Market Definition

Virtualized evolved packet core (vEPC) is a software-driven framework that replicates the functions of a traditional mobile core network by decoupling them from dedicated hardware and deploying them on commercial off-the-shelf servers or cloud-native platforms.

It includes virtualized components such as the Mobility Management Entity (vMME), Serving Gateway (vSGW), Packet Data Network Gateway (vPGW), and Home Subscriber Server (vHSS). Virtualizing these functions enables vEPC to deliver improved scalability, flexibility, and cost efficiency. The solution supports 4G LTE, VoLTE, and IoT connectivity and serves as a critical foundation for 5G core networks.

Virtualized Evolved Packet Core Market Overview

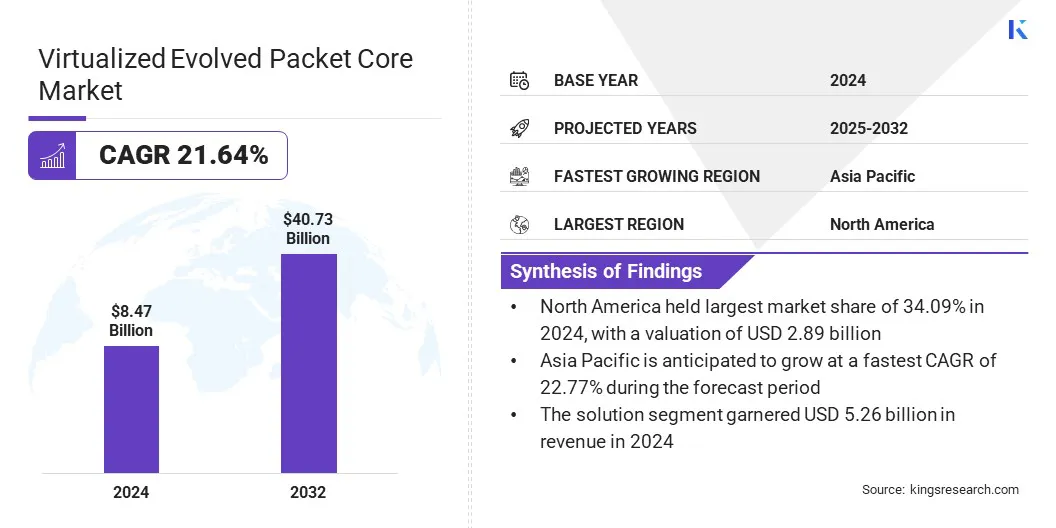

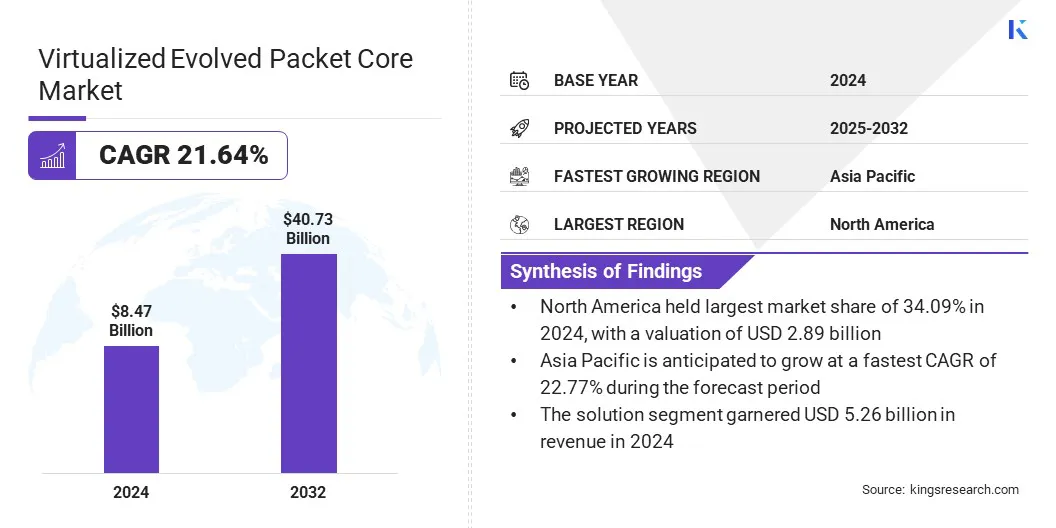

The global virtualized evolved packet core market size was valued at USD 8.47 billion in 2024 and is projected to grow from USD 10.28 billion in 2025 to USD 40.73 billion by 2032, exhibiting a CAGR of 21.64% during the forecast period.

Cloud-native vEPC adoption is transforming mobile networks through the enablement of microservices, containerization, and automated orchestration. This trend enhances agility, scalability, and cost-efficiency. Operators are positioned to support advanced 5G services, which accelerates the growth of the market globally.

Key Highlights:

- The virtualized evolved packet core industry was recorded at USD 8.47 billion in 2024.

- The market is projected to grow at a CAGR of 21.64% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, valued at USD 2.89 billion.

- The solution segment garnered USD 5.26 billion in revenue in 2024.

- The cloud-based segment is expected to reach USD 23.54 billion by 2032.

- The 5G segment is anticipated to witness fastest CAGR of 21.71% during the forecast period.

- The IoT & M2M segment is estimated to reach USD 13.41 billion by 2032.

- The telecom operators segment is predicted to hold a market share of 26.26% in 2032.

- Asia Pacific is anticipated to grow at a CAGR of 22.77% through the projection period.

