Market Definition

The wet pet food market involves the production and sale of moist or canned food products designed for pets, primarily dogs and cats. Wet pet food contains a higher moisture content and is available in various forms, including cans, pouches, and trays.

Wet Pet Food Market Overview

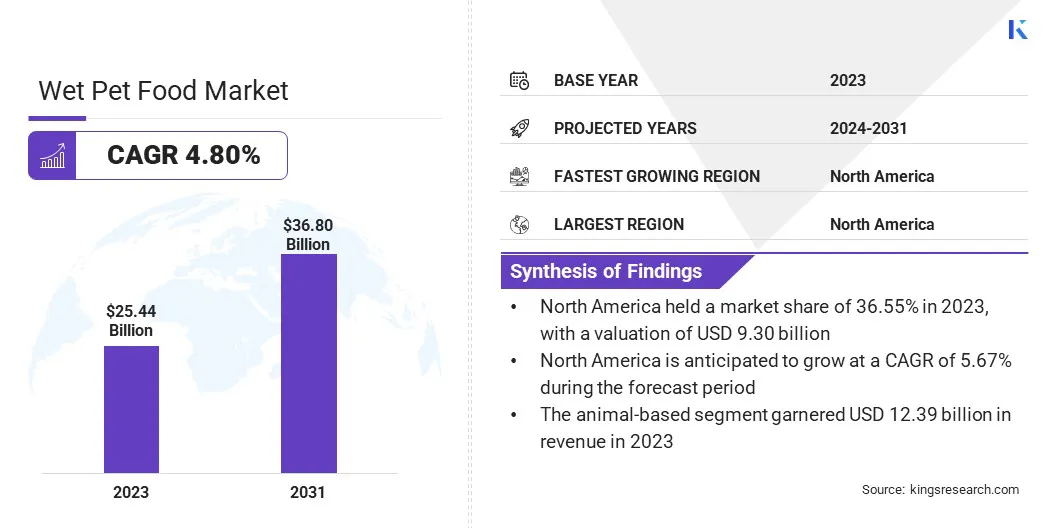

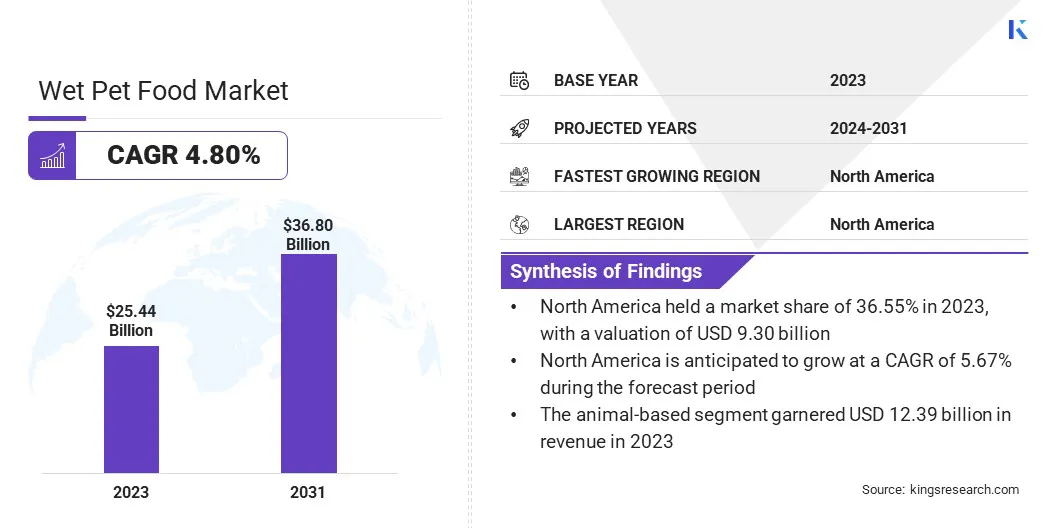

The global wet pet food market size was valued at USD 25.44 billion in 2023 and is projected to grow from USD 26.50 billion in 2024 to USD 36.80 billion by 2031, exhibiting a CAGR of 4.80% during the forecast period.

This growth is driven by several key factors, including the increasing trend of pet humanization, where pet owners are increasingly treating their pets as family members and seeking premium, nutritious food options. The demand for convenient and easy-to-serve meal options is also rising, with wet pet food offering a practical solution for busy pet owners.

Major companies operating in the global wet pet food industry are Nestlé Purina PetCare Company, Hill's Pet Nutrition, Inc., SCHELL & KAMPETER, INC., Simmons Foods, Inc., Wellness Pet, LLC, Merrick Pet Care, Inc, Canidae, LLC, PPN Limited Partnership, Royal Canin SAS, Nature's Logic, Blue Buffalo Company, Ltd., saturn petcare, inc., Tiernahrung Deuerer GmbH, Natural Balance Pet Foods, and FirstMate Pet Foods.

Advancements in pet food formulations, such as the inclusion of organic and functional ingredients, are contributing to the market's expansion. The growing awareness of pet health and wellness, along with the increasing availability of specialty diets catering to specific health needs is further boosting the market.

