Market Definition

Urban farming involves cultivating, processing, and distributing food within or near cities. It encompasses methods such as soil-based cultivation, hydroponics, aquaponics, and aeroponics, often supported by advanced climate control technologies. The practice emphasizes localized food production, reducing dependence on lengthy supply chains and lowering transportation emissions.

Urban farming enhances food security, improves access to fresh produce, promotes sustainability, and repurposes underutilized urban spaces. It is increasingly seen as a strategic approach to address urbanization challenges and rising demand for sustainable, nutritious food.

Urban Farming Market Overview

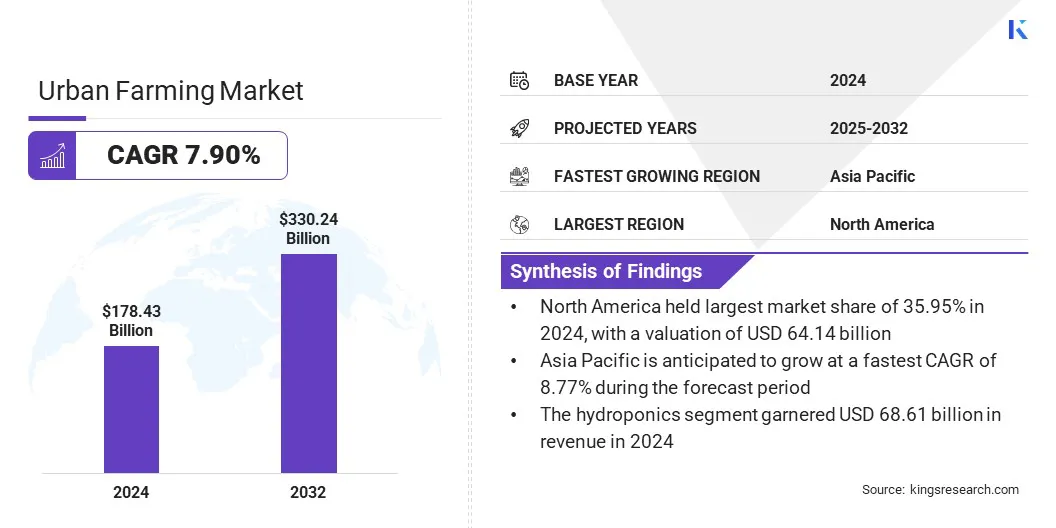

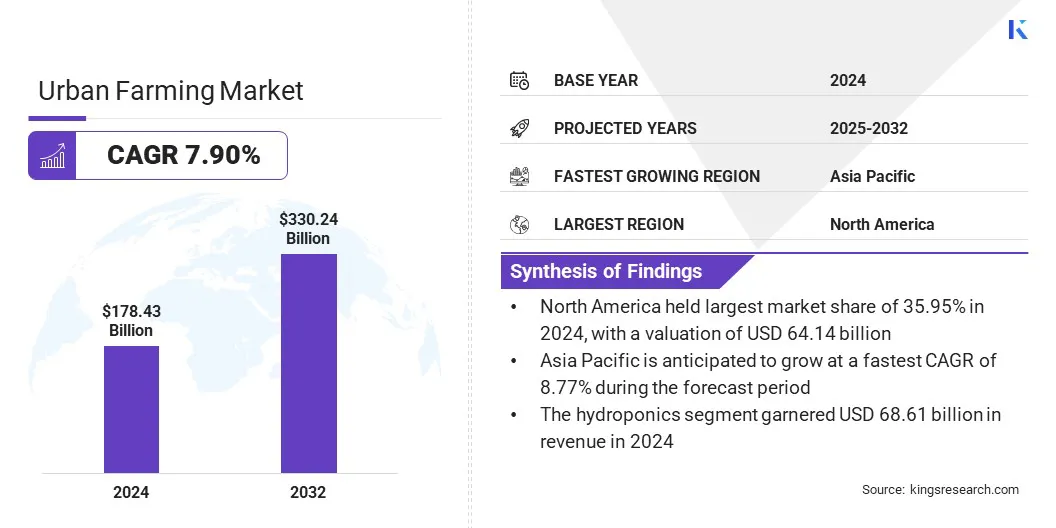

The global urban farming market size was valued at USD 178.43 billion in 2024 and is projected to grow from USD 191.71 billion in 2025 to USD 330.24 billion by 2032, exhibiting a CAGR of 7.90% during the forecast period.

