Market Definition

The weigh in motion (WIM) market encompasses the development, production, and deployment of systems that measure vehicle weight in motion without stopping. These systems use sensors, load cells, and advanced software to collect real-time weight data, enhancing traffic management, road safety, and regulatory compliance.

Weigh in Motion Market Overview

The global weigh in motion market size was valued at USD 1,305.2 million in 2023 and is projected to grow from USD 1,428.3 million in 2024 to USD 2,925.5 million by 2031, exhibiting a CAGR of 10.79% during the forecast period. Market's expansion is driven by stringent vehicle weight regulations, increased investments in intelligent transportation systems, and the need to enhance road safety and infrastructure durability.

Major companies operating in the global weigh in motion industry are SWARCO, Sensys Networks, Inc., Q-Free, Roadsys, Inc, TE Connectivity, International Road Dynamics Inc., Sterela, Traffic Data Systems, Kistler Group, Clearview Intelligence, METTLER TOLEDO, Intercomp Company, Cardinal, CAMEA, and Avery Weigh-Tronix, LLC.

Emerging economies are rapidly adopting WIM systems as governments focus on improving freight efficiency, road longevity, and sustainable mobility. With continuous advancements in automated enforcement solutions and predictive maintenance analytics, the WIM market is estimated to experience significant expansion in the coming years.

- In January 2025, Quarterhill, in partnership with Belgium-based Jacops NV, secured a contract with Brussels Mobilit. Quarterhill will design and supply the weigh-in-motion (WIM) subsystem, provide technical support and training, and equip Jacops with software for commercial vehicle monitoring and enforcement, enhancing traffic management and regulatory compliance.

Key Highlights:

- The global weigh in motion market size was recorded at USD 1,305.2 million in 2023.

- The market is projected to grow at a CAGR of 10.79% from 2024 to 2031.

- North America held a share of 34.09% in 2023, valued at USD 444.9 million.

- The hardware segment garnered USD 629.5 million in revenue in 2023.

- The low-speed weigh-in-motion (LS-WIM) segment is expected to reach USD 1,501.3 million by 2031.

- The in-road systems segment is expected to reach USD 1,698.9 million by 2031.

- The Piezoelectric Sensors segment is projected to generate a revenue of USD 1,188.3 million by 2031.

- The highway toll authorities segment garnered USD 444.9 million in revenue in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 11.26% over the forecast period.

Market Driver

"Rising Demand for Efficient Freight Transport and Logistics Optimization"

The growth of the weigh in motion market is driven by the growing need for efficient freight transport, logistics optimization, and accident prevention. The expansion of e-commerce, global supply chains, and just-in-time delivery is prompting transportation companies to enhance fleet efficiency while complying with weight regulations.

Overloaded trucks contribute to road wear, fuel inefficiency, higher costs, and increased accident risks. The rising emphasis on accident prevention, combined with advancements in smart logistics and data-driven transportation networks, is fostering the adoption of WIM solutions across highways, ports, and logistics hubs.

Market Challenge

"High Initial Investment and Maintenance Costs"

A key challenge influencing the growth of the weigh in motion market is the high initial investment and ongoing maintenance costs associated with implementing WIM systems.

These systems require sophisticated sensors, durable road installations, and integration with existing traffic management infrastructure. The cost of installation, calibration, and periodic maintenance can be a barrier, particularly for emerging economies and budget-constrained regions.

To address this challenge, stakeholders can adopt a Public-Private Partnership (PPP) model, where private technology providers collaborate with government agencies to share investment costs. Leasing and subscription-based models can enhance affordability for municipalities and transportation agencies.

Market Trend

"Adoption of AI"

A significant trend in the weigh in motion market is the growing adoption of artificial ntelligence (AI) to enhance system accuracy, automation, and predictive analytics. Traditional WIM solutions primarily focused on weight measurement, while AI-powered systems enable vehicle classification, traffic analysis, and predictive maintenance.

By leveraging machine learning algorithms, AI can analyze vast amounts of real-time data to detect overloading trends, predict road wear, and optimize enforcement strategies.

With advancements in edge AI processing, AI-driven WIM solutions are expected to revolutionize freight monitoring, road safety, and infrastructure management in the coming years.

- In March 2025, MIPS, a global leader in compute subsystems for autonomous platforms, launched the MIPS Atlas portfolio to provide secure, high-performance edge AI solutions for automotive, industrial, and embedded technology firms. Integrating real-time computing, functional safety, and post-generative AI deployment, Atlas advances next-gen autonomous platforms, tapping into the projected $1 trillion Physical AI market.