Specialty diets, such as grain-free, hypoallergenic, and weight management options, are gaining popularity among pet owners seeking tailored nutrition for their pets.

- In January 2025, BENEO introduced its low-glycaemic syrup BeneoCarb S for pet food applications, including semi-moist and moist products or snacks. Derived from sugar beet, this syrup offers a natural alternative to traditional ingredients such as glucose syrup or caramel, as well as an opportunity to appeal to health-conscious pet owners.

Key Highlights

- The global wet pet food market size was recorded at USD 25.44 billion in 2023.

- The market is projected to grow at a CAGR of 4.80% from 2024 to 2031.

- North America held a market share of 36.55% in 2023, with a valuation of USD 9.30 billion.

- The can segment garnered USD 11.61 billion in revenue in 2023.

- The dog segment is expected to reach USD 15.20 billion by 2031.

- The plant derivatives segment is anticipated to witness the fastest CAGR of 5.82% during the forecast period.

- The supermarkets/hypermarkets segment garnered USD 10.76 billion in revenue in 2023.

- The market in North America is anticipated to grow at a CAGR of 5.67% during the forecast period.

Market Driver

"Growing Focus on Pet Health and Nutrition"

Health and wellness trends in the wet pet food market are increasingly influencing consumer choices, as pet owners prioritize the well-being of their pets Health and wellness in the market are increasingly influencing consumer choices, as pet owners prioritize their pets' well-being.

A key driver is the rising demand for balanced and wholesome nutrition, with owners seeking high-quality proteins, essential nutrients, and functional ingredients that support overall health. Ingredients like omega fatty acids for skin and coat, glucosamine for joint health, and probiotics for digestion are gaining popularity.

Limited ingredient diets (LID) are also in high demand, especially for pets with food sensitivities or allergies. Additionally, grain-free and gluten-free options cater to digestive needs. Hydration plays a crucial role, as wet food’s higher moisture content supports urinary health, particularly in cats.

The market is also seeing increased demand for age-specific formulations, with products designed for puppies, senior pets, and those requiring weight management or specialized care.

- In February 2025, Calysta and Marsapet launched the first complete dog food featuring FeedKind Pet protein, a cultured protein fermented without using any arable land or animal ingredients. Produced under its Marsavet line and targeted at animal health, MicroBell dry kibble is a vegan, grain free, and gluten free pet food with all the necessary amino acids to keep dogs healthy.

Market Challenge

"Sourcing and Quality Control of Raw Ingredients"

Ensuring the consistent sourcing and quality control of raw ingredients is a major challenge in wet pet food manufacturing. The nutritional value, safety, and palatability of the final product depend on the integrity of fresh and perishable ingredients like meats, fish, and vegetables.

Maintaining ingredient quality from farm to production facility requires strict oversight, especially as seasonal changes and supply chain disruptions can impact availability and consistency.

A key concern is securing reliable suppliers who adhere to stringent food safety and ethical standards. Quality control measures must include rigorous testing for contaminants, harmful chemicals, and nutritional accuracy. Proper storage and temperature management are also essential to preserve freshness.

As consumer demand for ethically sourced food grows, manufacturers are increasingly focusing on sustainable practices, such as using free-range, antibiotic-free proteins and non-GMO crops. Implementing strict sourcing and quality checks helps ensure pet food remains safe, nutritious, and aligned with transparency and sustainability expectations.

Market Trend

"Humanization of Pets"

The humanization of pets is changing the way we approach pet food, with more pet owners treating their animals like family members. This shift has sparked a demand for premium, gourmet, and human-grade wet pet foods, made from high-quality ingredients like free-range meats, wild-caught fish, and organic vegetables foods .

Pet owners are also more focused on feeding their pets foods with functional ingredients like probiotics and omega-3s to support their pets' health from digestion to joint care. There’s also a growing trend towards personalized pet nutrition where pet food is tailored to individual needs based on age, breed, or health conditions.

- In March 2024, CESAR Canine Cuisine, a brand under Mars Petcare, introduced CESAR Filets in Gravy Wet Dog Food Mini-Pouches. These mini-pouches are designed for convenience, featuring peel-and-serve packaging that makes feeding on-the-go easier for pet owners. Each pouch contains high-quality protein, with chicken or beef as the primary ingredient, and is free from artificial flavors.

Wet Pet Food Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Can, Pouch, Tray

|

|

By Pet

|

Dog, Cat, Other

|

|

By Source

|

Animal-Based, Plant Derivatives, Synthetic

|

|

By Distribution Channel

|

Pet Specialty Stores, Supermarkets/Hypermarkets, Online Stores, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Can, Pouch, Tray): The can segment earned USD 11.61 billion in 2023 due to its long shelf life, convenience, and popularity among pet owners seeking cost-effective packaging solutions for wet pet food.

- By Pet (Dog, Cat, Other): The dog segment held 42.51% of the market in 2023, due to the high number of dog ownerships globally and the increasing demand for specialized, nutritious food products tailored to canine health and preferences.

