Market Definition

The market refers to the industry focused on the development, production, and deployment of inductive or resonant-based charging systems that enable electric vehicles (EVs) to charge without physical cables.

This market encompasses hardware components such as charging pads, power control units, and vehicle receivers, along with associated software and infrastructure solutions.

Wireless EV Charging Market Overview

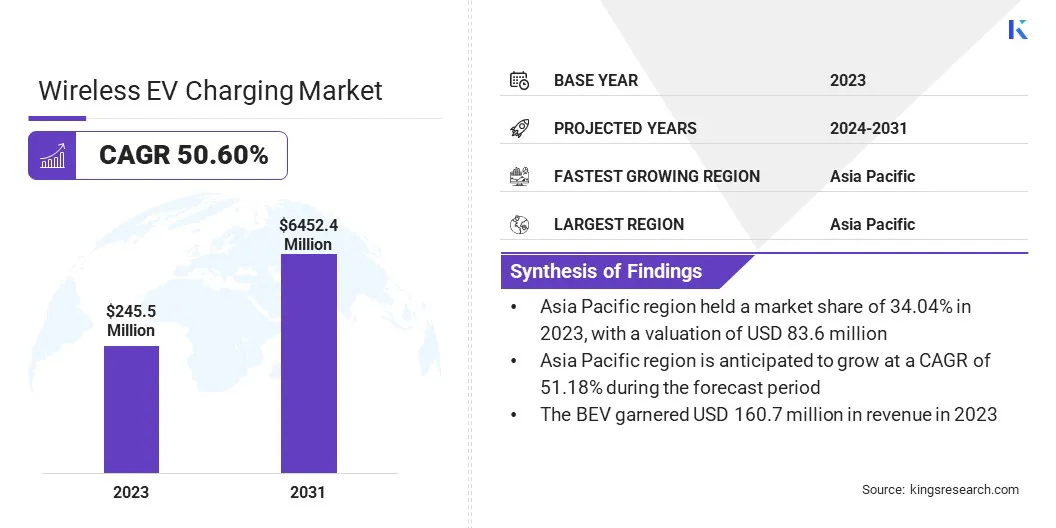

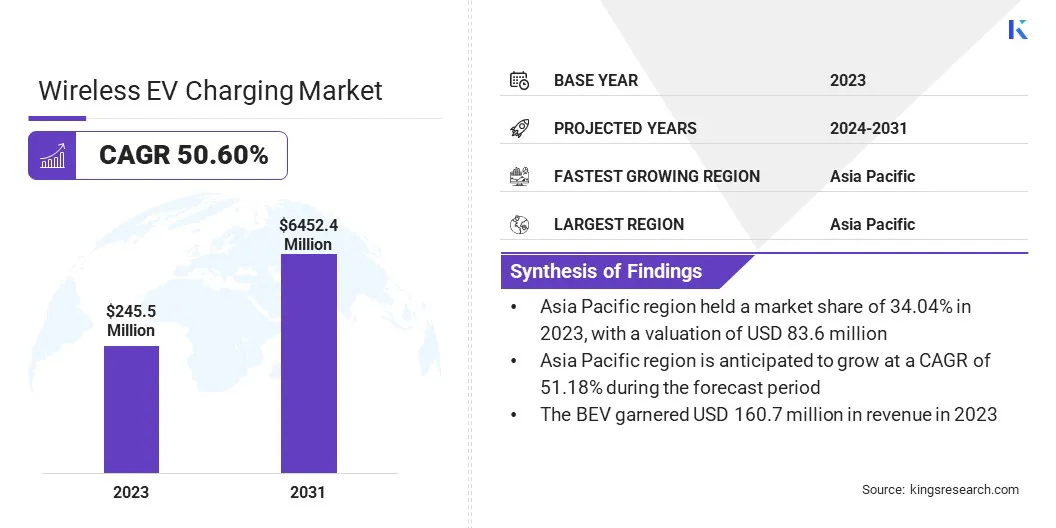

The global wireless EV charging market size was valued at USD 245.5 million in 2023 and is projected to grow from USD 367.3 million in 2024 to USD 6452.4 million by 2031, exhibiting a CAGR of 50.60% during the forecast period.

The market is driven by increasing EV adoption, advancements in wireless power transfer technology, and growing investments in smart charging infrastructure. Wireless charging solutions eliminate the need for physical connectors, enhancing user convenience and reducing wear & tear on charging components.

Major companies operating in the wireless EV charging industry are WiTricity Corporation, InductEV Inc., Mitsubishi Corporation, Electreon, Siemens, TOSHIBA CORPORATION, Dash Dynamic, Plugless Power Inc., WIRELESS ADVANCED VEHICLE ELECTRIFICATION, LLC., WiPowerOne, and Mojo Mobility Inc.

