and 29 CFR 1910.120 for hazardous waste operations, mandate the use of gas monitors.

- In the EU, the ATEX Directive 2014/34/EU ensures that equipment used in explosive atmospheres meets essential safety and health standards. It mandates conformity assessments before market introduction, ensuring safe and reliable gas detection systems.

- In India, the Factories Act, 1948 enforces safety protocols in manufacturing units, mandating gas detection systems to safeguard workers from exposure to hazardous gases in confined spaces.

Competitive Landscape

Companies in the wireless gas detection ndustry are increasingly focusing on developing advanced sensor technologies, enhancing connectivity, and integrating real-time monitoring systems to improve safety and efficiency.

These innovations aim to provide more accurate gas detection, faster response times, and seamless data transfer. Additionally, there is a growing emphasis on creating portable, user-friendly devices that can be easily deployed in hazardous environments.

Companies are also incorporating artificial intelligence and cloud-based solutions to enable predictive maintenance and enhance the reliability of gas detection systems.

- In April 2023, Teledyne FLIR launched the G-Series Optical Gas Imaging (OGI) cameras, featuring advanced gas quantification and wireless data transfer. The seven models, designed for industries such as oil and gas, manufacturing, and utilities, enable efficient leak detection and documentation. With built-in quantification, wireless connectivity, and compatibility with third-party analysis software, the G-Series improves field operations, ensuring faster and safer identification of harmful gas emissions.

List of Key Companies in Wireless Gas Detection Market:

- Honeywell International Inc.

- Drägerwerk AG & Co. KGaA

- MSA

- Agilent Technologies, Inc.

- Teledyne Technologies Incorporated

- Siemens

- United Electric Controls

- SCHAUENBURG International GmbH

- Otis Instruments Inc.

- GAO Tek & GAO Group Inc.

- Emerson Electric Co.

- AMBETRONICS ENGINEERS Pvt. Ltd.

- Global Detection Systems Corp.

- C. Systems, Inc.

- OleumTech

Recent Developments (Product Launch)

- In January 2024, MSA Safety showcased its advanced gas detection solutions at the International Air-Conditioning, Heating, Refrigerating Exposition (AHR Expo) in Chicago. The featured products include MSA Chillgard 5000 Monitor and Bacharach Multi-Zone Gas Monitor, offering 24/7 remote leak monitoring and data analytics. These aspirated detection systems draw air from sample points into units where sensors detect refrigerant concentrations and issue alerts upon leak detection. The Chillgard 5000 serves HVAC applications, while the Multi-Zone is designed for refrigeration, advancing safety compliance, reducing emissions, and providing actionable data.

Key Highlights:

Key Highlights: North America wireless gas detection market share stood at around 35.95% in 2023, valued at USD 662.4 million. This dominance is reinforced by safety regulations, technological advancements, and the presence of key market players.

North America wireless gas detection market share stood at around 35.95% in 2023, valued at USD 662.4 million. This dominance is reinforced by safety regulations, technological advancements, and the presence of key market players.