Major companies operating in the virtualized evolved packet core market are Nokia, Cisco Systems, Inc., Nanjing ZTE software Co. Ltd., F5, Inc., Huawei Technologies Co., Ltd., Affirmed Networks, NEC Corporation, Mavenir, Telefonaktiebolaget LM Ericsson, Cumucore Oy, Hewlett Packard Enterprise Development LP, Telrad Networks, IPLOOK, Parallel Wireless, SAMSUNG, and others.

The global expansion of smart city projects drives significant growth in the market. Smart cities require scalable, flexible core networks to support applications such as intelligent transportation, energy management, smart utilities, surveillance, and healthcare.

vEPC enables operators and city authorities to virtualize network functions, optimize resource allocation, and manage latency-sensitive data. Its support for IoT connectivity and service quality makes vEPC a key enabler of smart infrastructure.

- In July 2025, AppLogic Networks Enhanced its portfolio of virtualized evolved packet core solutions to support 400 Gigabit Ethernet (400GE), meeting rising global network demands. These demands stem from 4K/8K streaming, cloud gaming, AI workloads, and the rapid growth of IoT applications, ensuring scalable and high-capacity network infrastructure.

Market Driver

Proliferation of 5G Deployments Across Developing Countries

Rapid deployment of 5G networks across developed and emerging countries is significantly driving the virtualized evolved packet core (vEPC) market. 5G networks demand a core infrastructure that delivers ultra-low latency, high throughput, and scalable performance, limiting the relevance of traditional hardware-based EPC models.

Moreover, vEPC allows telecom operators to meet these requirements efficiently through virtualization and cloud-native architectures, reducing operational costs. Through network slicing, operators can deliver customized connectivity solutions for sectors such as healthcare, manufacturing, and logistics.

Furthermore, the growing adoption of standalone 5G networks is further accelerating the transition toward dual-mode EPC architectures. The capability of vEPC to enable a smooth migration from 4G LTE to 5G reinforces its importance in supporting advanced digital ecosystems and driving long-term market growth.

- In March 2025, 5G Americas and Omdia reported that 5G adoption accelerated four times faster than 4G LTE with 8.3 billion 5G connections by 2029, accounting for 59% of global wireless technologies.