- By Source (Animal-Based, Plant Derivatives, Synthetic): The animal-based segment is projected to reach USD 17.64 billion by 2031, owing to the growing preference for high-protein, natural ingredients that align with the nutritional needs of pets, particularly dogs and cats, and the increasing demand for premium, meat-based formulations.

- By Distribution Channel (Pet Specialty Stores, Supermarkets/Hypermarkets, Online Stores, Others): The online retailers segment is anticipated to grow at a CAGR of 6.40% during the forecast period due to the convenience of home delivery, the rising popularity of e-commerce platforms, and the ability for consumers to easily compare products, read reviews, and access a wider variety of pet food options.

Wet Pet Food Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America wet pet food market share stood around 36.55% in 2023 in the global market, with a valuation of USD 9.30 billion. This significant market share is attributed to the high pet ownership rates, particularly in the United States and Canada, along with an increasing preference for premium pet food products.

The growing awareness regarding pet health and wellness, coupled with the rising demand for natural and organic ingredients in pet food, has further driven the market growth in this region. The increasing number of pet owners opting for convenient, ready-to-serve, and nutritionally balanced meals for their pets has contributed to the market's expansion.

- In May 2024, Nestlé Purina invested USD 226.9 million to expand its pet food plant in the city of Silao, Mexico. This expansion will include the addition of a third line for wet pet food and a fourth line for dry pet food.

The wet pet food industry in Asia-Pacific is positioned for significant growth at a robust CAGR of 4.95% over the forecast period. The growing trend of pet adoption in the region is driving demand for high-quality, convenient, and nutritionally balanced wet pet food.

Additionally, increasing awareness of pet health and the shift toward premium pet food options are further fueling market growth. To cater to evolving consumer preferences, local and international brands are introducing region-specific products, further strengthening the market's expansion.

Regulatory Frameworks

- In the U.S., pet food is regulated by the Food and Drug Administration (FDA), which oversees it under standards similar to other animal foods. The Federal Food, Drug, and Cosmetic Act (FD&C Act) mandates that all pet food must be safe to consume, produced under sanitary conditions, free from harmful substances, and accurately labeled. Additionally, the Association of American Feed Control Officials (AAFCO) establishes guidelines and nutritional standards for pet food

- The Canadian Food Inspection Agency (CFIA) regulates pet food imports and related products to prevent animal diseases from being introduced into Canada.

Competitive Landscape

The wet pet food market is highly competitive and fragmented, with both global leaders and regional players competing for market share. Major companies are focusing on premium offerings, natural ingredients, and specialized diets to cater to the growing demand for health-conscious options.

Smaller brands are gaining traction with unique formulations and affordable alternatives. The expansion of online retail has further intensified competition, providing consumers with greater convenience and a wider product selection.

Additionally, companies are emphasizing sustainability and transparency in their product to differentiate themselves in the market. Mergers and acquisitions continue to reshape the industry, driving consolidation and strategic growth.

- In July 2023, Kemin Nutrisurance, the pet food and rendering technologies division of Kemin Industries, inaugurated its first pilot laboratory dedicated to wet pet food at its global headquarters in Iowa, U.S. Kemin aims to enhance its research and development capabilities by allowing the creation, testing, and validation of both wet and dry pet food products in this new facility.

List of Key Companies in Wet Pet Food Market:

- Nestlé Purina PetCare Company

- Hill's Pet Nutrition, Inc.

- SCHELL & KAMPETER, INC.

- Simmons Foods, Inc.

- Wellness Pet, LLC

- Merrick Pet Care, Inc

- Canidae, LLC

- PPN Limited Partnership

- Royal Canin SAS

- Nature's Logic

- Blue Buffalo Company, Ltd.

- saturn petcare, inc.

- Tiernahrung Deuerer GmbH

- Natural Balance Pet Foods

- FirstMate Pet Foods.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In February 2025, Nestlé Purina PetCare expanded its pyramid-shaped wet cat food range across Europe and the United States. This premium wet cat food features an innovative shape designed to enhance portion control and freshness while catering to evolving pet owner preferences.

- In November 2024, General Mills, Inc. entered into a definitive agreement to acquire Whitebridge Pet Brands’ North American Premium Cat feeding and Pet treating business from NXMH in a transaction valued at USD 1.45 billion.

- In June 2024, CVC Capital Partners IX acquired a majority stake in Partner in Pet Food (PPF). This acquisition aims to accelerate PPF's European expansion strategy and strengthen its position in the industry.

- In June 2024, United Petfood entered the U.S. by acquiring a production facility in Mishawaka, Indiana, from Wellness Pet Company. This strategic move enables United Petfood to locally produce high-quality pet food, enhancing its ability to serve American customers and explore new growth opportunities across continents.

- In January 2024, United Petfood acquired Vital Petfood Group (VPG), a Danish pet food manufacturer based in Denmark. Through this acquisition, United Petfood aims to strengthen its presence in the Nordic region, enhance production capacity, and improve supply chain efficiency.