Market Definition

The water soluble film market involves producing and utilizing biodegradable, water-dissolvable films for various applications such as packaging, pharmaceuticals, and agriculture.

Industries adopt these films to reduce environmental impact, improve product efficiency, and meet consumer preferences for green solutions. The market is growing rapidly, driven by the demand for sustainable and eco-friendly alternatives.

Water Soluble Film Market Overview

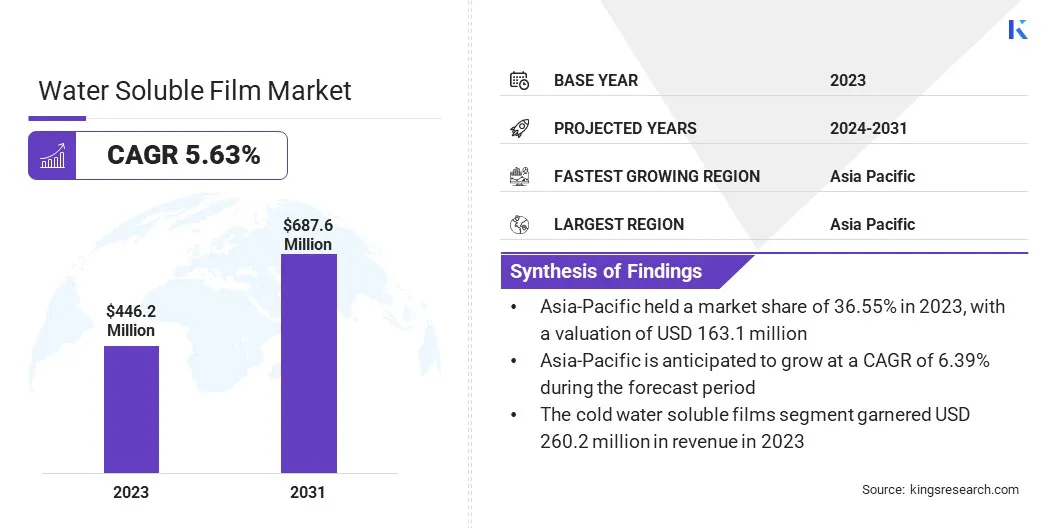

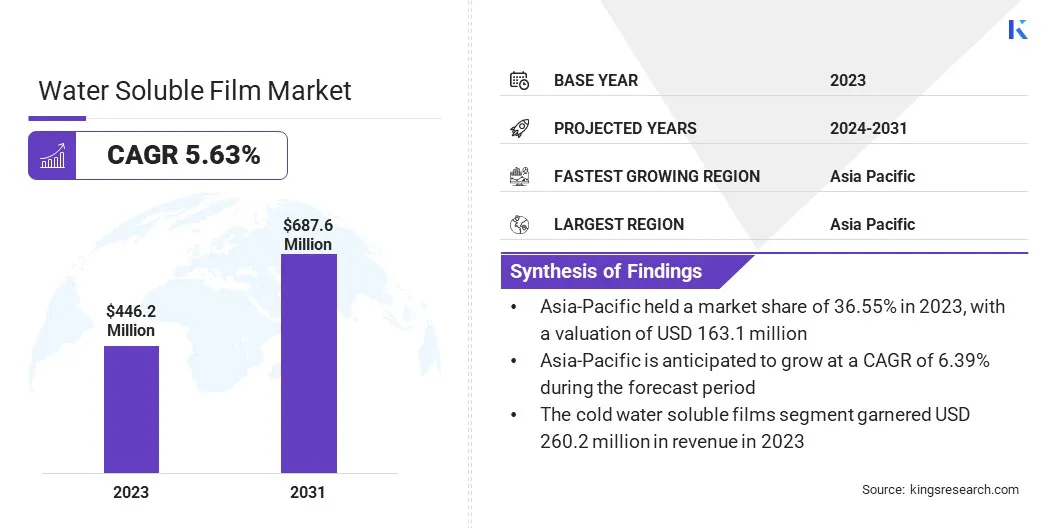

The global water soluble film market size was valued at USD 446.2 million in 2023, which is estimated to be USD 468.8 million in 2024 and reach USD 687.6 million by 2031, growing at a CAGR of 5.63% from 2024 to 2031.

The rising demand for sustainable packaging is driving the market, fueled by the global push to reduce plastic waste. Consumers and industries are increasingly adopting eco-friendly alternatives, boosting the need for biodegradable, water-soluble materials.

