Market Definition

The market refers to the sector focused on the application of biotechnology in industrial processes to develop sustainable, efficient, and environmentally friendly products and manufacturing methods.

Also known as industrial biotechnology, this market encompasses the use of microorganisms, enzymes, and biological systems for the production of bio-based chemicals, materials, fuels, and other industrial products. The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

White Biotechnology Market Overview

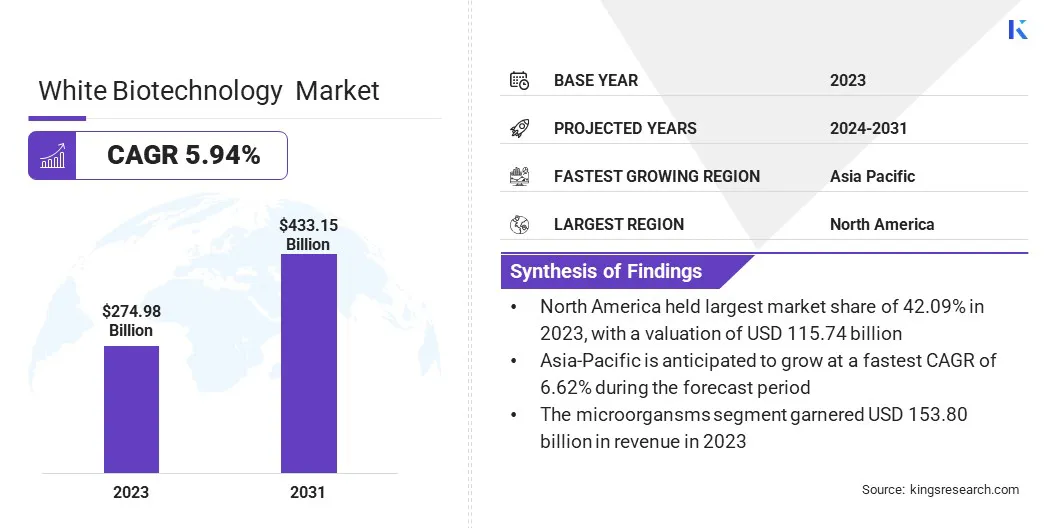

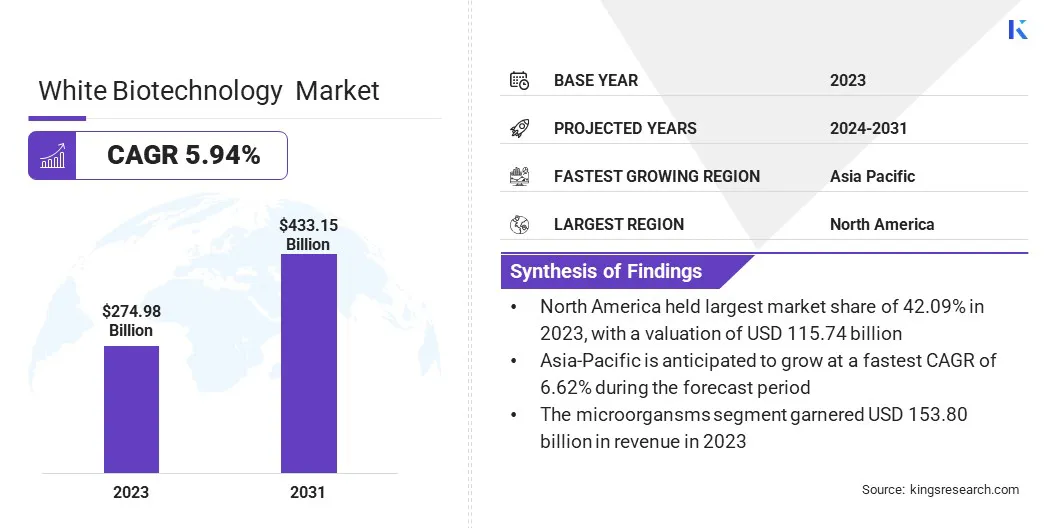

The global white biotechnology market size was valued at USD 274.98 billion in 2023 and is projected to grow from USD 289.23 billion in 2024 to USD 433.15 billion by 2031, exhibiting a CAGR of 5.94% during the forecast period.

This growth trajectory is attributed to the increasing demand for sustainable and resource-efficient industrial processes, coupled with heightened environmental awareness and the global transition toward a bio-based economy.

Major companies operating in the white biotechnology industry are Corbion NV, BASF SE, Evonik Industries AG, Covestro AG, Henkel AG & Co. KGaA, Biosynth, AB Enzymes, Givaudan, ADM, Advanced Enzyme Technologies, Novozymes A/S, dsm-firmenich, thyssenkrupp Uhde GmbH, Zymtronix Catalytic Systems, Inc., and Nature BioScience Pvt. L.T.D.

