Market Definition

The market refers to the global industry involved in the development, manufacturing, distribution, and servicing of systems that utilize vacuum-based technology for rapid cooling of temperature-sensitive goods.

The market is segmented by application areas such as fresh produce, baked goods, meat, and other perishables, reflecting its vital role in preserving product quality, extending shelf life, and improving operational efficiency. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Vacuum Cooling Equipment Market Overview

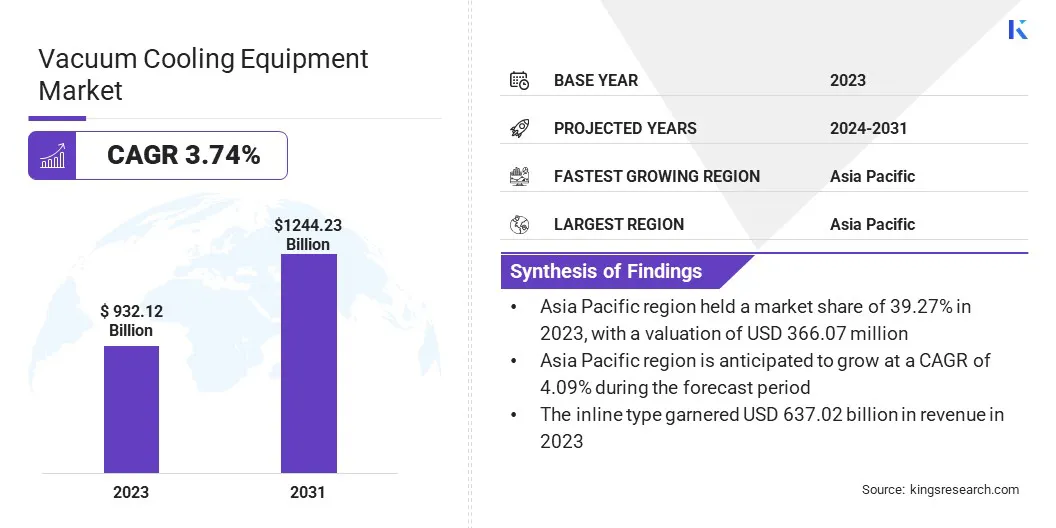

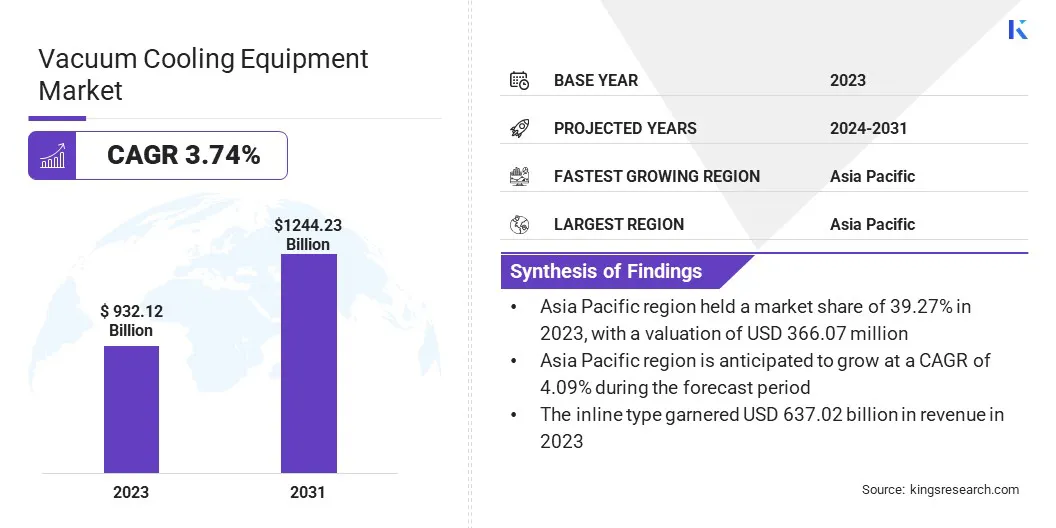

The global vacuum cooling equipment market size was valued at USD 932.12 billion in 2023 and is projected to grow from USD 962.26 billion in 2024 to USD 1244.23 billion by 2031, exhibiting a CAGR of 3.74% during the forecast period.

The growth is driven by the increasing demand for efficient post-harvest and food processing technologies. The rising focus on food safety and quality has led to the widespread adoption of vacuum cooling systems, particularly in the fresh produce, bakery, and meat industries. These systems offer rapid and uniform cooling, helping preserve product freshness and extending shelf life, an essential advantage in modern cold chain logistics.