Major companies operating in the global water soluble film industry are Mitsubishi Chemical Corporation, AICELLO CORPORATION, Cortec Corporation, AMC (UK) Ltd, Sekisui Specialty Chemicals, ECOPOL S.p.A, NOBLE INDUSTRIES, KURARAY CO., LTD., Arrow GreenTech Ltd, Guangdong Proudly New Material Technology Corp., Medanos Claros HK Limited, KK NonWovens, ACEDAG LTD, Soltec Development, and Joyforce Chemical Industrial Co., Ltd.

Water soluble films are evolving as an essential product in industries focused on sustainable solutions. It is increasingly gaining traction across various sectors such as packaging, pharmaceuticals, and agriculture.

The market is characterized by a shift toward biodegradable and eco-friendly alternatives, offering manufacturers an efficient solution for reducing environmental impact. Key players in the market are advancing technologies to improve film quality and functionality, positioning water-soluble films as a versatile choice for a range of applications, contributing to market expansion.

- In March 2023, the University of Alicante developed a water-soluble, compostable plastic made from potato starch, offering a sustainable alternative to traditional plastics. This innovation, set for market release through Solublion, supports the growing demand for eco-friendly, biodegradable packaging solutions.

Key Highlights:

- The global water soluble film market size was valued at USD 446.2 million in 2023.

- The market is projected to grow at a CAGR of 5.63% from 2024 to 2031.

- Asia Pacific held a market share of 36.55% in 2023, with a valuation of USD 163.1 million.

- The cold water soluble films segment garnered USD 260.2 million in revenue in 2023.

- The Polyvinyl Alcohol (PVA) segment is expected to reach USD 255.7 million by 2031.

- The cosmetics and personal care segment is anticipated to register the fastest CAGR of 7.20% during the forecast period.

- The market in North America is anticipated to grow at a CAGR of 5.17% during the forecast period.

Market Driver

"Applications in Pharmaceuticals"

The growing use of water-soluble films in pharmaceuticals is a key driver of the market, particularly in single-dose packaging. These films provide enhanced product safety by ensuring precise dosage and preventing contamination.

Additionally, their water-soluble nature offers increased convenience, as the films dissolve quickly and easily, improving the user experience. Water-soluble films are becoming an essential solution for drug manufacturers, due to the rising demand for efficient, eco-friendly, and tamper-proof packaging in the pharmaceutical sector, contributing to market expansion.

- In January 2024, Arrow Greentech Limited received a patent for an improved water-soluble film, enhancing mechanical properties with nanoparticles like graphene. This innovation, ideal for packaging in pharmaceuticals and agrochemicals, contributes to the market growth.

Market Challenge

"Limited Durability and Mechanical Strength"

A challenge faced by the water soluble film market is the limited durability and mechanical strength of some biodegradable films, particularly when exposed to moisture or extreme conditions. This affects their reliability in packaging applications.

The solution lies in advancements such as the incorporation of nanoparticles like graphene, which enhances tensile strength, chemical resistance, and water solubility, making films more resilient and suitable for a broader range of applications. This innovation ensures improved performance without compromising environmental benefits.

Market Trend

"Expanding Agricultural Use"

A key trend in the water soluble film market is its increasing adoption in agriculture, particularly for controlled release of fertilizers and pesticides. These films help in precisely delivering nutrients and chemicals to crops, minimizing waste and reducing environmental impact.

By dissolving in water, they prevent excess runoff, promoting more efficient resource use. This application not only supports sustainable farming practices but also ensures better crop yields while mitigating the negative effects of traditional agricultural chemical usage, contributing to greener farming solutions.

- In December 2024, POLYVA introduced a water-soluble packaging machine for pesticides, enhancing the controlled release of pesticides in agriculture. This innovation aligns with the trend of using water-soluble films to reduce environmental impact, offering precise and eco-friendly solutions for pesticide application, promoting sustainability in farming practices.

Water Soluble Film Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Cold Water Soluble Films, Hot Water Soluble Films

|

|

By Material

|

Polyvinyl Alcohol (PVA), Starch-Based Films, Polyethylene Oxide (PEO), Others

|

|

By End-Use Industry

|

Household Cleaning, Agriculture, Textiles, Cosmetics and Personal Care, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Cold Water Soluble Films, Hot Water Soluble Films): The cold water soluble films segment earned USD 260.2 million in 2023, due to their widespread use in eco-friendly packaging and detergent pods, offering efficient dissolution properties.

