Market Definition

The market encompasses the global trade and application of chemical compounds used to protect structures from water ingress. It includes materials supplied for construction, infrastructure, and industrial projects across residential, commercial, and civil engineering sectors.

The market spans manufacturing, distribution, and application services, covering various end uses such as roofing, basements, tunnels, water tanks, and bridges. The report identifies the principal factors contributing to the market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

Waterproofing Chemicals Market Overview

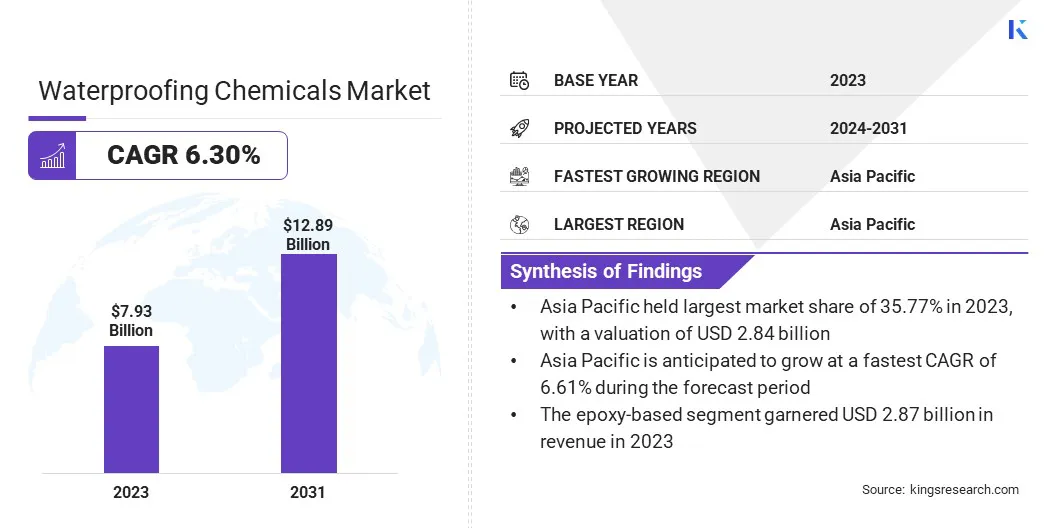

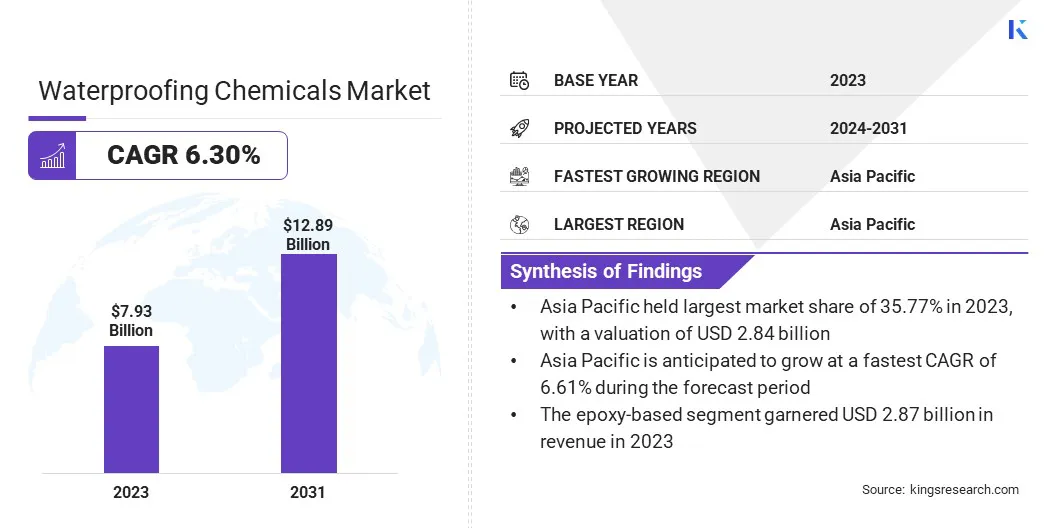

The global waterproofing chemicals market size was valued at USD 7.93 billion in 2023 and is projected to grow from USD 8.40 billion in 2024 to USD 12.89 billion by 2031, exhibiting a CAGR of 6.30% during the forecast period.

