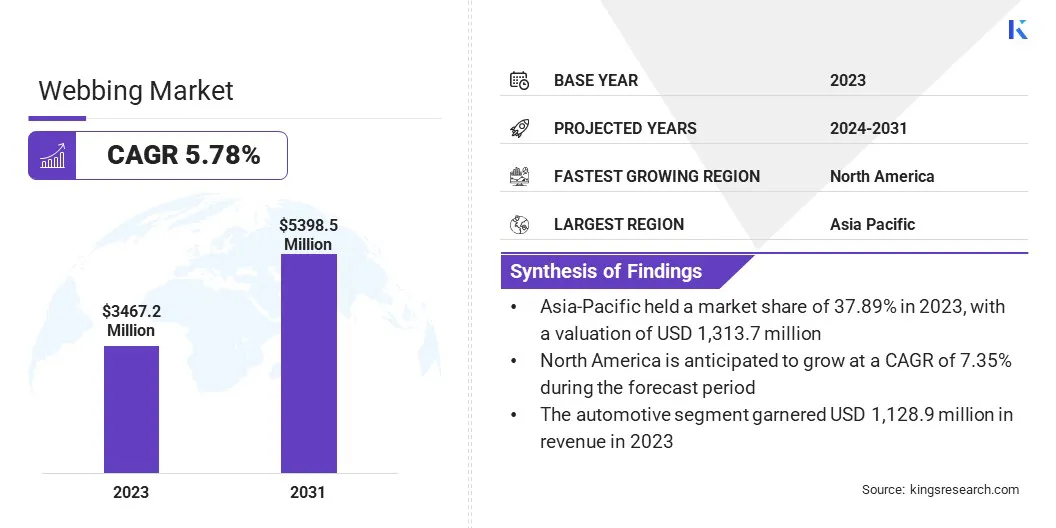

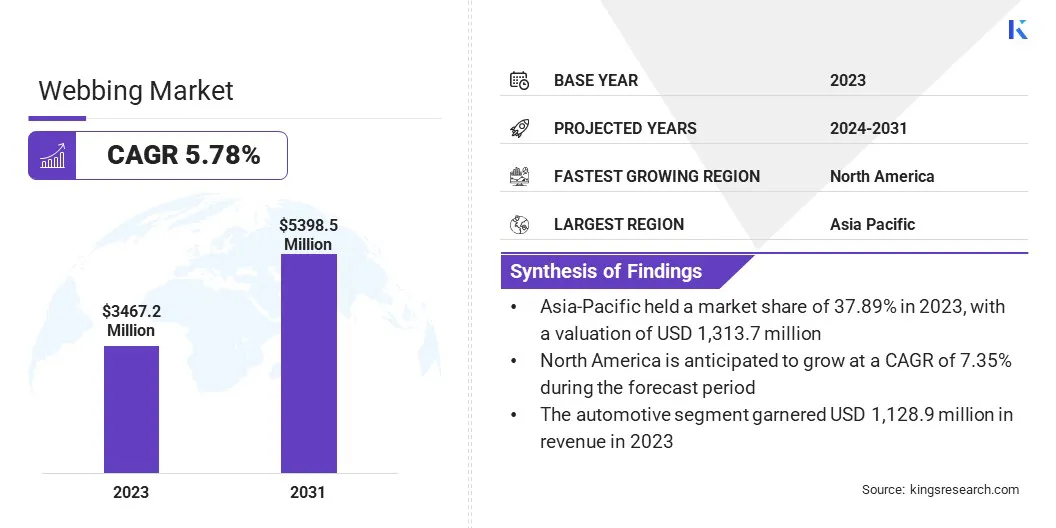

Webbing Market Size

The global Webbing Market size was valued at USD 3,467.2 million in 2023 and is projected to grow from USD 3,642.0 million in 2024 to USD 5,398.5 million by 2031, exhibiting a CAGR of 5.78% during the forecast period. The market is expanding due to its increasing application across diverse sectors.

Innovations in manufacturing processes are enhancing product quality, while the shift toward sustainable materials is reshaping industry standards. Growing demand for versatile webbing solutions in various consumer and industrial applications is fueling market growth. As companies seek advanced and eco-friendly options, the market is set to experience continued expansion and innovation in their product portfolio.

In the scope of work, the report includes solutions offered by companies such as E. Oppermann GmbH, American Cord & Webbing Co., Inc., Belt Tech, Inc, Jiangsu Daxin Ribbon Co., Ltd., Narrowtex Australia Pty Ltd, Murdock Webbing Company, Inc., Bally Ribbon Mills, Marling Leek Limited, Leedon Webbing, Indolift. and others.