Market Challenge

Rising Cybersecurity Concerns in Virtualized Environments

Rising cybersecurity concerns in virtualized environments represent a significant challenge for the virtualized evolved packet core market. Virtualized cores increase the risk of attacks such as data breaches, denial-of-service, and unauthorized access, as traffic is managed across distributed cloud environments. These risks pose threats to industries like healthcare, finance, and government that rely on secure communication.

Operators are adopting advanced security mechanisms, including data encryption, secure API integration, identity and access management, and continuous network monitoring.

Vendors are incorporating zero-trust architectures and AI-driven security analytics into vEPC offerings to enhance threat detection and minimize potential vulnerabilities. This growing emphasis on security is shaping deployment strategies, as enterprises and service providers focus on implementing robust and compliant frameworks to protect mission-critical data in high-risk environments.

Market Trend

Integration of vEPC with Edge Computing is Enhancing Ultra-Low Latency Applications

The integration of virtualized evolved packet core (vEPC) with edge computing is emerging as a key industry trend, facilitating ultra-low latency applications across multiple sectors.

Deploying vEPC functions closer to end-users minimizes data transmission distances, enabling near real-time responsiveness essential for autonomous vehicles, industrial automation, augmented reality, and remote healthcare. This integration enhances reliability, performance, and resource efficiency for operators and enterprises.

It also enhances 5G deployments, as edge-enabled vEPC supports advanced applications requiring millisecond-level latency. Furthermore, the approach introduces new revenue opportunities for telecom operators through customized connectivity solutions for various industries. The combined capabilities of edge computing and vEPC are accelerating the development of ultra-reliable, next-generation digital ecosystems.

- In March 2025, A5G Networks, zTouch Networks, and Northeastern University successfully integrated the zTouch AI-powered automation and optimization framework (zTouch.OS) with A5G’s AI-driven mobile packet core, advancing performance within Northeastern’s AI-RAN over-the-air private 5G network environment.

Virtualized Evolved Packet Core Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solution, Services

|

|

By Deployment

|

On-premises, Cloud-based

|

|

By Network

|

4G, 5G

|

|

By Application

|

IoT & M2M, Mobile Private Networks (MPN) & MVNO, Mobile Broadband, LTE/VoLTE & VoWiFi

|

|

By End User

|

Telecom Operators, Enterprises, Government and Public Safety, Cloud Service Providers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Solution, and Services): The solution segment earned USD 5.26 billion in 2024 due to rising demand for virtualized MME, SGW, PGW, and HSS, enabling flexible deployments and supporting operators’ large-scale 4G and 5G rollouts.

- By Deployment (On-premises and Cloud-based): The cloud-based held 57.87% of the market in 2024, owing to containerized vEPC adoption, delivering agility, scalability, and cost-efficiency for telecom operators transitioning networks toward advanced 5G-ready cloud-native architectures.

- By Network (4G and 5G): The 4G segment is projected to reach USD 21.95 billion by 2032, propelled by rapid LTE expansion, VoLTE services, and enterprise private LTE deployments requiring reliable, cost-efficient vEPC solutions worldwide.

- By Application (IoT & M2M, Mobile Private Networks (MPN) & MVNO, Mobile Broadband, and LTE/VoLTE & VoWiFi): The IoT & M2M segment is predicted to hold the market of 32.93% in 2032, fueled by massive connected device growth requiring scalable, secure, and low-latency vEPC-driven connectivity management.

- By End User (Telecom Operators, Enterprises, Government and Public Safety, Cloud Service Providers, and Others): The enterprises segment is set to grow at a CAGR of 22.24% through the forecast period, propelled by increasing private LTE/5G adoption in manufacturing, logistics, and utilities seeking customized, secure connectivity.