The market is registering consistent growth, fueled by the increasing need for water-resistant and long-lasting construction solutions across residential, commercial, and infrastructure projects. Rapid urban development and the expansion of smart cities are encouraging the use of advanced waterproofing technologies to enhance structural integrity.

Major companies operating in the waterproofing chemicals industry are Saint-Gobain Group, BASF, Dow, Sika AG, Carlisle Companies Inc., MAPEI, RPM International Inc., Pidilite Industries Ltd., W. R. Meadows, Inc., SOPREMA, Inc., UltraTech Cement Ltd., ARDEX Americas, Berkshire Hathaway Inc., RichlamGroup, and Xypex Chemical Corporation.

Rising infrastructure investments, particularly in transportation networks, tunnels, and water conservation systems, are further supporting the market expansion. Additionally, the shift toward sustainable construction practices is driving the demand for eco-friendly chemical formulations.

Key Highlights

- The waterproofing chemicals industry size was valued at USD 7.93 billion in 2023.

- The market is projected to grow at a CAGR of 6.30% from 2024 to 2031.

- Asia Pacific held a market share of 35.77% in 2023, with a valuation of USD 2.84 billion.

- The bitumen segment garnered USD 2.37 billion in revenue in 2023.

- The epoxy-based segment is expected to reach USD 4.66 billion by 2031.

- The roofing & walls segment is expected to reach USD 3.12 billion by 2031.

- The market in North America is anticipated to grow at a CAGR of 6.21% during the forecast period.

Market Driver

"Growing Demand for Durable and Long-lasting Waterproofing Solutions"

The waterproofing chemicals market is registering growth, driven by the increasing demand for durable and long-lasting construction solutions. The construction industry prioritizes longevity and resistance to harsh environmental conditions, increasing the focus on the development and adoption of advanced waterproofing technologies.

These solutions are designed to protect structures from water ingress, which can cause damage and lead to costly repairs over time. The emphasis on durability ensures that buildings, infrastructure, and other construction projects maintain their integrity and functionality for extended periods, even in extreme weather conditions.

This shift is contributing to the rise of innovative waterproofing solutions that not only provide superior protection but also support the overall sustainability of construction projects.

- In March 2023, Bostik launched its SEAL & BLOCK waterproofing solutions in India. The product range includes cementitious coatings, liquid-applied membranes, and preformed sheet membranes, aimed at enhancing the durability and sustainability of construction projects.

Market Challenge

"Shortage of Skilled Labor"

A major challenge in the waterproofing chemicals market is the shortage of skilled labor required for the proper application of these products. Incorrect application can lead to performance failures, structural damage, increased maintenance costs, and diminished trust in the product’s reliability. This challenge is particularly significant in regions with rapid urban development but limited access to trained professionals.

Manufacturers are developing more user-friendly formulations, such as pre-mixed compounds & easy-to-apply membranes, and are also investing in training programs to upskill local applicators. These efforts aim to reduce the skill barrier while ensuring consistent and long-lasting waterproofing performance.

Market Trend

"Shift Toward Sustainable and Environment-friendly Waterproofing Solutions"

The waterproofing chemicals market is registering a growing shift toward sustainable and environment-friendly solutions. This change is driven by the increasing adoption of green building standards and heightened awareness about the environmental impact of construction practices.

Water-based and solvent-free formulations are gaining traction, due to their lower environmental footprint, reducing the emission of harmful chemicals and Volatile Organic Compounds (VOCs) that contribute to pollution.

As more industries prioritize eco-friendly construction methods, these sustainable waterproofing chemicals offer an effective solution that aligns with modern environmental goals. The focus on sustainability is reshaping the market, pushing manufacturers to innovate and develop products that provide superior protection without compromising on environmental responsibility.

- In February 2024, Arkema showcased new technologies for more sustainable paints & coatings at Paint India 2024. The company highlighted advancements in waterborne and bio-based coating solutions, including Encor, an acrylic elastomeric emulsion for waterproofing and durability, aimed at increasing circularity, energy efficiency, and reducing carbon footprints.

Waterproofing Chemicals Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Bitumen, Elastomers, PVC, TPO, EPDM, Others

|

|

By Technology

|

Epoxy-based, Polyurethane-based, Water-based, Others

|

|

By Application

|

Roofing & Walls, Floors & Basements, Waste & Water management, Building Structures, Landfills & Tunnels, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Bitumen, Elastomers, PVC, TPO, EPDM, Others): The bitumen segment earned USD 2.37 billion in 2023, due to its widespread use in roofing and road applications, cost-effectiveness, and strong water resistance.