- By Material [Polyvinyl Alcohol (PVA), Starch-Based Films, Polyethylene Oxide (PEO), Others]: The Polyvinyl Alcohol (PVA) segment held 38.63% share of the market in 2023, due to its superior water solubility, biodegradability, and suitability for various packaging applications.

- By End-Use Industry (Household Cleaning, Agriculture, Textiles, Cosmetics and Personal Care, Others): The household cleaning segment is projected to reach USD 228.5 million by 2031, owing to its increasing demand for eco-friendly, pre-measured detergent pods and water-soluble film applications.

Water Soluble Film Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a water soluble film market share of around 36.55% in 2023, with a valuation of USD 163.1 million. Countries like China, India, and Japan are leading in industrial applications, including agriculture and household cleaning products.

The region's vast manufacturing base, coupled with increasing demand for eco-friendly solutions, fosters significant market growth. Government regulations promoting biodegradable materials further support the usage of water-soluble films, positioning Asia Pacific as a leader in this market.

The water soluble film industry in North America is poised for significant growth at a robust CAGR of 5.17% over the forecast period. North America is a fast-growing region in the water-soluble film market, driven by rising consumer demand for sustainable packaging and eco-friendly products.

The region’s robust pharmaceutical, household cleaning, and agriculture sectors are key contributors to this growth. The increasing shift toward biodegradable materials, supported by stricter environmental regulations, has spurred innovation and adoption of water-soluble films. Additionally, the strong presence of key market players and advancements in film technology make North America a rapidly expanding market for these products.

- In September 2024, Winner Medical acquired 75.2% equity of Global Resources International at USD 120 million, strengthening its presence in the U.S., Europe, and Asia. This acquisition expands Winner’s capabilities in medical consumables and water-soluble, degradable protective materials, enhancing supply chains and R&D.

Regulatory Frameworks

- In the EU, Rules laid out in the Packaging and Packaging Waste Regulation 2025/40 (PPWR) regulate what kind of packaging can be placed on the EU market, as well as packaging waste management and prevention measures.

- In the EU, the Waste Framework Directive lays down some basic waste management principles.

- In the U.S., the Environmental Protection Agency (EPA) protects people and the environment from significant health risks, sponsors and conducts research, and develops and enforces environmental regulations.

Competitive Landscape:

The global water soluble film market is characterized by a large number of participants, including established corporations and rising organizations. In the water-soluble film market, competitors are focusing on strategic investments and partnerships to expand R&D capabilities and drive innovation in sustainable delivery systems.

Companies are working toward developing next-generation biodegradable films, enhancing their product lines, and exploring new applications in industries like personal care and healthcare, with a strong emphasis on sustainability and environmental impact. These efforts aim to meet the growing demand for eco-friendly packaging solutions globally.

- In December 2023, Ecopol S.p.A. made a strategic investment in JRF Technology LLC to enhance R&D and accelerate the development of biodegradable films and sustainable delivery systems. This partnership strengthens both companies' capabilities in advancing water-soluble polymer technologies for various applications.

List of Key Companies in Water Soluble Film Market:

- Mitsubishi Chemical Corporation

- AICELLO CORPORATION

- Cortec Corporation

- AMC (UK) Ltd

- Sekisui Specialty Chemicals

- ECOPOL S.p.A

- NOBLE INDUSTRIES

- KURARAY CO., LTD.

- Arrow GreenTech Ltd

- Guangdong Proudly New Material Technology Corp.

- Medanos Claros HK Limited

- KK NonWovens

- ACEDAG LTD

- Soltec Development

- Joyforce Chemical Industrial Co., Ltd

Recent Developments (Strategic Investment/Expansion)

- In September 2023, SK Capital completed a strategic investment in Ecopol, acquiring a majority stake. This partnership is designed to accelerate Ecopol's growth and enhance its innovative capabilities in sustainable delivery systems, strengthening its position in global markets.

- In October 2023, Ecopol officially began production at its new U.S. facility in Griffin, Georgia. The plant is strategically designed for long-term growth, with potential for expansion, further strengthening Ecopol's presence in the U.S. market.

- In April 2023, Camm Spain (formerly Green Cycles) expanded its production capacity to 1,500 tonnes. The company focuses on water-soluble, compostable materials that can replace conventional plastics, supporting recycling processes and ensuring environmental sustainability with easy paper recycling.