This growth is driven by the increasing adoption of rooftop farming in metropolitan areas, which transforms underutilized urban spaces into productive zones for fresh food cultivation, thereby promoting sustainability and effectively mitigating space constraints in densely populated cities.

Key Highlights:

- The urban farming industry was recorded at USD 64.14 billion in 2024.

- The market is projected to grow at a CAGR of 7.90% from 2025 to 2032.

- North America held a share of 35.95% in 2024, valued at USD 64.14 billion.

- The indoor segment garnered USD 102.95 billion in revenue in 2024.

- The hydroponics segment is expected to reach USD 127.14 billion by 2032.

- The herbs & microgreens segment is anticipated to witness the fastest CAGR of 8.43% over the forecast period.

- The lighting system segment is projected to hold a share of 26.26% by 2032.

- The residential growers segment is estimated to grow at the fastest CAGR of 8.14% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 8.77% through the projection period.

Major companies operating in the urban farming market are Urban Crop Solutions, LED iBond International A/S, Gotham Greens, ams-OSRAM AG, Eden Green Technology, Plenty Unlimited Inc., BrightFarms, CubicFarm Systems Corp., Koninklijke Philips N.V., Freight Farms, Inc., Hydrofarm, Heliospectra, Local Bounti, AmHydro, and Soli Organic Inc.

The adoption of renewable energy solutions is influencing the market. Indoor farms, which rely heavily on artificial lighting, HVAC systems, and automated irrigation, traditionally consume significant energy from conventional grids. By incorporating renewable sources such as rooftop solar panels, biomass energy, and wind power, farms are significantly reducing their operational costs and carbon footprints, enhancing profitability while supporting sustainable production models.

Moreover, renewable energy integration enables urban farms to access government incentives, attract environmentally conscious investors, and strengthen consumer trust, positioning urban farming as a cost-efficient, climate-resilient food production system.

- In March 2025, the U.S.-based Center of Excellence for Indoor Agriculture, a U.S.-based organization supporting vertical farming and greenhouse growth, received a Pennsylvania Agricultural Innovation Grant. The grant funded initiatives to enhance energy-efficient indoor farm design, promoting strategies that lower energy use while improving productivity in controlled environment agriculture.

Market Driver

Rising Adoption of AI-Powered Robotics and Automation

The growth of the urban farming market is fueled by the adoption of AI-powered robotics and automation, which enhance efficiency in crop monitoring, maintenance, and harvesting. Automated systems perform tasks such as planting, nutrient delivery, and pest detection with higher precision than manual labor.

AI algorithms process real-time sensor data to optimize growth conditions, reducing labor costs, minimizing errors, and ensuring consistent crop quality, crucial for large-scale commercial farms supplying supermarkets and restaurants. Robotics also improves yield preservation and reduces post-harvest losses for delicate crops such as leafy greens and herbs. As farms expand in size and complexity, AI-driven automation is enhancing scalability and operational efficiency.

- In January 2025, Syngenta Crop Protection partnered with TraitSeq to accelerate the development of advanced biostimulants. This collaboration leverages AI-driven insights to support urban farming by enhancing crop performance, driving sustainability, and enabling farmers to adopt resource-efficient cultivation practices in competitive urban agricultural environments.

Market Challenge

High Energy Consumption for Lighting and Climate Control

High energy consumption for lighting and climate control presents a key challenge to the expansion of the urban farming market, as these systems account for a major share of operating expenses.