Major companies operating in the vacuum cooling equipment industry are yasujima, Dongguan Huaxian Ltd., Revent, DC Norris, Focusun Refrigeration Corp., TRJ RefRIgeration Inc., Agrimaint Inc., Weber Vacuum Group, WEC Group Ltd., Atlas Copco AB, Southern Vacuum Cooling Inc., Celtic, Verhoeven Family of Co, Shenzhen Iceups Refrigeration Equipment Co., Ltd., and Dongguan COLDMAX Ltd.

Moreover, the market is benefiting from the global expansion of food export activities, where maintaining optimal temperature during storage and transportation is critical. The growing preference for automation and energy-efficient operations in food processing facilities has accelerated the integration of advanced vacuum cooling solutions.

Technological innovations, including improvements in cooling speed, system design, and environmental performance, continue to attract investment and drive adoption across various regions.

- In April 2024, Atlas Copco Group acquired Delta Temp, a Belgian specialty rental company providing industrial cooling solutions. The acquisition will bolster Atlas Copco's Specialty Rental division, facilitating the expansion of its temperature control business in Europe. Delta Temp offers rental services for chillers and related equipment, delivering tailored cooling solutions across industries such as manufacturing, pharmaceuticals, food & beverage, chemicals, and steel production.

Key Highlights

- The vacuum cooling equipment industry size was recorded at USD 932.12 billion in 2023.

- The market is projected to grow at a CAGR of 3.74% from 2024 to 2031.

- Asia Pacific held a market share of 39.27% in 2023, with a valuation of USD 366.07 billion.

- The water cooled segment garnered USD 560.25 billion in revenue in 2023.

- The inline type segment is expected to reach USD 840.48 billion by 2031.

- The fruits and vegetables segment is expected to reach USD 613.78 billion by 2031.

- North America is anticipated to grow at a CAGR of 3.87% during the forecast period.

Market Driver

Expansion of Cold Chain Logistics and Food Exports

The market is significantly driven by the expansion of cold chain logistics and the growth of global food exports. As international trade in perishable goods continues to rise, maintaining product freshness and quality during long-distance transportation has become a top priority.

This has led to a greater reliance on efficient cooling solutions like vacuum cooling, which offers rapid temperature reduction and helps preserve texture, appearance, and shelf life. Additionally, the development of modern cold chain infrastructure, including temperature-controlled storage, transportation, and handling systems, has created a favorable environment for the adoption of vacuum cooling equipment.

To comply with stringent food safety and quality regulations, exporters and logistics providers are increasingly integrating advanced cooling technologies into their operations.

- In March 2024, Fundalogical Ventures (FLV) announced its first investment in Indicold, a tech-enabled cold supply chain company, through its Pre-Series A funding round. The investment will support Indicold’s tech development, geographic expansion, and team growth.

Market Challenge

High Initial Cost of Installation and Setup

The major challenge in the vacuum cooling equipment market is the high initial cost of installation and setup, which can be a significant barrier for small and medium-sized enterprises (SMEs). Vacuum cooling systems require advanced technology, specialized components, and precise engineering, which contribute to their elevated capital investment compared to conventional cooling methods.

To address this challenge, key players are developing cost-efficient and modular vacuum cooling systems tailored for diverse operational scales. They are also partnering with governments and financial institutions to offer leasing options and access to subsidy programs, thereby lowering adoption barriers for small and medium-sized enterprises.

Market Trend

Growing Adoption in Bakery and Meat Processing Industries

The market is undergoing a significant shift as its applications expand beyond traditional sectors like fresh produce into high-demand areas such as bakery and meat processing. In bakeries, vacuum cooling is increasingly utilized for its ability to accelerate cooling times, improve product consistency, and retain moisture, resulting in better texture and longer shelf life for baked goods.

Meanwhile, in the meat processing industry, the technology is being adopted to rapidly reduce product temperatures, enhancing food safety by limiting bacterial growth and meeting stringent hygiene standards.

- In March 2024, MULTIVAC introduced its Cooling Packing System at Anuga FoodTec in Cologne, Germany. This innovative vacuum cooling solution is designed for bakery products and integrates directly into thermoforming packaging machines. By enabling immediate post-bake cooling and packaging, the system enhances product freshness, extends shelf life, and reduces energy consumption. Additionally, it offers space-saving benefits for bakeries, aligning with the industry's move towards more efficient and sustainable processing solutions.

Vacuum Cooling Equipment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Cooling Type

|

Water Cooled, Air Cooled

|

|

By Type

|

Inline Type, Pallet Type

|

|

By Application

|

Fruits and Vegetables, Baked Products, Meat, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Cooling Type (Water Cooled, Air Cooled): The water cooled segment earned USD 560.25 billion in 2023 due to its higher cooling efficiency and suitability for large-scale industrial applications.