The market is experiencing robust growth, driven by its increasing demand across various industries, particularly automotive and e-commerce. In the automotive sector, stringent safety standards are propelling the need for high-quality webbing materials used in seat belts, airbags, and safety harnesses.

- According to the European Automobile Manufacturers Association, global motor vehicle production reached 85.4 million units in 2022, marking a 5.7% increase from 2021.

In addition, the growing prevalence of e-commerce is boosting the demand for durable, lightweight, and flexible packaging solutions, with webbing materials being integral to the secure transit of goods. The shift toward eco-friendly and sustainable materials is further shaping market dynamics. These factors collectively contribute to the expanding scope and growth of the webbing market globally.

Webbing is a woven fabric commonly crafted from synthetic materials such as nylon, polyester, or polypropylene. It is engineered for applications that demand high durability and strength, including safety equipment, automotive parts, outdoor gear, and packaging solutions.

Webbing is known for its ability to distribute weight evenly, resist abrasion, and endure environmental factors like UV exposure and moisture. This product is available in various widths and thicknesses to cater to various requirements. The versatility of webbing makes it an ideal choice for use in seat belts, harnesses, straps, and securing materials, establishing it as an essential component across multiple industries due to its reliability and flexibility.

Analyst’s Review

Innovations and new product launches by key market players are driving significant growth in the webbing industry.

- For instance, in May 2023, Webbing Products Pty Ltd introduced a new high-performance line-of-sight protective sleeving product. This advanced product offers enhanced abrasion resistance and superior protection against bursts and pinholes.

Such innovations address evolving industry needs and set new benchmarks in safety and performance. As key players continue to introduce cutting-edge solutions that find applications across various industries, they are expected to further accelerate market growth by meeting increasing demands for advanced, high-quality webbing products.

Webbing Market Growth Factors

The increasing use of webbing in automotive applications, such as seat belts, safety harnesses, and airbags, is a significant factor that drives market growth. As global vehicle safety standards become more stringent, the demand for high-quality webbing materials continues to rise.

Automakers are prioritizing the incorporation of robust, durable, and reliable webbing solutions to enhance passenger safety and reduce injury risks. This shift is propelled by the necessity to comply with rigorous safety regulations and improve overall vehicle safety performance. In addition, advancements in webbing technology, including superior tensile strength and enhanced resistance to wear and tear, are enabling manufacturers to produce top-tier products, thereby fueling market growth.

However, fluctuations in raw material prices, such as those for synthetic fibers, are expected to pose a significant challenge to the growth of the webbing market. These fluctuations create price variabilities in procuring raw materials, which increases production costs and pricing instability for end-users, thereby hindering the overall market growth.

Key players are actively addressing this challenge by diversifying their supplier bases, investing in cost-effective production technologies, and exploring alternative materials to stabilize costs. Companies are also adopting strategic procurement practices and forming long-term agreements with suppliers to manage price fluctuations effectively and ensure a consistent supply of raw materials.

Webbing Market Trends

Innovations in manufacturing processes, such as advanced weaving techniques and the utilization of high-performance synthetic fibers, are driving market growth by significantly enhancing the quality and functionality of webbing products. These advancements result in webbing with superior strength, flexibility, and resistance to wear and tear, meeting the stringent requirements of diverse industries such as automotive, aerospace, and outdoor gear.

The ability to produce more durable and reliable webbing solutions allows manufacturers to cater to the evolving needs of their clients, thereby expanding their market reach. In addition, these technological improvements position companies to offer premium products, fostering increased demand and bolstering market growth.

The expansion of e-commerce and the increasing demand for effective and secure packaging solutions are driving significant growth in the webbing market. E-commerce businesses rely heavily on packaging materials, such as webbing straps and tapes, to ensure goods are transported safely to customers.

As online shopping continues to rise, the need for lightweight, durable, and flexible packaging materials is growing. Webbing materials are particularly well-suited for securing packages, reducing shipping damage, and improving overall customer satisfaction.

With the expanding global e-commerce sector, webbing manufacturers are seeing a consistent increase in orders from companies seeking enhanced packaging solutions. This trend is likely to continue, underscoring e-commerce-related demand as a key growth driver for the market.

Segmentation Analysis

The global market has been segmented based on application, material, type, and geography.