Although LED grow lights are more efficient than traditional options, they still consume significant electricity, while climate control systems further increase costs. This limits profitability, particularly for small and medium-scale operators, and raises concerns about the long-term sustainability in regions with high energy prices.

To overcome this challenge, industry players are focusing on energy-efficient technologies, renewable energy integration, and optimization strategies that balance cost with productivity. Collaboration with utility providers and adoption of hybrid greenhouse models further help mitigate operational expenses.

Market Trend

Implementation of Vertical Farming with Smart Technologies

The adoption of vertical farming integrated with smart technologies is a key trend in the urban farming market, enabling high yields in limited spaces. IoT sensors, automated irrigation, AI-driven climate control, and blockchain traceability are increasingly employed to enhance efficiency and transparency. These technologies allow continuous monitoring of nutrient levels, temperature, and humidity while automating adjustments for optimal plant growth.

Vertical farms using smart systems can operate year-round, deliver consistent quality, and reduce waste. This trend is boosting commercial adoption, as retailers and investors recognize the scalability and profitability of technologically advanced farms.

- In January 2023, Siemens entered a strategic collaboration with 80 Acres Farms. With operations across Ohio, Kentucky, Georgia, and R&D centers in Arkansas and the Netherlands, 80 Acres Farms produces sustainable, next-generation food using advanced, eco-friendly indoor cultivation near consumers.

Urban Farming Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Indoor, Outdoor

|

|

By Technique

|

Hydroponics, Aquaponics, Aeroponics

|

|

By Crop

|

Fruits & Vegetables, Herbs & Microgreens, Flowers & Ornamentals, Grains & Cereals, Others

|

|

By Component

|

Lighting System, Irrigation & Fertigation System, Climate Control, Sensors, Others

|

|

By End User

|

Commercial Farms, Residential Growers, Community Gardens & NGOs, Research & Educational Institutes

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Indoor and Outdoor): The indoor segment captured the largest share of 57.70% in 2024, mainly due to controlled-environment systems that ensure year-round production, higher yields, and consistent quality across urban locations.

- By Technique (Hydroponics, Aquaponics, and Aeroponics): The aeroponics segment is poised to record the fastest CAGR of 7.98% through the forecast period, owing to minimal water use, precise nutrient delivery, and scalability in space-constrained urban environments.

- By Crop (Fruits & Vegetables, Herbs & Microgreens, Flowers & Ornamentals, Grains & Cereals, and Others): The herbs & microgreens segment is anticipated to grow at a CAGR of 8.43% over the forecast period, fueled by increasing demand from restaurants, health-conscious consumers, and premium retail channels.

- By Component (Lighting System, Irrigation & Fertigation System, Climate Control, Sensors, and Others): The lighting system segment secured the largest revenue of USD 46.80 billion in 2024, supported by the adoption of energy-efficient LEDs that optimize crop growth and reduce operational costs.

- By End User (Commercial Farms, Residential Growers, Community Gardens & NGOs, and Research & Educational Institutes): The commercial farms segment is projected to reach USD 117.60 billion by 2032, propelled by large-scale partnerships with retailers, investment in advanced hydroponic systems, and reliable supply for urban populations.

Urban Farming Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America urban farming market accounted for a significant share of 35.95% in 2024, valued at USD 64.14 billion. This dominance is reinforced by strong institutional support, advanced technological adoption, and high consumer demand for locally grown, pesticide-free produce. Large-scale vertical farms, rooftop farms, and hydroponic greenhouses, backed by private investment and government incentives, are further aiding this expansion.

Advanced infrastructure, including LED lighting, AI-based climate controls, and sustainable energy integration, enhances efficiency and scalability. Furthermore, partnerships with retail chains and food service providers ensure stable demand, fueling regional market expansion.

- In March 2025, the Agricultural Research Service (ARS) collaborated with universities and businesses across more than 90 research sites to study LED light-spectrum effects on plant growth, nutrient optimization, plant pathology, plant breeding, pollinator dynamics, and automation processes for advanced agricultural production.

