Market Definition

The market encompasses products, technologies, and services aimed at managing and mitigating populations of disease-carrying vectors such as mosquitoes, ticks, flies, and rodents.

This industry includes insecticides, biological control agents, larvicides, traps, and integrated vector management (IVM) solutions used across public health, agriculture, and commercial sectors. Additionally, innovative solutions such as genetically modified mosquitoes, microbial-based larvicides, and digital surveillance tools are gaining traction.

Vector Control Market Overview

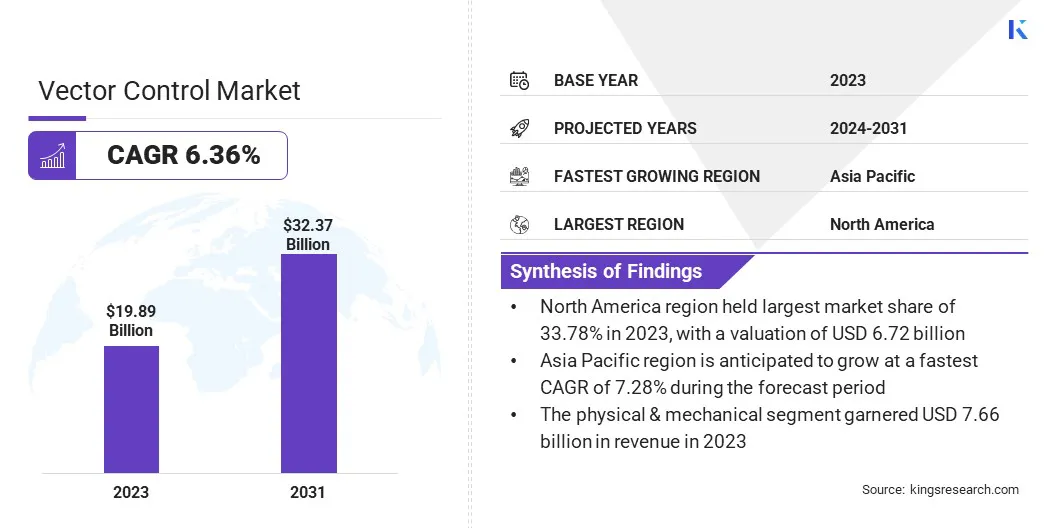

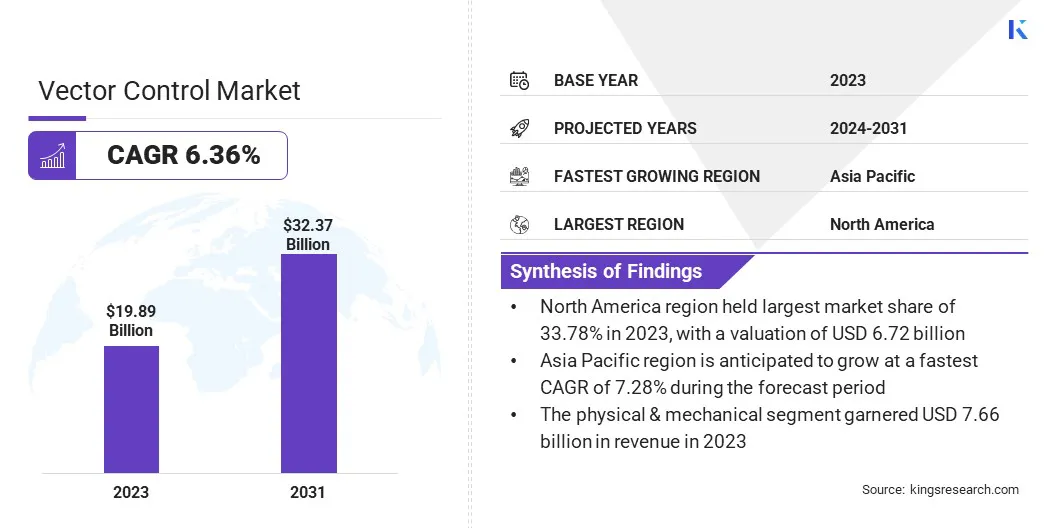

Global vector control market size was valued at USD 19.89 billion in 2023 and is projected to grow from USD 21.03 billion in 2024 to USD 32.37 billion by 2031, exhibiting a CAGR of 6.36% during the forecast period.