- By Technology (Epoxy-based, Polyurethane-based, Water-based, Others): The epoxy-based segment held 36.22% share of the market in 2023, due to its superior adhesion, durability, and chemical resistance in industrial and commercial waterproofing.

- By Application (Roofing & Walls, Floors & Basements, Waste & Water management, Building Structures, Landfills & Tunnels, Others): The roofing & walls segment is projected to reach USD 3.12 billion by 2031, owing to rising construction activities, climate resilience needs, and the demand for low-maintenance waterproofing solutions.

Waterproofing Chemicals Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific waterproofing chemicals market share stood at around 35.77% in 2023, with a valuation of USD 2.84 billion. This dominance is largely attributed to large-scale urban development and high-volume construction activity in countries like China, India, and Indonesia.

The prevalence of monsoon and frequent flooding events in the region has intensified the demand for effective waterproofing in residential and public infrastructure. Additionally, the presence of a strong manufacturing base for construction chemicals and lower production costs have enabled greater availability and affordability of waterproofing solutions across Asia.

The waterproofing chemicals industry in North America is expected to register the fastest growth, with a projected CAGR of 6.21% over the forecast period. This growth is supported by increasing investments in the renovation of aging infrastructure in the U.S. and Canada, particularly in cities with decades-old sewer systems, tunnels, and transportation networks.

The rising adoption of energy-efficient and green buildings has further driven the use of high-performance waterproofing chemicals, especially in commercial real estate and industrial facilities.

Moreover, harsh winter conditions in parts of North America have heightened the need for advanced waterproofing technologies that offer long-term durability and freeze-thaw resistance.

- In June 2024, SewerAI raised USD 15 million in a Series B funding round to modernize sewer inspections through cloud and AI technologies, aiming to enhance efficiency and accuracy in managing critical infrastructure.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) is the regulatory authority for waterproofing chemicals. The EPA, under the Toxic Substances Control Act (TSCA), regulates the manufacturing, processing, and distribution of chemicals, including those used in waterproofing.

- In Europe, the regulatory authority for waterproofing chemicals is the European Chemicals Agency (ECHA). The European Union (EU) law governing chemicals is the REACH regulation, which focuses on registration, evaluation, authorization, and restriction of chemicals.

Competitive Landscape

The waterproofing chemicals industry is characterized by key players focusing on product innovation, particularly in environmentally sustainable and energy-efficient solutions. Companies are pursuing strategic partnerships and collaborations to expand their offerings and enhance market reach.

Strengthening distribution networks, especially in emerging markets, and pursuing mergers & acquisitions to consolidate resources are key strategies. Additionally, firms are developing tailored solutions for specific applications, such as roofing and infrastructure, to differentiate themselves. Cost efficiency and sustainability remain central to the strategies employed by market leaders to maintain competitive advantage.

- In March 2025, Beacon acquired DM Figley Company, Inc., a wholesale distributor of waterproofing and sealant products. This acquisition expands Beacon’s specialty waterproofing division, bringing its network to nearly 60 branches nationwide.

List of Key Companies in Waterproofing Chemicals Market:

- Saint-Gobain Group

- BASF

- Dow

- Sika AG

- Carlisle Companies Inc.

- MAPEI

- RPM International Inc.

- Pidilite Industries Ltd.

- W. R. Meadows, Inc.

- SOPREMA, Inc.

- UltraTech Cement Ltd.

- ARDEX Americas

- Berkshire Hathaway Inc.

- RichlamGroup

- Xypex Chemical Corporation

Recent Developments (Expansion/Acquisitions)

- In January 2025, Sika expanded its global presence with the opening of two new plants in Singapore and Xi'an, China. The Singapore plant focuses on mortar production, while the Xi'an plant manufactures a full range of products, including cementitious waterproofing solutions, to cater to local market demands.

- In October 2024, Thermax signed an agreement to acquire Buildtech Products India Private Limited, which manufactures admixtures, accelerators, and capsules used in tunnels, infrastructure and railway projects. This partnership solidifies Thermax’s presence in the construction chemicals sector.

- In June 2024, Saint-Gobain acquired FOSROC, a global construction chemicals company offering waterproofing, sealants, and concrete repair products. The acquisition aims to strengthen Saint-Gobain’s position in the construction chemicals sector and expand its presence in high-growth regions such as India and the Middle East.