Virtualized Evolved Packet Core Market Regional Analysis

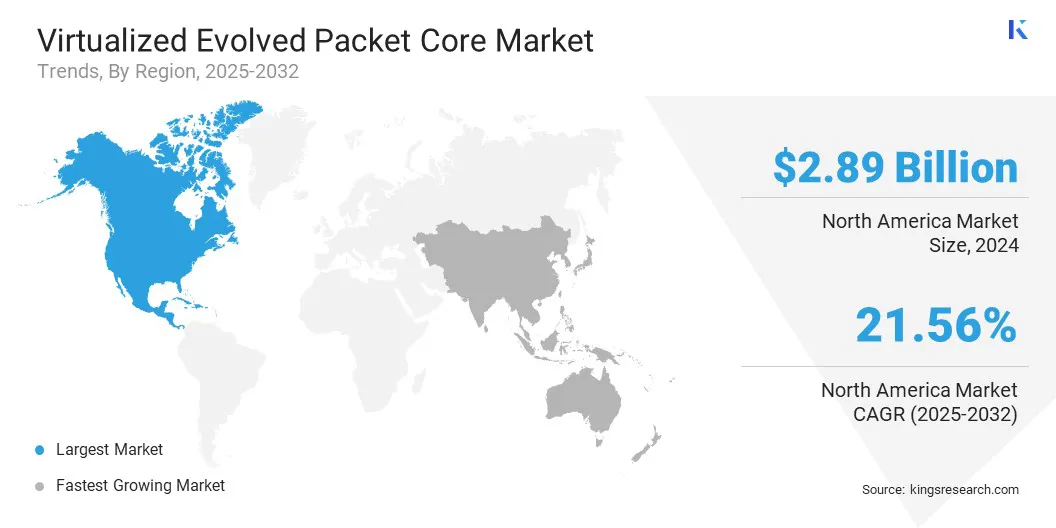

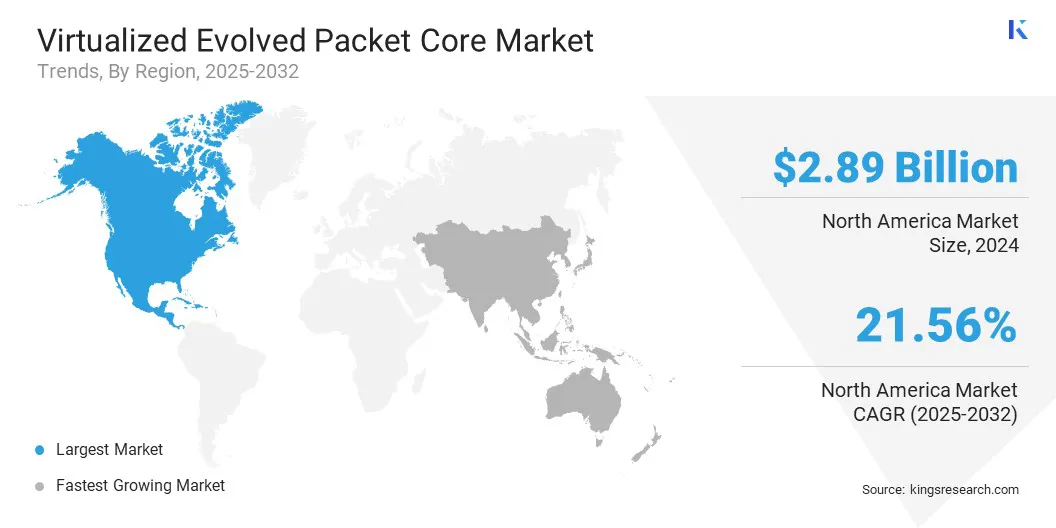

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 34.09% of the virtualized evolved packet core (vEPC) market in 2024, valued at USD 2.89 billion. This leadership position is attributed to mature carrier ecosystem and strong enterprise adoption of private networks. Regional service providers are focusing on cloud-first modernization strategies to reduce capital and operational expenditures while ensuring service quality.

Moreover, the ongoing trials and commercial launches of standalone 5G have accelerated demand for cloud-native and virtualized core solutions enabling network slicing, VoLTE, and large-scale IoT connectivity.