The market's growth is driven by increasing concerns over vector-borne diseases, regulatory support for integrated pest management, and advancements in eco-friendly control solutions.

Key factors contributing to this growth are rising investments in public health initiatives, technological advancements such as AI-driven surveillance and genetic vector control, and the expansion of sustainable alternatives to chemical pesticides.

Major companies operating in the vector control industry are Azelis group, Mitsui Chemicals, Inc., Tagros Chemicals India Pvt. Ltd., FMC Corporation, ADAMA, Bayer AG, Clarke, Nufarm Canada, Certis USA L.L.C., Syngenta, Gowan Company, PelGar International, BASF, S.C. Johnson & Son Inc., and Sumitomo Chemical India ltd.

Additionally, climate change and urbanization are fueling vector population growth, further driving demand for effective control solutions. Strategic collaborations between governments, private enterprises, and research institutions will continue to shape the market, fostering innovation and ensuring long-term sustainability.

- In November 2024, EMPHNET, in collaboration with Sudan’s Federal Ministry of Health and Kassala State Ministry of Health, launched the Volunteers for Vector Control (V4V) project, a community-driven initiative using Larval Source Management (LSM) to combat malaria and dengue in high-risk areas.

Key Highlights:

- The vector control industry size was recorded at USD 19.89 billion in 2023.

- The market is projected to grow at a CAGR of 6.36% from 2024 to 2031.

- North America held a market share of 33.78% in 2023, with a valuation of USD 6.72 billion.

- The insects segment garnered USD 7.65 billion in revenue in 2023.

- The physical & mechanical segment is expected to reach USD 12.59 billion by 2031.

- The residential segment is expected to reach USD 12.40 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 7.28% during the forecast period.

Market Driver

"Rising Incidence of Vector-Borne Diseases"

The vector control market is driven by the increasing incedence of vector-borne diseases such as malaria, dengue, Zika virus, Lyme disease, and chikungunya.

Climate change, urbanization, and global travel have contributed to the geographical spread of disease-carrying vectors, intensifying the need for effective control measures. Additionally, public awareness and community-led initiatives are encouraging the adoption of preventive solutions, further boosting market demand.

- According to the World Health Organization, Dengue is the most widespread viral infection transmitted by Aedes mosquitoes, posing a significant global health challenge. Over 3.9 billion people across 132 countries are at risk of this disease, with approximately 96 million symptomatic cases reported annually. Dengue results in an estimated 40,000 fatalities each year, highlighting the need for effective vector control and disease management strategies.

Market Challenge

"Adverse Impact of Synthetic Vector-Control Solutions"

A major challenge facing the vector control market is the increasing use of synthetic vector-control solutions such as chemical pesticides. Many widely used insecticides, such as organophosphates and pyrethroids, have been linked to insecticide resistance. They also cause ecological damage and potential health risks.

Governments worldwide are imposing stringent regulations on pesticide formulations, limiting their use in certain regions, and driving up compliance costs for manufacturers. To address this challenge, market players are shifting to sustainable and innovative alternatives, such as microbial larvicides, essential oil-based repellents, and genetic vector control methods.

Companies investing in R&D for bio-based insecticides, pheromone traps, and sterile insect techniques (SIT) are better positioned to comply with evolving regulations while maintaining market competitiveness. Public-private partnerships can also play a key role in accelerating the approval and adoption of eco-friendly solutions.

Market Trend

"Adoption of Smart Vector Control Technologies"

A significant trend shaping the vector control market is the increasing adoption of smart technologies, such as artificial intelligence (AI), IoT-based surveillance, and automated vector monitoring systems. Traditional vector management relies on manual data collection and reactive measures, which often result in delayed and inefficient interventions.

On the other hand, AI-powered solutions, integrated with IoT and big data analytics, enable real-time, data-driven decision-making. AI-driven predictive analytics can process vast datasets, including climate patterns, population density, and historical disease outbreaks, to forecast vector hotspots with high accuracy.

- In September 2024, the geospatial information scientists of Heidelberg University developed an AI-driven mapping approach that uses breeding site density as a key predictor of mosquito populations, enhancing surveillance accuracy and optimizing vector control strategies.