The Asia-Pacific urban farming industry is projected to expand at a CAGR of 8.77% over the forecast period. This expansion is propelled by rapid urbanization, limited arable land, and population density. Government investments in smart city projects are fostering the adoption of vertical farming and rooftop agriculture to enhance food security and sustainability.

Advanced systems such as hydroponics and aeroponics are being widely implemented in countries such as China, Japan, and Singapore, while emerging markets such as India are increasingly promoting community urban farming initiatives. The emphasis on resource efficiency, combined with rising consumer demand for fresh, locally sourced produce, position the region as a major market for urban farming.

Regulatory Frameworks

- In the U.S., the USDA Urban Agriculture and Innovative Production Program (UAIP) regulates funding, technical assistance, and eligibility for urban farms, promoting innovation, food access, and sustainable models.

- In Canada, the Toronto GrowTO Urban Agriculture Strategy regulates rooftop farming, greenhouses, and community gardens. It supports energy-efficient farming practices and enhances the integration of urban farms into municipal planning.

- In the EU, the EU Farm to Fork Strategy fuels sustainable food production. It emphasizes reduced pesticide use, lower emissions, and support for urban food systems aligned with the EU Green Deal objectives.

- In Singapore, the Singapore Food Agency (SFA) Licensing Framework regulates urban farming projects, including rooftop and vertical farms. It ensures food safety standards while providing grants for advanced technology adoption.

- In Japan, the Urban Agriculture Promotion Basic Act focuses on preserving and promoting urban farming. It strengthens local food supply, environmental sustainability, and the use of urban land for agriculture.

- In the United Arab Emirates, the Dubai Municipality Urban Farming Regulation facilitates vertical and hydroponic farms. It promotes sustainable farming models to enhance food security and reduce import dependency.

Competitive Landscape

Key players operating in the urban farming industry are investing in research and development to advance hydroponic, aeroponic, and climate-control technologies to increase yield while reducing resource use. Partnerships with retailers, restaurants, and municipal bodies are boosting demand and integrating urban farms into local food systems.

Numerous players are scaling operations by combining renewable energy solutions with farm infrastructure to lower operational costs and appeal to environmentally conscious consumers. Additionally, digital tools such as IoT sensors, AI-driven analytics, and blockchain traceability are enhancing efficiency and transparency. There is a strategic emphasis on scalability, cost-efficiency, and product quality to strengthen competitive advantage in the evolving market.

- In February 2024, Masdar City, Abu Dhabi’s sustainability hub, partnered with Alesca Technologies to launch its first indoor vertical farm. The project integrates automated equipment and AI-driven farming to produce chemical-free leafy greens, lettuces, and herbs, enhancing community engagement and addressing urban food security challenges through advanced agricultural innovation.

Key Companies in Urban Farming Market:

- Urban Crop Solutions

- LED iBond International A/S

- Gotham Greens

- ams-OSRAM AG

- Eden Green Technology

- Plenty Unlimited Inc.

- BrightFarms

- CubicFarm Systems Corp.

- Koninklijke Philips N.V.

- Freight Farms, Inc.

- Hydrofarm

- Heliospectra

- Local Bounti

- AmHydro

- Soli Organic Inc

Recent Developments (Partnerships/Merger/Launch)

- In August 2025, 80 Acres Farms and Soli Organic completed a strategic merger, establishing one of the largest indoor farming networks globally. Operating under the 80 Acres Farms brand from Hamilton, Ohio, the company projected revenues of nearly USD 200 million in its first year.

- In June 2025, Water Garden Farms (WGF), Siemens, and CEAd partnered to integrate AI and automated precision agriculture into indoor farming operations. The collaboration supports WGF’s sustainable, decentralized farming model and includes plans for a 500,000-square-foot solar-powered greenhouse in West Virginia.

- In September 2024, Urban Crop Solutions commissioned its first vertical farming tower at Agrotopia, Roeselare. The installation integrates vertical systems into greenhouse farming, enabling multi-level cultivation with dynamic lighting that combines natural sunlight and LEDs to maximize space efficiency.