By Application

Based on application, the webbing market has been categorized into automotive, aerospace & military, safety and rescue, fashion and apparel, sporting goods, and others. The automotive segment garnered the highest revenue of USD 1,128.9 million in 2023.

The demand for high-performance webbing materials used in seat belts, airbags, and safety harnesses is rising due to stricter safety regulations and higher consumer expectations. Innovations in webbing technology, such as enhanced tensile strength and flexibility, are meeting the evolving needs of automotive safety features.

Additionally, advancements in manufacturing processes are enabling the production of more durable and reliable webbing products. The growth of this segment is further supported by the automotive industry's shift toward integrating advanced safety systems and the continuous development of new vehicle models, which drives the need for superior webbing solutions.

By Material

Based on material, the market has been categorized into polyester, nylon, polypropylene, cotton, and others. The polyester segment captured the largest webbing market share of 60.45% in 2023, mainly due to its exceptional durability, strength, and resistance to abrasion, UV degradation, and moisture.

Polyester's versatility makes it an ideal choice for various applications, including automotive, outdoor gear, safety harnesses, and packaging. The segment benefits from polyester's cost-effectiveness and high performance, attracting manufacturers looking for reliable materials.

Additionally, advancements in production techniques, such as enhanced weaving methods and the use of recycled fibers, are expanding polyester's market applications and improving sustainability. With the growing demand for durable and versatile webbing solutions, the polyester segment is set for continued expansion and innovation.

By Type

Based on type, the market has been categorized into flat webbing and tubular webbing. The flat webbing segment is expected to garner the highest revenue of USD 3,477.8 million by 2031. Flat webbing is known for offering even distribution of load and ease of handling.

Hence, it is extensively used in various industries, including automotive, aerospace, outdoor gear, and packaging. Its design allows for effective load-bearing and secure fastening, making it ideal for seat belts, safety harnesses, and securing cargos. The growth of this segment is supported by increasing demand for reliable and strong webbing solutions in safety-critical applications.

Innovations in flat webbing materials, such as improved tensile strength and resistance to environmental factors, are enhancing product performance and expanding its use cases. The rise in outdoor activities such as hiking, water sports and the need for efficient, durable packaging solutions are further fueling demand. As industries continue to prioritize safety and functionality, the flat webbing segment is poised for sustained growth and development.

Webbing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific webbing market share stood around 37.89% in 2023 in the global market, with a valuation of USD 1,313.7 million. The expanding automotive sector, particularly in China, Japan, and India, is increasing the demand for webbing materials in safety applications like seat belts and airbags. In addition, the rise of e-commerce operations is fueling the need for durable packaging solutions.

The region is also seeing advancements in webbing technology because of enhanced manufacturing techniques and the use of sustainable materials. As industrial and consumer demands grow, the Asia-Pacific market is poised for significant expansion, supported by technological innovations and regulatory shift toward eco-friendly products.

North America is anticipated to witness the fastest growth at a CAGR of 7.35% over the forecast period. The growing textile industry is a key contributor to market growth, as increased demand for textile-based products fuels the need for high-quality webbing materials.

- According to the government portal of Mexico, in 2023, the main commercial destinations for textiles were the United States, which registered generated value of USD 8.06 billion, and Canada, which recorded USD 108 million.

In addition, the rise in defense and aerospace applications further fuels the demand for specialized webbing materials. North America's focus on innovation and technology, coupled with substantial investments in research and development, is accelerating market growth.

Competitive Landscape

The global webbing market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategies, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in the Webbing Market

- Oppermann GmbH

- American Cord & Webbing Co., Inc.

- Belt Tech, Inc

- Jiangsu Daxin Ribbon Co., Ltd.

- Narrowtex Australia Pty Ltd

- Murdock Webbing Company, Inc.

- Bally Ribbon Mills

- Marling Leek Limited

- Leedon Webbing

- Indolift

Key Industry Development

- June 2024 (Product Launch): Indolift, a provider of high-quality lifting equipment, announced the launch of its latest innovation, the Indolift Webbing Sling. Designed to meet the evolving needs of modern industries, this product aims to revolutionize lifting solutions with its advanced features and superior performance.

The global webbing market has been segmented as below:

By Application

- Automotive

- Aerospace & Military

- Safety and Rescue

- Fashion and Apparel

- Sporting Goods

- Others

By Material

- Polyester

- Nylon

- Polypropylene

- Cotton

- Others

By Type

- Flat Webbing

- Tubular Webbing

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America