Key players are focusing on developing efficient, high-power charging systems to support passenger and commercial EVs. Additionally, government incentives and public-private collaborations are fostering the deployment of wireless charging stations across urban and highway networks.

The integration of wireless charging with autonomous vehicles and smart city initiatives further accelerates market growth, positioning it as a crucial component of the future EV ecosystem.

Key Highlights:

- The wireless EV charging industry size was valued at USD 245.5 million in 2023.

- The market is projected to grow at a CAGR of 50.60% from 2024 to 2031.

- Asia Pacific held a market share of 34.04% in 2023, with a valuation of USD 83.6 million.

- The magnetic resonance segment garnered USD 94.4 million in revenue in 2023.

- The dynamic segment is expected to reach USD 3724.3 million by 2031.

- The BEV segment is expected to reach USD 4374.7 million by 2031.

- The passenger cars segment is expected to reach USD 3695.9 million by 2031.

- The up to 50 kW segment garnered USD 97.2 million in revenue in 2023.

- The residential segment is expected to reach USD 3397.8 million by 2031.

- The market in Europe is anticipated to grow at a CAGR of 51.18% during the forecast period.

Market Driver

"Rising Adoption of EVs"

The wireless EV charging market is significantly driven by the rising adoption of EVs globally. With governments and automotive manufacturers prioritizing sustainability and reducing carbon emissions, EV adoption has surged, necessitating advanced and efficient charging solutions.

Traditional plug-in charging systems require physical connections, which can be cumbersome and prone to wear & tear. Wireless charging offers a seamless, automated alternative that enhances user convenience by eliminating manual plug-ins.

The demand for wireless charging solutions will accelerate as EV penetration continues to rise, providing long-term growth opportunities for key industry players.

- In 2023, according to the International Energy Agency, nearly 14 million new electric cars were registered globally, driving EV adoption to 40 million units on the road. This 35% year-on-year growth accelerates the demand for wireless EV charging solutions, reinforcing market expansion and infrastructure investments.

Market Challenge

"High Initial Investment and Infrastructure Costs"

Primary challenges in the wireless EV charging market are the high initial investment required for deploying wireless charging infrastructure. The cost of manufacturing and installing inductive charging systems, including ground-based charging pads, power control units, and vehicle receivers, is significantly higher than traditional wired charging solutions.

Additionally, integrating wireless charging into existing infrastructure, such as public parking lots, highways, and residential areas, requires substantial capital expenditure and technological modifications, further adding to deployment costs. Industry players and governments can collaborate to introduce incentive programs, subsidies, and public-private partnerships aimed at reducing infrastructure costs and accelerating adoption.

Standardization of wireless charging technology across different vehicle manufacturers and charging networks can help drive down costs by enabling mass production, supply chain optimization, and economies of scale.

Furthermore, technological advancements in power efficiency, material innovation, and system durability can lower the long-term operational and maintenance costs of wireless charging infrastructure.

Market Trend

"Expansion of Wireless Charging in Commercial Fleet Operations"

A growing trend in the wireless EV charging market is its increasing adoption in commercial fleet operations, including electric buses, taxis, logistics vehicles, and ride-sharing services. The demand for efficient, automated, and high-power charging solutions is rising as businesses & municipalities shift toward electrified transportation to meet sustainability goals and reduce operational costs.

Wireless charging offers a seamless way to keep fleet vehicles powered without the logistical challenges of plug-in charging, reducing downtime and enhancing operational efficiency. Fleet operators are exploring stationary and dynamic wireless charging solutions to optimize vehicle usage.

Stationary wireless charging is being implemented in bus depots, taxi stands, and delivery hubs, allowing vehicles to recharge during scheduled stops without human intervention. Meanwhile, dynamic wireless charging, where EVs charge while moving along electrified roads, is being tested to extend range and eliminate charging delays.

- In August 2024, InductEV and EO Charging partnered to advance high-power wireless charging for commercial EV fleets, streamlining operations by enabling seamless, automated charging at depots and transit hubs, aligning with the growing trend of wireless charging adoption in commercial fleet operations.

Wireless EV Charging Market Report Snapshot

|

Segmentation

|

Details

|

|

By Charging System

|

Magnetic Resonance, Inductive, Capacitive

|

|

By Type

|

Dynamic, Static

|

|

By Propulsion

|

BEV, PHEV

|

|

By Vehicle

|

Passenger Cars, Commercial Vehicles

|

|

By Power

|

Up to 50 kW, 51-100 kW, Above 100 kW

|

|

By Application

|

Commercial, Residential

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Charging System (Magnetic Resonance, Inductive, Capacitive): The magnetic resonance segment earned USD 94.4 million in 2023, due to its higher efficiency, longer transmission range, and ability to charge multiple vehicles simultaneously.