Technological advancements in genetic engineering, enzymatic catalysis, and microbial fermentation are enhancing production capabilities and broadening the applicability of white biotechnology across key sectors such as pharmaceuticals, agriculture, specialty chemicals, food and beverages, and bioenergy.

Supportive regulatory frameworks and government incentives designed to advance low-carbon initiatives and circular economy models are anticipated to play a pivotal role in accelerating the global expansion of the market.

Key Highlights

- The white biotechnology industry size was recorded at USD 274.98 billion in 2023.

- The market is projected to grow at a CAGR of 5.94% from 2024 to 2031.

- North America held a market share of 42.09% in 2023, with a valuation of USD 115.74 billion.

- The microorganisms segment garnered USD 153.80 billion in revenue in 2023.

- The biofuels segment is expected to reach USD 139.45 billion by 2031.

- The chemicals & materials segment is anticipated to witness fastest CAGR of 8.13% during the forecast period

- The industrial manufacturers segment garnered USD 110.29 billion in revenue in 2023.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.62% during the forecast period.

Market Driver

Rising Adoption of Bio-Based Products Across Industries

The growing adoption of bio-based products across industries is driving the market. Sectors such as chemicals, food and beverages, agriculture, and energy are increasingly utilizing bio-based alternatives to reduce environmental impact and reliance on fossil resources.

Applications range from bio-polymers and enzymes to biofertilizers and biofuels, supporting sustainability goals while enhancing process efficiency and product performance. This industry-wide shift is accelerating innovation and reinforcing the role of white biotechnology in advancing the global bioeconomy.

- In June 2024, BASF, in collaboration with Saarland University, the University of Marburg, and University of Kaiserslautern-Landau, launched the FUMBIO research project to develop a CO₂-neutral process for producing bio-based fumarate using a bacterium derived from a Holstein cow's rumen.

Market Challenge

Regulatory and Compliance Barriers

The white biotechnology market is constrained by complex and region-specific regulatory frameworks, which pose challenges to product development and commercialization. Regulatory approval processes especially for genetically modified organisms and novel bio-based compounds are resource-intensive which impacts time-to-market and increases the operational costs.

The lack of globally harmonized standards further complicates international trade, particularly for small and medium-sized enterprises. These regulatory complexities hinder innovation and slow the broader adoption of white biotechnology solutions across industries.

To address these challenges, key players are strengthening regulatory readiness, establishing comprehensive internal compliance systems, and actively participating in industry groups to support the alignment of global standards. Companies are also contributing to policy development efforts and forming public-private partnerships to improve transparent regulatory frameworks.

Market Trend

Advancements in Biotechnological Research and Innovation

Advancements in biotechnological research are enhancing the efficiency, scalability, and cost-effectiveness of white biotechnology processes. Progress in areas such as genetic engineering, synthetic biology, and metabolic engineering is leding to the develpoment of highly efficient microbial strains and enzyme systems.

The application of computational biology, including bioinformatics, and systems biology, is further accelerating strain optimization and process design, enabling faster development cycles and improved scalability. These developments are expanding the industrial applications of white biotechnology and strengthening its role in promoting sustainable manufacturing.

- In February 2025, thyssenkrupp Uhde GmbH and Novonesis introduced their jointly developed uhde enzymatic esterification. This advanced process enables sustainable ester production by lowering energy requirements and improving product quality through the use of biocatalysis.

White Biotechnology Market Report Snapshot

|

Segmentation

|

Details

|

|

By Source

|

Microorganisms, Plant-based, Algae-based, Others

|

|

By Product Type

|

Biofuels (Bioethanol, Biodiesel), Biochemicals (Organic acids, Alcohols, Ketones), Biopolymers (Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Starch Blends), Industrial Enzymes (Proteases, Amylases, Lipases, Others)

|

|

By Application

|

Bioenergy (Biofuel production, Biogas), Food & Feed Industry (Fermentation, Probiotics, Enzyme additives), Pharmaceuticals (Biocatalysis, API production), Chemicals & Materials, Others

|

|

By End-user

|

Industrial Manufacturers, Biotechnology Companies, Research Institutes, Agricultural Sector, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Source (Microorganisms, Plant-based, Algae-based, Others): The microorganisms segment earned USD 153.80 billion in 2023 due to their widespread applicability, high efficiency in bioprocessing, and scalability in industrial production.

- By Product Type (Biofuels (Bioethanol, Biodiesel), Biochemicals (Organic acids, Alcohols, Ketones), Biopolymers (Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Starch Blends), Industrial Enzymes (Proteases, Amylases, Lipases, Others)): The biofuels segment held 33.09% of the market in 2023, due to growing demand for renewable energy and supportive government policies.