Vector Control Market Report Snapshot

|

Segmentation

|

Details

|

|

By Vector

|

Insects, Rodents, Others

|

|

By Method

|

Chemical, Physical & Mechanical, Biological

|

|

By End Use

|

Residential, Commercial, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Vector (Insects, Rodents, Others): The insects segment earned USD 7.65 billion in 2023 due to the increasing prevalence of insect-borne diseases such as malaria, dengue, Zika virus, and chikungunya.

- By Method (Chemical, Physical & Mechanical, Biological): The physical & mechanical segment held 38.53% of the market in 2023 due to the growing adoption of non-chemical control solutions such as mosquito traps, netting, and ultrasonic repellents.

- By End Use (Residential, Commercial, Industrial): The residential segment is projected to reach USD 12.40 billion by 2031, owing to the increasing consumer awareness of vector-borne diseases and the rising adoption of household insect repellents, mosquito nets, and electronic pest control devices.

Vector Control Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America vector control market share stood at around 33.78% in 2023 in the global market, with a valuation of USD 6.72 billion. The dominance is driven by rising incidence of vector-borne diseases such as West Nile virus, Lyme disease, and Zika virus. Stringent government regulations, public health initiatives, and strong investments in research and development are key growth drivers in this region.

The U.S. Environmental Protection Agency (USEPA) and the Centers for Disease Control and Prevention (CDC) actively support integrated vector management (IVM) programs, fostering demand for innovative vector control solutions. The increasing adoption of biological control methods, smart monitoring technologies, and eco-friendly insecticides is further fueling market expansion.

Asia Pacific is poised to grow at a significant rate at a CAGR of 7.28% over the forecast period. This growth is driven by rising cases of vector-borne diseases such as dengue, malaria, and chikungunya, particularly in densely populated countries like India, China, and Indonesia.

Rapid urbanization, climate change, and inadequate waste management contribute to increasing vector populations, necessitating effective control measures. Government initiatives, such as India’s National Vector Borne Disease Control Programme (NVBDCP) and China’s public health safety programs, are driving investments in vector control solutions.

Regulatory Frameworks:

- In the U.S., the EPA regulates pesticides used in the market, ensuring safety and environmental compliance. The CDC oversees public health strategies, providing guidelines and technical support for surveillance, outbreak response, and integrated vector management programs across states and local agencies.

- In Europe, the European Food Safety Authority (EFSA) ensures vector control products in food-related environments meet strict safety standards, impacting market approvals. The European Centre for Disease Prevention and Control (ECDC) assesses vector-borne disease risks and shapes public health policies, driving demand for innovative, compliant solutions in the market.

- In India, the Central Insecticides Board & Registration Committee (CIBRC) regulates the approval and registration of insecticides and vector control products under the Insecticides Act, 1968, ensuring compliance with safety and efficacy standards. The Ministry of Health and Family Welfare (MoHFW), through the NCVBDC, oversees national disease control programs and sets public health guidelines for vector management.

Competitive Landscape

The vector control industry is characterized by a number of participantswho are heavily investing in research and development (R&D), strategic partnerships, and advanced vector control technologies to gain a competitive edge.

Companies are focusing on eco-friendly formulations, biological control methods, and AI-powered surveillance systems to meet the growing demand for sustainable solutions. Emerging players are competing with market leaders by introducing cost-effective and region-specific vector control solutions, particularly in price-sensitive markets across Asia Pacific, Latin America, and Africa.

As government regulations tighten and vector-borne solutions become more mainstream, market participants are focusing on innovation, sustainability, and strategic collaborations to expand their global footprint and maintain competitiveness in the market..

List of Key Companies in Vector Control Market:

- Azelis group

- Mitsui Chemicals, Inc.

- Tagros Chemicals India Pvt. Ltd.

- FMC Corporation

- ADAMA

- Bayer AG

- Clarke

- Nufarm Canada

- Certis USA L.L.C.

- Syngenta

- Gowan Company

- PelGar International

- BASF

- S.C. Johnson & Son Inc.

- Sumitomo Chemical India ltd.

Recent Developments (New Product Launch)

- In March 2023, Mitsui Chemicals Agro, Inc. launched VECTRON T500, an Indoor Residual Spray (IRS) for malaria control, prequalified by WHO. Featuring TENEBENAL, the first meta-diamide active ingredient (IRAC Group 30), it introduces a novel mode of action to combat insecticide-resistant mosquitoes and enhance long-lasting vector control efficacy.