Collaboration with hyperscalers and the presence of dense data center infrastructure enable low-latency, distributed vEPC deployments for industries such as manufacturing, healthcare, and logistics. Furthermore, operators require enhanced security, regulatory compliance, and lifecycle management, leading vendors to offer integrated orchestration, automation, and managed service capabilities.

- In February 2025, NEC Corporation launched an advanced solution to modernize network infrastructure deployment, optimizing planning, design, and construction. The solution supports v-RAN, O-RAN, and NFV, enabling a nearly 60% reduction in deployment time compared to traditional methods and accelerating the implementation of cloud-native technologies across mobile network infrastructures.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) Open Internet Order regulates network neutrality. It ensures operators deploying vEPC manage traffic transparently, supporting fair competition and consistent quality of service across virtualized networks.

- In the EU, the European Electronic Communications Code (EECC) regulates telecom services. It promotes interoperability and high-quality communication services, guiding vEPC deployments toward harmonized, cross-border standards.

- In China, the Cybersecurity Law of the People’s Republic of China regulates network and information security. It requires vEPC deployments to store critical data locally and meet strict security protocols for resilience.

- In India, the Telecom Regulatory Authority of India (TRAI) Guidelines regulate telecom infrastructure modernization. They outline compliance for vEPC adoption, ensuring lawful interception, service continuity, and alignment with licensing frameworks.

- In Japan, the Telecommunications Business Act regulates telecom operations. It establishes service quality, interoperability, and data security obligations for vEPC systems, strengthening reliability across both operator and enterprise deployments.

Competitive Landscape

Key players operating in the virtualized evolved packet core industry are actively pursuing technology integration, expanding product portfolios, and investing in advanced network capabilities.

Companies are increasing partnerships with system integrators and cloud service providers to enhance deployment efficiency and scalability. They are focusing on research and development initiatives targeting virtualization, automation, and orchestration of core network functions. Strategic acquisitions and alliances are being executed to strengthen market positioning and broaden service offerings.

Investment in software-defined networking, edge computing solutions, and hybrid cloud deployments is ongoing to maintain competitiveness. Expansion into emerging segments and industrial verticals, alongside development of modular and flexible vEPC architectures, forms a key growth imperative.

Continuous updates to solutions, proactive migration strategies, and alignment with evolving network standards are being prioritized to address the demands of diverse subscriber bases and support multiple deployment scenarios.

- In February 2025, Mavenir partnered with Telefónica through a new five-year contract, enabling O2 Telefónica Germany’s transition from virtualized IMS to Mavenir’s Cloud-Native IMS, covering both fixed and mobile networks for its subscriber base.

Top Key Companies in Virtualized Evolved Packet Core Market:

- Nokia

- Cisco Systems, Inc.

- Nanjing ZTE software Co. Ltd.

- F5, Inc.

- Huawei Technologies Co., Ltd.

- Affirmed Networks

- NEC Corporation

- Mavenir

- Telefonaktiebolaget LM Ericsson

- Cumucore Oy

- Hewlett Packard Enterprise Development LP

- Telrad Networks

- IPLOOK

- Parallel Wireless

- SAMSUNG

Recent Developments (Partnerships/Product Launch)

- In May 2025, Ericsson launched an enhanced cloud-native dual-mode 5G Core solution designed to accelerate vEPC adoption for operators. The development focuses on improving scalability, automation, and security for large-scale deployments.

- In March 2025, O2 Telefónica Germany extended its partnership with Amazon Web Services through a multi-year agreement, advancing 5G core deployment using AWS Outposts racks. The collaboration also introduced IMS voice services on AWS Graviton processors to improve performance, scalability, and management of network-intensive workloads.

- In February 2024, Intel Corporation announced two strategic initiatives to optimize 5G core networks: previewing Sierra Forest Xeon processors with up to 288 E-cores and commercially launching Intel Infrastructure Power Manager (IPM) software. These steps aim to reduce network footprint, power consumption, and total cost of ownership.