- By Application (Bioenergy (Biofuel production, Biogas), Food & Feed Industry (Fermentation, Probiotics, Enzyme additives), Pharmaceuticals (Biocatalysis, API production), Chemicals & Materials, Others): The bioenergy segment is projected to reach USD 119.82 billion by 2031, owing to increasing energy demand, emphasis on sustainability, and the shift toward bio-based fuel alternatives.

- By End-user (Industrial Manufacturers, Biotechnology Companies, Research Institutes, Agricultural Sector, Others): The agricultural sector segment is anticipated to grow at a CAGR of 7.07% during the forecast period, driven by the rising adoption of bio-based solutions for crop enhancement, soil health, and sustainable farming practices.

White Biotechnology Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America white biotechnology market share stood at around 42.09% in 2023 in the global market, with a valuation of USD 115.74 billion. This dominance is attributed to the region's well-established biotechnology infrastructure, strong investment in research and development, and supportive regulatory frameworks promoting sustainable industrial practices.

The presence of major biotechnology firms, coupled with increasing demand for bio-based products across sectors such as energy, agriculture, and pharmaceuticals is further contributing to the market growth.

Collaborations between academic institutions and industry stakeholders, supported by government initiatives focused on carbon reduction and bioeconomy development, are boosting innovation and accelerating the commercialization of white biotechnology solutions in this region.

- In February 2023, Zymtronix Catalytic Systems, Inc. and Ginkgo Bioworks announced a strategic partnership to enhance enzyme development for Zymtronix’s cell-free biomanufacturing platform. The collaboration aims to accelerate sustainable ingredient production across industries such as food, agriculture, cosmetics, and pharmaceuticals, with Ginkgo optimizing enzyme expression and performance.

The white biotechnology industry in Asia-Pacific is poised for significant growth at a robust CAGR of 6.62% over the forecast period. Asia-Pacific is registering rapid growth in the market, driven by rapid industrialization, increasing environmental awareness, and rising demand for sustainable production methods across key sectors such as chemicals, agriculture, and energy.

Furthermore, the expansion of domestic biotechnology firms and growing partnerships with global industry leaders are enhancing regional capabilities and accelerating technology adoption. The region’s abundant availability of biomass and cost-effective labor also provides a competitive advantage for large-scale biotechnological production.

Regulatory Frameworks

- In Canada, the Canadian Environmental Protection Act (CEPA) regulates biotechnology-derived substances. It ensures that new living organisms and bio-based products used in industrial applications are assessed for environmental and human health risks before approval and commercialization.

- In the United States, the Coordinated Framework for the Regulation of Biotechnology regulates biotechnology products through the EPA, FDA, and USDA, ensuring the safe use of GMOs and bioengineered materials under laws like TSCA, FIFRA, and FDCA.

- In the European Union, Regulation (EC) No 1829/2003 on Genetically Modified Food and Feed and Regulation (EC) No 1907/2006 (REACH) regulates biotechnology and chemical substances. These regulations ensure the safety of bio-based products, including GMOs and industrial chemicals, by requiring pre-market authorization and compliance with environmental and human health standards, making them applicable to white biotechnology.

Competitive Landscape

The white biotechnology market is characterized by the presence of a mix of established multinational corporations and emerging biotech firms competing across various application segments.

Companies are focusing on strategic initiatives such as mergers and acquisitions, research collaborations, and investments in advanced bioprocessing technologies to strengthen their market position. Innovation-driven competition is prominent, with companies continuously developing novel enzymes, microbial strains, and bio-based products to meet evolving industrial demands.

- In January 2023, Carbios and Novozymes announced an long-term partnership to advance the industrial-scale production of Carbios' proprietary PET-degrading enzymes. This collaboration builds upon their relationship established in 2019, focusing on developing enzyme-based solutions to tackle plastic pollution.

List of Key Companies in White Biotechnology Market:

- Corbion NV

- BASF SE

- Evonik Industries AG

- Covestro AG

- Henkel AG & Co. KGaA

- Biosynth

- AB Enzymes

- Givaudan

- ADM

- Advanced Enzyme Technologies

- Novozymes A/S

- dsm-firmenich

- thyssenkrupp Uhde GmbH

- Zymtronix Catalytic Systems, Inc.

- Nature BioScience Pvt. L.T.D.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In July 2024, BASF and the University of Graz developed a new computer-assisted model to enhance the efficiency of biocatalytic production processes. This innovation allows for faster scaling of production from laboratory to industrial levels, reducing costs and resource consumption.

announced the