- By Type (Dynamic, Static): The dynamic segment held 57.86% share of the market in 2023, due to its ability to charge EVs while in motion, significantly reducing range anxiety and minimizing downtime for recharging.

- By Propulsion (BEV, PHEV): The BEV segment is projected to reach USD 4374.7 million by 2031, owing to the rapid adoption of fully electric vehicles, stringent emission regulations, and advancements in battery technology.

- By Vehicle (Passenger Cars, Commercial Vehicles): The passenger cars segment is projected to reach USD 3695.9 million by 2031, owing to the rising consumer preference for wireless charging-enabled EVs, increasing smart home charging solutions, and collaborations between automakers and technology providers.

- By Power (Up to 50 kW, 51-100 kW, Above 100 kW): The Up to 50 kW segment held 39.57% share of the market in 2023, due to its widespread application in residential and commercial settings, catering primarily to passenger vehicles and light-duty EVs.

- By Application (Commercial, Residential): The residential segment is projected to reach USD 3397.8 million by 2031, owing to the growing adoption of EVs among individual consumers, increasing smart home integration, and rising investments in private wireless charging infrastructure.

Wireless EV Charging Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a wireless EV charging market share of around 34.04% in 2023, with a valuation of USD 83.6 million. The dominance is driven by rapid EV adoption, government initiatives supporting electrification, and increasing investments in smart transportation infrastructure.

Countries such as China, Japan, and South Korea are at the forefront of technological advancements, integrating wireless charging in urban transit systems and commercial fleet operations.

The region benefits from strong automotive manufacturing capabilities, partnerships between automakers and charging technology providers, and growing demand for premium EV models equipped with wireless charging features. Furthermore, government incentives, subsidies, and policies promoting EV adoption continue to accelerate the market growth.

- In September 2024, the Ministry of Heavy Industry (MHI) launched the PM e-Drive initiative, aimed at accelerating EV adoption, enhancing charging infrastructure, and promoting advanced technologies such as wireless EV charging, reinforcing India’s commitment to sustainable and smart mobility solutions.

The market in Europe is poised to grow at a significant CAGR of 50.63% over the forecast period, fueled by strict emission regulations, rising EV adoption, and ambitious government policies promoting sustainable mobility.

The region is registering increasing investments in wireless charging infrastructure, particularly in Germany, the UK, France, and the Netherlands, where smart city initiatives and EV-friendly regulations drive adoption. Automakers and technology firms are actively collaborating to develop standardized, high-efficiency wireless charging solutions, further propelling the market.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) regulates wireless power transfer (WPT) frequencies, ensuring compliance with operational standards, while the Department of Energy (DOE) regulates and supports wireless EV charging innovation, funding infrastructure development and advancing market adoption through strategic investments.

- In Europe, the European Commission (EC) regulates the market by setting policies, funding infrastructure development, and ensuring compliance with sustainability and interoperability standards. The EC promotes seamless wireless charging integration, supporting EV adoption and advancing smart mobility transition in the region.

Competitive Landscape

The wireless EV charging industry is characterized by intense competition. Leading market players are focusing on technological advancements, strategic partnerships, and expansion initiatives to strengthen their market presence. Key companies are investing in R&D to enhance charging efficiency, extend charging range, and develop cost-effective solutions to accelerate adoption.

Major automotive manufacturers are collaborating with wireless charging technology providers to integrate factory-fitted wireless charging solutions into upcoming EV models. Additionally, public and private sector investments are fostering the deployment of wireless charging infrastructure in smart cities, highways, and commercial fleet depots.

The growing emphasis on patent protection and proprietary technologies has led to increased competition among players striving to establish industry standards and gain regulatory approvals.

- In May 2024, WiTricity partnered with International Transportation Service to launch a wireless EV charging pilot for Ford E-Transit vans at the Port of Long Beach, enhancing fleet efficiency and showcasing the scalability of wireless charging in commercial logistics operations.

List of Key Companies in Wireless EV Charging Market:

- WiTricity Corporation

- InductEV Inc.

- Mitsubishi Corporation

- Electreon

- Siemens

- TOSHIBA CORPORATION

- Dash Dynamic

- Plugless Power Inc.

- WIRELESS ADVANCED VEHICLE ELECTRIFICATION, LLC.

- WiPowerOne

- Mojo Mobility Inc.

Recent Developments (Partnerships)

- In November 2024, Electreon and Xos Inc. partnered with the State of Michigan to deploy wireless charging infrastructure for delivery fleets in Detroit, including UPS vehicles. This initiative highlights the growing adoption of dynamic wireless charging, enhancing fleet efficiency and sustainability in the market.