- By Type (Inline Type, Pallet Type): The inline type held 68.34% of the market in 2023, due to its faster processing capability and seamless integration into automated production lines.

- By Application (Fruits and Vegetables, Baked Products, Meat, and Others): The fruits and vegetables segment is projected to reach USD 613.78 billion by 2031, owing to growing demand for fresh produce and increasing investment in post-harvest handling solutions.

Vacuum Cooling Equipment Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific vacuum cooling equipment market share stood around 39.27% in 2023 in the global market, with a valuation of USD 366.07 billion. This dominance is attributed to the region’s robust agricultural output, growing food processing industry, and increasing demand for efficient post-harvest solutions.

Countries like China, Japan, and India are witnessing significant investments in cold chain infrastructure and automated cooling technologies to address rising food safety concerns and export requirements. Additionally, rapid urbanization, shifting consumer preferences toward fresh and packaged foods, and government initiatives to reduce food waste have further fueled market growth in the region.

- In August 2024, the Government of India announced that it is implementing schemes to set up cold storage for perishable horticultural produce and warehouses for foodgrains across the country to reduce post-harvest losses. Moreover, the Department of Agriculture & Farmers Welfare under the Indian government offers financial help for building, expanding, or upgrading cold storage units up to 5000 MT.

North America is poised to grow at a significant growth at a CAGR of 3.87% over the forecast period, driven by the region’s advanced food logistics network and strong regulatory focus on food quality and safety. The presence of well-established food processing companies, combined with increasing adoption of energy-efficient and automated cooling systems, supports steady market expansion.

Moreover, rising consumer demand for high-quality perishable goods, widespread use of vacuum cooling in commercial baking and meat processing, and ongoing innovations in cooling technology contribute to North America’s growing share in the global market.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates vacuum cooling equipment used in food processing facilities to ensure compliance with food safety and hygiene standards under its Current Good Manufacturing Practices (CGMPs). Meanwhile, the U.S. Department of Agriculture (USDA) oversees vacuum cooling systems specifically used in meat and poultry processing and mandates strict sanitation, equipment design, and operational protocols to maintain food safety throughout the cooling and storage process.

- In India, the Food Safety and Standards Authority of India provides clear protocols and standards for food processing equipment, promoting the adoption of advanced and efficient cooling technologies while ensuring consumer safety.

Competitive Landscape

The global vacuum cooling equipment market is characterized by intense competition, with key players focusing on strategic initiatives to strengthen their market position. Leading manufacturers are heavily investing in research and development to enhance system efficiency, reduce energy consumption, and improve automation features.

Product innovation remains a core strategy, with companies introducing modular and customizable vacuum cooling systems tailored to specific industry needs. In addition, market participants are expanding their global footprint through mergers, acquisitions, and strategic partnerships with regional distributors and service providers.

These collaborations aim to enhance after-sales service, improve customer reach, and ensure timely equipment maintenance. Many companies are also investing in smart technologies and IoT integration to offer real-time monitoring and control capabilities, enabling clients to optimize operational performance.

Furthermore, participation in international trade fairs, exhibitions, and targeted marketing campaigns is being employed to increase brand visibility and attract new customers across emerging markets.

- In June 2024, EXAIR and BETE announced their strategic merger that combines EXAIR’s expertise in engineered compressed air solutions with BETE’s renowned spray nozzle technologies. The collaboration aims to enhance product offerings, customer engagement, and market reach, driving innovation and creating new solutions for customers worldwide.

List of Key Companies in Vacuum Cooling Equipment Market:

- Yasujima

- Dongguan Huaxian Ltd.

- Revent

- DC Norris

- Focusun Refrigeration Corp.

- TRJ RefRIgeration Inc.

- Agrimaint Inc.

- Weber Vacuum Group

- WEC Group Ltd.

- Atlas Copco AB

- Southern Vacuum Cooling Inc.

- Celtic

- Verhoeven Family of Co

- Shenzhen Iceups Refrigeration Equipment Co., Ltd.

- Dongguan COLDMAX Ltd.

Recent Developments (Product Launch)

- In January 2024, GEA unveiled a new continuous bacon processing line at the International Production & Processing Expo (IPPE) in Atlanta. This all-in-one system streamlines bacon production by incorporating stages such as injection, smoking, and freezing into a seamless process. The integration of these steps accelerates production ensures consistent quality and enhances food safety.

- In April 2023, Oyster launched the Oyster Tempo, a high-performance cooler featuring a patented integrated vacuum insulation system. The cooler is made from recyclable aluminum and chemical-free silica. It does not require ice, offers high internal space, and retains cold temperatures for longer periods. The Oyster Tempo is designed to improve thermal performance, usability, and sustainability, serving as an environmentally conscious option for keeping food and drinks cold in different settings.

and