Weigh in Motion Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Type

|

Low-Speed Weigh-in-Motion (LS-WIM), High-Speed Weigh-in-Motion (HS-WIM)

|

|

By Installation Method

|

In-Road Systems, Bridge WIM Systems, Onboard WIM Systems

|

|

By Sensor Type

|

Piezoelectric Sensors, Bending Plate Sensors, Load Cell Sensors, Other Sensors

|

|

By End User

|

Highway Toll Authorities, Logistics and Freight Services, Oil & Refinery Industries, Other Industries

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, and Services): The hardware segment earned USD 629.5 million in 2023 due to the increasing demand for advanced sensor technologies, weighbridges, and real-time monitoring devices that ensure accurate vehicle weight measurements.

- By Type (Low-Speed Weigh-in-Motion (LS-WIM) and High-Speed Weigh-in-Motion (HS-WIM): The high-speed weigh-in-motion (HS-WIM) held a substantial share of 60.88% in 2023, propelled by the growing need for uninterrupted traffic flow at toll booths, border crossings, and highways while ensuring weight regulation compliance.

- By Installation Method (In-Road Systems, Bridge WIM Systems, and Onboard WIM Systems): The in-road systems segment is projected to reach USD 1,698.9 million by 2031, owing to the widespread deployment of embedded sensors on highways, toll plazas, and freight corridors for seamless weight monitoring.

- By Sensor Type (Piezoelectric Sensors, Bending Plate Sensors, Load Cell Sensors, and Other Sensors): The piezoelectric sensors segment is projected to reach USD 1,188.3 million by 2031, fueled by their high sensitivity, durability, and cost-effectiveness in real-time vehicle weight measurement.

- By End User (Highway Toll Authorities, Logistics and Freight Services, Oil & Refinery Industries, and Other Industries): The highway toll authorities segment earned USD 444.9 million in 2023 due to the widespread adoption of advanced WIM systems integrated into automated toll collection and traffic management solutions.

Weigh in Motion Market Regional Analysis

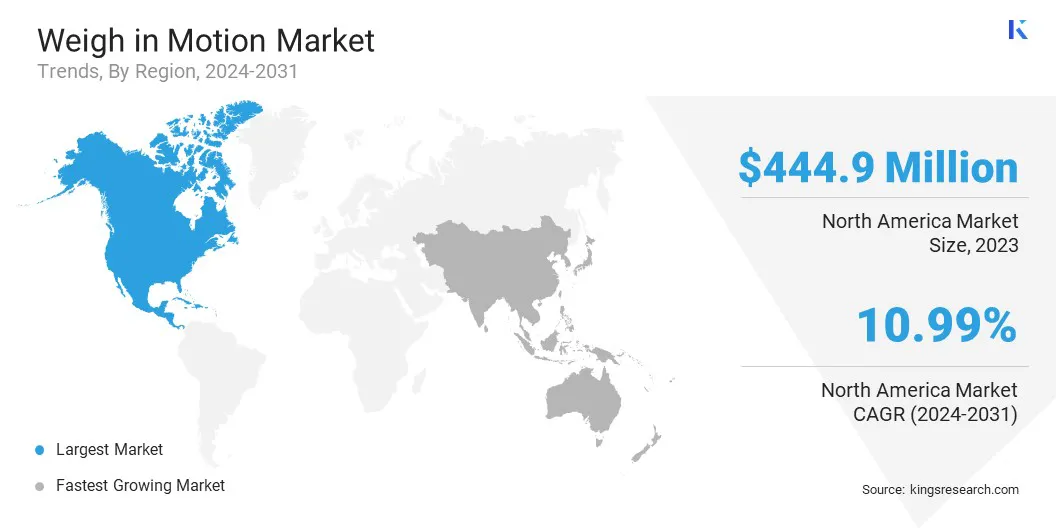

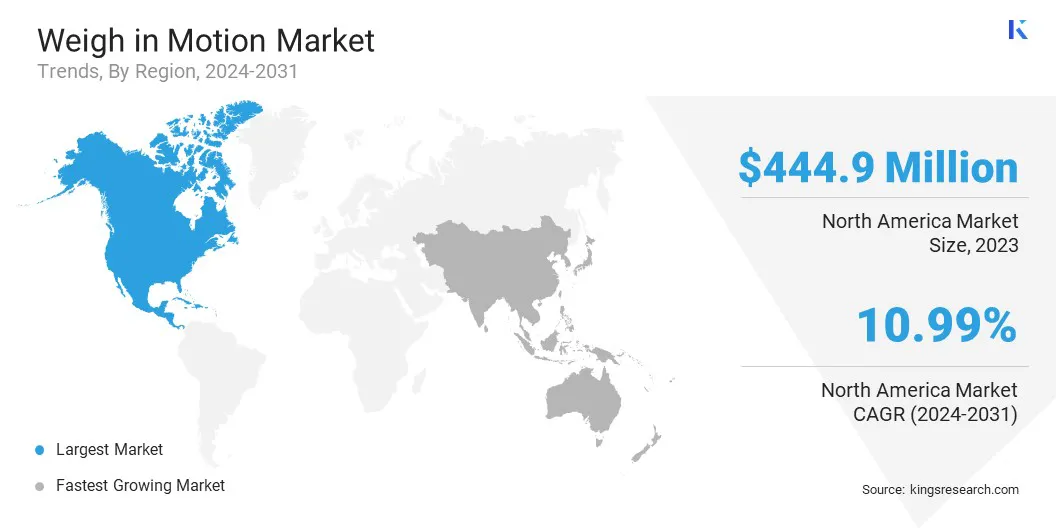

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America weigh in motion market share stood at around 34.09% in 2023, valued at USD 444.9 million. This dominance is reinforced by government regulations on vehicle weight limits, advanced transportation infrastructure, and high adoption of intelligent traffic management systems.

The United States and Canada are leading markets, supported by increased investment in smart highways, automated toll collection, and freight monitoring systems. Additionally, the rising focus on road safety, minimizing infrastructure damage, and optimizing logistics efficiency is fueling the demand for WIM solutions.

Ongoing technological advancements and increased deployment of high-speed WIM systems further support regional market growth.

- In July 2023, the New York City Department of Transportation (NYC DOT) successfully implemented the nation’s first automated WIM enforcement program, achieving a 64% reduction in overweight trucks on the Brooklyn Queens Expressway (BQE) . This highlights North America's growing adoption of intelligent WIM solutions for road safety and infrastructure protection.

Asia Pacific weigh in motion industry is poised to grow at a CAGR of 11.26% over the forecast period, aided by rapid urbanization, expanding transportation networks, and increasing government investments in smart infrastructure.

Countries such as China, India, and Japan are at the forefront, implementing WIM systems to regulate freight movement, enhance road safety, and reduce infrastructure damage caused by overloaded trucks. Additionally, rising trade volumes and the growing need for efficient logistics management are propelling regional market growth.

Regulatory Frameworks

- In the U.S., the Federal Highway Administration (FHWA) oversses the Weigh-in-Motion (WIM) market by regulating weight enforcement programs, funding WIM system deployment, and ensuring compliance with federal truck weight limits to protect road infrastructure and enhance transportation safety.

- In Europe, the European Commission (EC) regulates WIM systems, enforcing vehicle weight limits, road safety, and infrastructure protection while promoting WIM adoption under smart mobility and intelligent transportation initiatives.

Competitive Landscape

Companies operating in weigh in motion market are heavily investing in AI-powered analytics, sensor advancements, and data integration to improve precision and automation. Strategic collaborations with governments, highway authorities, and logistics firms are key to market expansion.

Infrastructure modernization, stricter regulations, and the need for intelligent traffic management are intesifying competition. New entrants focus on cost-efficient, scalable solutions to penetrate regional markets, while major players strengthen their portfolios through product innovation and acquisitions to maintain a competitive edge.

Leading companies are expanding their presence in emerging economies, where governments are prioritizing smart transportation systems. Furthermore, the rising adoption of high-speed WIM (HS-WIM) technology in tolling and freight corridors is fueling market growth, making technological advancements and regulatory compliance key factors in shaping the competitive landscape.

- In April 2023, International Road Dynamics (IRD) secured a USD 1.9 million contract in Indiana to implement virtual weigh-in-motion (VWIM) systems, highlighting the growing adoption of WIM technology for efficient weight enforcement and infrastructure protection in North America.

List of Key Companies in Weigh in Motion Market:

- SWARCO

- Sensys Networks, Inc.

- Q-Free

- Roadsys, Inc

- TE Connectivity

- International Road Dynamics Inc.

- Sterela

- Traffic Data Systems

- Kistler Group

- Clearview Intelligence

- METTLER TOLEDO

- Intercomp Company

- Cardinal

- CAMEA

- Avery Weigh-Tronix, LLC

Recent Developments (New Product Launch)

- In November 2024, Quarterhill Inc. secured two contracts worth USD 3.4 million in Idaho for weigh station upgrades. The project, part of the I-15 Inkom Corridor, includes relocating WIM systems, advanced license plate readers, over-height detectors, and automatic vehicle identification technology.

- In April 2023, Q-Free expanded its Kinetic Mobility platform to offer Software-as-a-Service (SaaS) advantages across its entire suite, enhancing Weigh-in-Motion (WIM) solutions with cloud-based scalability, real-time data analytics, and improved operational efficiency for tolling and traffic management authorities worldwide.